Macro Monitor Q2 2025

Deep tech investment trends across the US, Europe, and Asia—covering VC/PE funding, exits, and cross-border deals. For the data nerds out there, this one’s for you!

Quick note. I started this blog six months ago with a mix of monthly macro monitors (like this one, and this) and deep dives (such as the one on DeepSeek or the one on China’s global expansion). Over time, I noticed that deep dives tend to attract much more interest than the macro updates, so for some time I was considering focusing solely on deep-dives.

In the end, I decided to keep the macro monitors — but publish them quarterly instead. I believe that looking back to track broader macro trends is just as valuable as zooming in on specific companies or themes.

Let me know in the comments: is this kind of content interesting or a bit boring? I’m still experimenting with the format, and your feedback genuinely matters.

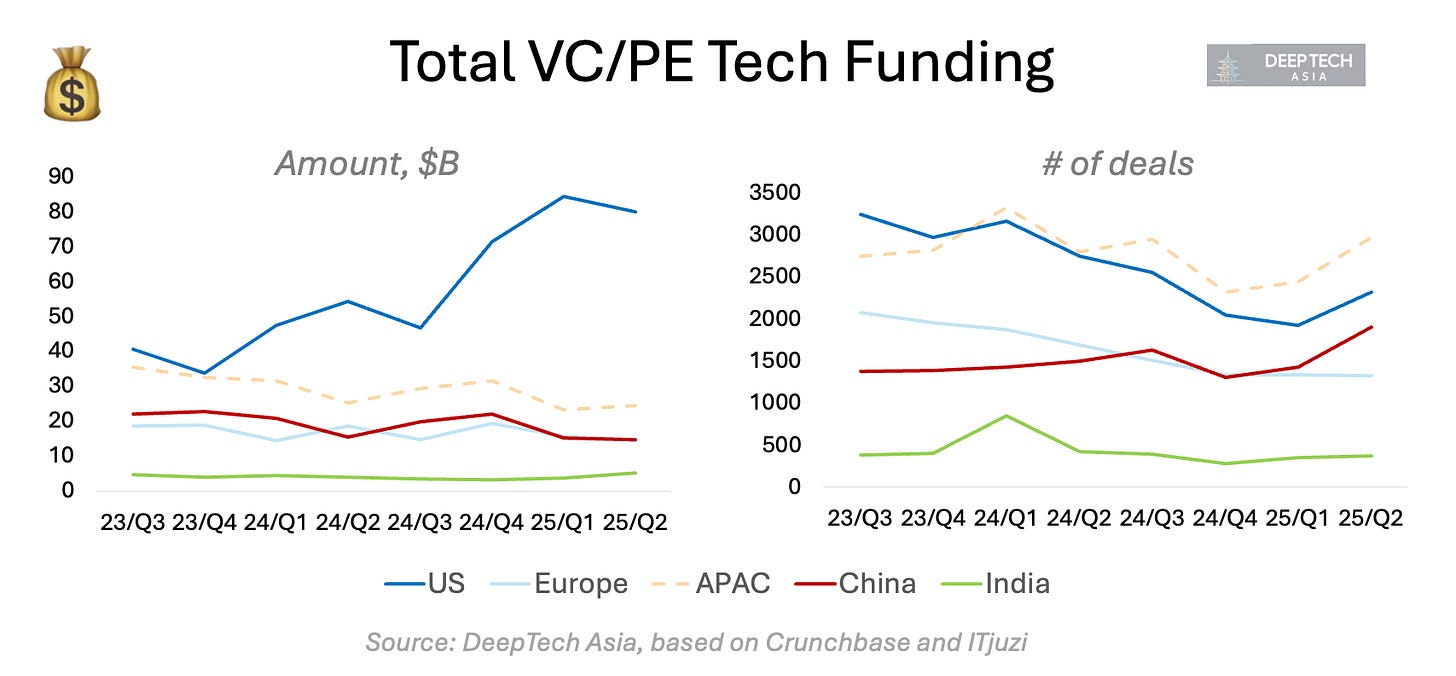

Over the past few quarters, the US has pulled even further ahead of China and Europe (including the UK and Israel) in tech funding. In Q2 2025, US startups raised a massive $80B, over 5x more than their counterparts in China or Europe. That spike was largely driven by mega deals like Meta’s $14.3B investment in Scale AI and Crusoe’s $11.6B round.

India’s tech scene is gaining steam, but it's still playing catch-up—raising about $5B this quarter, which is almost three times less than China or Europe.

What’s interesting is that while the US led in funding volume, deal activity surged on both sides. Chinese startups closed around 1,900 deals, nearly matching the 2,300 in the US.

That gap between deal count and total capital raised is telling—Chinese startups are proving to be a lot more capital efficient than their American peers.

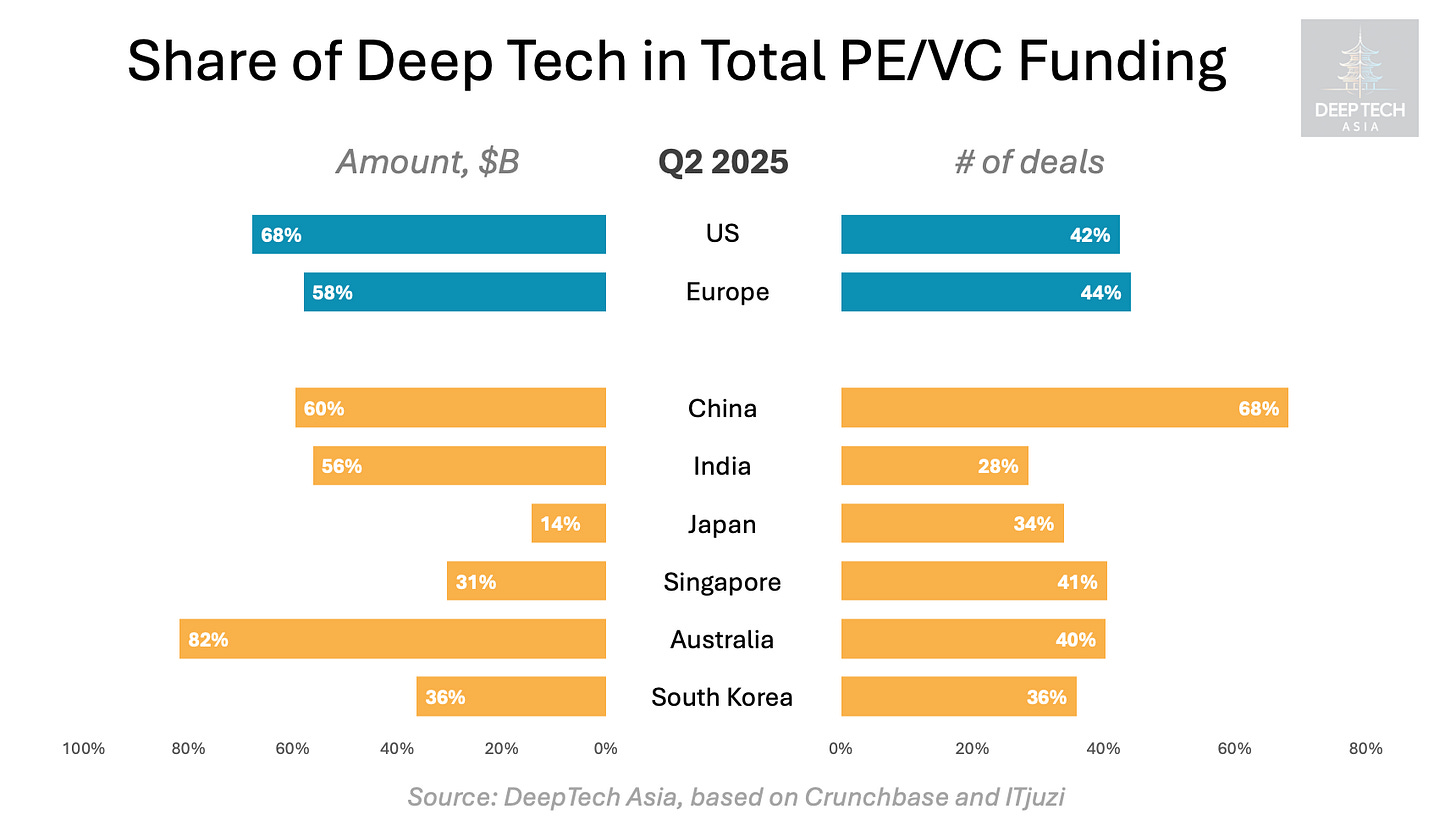

By number of deals, China leads deep tech investing with a 68% share, especially in areas like AI, compute, space, biotech, energy, and robotics. Singapore and Australia are on par with the US and Europe when it comes to deep tech investment activity, while South Korea, Japan, and India are still trailing.

In terms of total funding, India and Australia’s high deep tech share was mainly driven by a few big energy-related deals—like Greenko Group’s $1.4B secondary round, Exide Energy Solutions’ $421M raise, and Pacific Energy’s $240M PE round.

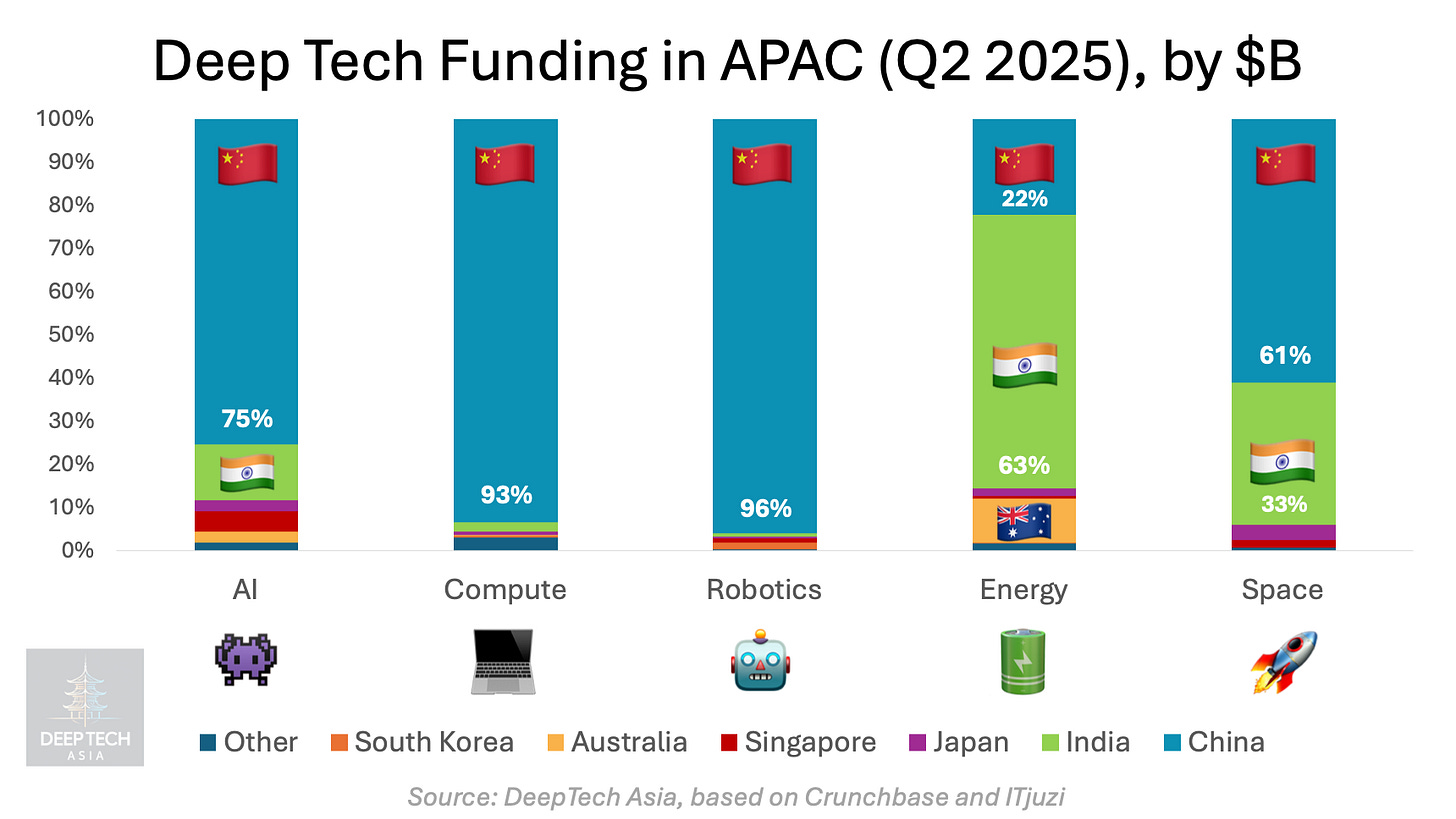

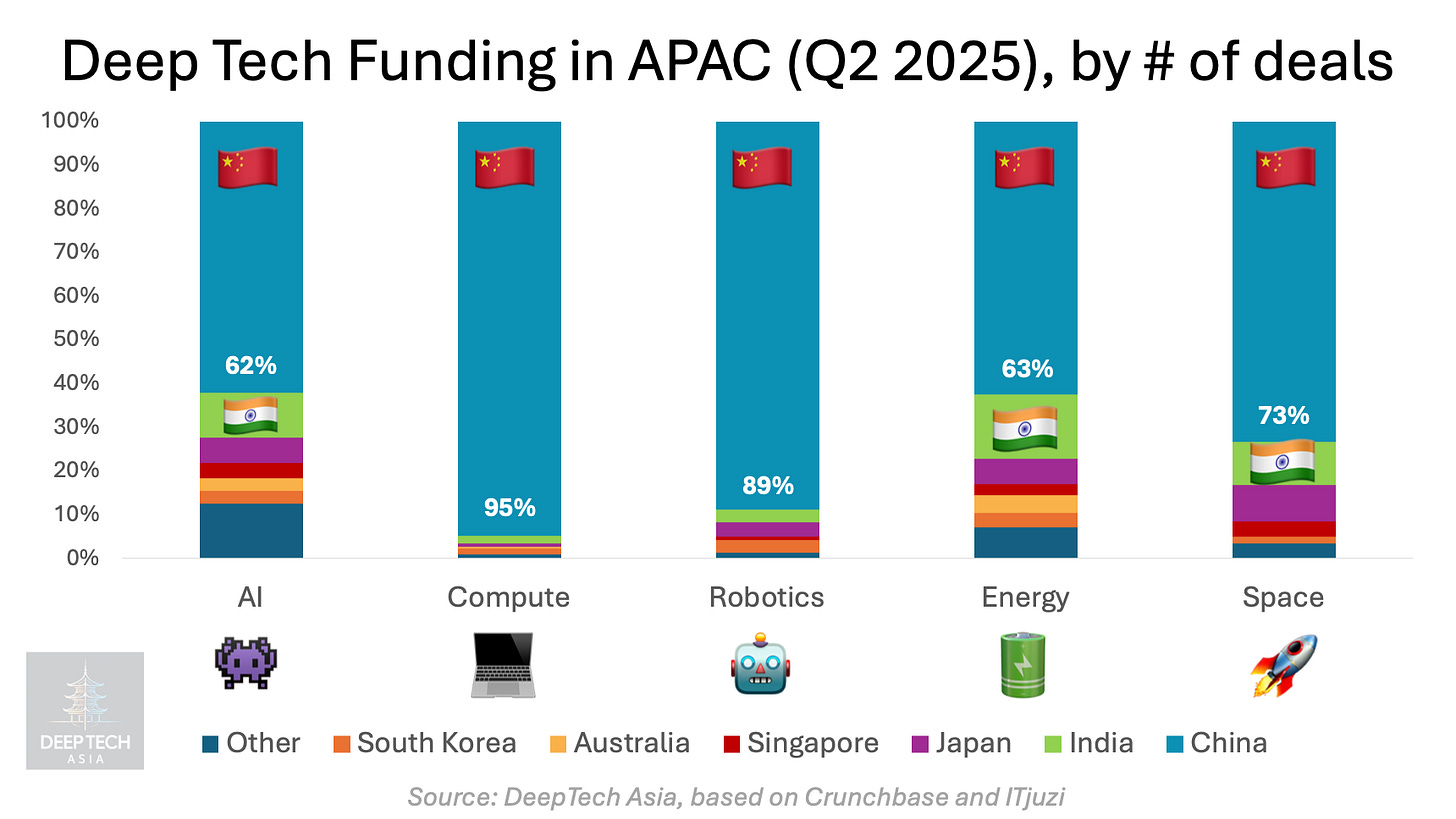

Looking closer at deep tech investment across APAC, China still dominates most categories—especially robotics and compute, where it makes up 96% and 93% of the deals. As mentioned earlier, India stood out in climate thanks to a few massive energy rounds, but it’s also starting to catch up in AI and space tech.

China still leads in number of deals, but AI and energy are starting to see more diversity, with India, Singapore, and Australia quickly gaining ground.

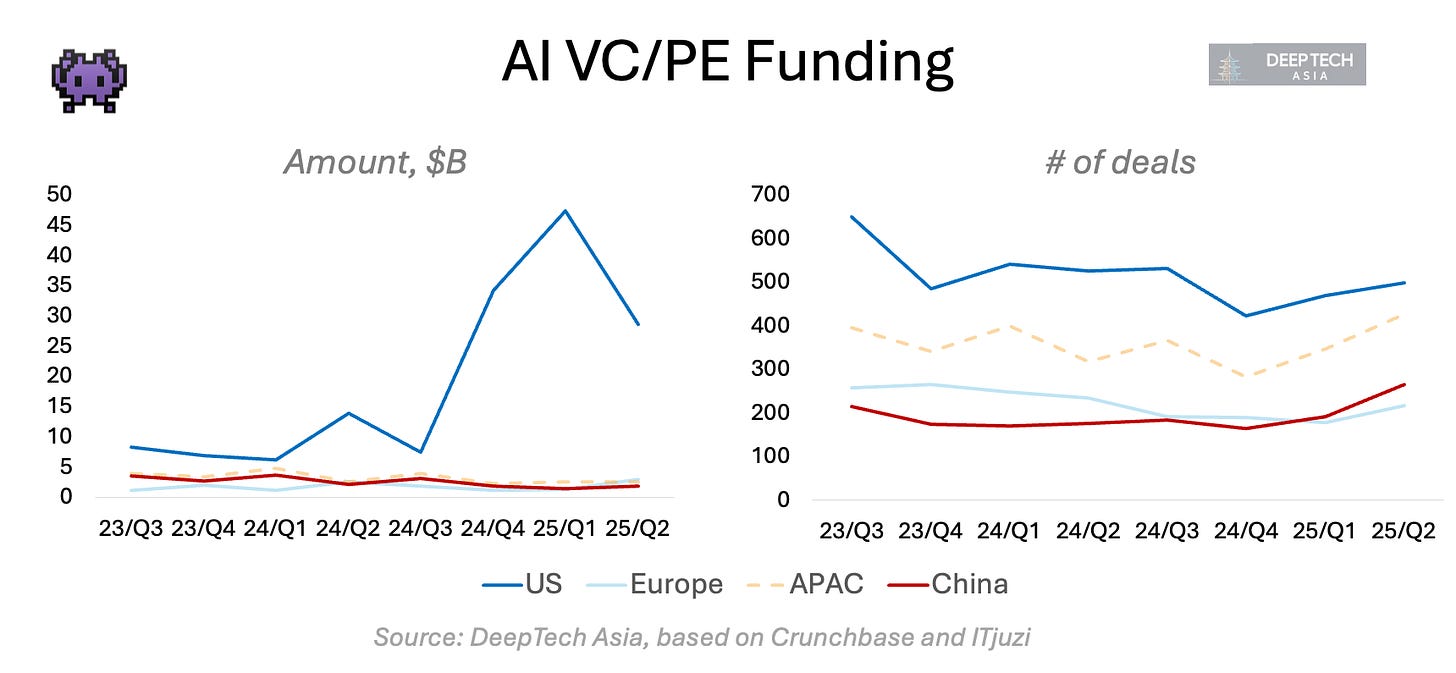

Since Q4 2024, AI investment in the US has completely outpaced the rest of the world. Over the past 9 months, around 90% of all AI software funding went to US companies, driven by massive rounds like OpenAI’s $40B raise (the biggest private round ever), Scale AI’s $14B, Crusoe’s $11.6B, and more. In Q2 2025, Europe edged ahead of China in total AI funding ($3B vs. $1.8B).

At the same time, the number of AI startups raising capital in China is growing faster than in both Europe and the US. A few notable examples include:

🇨🇳 $140M Series A from Chinese government funds: United Imaging (联影智能) is a medical AI company enabling smart equipment to support biomedical research and automating clinical workflow.

🇸🇬 $75M Series B from Benchmark: Manus AI, a versatile AI agent enhancing productivity and research across various domains. Media positioned it as Benchmark’s first deal in China, although the US fund invested in Manus’ Singaporean entity.

🇨🇳 $55M Series C+ from SingTel, Bosch and Gentree: Whale AI (帷幄), a martech startup providing brands with data and AI-driven insights and operation automation, helping them reduce costs and increase efficiency in marketing and operation.

🇨🇳 $42M pre-A from HongShan, Yunqi, PnP, Prosperity7: Noematrix (穹彻智能), a spin-off from another deep tech startup Flexiv, developing LLMs and infrastructure for embodied AI applications and general robotics solutions in different industries.

🇦🇺 $24M Series B from Bessemer: Relevance AI, an AI agent operating system that helps companies automate repetitive reasoning tasks.

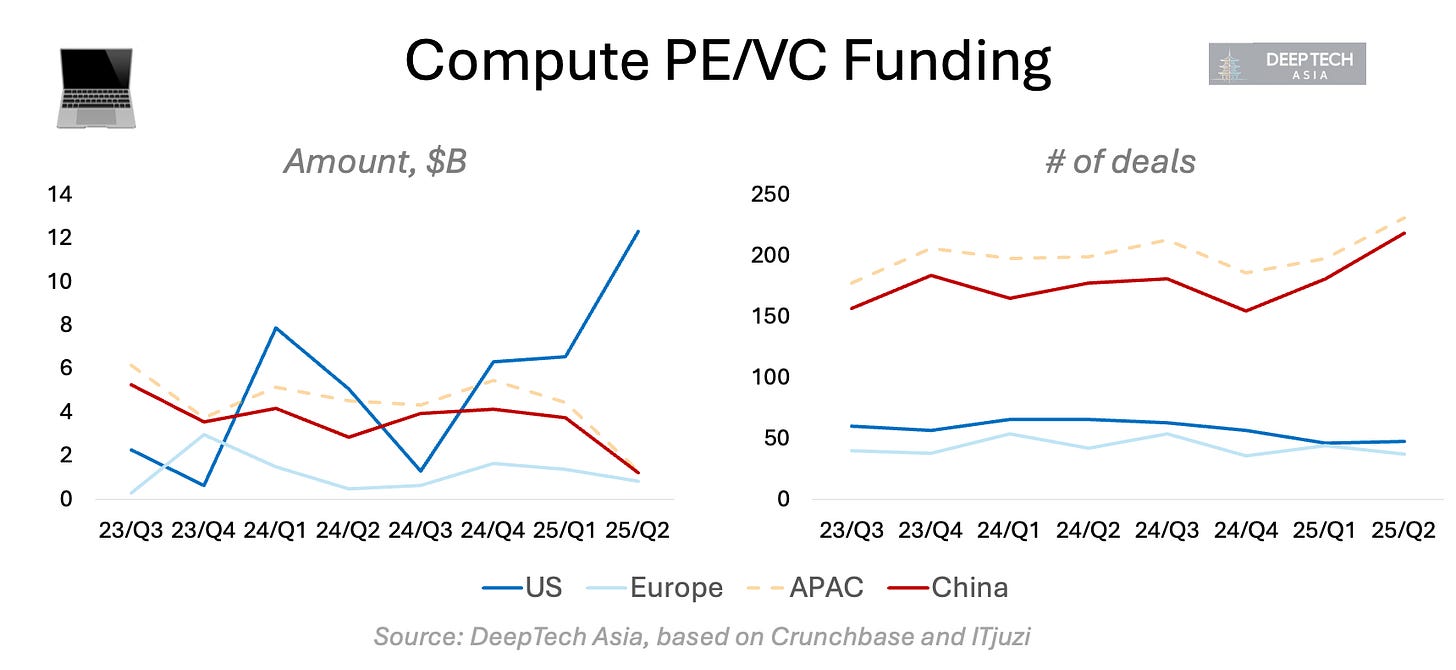

Over the past couple of quarters, American compute startups have been pulling in more and more capital, driven by surging demand from AI companies—as shown in the previous chart. In contrast, compute funding in Asia and Europe has been on the decline. In China, it dropped from $4.2B in Q4 2024 to just $1.2B in Q2 2025.

That said, China still leads by a wide margin when it comes to the number of compute startups raising money—almost 4x more than the US and Europe. The number of deals in China jumped from 155 in Q4 2024 to 219 in Q2 2025, driven by strong market demand and government efforts to build a full local semiconductor supply chain. A few standout investments include:

🇨🇳 $224M PE round: Yangtze Memory (长江存储), the leading developer and manufacturer of 3D NAND flash memory wafers, chips and other solutions used in mobile communications, consumer electronics, computers and data centers.

🇨🇳 $140M Series C from state funds: Axera (爱芯元智), a developer of AI perception and edge compute chips with multi-threaded heterogeneous multi-core design which supports leading LLM/VLMs.

🇨🇳 $14M round from state funds: Enflame (燧原科技), an AI startup developing cloud-based deep learning chips for AI training. The company raised a $280M Series D round in 2024 and is now preparing for an IPO.

🇨🇳 $7M Series C from IDG and Tencent: Jaguar Micro (云豹智能), a startup specialising on programmable data processing units (DPU). Its co-founder Sunny Siu (萧启阳) created RMI that was acquired by Netlogic / Broadcom in 2009.

🇯🇵 $7M round from Honda Motor: Rapidus, a semiconductor company developing advanced logic chips of 2 nanometers or below and building an advanced foundry in Japan.

🇰🇷 $5M round from Korea Development Bank, SBI Korea: ENERZAi, an AI startup developing AI inference optimisation engines.

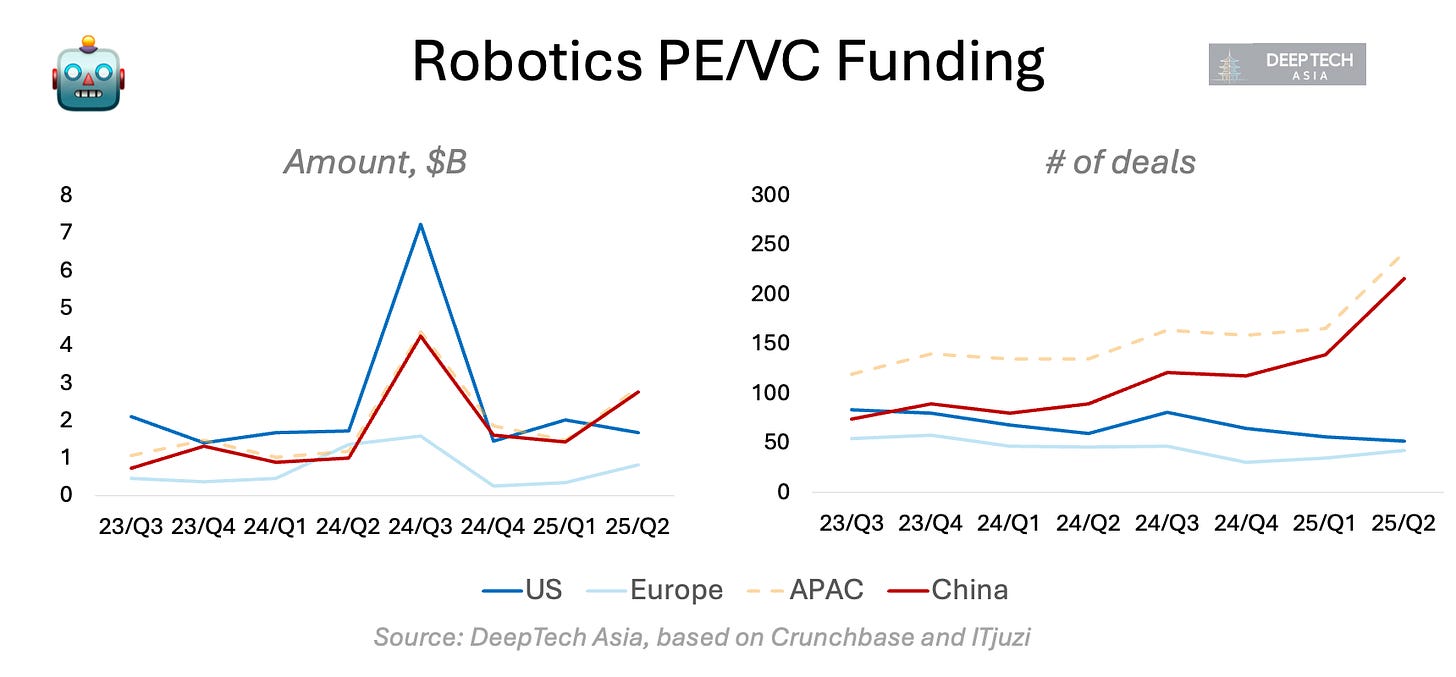

In Q3 2024, robotics and autonomous vehicle (AV) startups in both the US and China pulled in record-breaking funding—but that was largely thanks to two massive deals: Waymo’s $5.6B Series C in the US and a $3.2B round by Yinwang Intelligence (引望智能), a Huawei spin-off focused on AVs.

Since then, funding for Chinese robotics startups has been climbing steadily, while in the US it’s mostly flat. In Europe, robotics startups are raising more each quarter too, but the total is still 4–5 times lower than in China.

Some of the recent robotics investments in China and the of Asia include:

🇨🇳 $420M round from Ant Group and CATL: Zaofu Intelligent (造父智能), a robotaxi spin-off from bike-sharing platform Hellobike, focusing on developing and commercial application of L4 autonomous driving technology.

🇨🇳 $154M Series B from JiYuan (former GGV), CATL: Galbot (银河通用机器人), a leading company in embodied multi-modal large-model general-purpose robotics, focusing on the global customers.

🇨🇳 $98M Series C+ from Tencent, Alibaba, China Mobile: Unitree (宇树科技), a leading developer of general-purpose legged/humanoid robots and dexterous mechanical arms for consumer and industry applications.

🇨🇳 $91M Series C from Gaorong and TH Capital: Flexiv (非夕), a developer of human-inspired general-purpose adaptive robots for industrial automation.

🇨🇳 $91M B+ Series A from Baidu, EQT and CDH: Zelos (九识智能), a startup developing and producing L4-level unmanned robovans for urban, industrial and warehouse logistics; used for express delivery, supermarket retail, brand logistics, and community group buying.

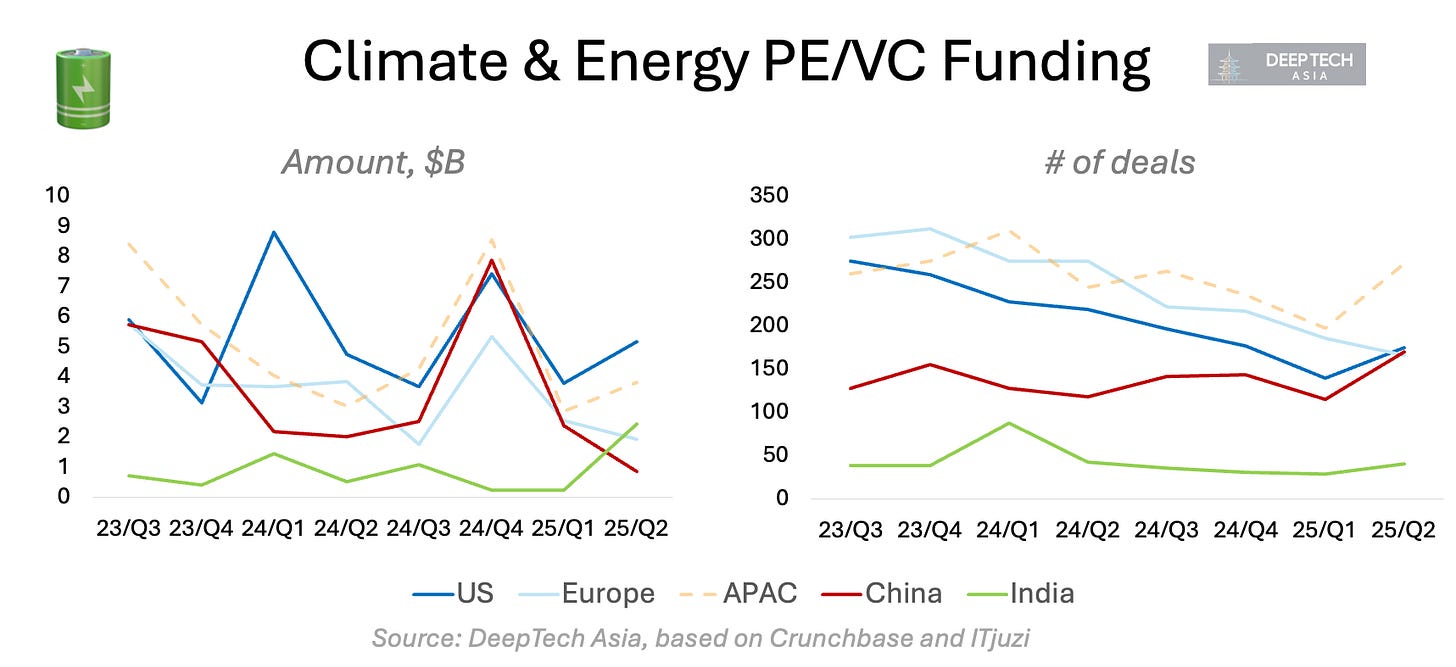

In Q2 2025, climate investment in the US saw a rebound—even with the Trump administration’s unfriendly stance toward sustainability. Both the number of deals and total funding went up, thanks to major rounds like TerraPower ($650M), Takanock ($500M), and Silicon Ranch ($500M).

Meanwhile, climate funding in Europe keeps trending down, though the number of deals is still on par with the US.

China also had a similar number of climate startups raising money in Q2 2025. But for the first time, India pulled ahead of China in total PE/VC climate funding, boosted by big rounds for Greenko, GreenLine, and a few others.

🇮🇳 $1.4B secondary transaction by AM Green Group: Greenko Group, a renewable energy company, replacing fossil fuels with integrated decarbonized energy and grid assets.

🇮🇳 $275M round: GreenLine Mobility, a company producing environment-friendly trucks powered by liquified natural gas (LNG).

🇦🇺 $78M Series D from SLB: RayGen, is a startup developing integrated energy solutions combining highly efficient solar technology and long duration energy storage.

🇮🇳 $58M PE round from ValueQuest: Jupiter International, a leading developer of solar panels, PV models and solar energy power solutions.

🇨🇳 $42M pre-A round from Ant Group: ZhongHai Storage (中海储能), a company producing large scale energy storage equipment and solutions based on iron-chromium flow batteries (ICFBs).

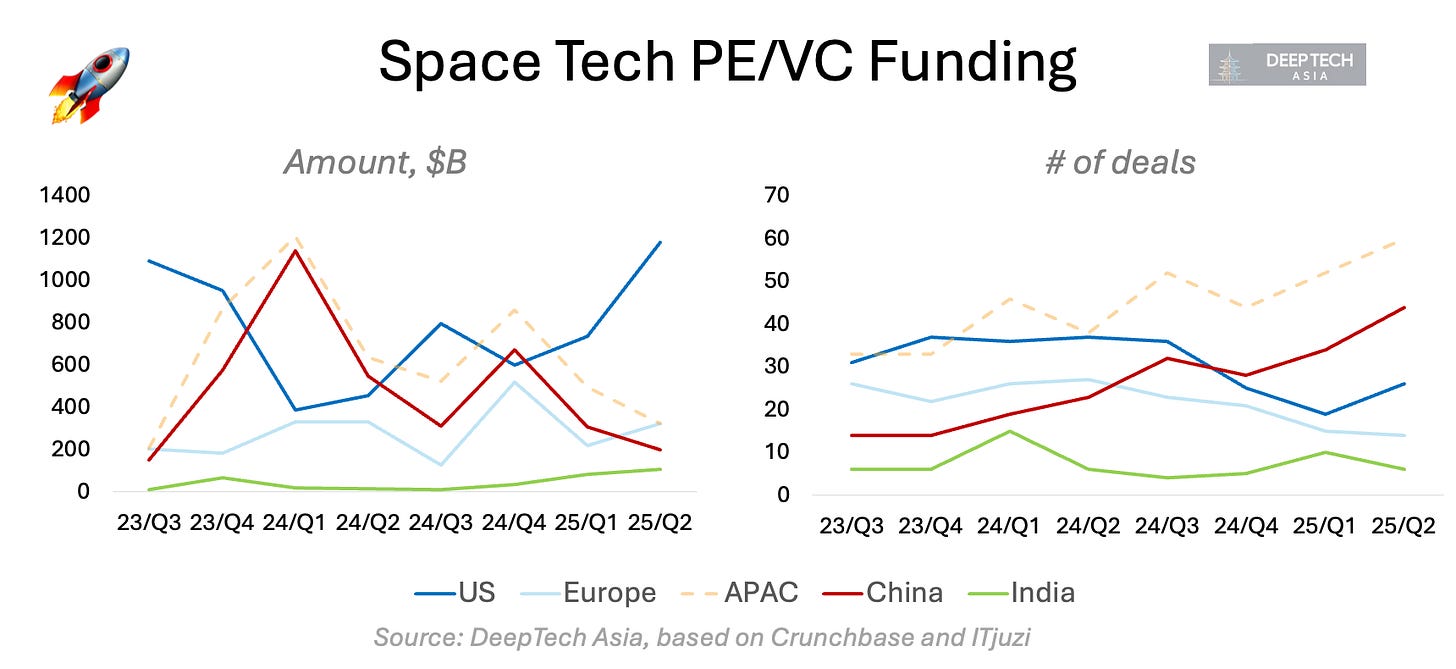

2024 was the year China overtook the US in PE/VC funding for space tech. But in the first half of 2025, American space startups have been much more successful at raising capital compared to their Chinese counterparts.

That said, the trend flips when you look at the number of deals—more Chinese companies closed funding rounds, which follows a similar pattern we’ve seen in other sectors.

India is also quickly gaining ground on China and Europe when it comes to space tech funding.

Here are some standout space tech deals in APAC from Q2 2025:

🇮🇳 $100M Series B from General Catalyst: Raphe, a leading manufacturer of high-efficiency drones leveraging ultra-light carbon fiber composites technology and autonomous navigation systems powered by simultaneous localization and mapping (SLAM).

🇨🇳 $42M Series B+ from Bohua Capital: Qianxun (千寻位置), a satellites startup, leveraging China’s Beidou system and over 6,000 GNSS augmentation stations to provide spatio-temporal intelligent services featuring centimeter-level positioning, millimeter-level perception and nanosecond-level timing.

🇨🇳 $42M Series A from Plum Ventures, Bohua Capital: Ubinexus (星移联信), a satellite internet startup designing communication load systems and building an intelligent constellation networking and satellite data operation map.

🇨🇳 $14M Series A from Bohua Capital: SpaceIoT (鹏鹄物宇), a satellite internet full stack solution provider focusing on internet-of-things applications in maritime, mining, utilities and other industries, as well as on customer use.

🇸🇬 $6M round from Paspalis, NTT Finance: Transcelestial, a laser communications startup that provides point-to-point wireless communication network.

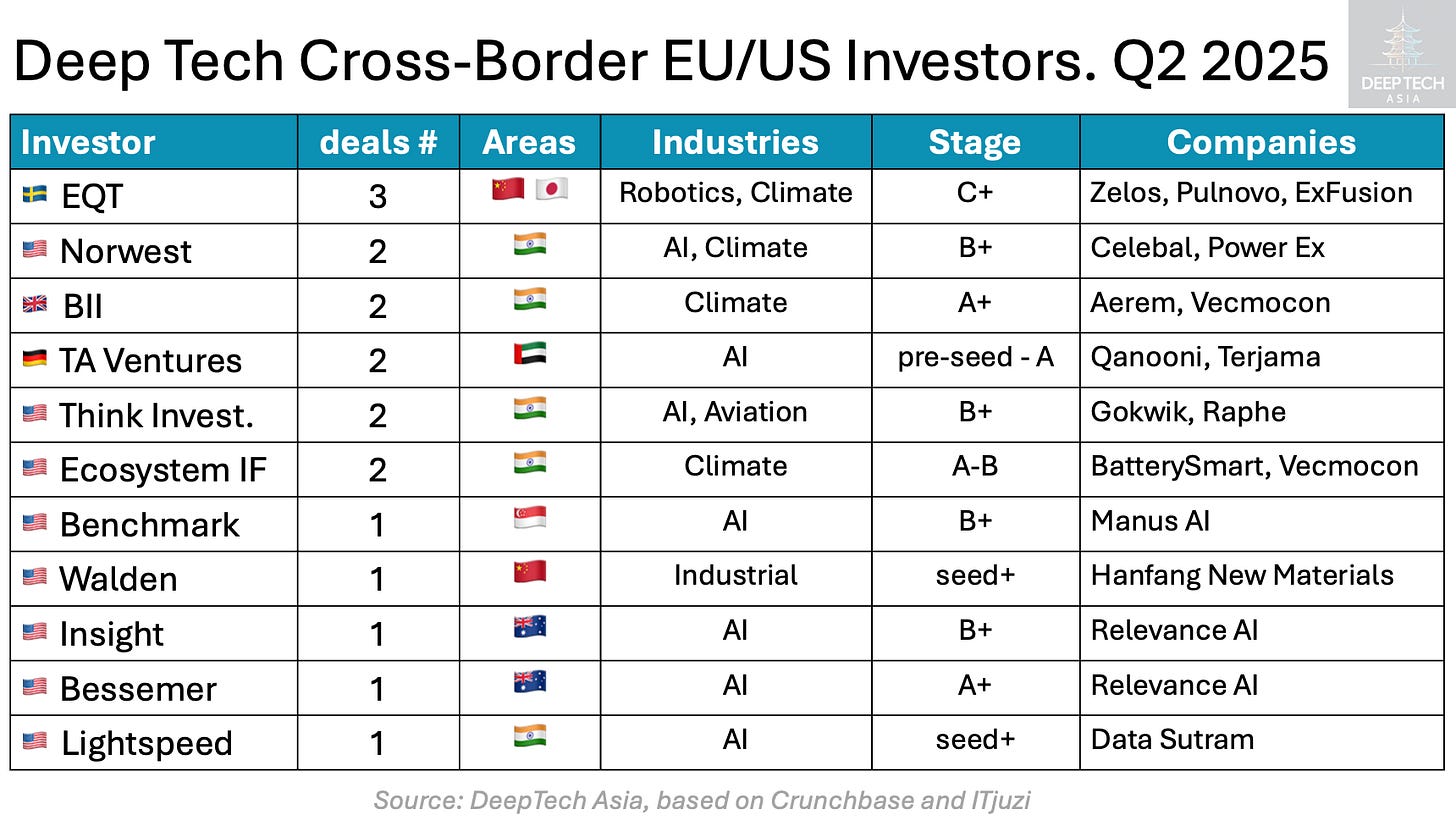

India is shaping up to be the hottest Asian market for deep tech investors from the US and Europe—especially in AI, climate tech, and increasingly, space.

EQT stands out as the most active Western backer in Asian deep tech and remains one of the few firms still consistently investing in China, despite growing caution from others.

Benchmark’s investment in Manus AI made waves across the tech world — widely seen as their “first Chinese deal.” Technically though, Benchmark backed Manus’s Singapore entity, which reflects a broader trend: many Chinese startups are now setting up HQs in Singapore to ease global expansion and navigate geopolitical headwinds.

Other examples of Singapore-headquartered startups with deep Chinese roots that raised from top-tier international VCs include Airwallex and PatSnap—both of which have successfully scaled beyond APAC.

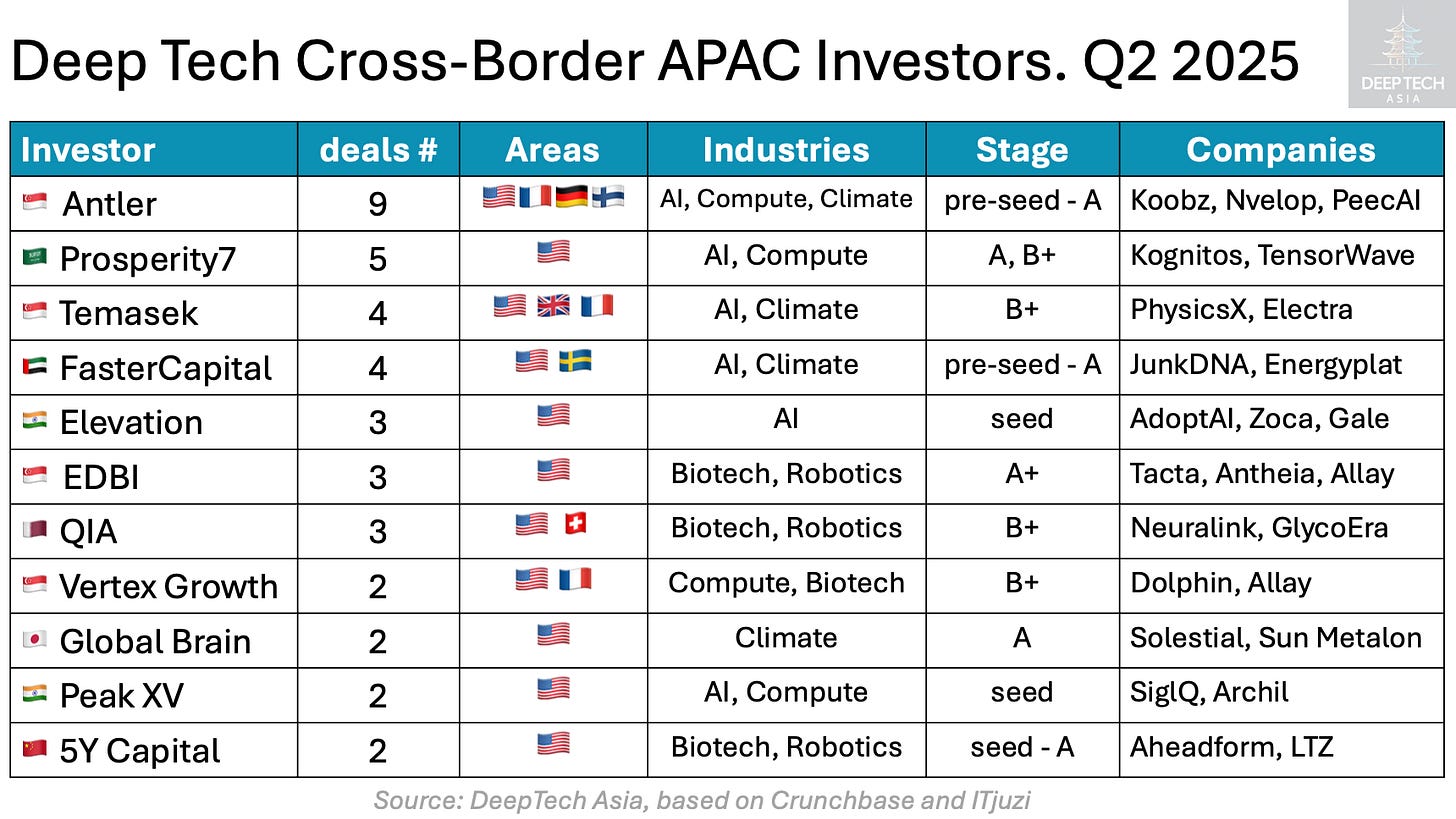

In Q2 2025, the US remained the primary target market for Asian investors seeking deep tech opportunities outside their home region. Several funds also maintained exposure to Europe—such as Antler, Temasek, FasterCapital, QIA, and Vertex.

Among early-stage (pre-seed) investors, Antler (Singapore), FasterCapital (UAE), and Elevation Capital (India) stood out as the most active Asian backers of deep tech startups in the US and Europe, with a strong focus on AI and climate tech.

On the mid-to-late stage side, Prosperity7 (backed by Saudi Aramco) and Temasek (Singapore) emerged as the leading APAC-based global investors. Notably, both firms also maintain significant exposure to China's deep tech sector.

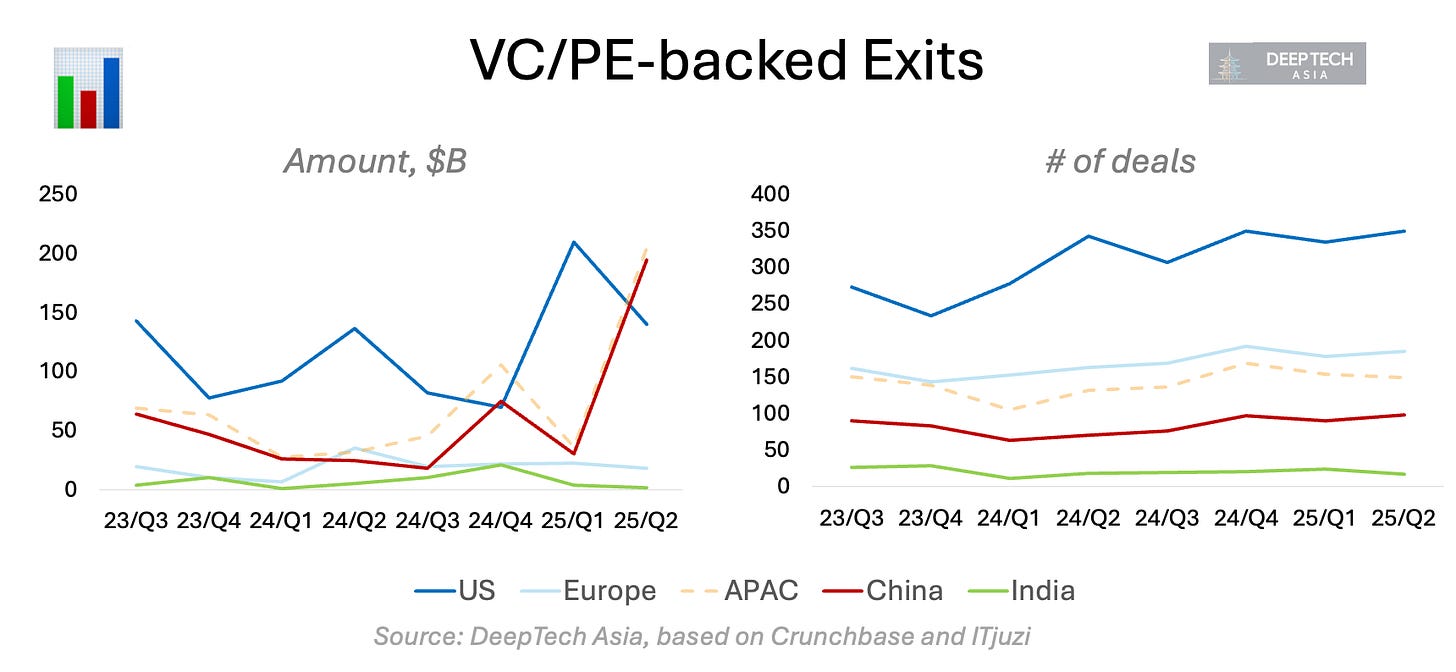

While VC exits in the US are slowly recovering, the situation in Asia still remain challenging. Both China and India significantly underperform in terms of the number of VC-backed M&As and IPOs.

Q2 2025 saw a strong spike in exit amount in China, but it was driven by a single transaction — $150B IPO of CATL on the Hong Kong stock exchange, over 75% of China’s total exit value in that period. If we exclude CATL, the exit amount in China would be stagnating.

At the same time, by number of exits China saw a 47% growth in PE/VC-backed tech M&As and a 32% growth in tech IPOs in the first half of 2025 compared to the same period in 2024. Although it’s a positive sign, the size of exits is a more direct indicator of the ecosystem health as a whole.

India has one of the most vibrant IPO markets in the world, there were 108 IPOs in India in Q2 2025, however, only less than 5% of the Indian tech companies going public are VC/PE-backed.

Below are some of the exit highlights from APAC:

🇨🇳 IPO at a $150B market cap: CATL (宁德时代), the world’s leading manufacturer of EV batteries and integrated battery solutions, major customers include Tesla, Volkswagen, Ford, Mercedes-Benz, and BMW.

🇨🇳 $2.5B acquisition by Tencent Music: Ximalaya (喜马拉雅), an online audio sharing platform accumulating 340 million audio contents across 100+ categories, powered by an AI voice assistant. Exit for Sierra Ventures, SIG, KPCB, Primavera, Hermitage and other funds.

🇨🇳 IPO at a $1.6B market cap: Unisound (云知声), an AI startup specialising on IoT solutions with focus on voice technology for smart home, healthcare, education, automotive and other use cases.

🇮🇳 IPO at a $1.4B market cap: Ather Energy, a manufacturer of electric scooters and provides fast electric vehicle charging. Exit for Stride Ventures, Tiger Global, InnoVen, GIC, NIIF.

🇨🇳 $831M acquisition: Source Photonics (索尔思), a global supplier of optical communication technology, the solutions and products for data centers, metropolitan, network communications and data connection, got acquired by an electronics equipment manufacturer Dongshan Precision (东山精密).

🇨🇳 IPO at a $765M market cap: Breton (博雷顿), developer of autonomous electric trucks for construction, mining and other industries.

If you have any proposals, ideas, or feedback, we’d love to hear from you! Feel free to reach out at denis@deeptech.asia or on LinkedIn.

Let’s connect and explore how we can improve together.

Thank you for this comprehensive analysis of the Asian deep tech startup space! This is invaluable for my research in scaling sustainable deep tech hardware startups