Would you invest in DeepSeek if you had a chance?

Not an investment advice, just a thought experiment in case it would be possible

Okay, now it’s my turn to write about DeepSeek. It’s hard to find someone who doesn’t write about this Chinese AI company these days.

No surprise.

DeepSeek erased trillions of dollars from the American stock market, NVIDIA was down 21% (their biggest dip ever), and the global media are panicking about the threat from Chinese tech which they claimed to be dead just a year ago.

There are already a lot of good articles about DeepSeek, but I haven’t seen much about the investment prospects related to the DeepSeek itself.

So, I decided to dive into it myself.

Just as a thought experiment, let’s assume that DeepSeek is raising a private round and you as an investor receive some allocation in this round. Would you invest?

Sure, many smart investors would say that DeepSeek is not a startup, it’s a subsidiary of a hedge fund which is fully funded by its parent company and doesn’t require any capital. However, DeepSeek is still at an early stage and for its further product development, commercialisation and expansion the capital of its parent company High-Flyer might not be enough.

In the past we’ve seen some open-source startups emerging as spin outs from other corporations and raising money from Tier1 investors, e.g.:

Confluent, a spin-out from LinkedIn, raised $455M from Benchmark, Sequoia, Coatue, and Index.

Clickhouse, a Yandex spin-off, raised $300M from Bessemer, Index and Coatue.

Heptio, a spin-out from Google, raised $33M from Accel and Lightspeed and got acquired by VMware for $550M.

Perhaps DeepSeek could also follow the same path and become “investable”. Below I’ll share my view on the key criteria for such a theoretical investment decision.

Investment structure — 6/10

First of all, if you are a non-Chinese investor managing assets in any currency other than RMB, investing directly in DeepSeek might not be feasible. Considering the attention company is now getting from the Chinese government, it may be designated as a national project in China, which typically restricts foreign investment unless you're a strategic state fund like Mubadala or Temasek.

However, foreign investors still could invest via an special purpose vehicle (SPV) or even a feeder fund managed by one of those lucky private funds that managed to get allocation in the company.

In most cases, these investment vehicles may even have a friendly jurisdiction for foreign investors, e.g. Caymans, Bermuda or even Delaware, which is usually the case for many other late stage Chinese unicorns (Bytedance, Red Note, Shein etc).

Valuation is hard to guess, but we may compare DeepSeek now with Open AI in early 2023 when it just released ChatGPT and raised $10B from Microsoft. Back then, Open AI also didn’t have any meaningful revenue and was valued at $29B.

You may apply a 50% China discount (e.g. P/S ratio for Alibaba is 50% lower than for Amazon), which would bring us to around $15B.

For the context, Zhipu AI, another Chinese open source LLM provider that is still behind Open AI in terms of performance, has recently raised a $412M round at $3B valuation.

Risks:

Limited transparency — medium. Although non-Chinese investors may invest through structures in familiar jurisdictions, having additional layers between them and the company creates complexity. Limited transparency increases chances of fraudulent schemes. Additionally, there are also language and cultural barriers that should not be underestimated.

Technology — 10/10

DeepSeek has released several AI models over the past year, including DeepSeek LLM with a long-term scalability perspective, DeepSeek-VL for real-world vision and language understanding applications and DeepSeek-V2, a Mixture-of-Experts (MoE) model with highly efficient training and inference.

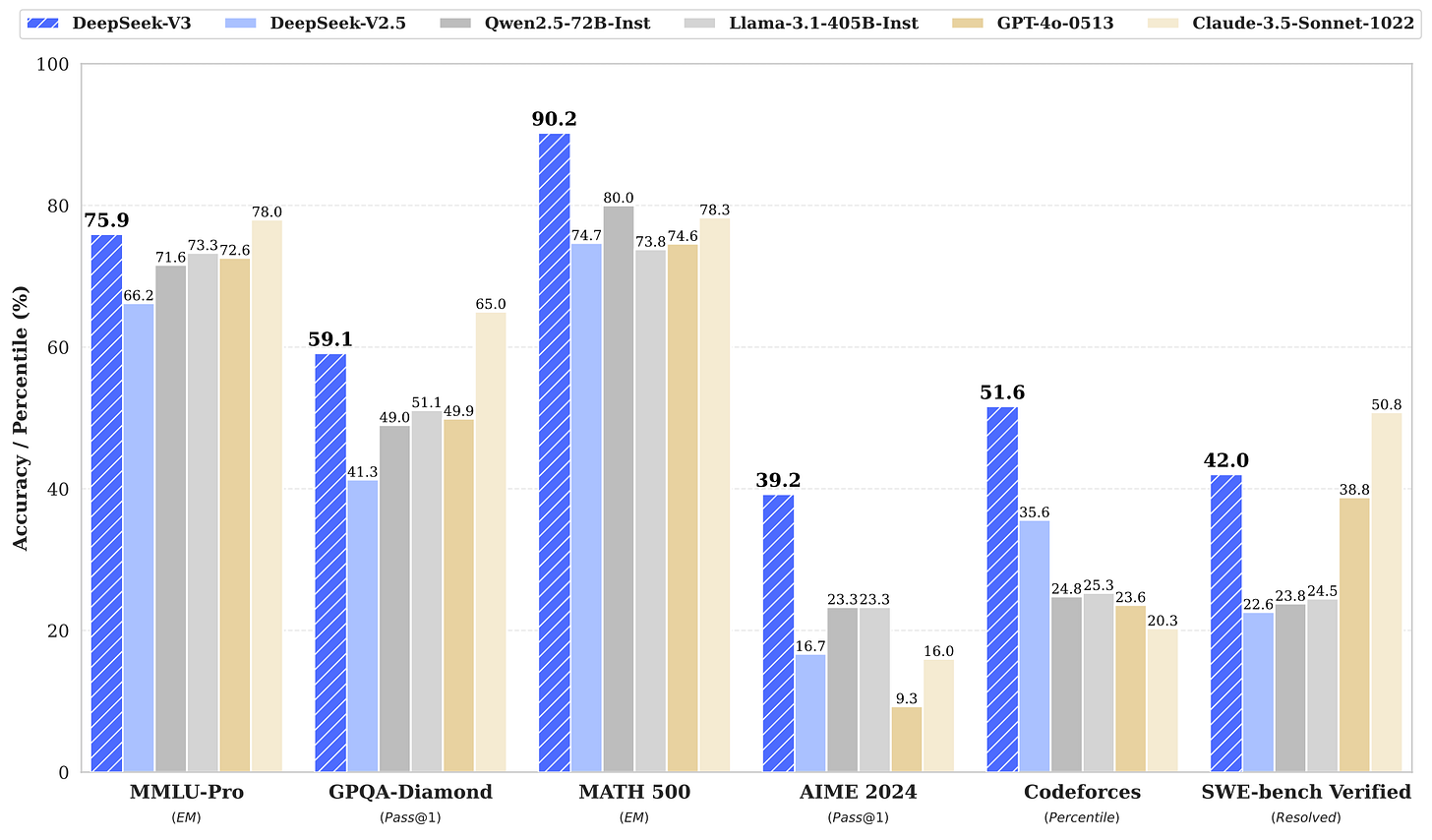

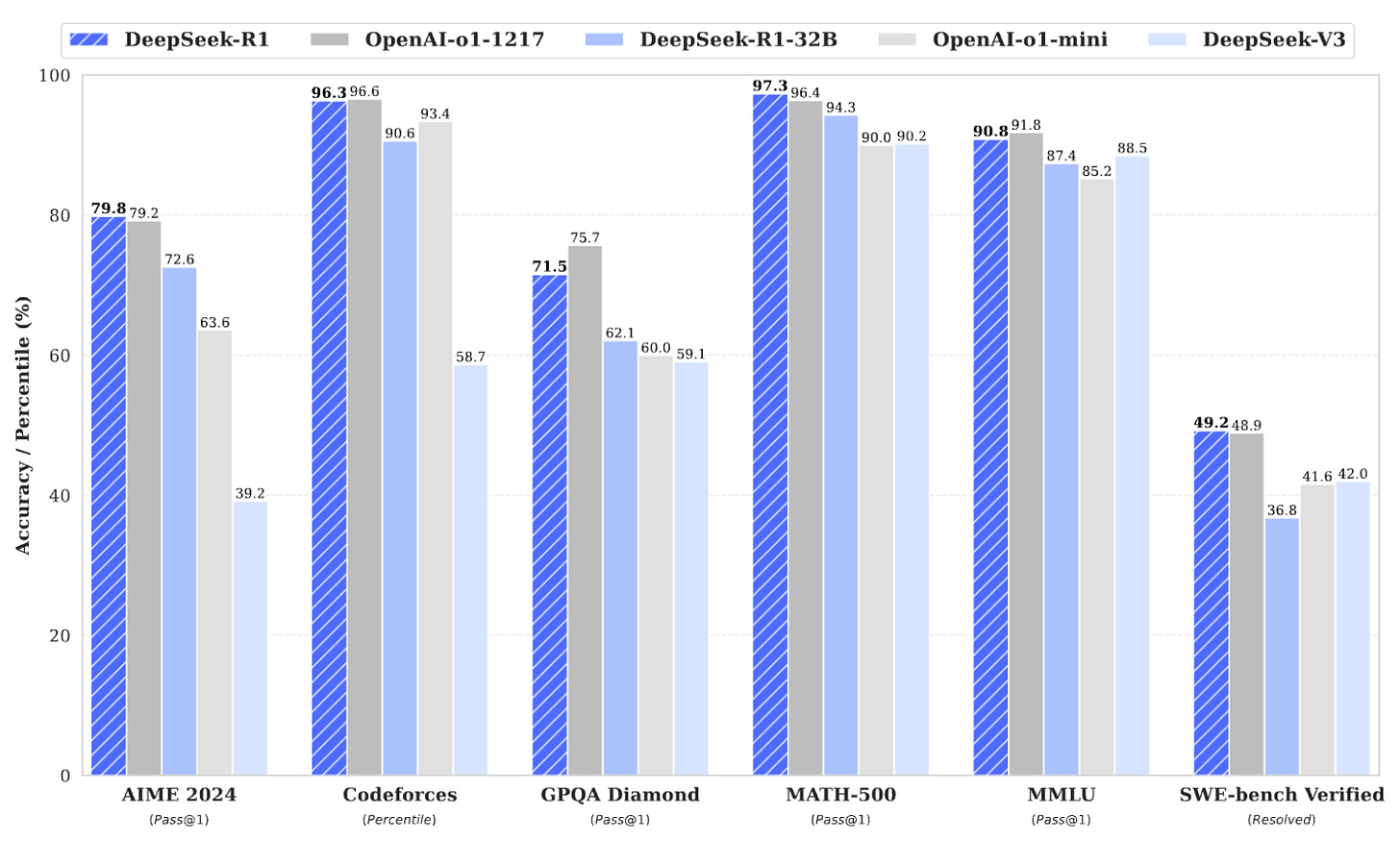

However, the biggest stir was caused by the recent two models released in January 2025, namely, DeepSeek-V3, a stronger version of V2 with 671B parameters and 37B activated for each token, and DeepSeek-R1, their first reasoning model trained via large-scale reinforcement learning (RL) without supervised fine-tuning (SFT).

V3 outperforms other open-source AI models and achieves performance comparable to the leading closed-source models, such as GPT-4o and Claude-3.5-Sonnet, while R1 outperforms OpenAI-o1 in most tasks, including reasoning, knowledge and math and is comparable with OpenAI-o1 in coding.

The major advantage of DeepSeek models is their efficiency. In its paper DeepSeek claims to have used only 2048 H800 GPUs for less than two months for its V3 model training, which is an equivalent of 2788k GPU hours. Assuming that the rental price of H800 is $2 per GPU hour, they estimated the compute costs on training only at $5.576M. It excluded any staff, infrastructure and energy costs.

For comparison, OpenAI spent $100M on training ChatGPT4, including $40M of the total compute cost and $18M in pure AI chip cost, according to this Stanford paper. Considering that staff cost in Hangzhou is considerably lower than in Silicon Valley, the total training cost for DeepSeek-V3 should be around $20-25M, which is 4-5x times lower than for the comparable ChatGPT4 model.

Despite its technological advancement, DeepSeek’s product is still at a very early stage. It doesn’t support the full multimodality and is inferior in terms of security compared to other leading AI models. However, those problems will be solved as the product matures, e.g. DeepSeek has recently announced its first multimodal model Janus-Pro.

Risks:

Security — low. Security researchers keep finding a lot of vulnerabilities in DeepSeek models exposing prompts and internal data of users. It’s common for an early stage company like DeepSeek, they would need to invest more resources in fixing this, but it’s doable.

Data privacy — low. A lot of users or potential customers are concerned about their data potentially accessed by the Chinese government. It is probably the case for individual users. However, any enterprise customers can deploy DeepSeek on the servers they trust, out of China. There was an interesting article by Interconnect explaining this.

Conclusion: DeepSeek has made an impressive progress in a limited amount of time with extremely constrained resources; technology is clearly the biggest advantage of the company.

Product and Business Model — 7/10

Although DeepSeek is promoting open source, we know a lot of successful commercial open source companies, such as Red Hat, MongoDB and Databricks, including several companies originated from China, e.g. PingCap.

Theoretically DeepSeek could also be one of them.

Closed-source horizontal LLM developers mainly monetise through their B2C product subscription, while some revenue portion comes through APIs. For example, Open AI generates 75% of its revenues through the ChatGPT subscriptions, while open source AI models like Llama keep their core product free and monetise mainly through APIs. At least for now.

Chinese LLM developers, vice versa, mainly monetise through APIs and MaaS (Model-as-a-Service) and on top of this have some B2C subscription revenue, which has been the case in China for many other software businesses. Some Chinese open source AI companies, such as Zhipu AI, provide some of their models for free, while keeping the other models proprietary.

Now, DeepSeek’s business model is similar to Llama’s one, it has two working products: 1) DeepSeek Chat which is free of charge, and 2) DeepSeek API.

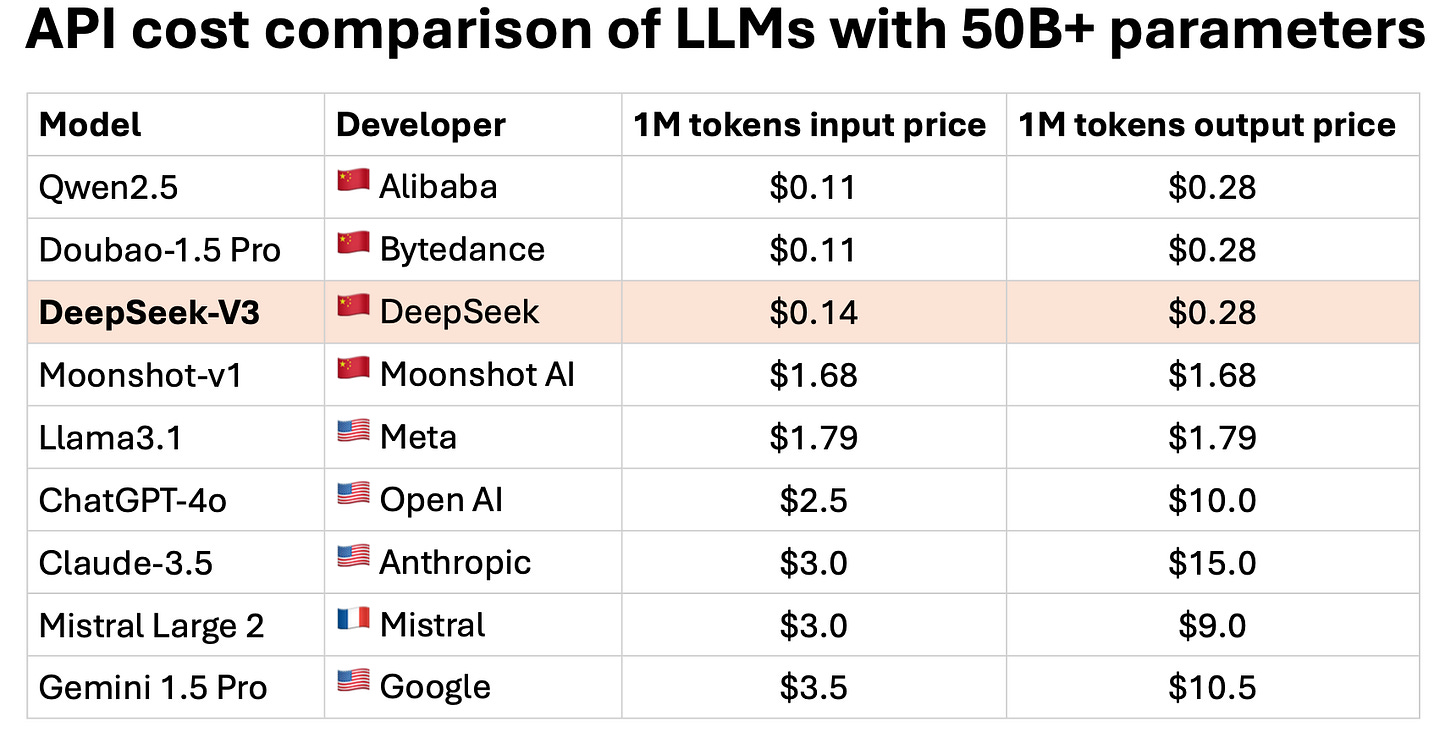

While DeepSeek-V3 APIs are 18x cheaper than ChatGPT-4o and other Western AI models, their pricing is almost the same as for their Chinese AI developers. It means that now there will be a pricing war between LLMs globally, but first of all, in China.

Unit economics is another question. In his interview in July 2024, the DeepSeek’s founder Liang Wenfeng mentioned that the DeepSeek has “modest profit margin above its costs”. However, it’s not clear if he included the full cost in his calculations.

Open AI is losing money on its models even with the current pricing. Considering that DeepSeek’s price is 18x lower than for Open AI, but the total training cost is potentially only 4-5 times lower, DeepSeek should now have ~4x lower margins than Open AI. It’s definitely not sustainable in the long run, unless DeepSeek raises money.

Risks:

Export controls — high. Trump is already considering tightening restrictions for chip exports to prevent Chinese companies like DeepSeek from getting enough GPUs. Of course, DeepSeek would still get them in one way or another, but the cost could rise significantly, which would make the cost advantage less critical.

Product development — low. Yes, DeepSeek still needs to develop a lot of features, such as multimodality, as well as optimise the existing models. However, with such a strong team it’s a matter of time.

Conclusion: the cost and price advantages are clearly impressive, but it’s still questionable if the company manages to maintain them with further tightening of export controls and the growth of the business.

Market and Competition — 4/10

China’s AI market size is projected to reach $100B in 2025, according to Qianzhan Research Institute and it’s going to be a bloodbath among corporates (Bytedance, Alibaba, Tencent etc) and large AI startups (Zhipu AI, 01.ai, Moonshot AI, potentially DeepSeek).

However, the biggest advantage of DeepSeek is that it’s open-source. Their biggest opportunity is the global market which is counted in trillions of dollars.

Some may say that no American or European companies would ever use a Chinese LLM because of censorship and data privacy. I wouldn’t agree with this statement, and I bet that Western companies are already deploying DeepSeek. As we mentioned above, as long they deploy DeepSeek on the servers they trust, they are relatively safe.

Risks:

Commoditisation — high. DeepSeek is pushing the prices for AI models down, thus decreasing margins for all LLM developers across the industry. In the short term, it may give advantage to DeepSeek, but in the long run it decreases the total addressable market.

Geopolitical barriers — high. Western countries will most likely prohibit sensitive industries (defence, finance etc) from using DeepSeek as infrastructure. There still may be enough non-sensitive segments on the Western markets that DeepSeek could penetrate. However, if China’s government decides to “participate more actively in DeepSeek’s development” and invest in it through one of its state funds, it can potentially jeopardise relationships between DeepSeek and its potential Western customers.

Technology diffusion — medium. Large companies like Alibaba and Bytedance may just adopt DeepSeek’s training method because it’s open source and eliminate the first-mover advantage.

Global competition — medium. DeepSeek has cost advantage against the US competitors. Global companies are not as aggressive as Chinese companies in terms of pricing. However, they will still adopt DeepSeek’s technology sooner or later if it proves to be a more efficient way to train AI models.

Challenges with global expansion — low. Previously there were not that many Chinese (or Asian) companies that succeeded in expanding globally, but the trend is changing with Huawei, BYD, CATL, Bytedance and others.

Government crackdown in China — medium. This risk has shattered the investment sentiments in China a lot over the past few years. AI is one of the national priorities for China, so this sector is pretty safe from any scrutiny from the government. However, at some point anything may change, so it is important to follow the state agenda closely.

Conclusion: the market is huge, but there are a lot of market risks associated with DeepSeek being a Chinese company expanding globally, as well as industrial risks for any LLM developers.

Team — 6/10

DeepSeek has around 140 employees, mostly scientists and developers who are based in China (Hangzhou, Shanghai, Beijing). But there are also some people in the US (California, Texas) who mainly cover sales and partnerships.

Liang Wenfeng (梁文锋), the founder, is very low profile. He was born in 1985, graduated from from Zhejiang University in 2008 with a major in Information and Electronic Engineering. In 2015, he created High-Flyer (幻方量化), one of the largest quant hedge funds in China ($7B AUM). In 2016, they started to experiment with AI and fully adopted AI for all their trading operations in 2017. In 2019, Liang spearheaded the team focused on training an advanced AI platform Firefly I (萤火一号). Since 2019, they’ve invested $140M in the Firefly project before it became DeepSeek in 2023.

Some people admit that Liang is not motivated to commercialise DeepSeek, because he earns much more money on High-Flyer and DeepSeek is just his “side-project”. Yes, in his interview Liang mentioned that he is focused on AGI rather than commercial applications. But he also says that he prioritises the ecosystem building over short term gain, which means that the end goal is still commercialisation, it’s just more long-term but potentially much more impactful.

Having said that, I would agree that if DeepSeek were to raise money from private investors, the commercialisation time horizons could be potentially the source of disagreements between Liang and his investors.

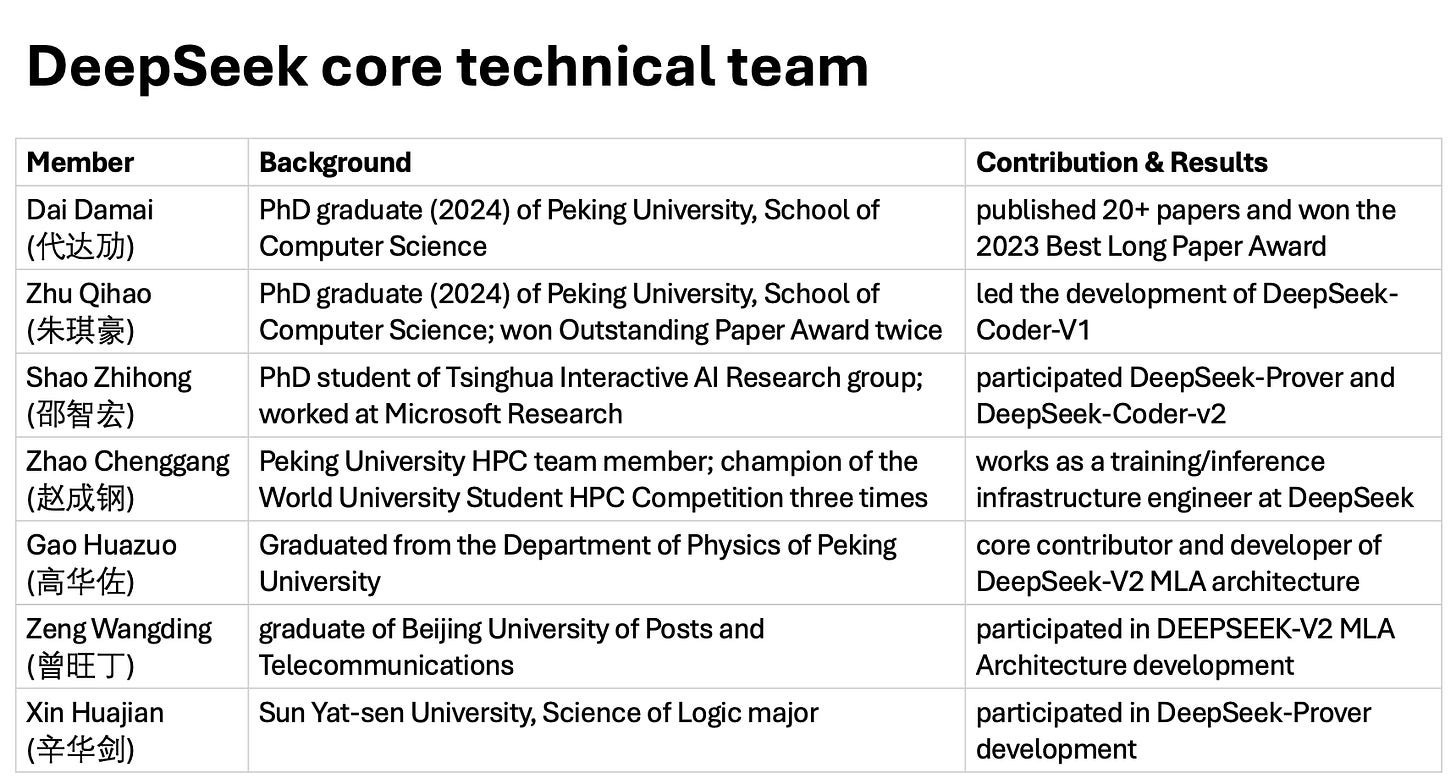

The team of DeepSeek is quite different from other LLM developers, it mainly consists of young PhD students and fresh graduates from Tsinghua, Peking, Zhejiang and other top-tier Chinese universities. Despite the young age, many of them have impressive background with dozens of paper in Chinese and global scientific papers and multiple championship titles at IT competitions.

Some other team members include:

Training core team

Wu Ya (吴俣), PhD graduate (2019) from Beihang University, worked at Microsoft on Xiaoice (小冰) emotional computing and Bing Encyclopedia projects. Leads DeepSeek post-training project.

Guo Daya (郭达雅), PhD graduate (2023) from Sun Yat-Sen University. Joined DeepSeek in July 2024, focuses on math and coding model development.

Hardware partnership team — mainly consists of ex-NVIDIA trainees, ex-Alibaba Cloud technical staff and High-Flyer AI team members, focusing on optimising compute power and improving hardware architecture.

Risks:

Founder’s motivation — medium. The founder prioritises AGI-focused research over commercialisation, which might be a problem for his potential investors in the long-term.

Almost no commercial team — medium. Now, DeepSeek consists mostly of scientists. Although Liang Wenfeng and his High-Flier colleagues have financial background too, it might not be enough to successfully build out the go-to-market strategy and sales processes.

Young team — low. Despite their impressive backgrounds, most employees at DeepSeek are not very experienced, which may be a challenge, but also an advantage.

Conclusion: the founder is less focused on commercialisation which is not ideal for many private investors; the team is young, not very experienced, but with impressive background and track record; the technical team managed to achieve significant efficiency gain and surpass Open AI; however, the further development of the company will require more complex and commercial skills that still need to be developed.

Exit potential — 6/10

In China, 85% of all VC exits are done through IPOs. According to ITjuzi, the only M&A exit for VC-backed AI startups in China was RavenTech. It was sold to Baidu in 2017 for $90M. That is why IPO is the most probable option.

As a Chinese company, DeepSeek would definitely go public in China. In 2024, there were six exits of VC-backed AI startups in China, including some sizeable ones, e.g. XtalPi ($2B+ market cap), Black Sesame ($1.8B market cap) and iFlyHealth ($1.1B market cap). For comparison, the US had 13 IPOs of VC-backed AI startups in 2024.

However, DeepSeek could also go public on Nasdaq or other US stock exchanges. With the growing geopolitical tensions it’s becoming more and more complicated, but we’ve seen a few significant Nasdaq IPOs recently, e.g. Hesai Technologies (Feb 2023) or Pony.ai (Nov 2024). If DeepSeek gets significant traction outside of China and maintains its ability to create media buzz, listing on Nasdaq could also be a good option.

Risks:

Limited IPO opportunities — medium. Because of several factors (geopolitics, government crackdown, macroeconomics), the Chinese stock market has been not in its best shape lately. Multiples are low, and investor expectations are not very optimistic, which results in fewer IPOs than in the US or even in Europe. There are some successful examples mentioned above, and the market seems to be reviving, but the situation is still unpredictable.

Final remarks

Below you can see the summary of criteria that could influence your theoretical decision about investing in DeepSeek based on my analysis.

Investment criteria:

Investment structure — 6/10

Technology — 10/10

Product and business model — 7/10

Market and competition — 4/10

Team — 6/10

Exit potential — 6/10

Average score: 6.5/10

Again, it’s not an investment advice, but just a thought experiment. I feel that if DeepSeek were to raise capital, it would definitely be a high reward opportunity, but also with high risk, especially the market risk. However, from now on this is going to be the case for any LLM investments. This is the main disruption DeepSeek brings.

Really excited to hear what you think!

How would you rate each criteria? Would you invest in DeepSeek if you had a chance?

Please let me know your thoughts and don’t hesitate to contact me at denis@deeptech.asia or find me on LinkedIn if you have any suggestions or comments. Always glad to discuss and hear other people’s opinion!

A lot of people are trying to get some exposure to it by investing in the ADRs thinking they’d have “some benefit” from DeepSeek’s tech. Due to restrictions, there is no other way to get a position in a Chinese private AI company I guess.