Chinese Tech Going Global. Playbook

Story on how China keeps forging new global champions (BYD, Bytedance, Jinko Solar, Goldwind), how they win against Western competitors and why sometimes it doesn't work

Before kicking off, I’d like to give a huge shout-out to Kyle Chan, JS Tan, Lillian Li, Blaine Curcio and Kevin Xu for inspiring with a lot of ideas for this article. Also special thanks to David Li, Lily Ottinger, Li Zhanglu, Alexander Kremer, Fedor Susov, Francesco Ricciuti, Huang Weijia and Patrick Kavanagh for their sharp insights and thought-provoking feedback.

Building global businesses is hard. Consistently creating multiple global champions across different industries? Almost impossible.

Unless you're China.

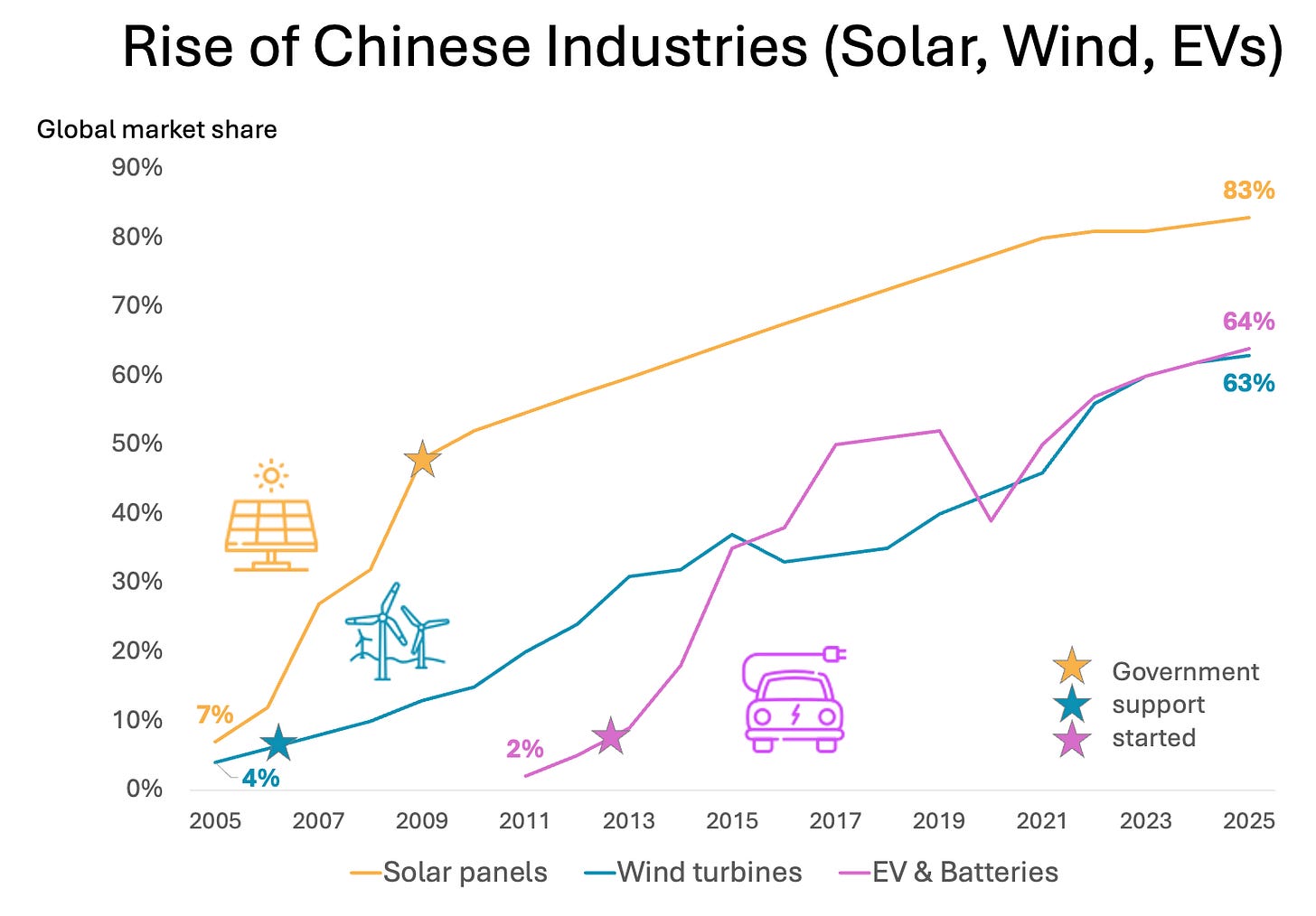

In just two decades, Chinese manufacturers in sectors like solar panels, wind turbines, and electric vehicles (EVs) have gone from near zero to 60–80% of global market share.

It looks like China has discovered a “secret sauce” for scaling industrial giants. But is it truly sustainable? And can it be replicated in other industries?

China’s “Magic” Formula

All these three industries in China — solar panels, wind turbines and EVs — have gone through the same evolution:

Stage 1. Inception. Key technologies were transferred to China by global market leaders in exchange for access to its massive and fast-growing domestic market. Companies like Applied Materials (PV manufacturing equipment), Vestas and Gamesa (wind turbine designs), and global automakers (Volkswagen, GM, and Toyota) agreed to share or localise technologies through JVs or licensing agreements with Chinese partners (SAIC, FAW, Dongfeng etc). These firms were lured by the enormous revenue potential of what was becoming the world’s largest market for clean energy and autos.

Even Tesla launched Gagifactory in Shanghai. Although it was a wholly-owned entity, some diffusion of talent probably may have taken place.

Stage 2. Strategic guidance. After noticing a promising tech trend, China’s central government designates this direction as the national strategic priority and includes it into the next Five-Year plan. This commands a clear signal to local governments to start providing generous incentives to any companies that are involved in strategic sectors. The toolsets are very extensive: subsidies, grants, tax breaks, cheap land, low-interest rates, procurement mandates or local component requirements.

In some cases, government support began almost immediately after the emergence of the first domestic players — for example, local content requirements for wind turbines were introduced as early as 2006, and consumer subsidies for electric vehicles rolled out in the early 2010s. In other cases, such as solar panels, the government stepped in only after domestic firms had already captured a dominant global position: by the time the Golden Sun Program was launched in 2009, Chinese manufacturers had already secured over 50% of global market share.

Important to note that by taking these “benefits”, companies also bear heavy responsibility to perform according to the strict KPIs (revenue growth, profitability, taxes etc).

Stage 3. Oversaturation. Such favourable conditions give birth to hundreds of copycats that flood the domestic market with cheap barely differentiated products. For example, in mid 2010s there were around 500 EV brands and thousands of solar panel producers in China. All this contributes to creating a broader industrial ecosystem with the complete and interconnected supply chain within one country or sometimes even within one province.

Stage 4. Price wars. Competition between local companies on the domestic market intensifies, prices fall, margins are being squeezed, many companies die. Some of them fail to meet government KPIs and get cut off from the subsidies. For example, 400 Chinese EV companies ceased operations between 2018 and 2025.

But for China, this is not a flaw, but a feature — both success and failure contribute to building the supply chain. As venture capitalist David Li aptly puts it: “China builds arenas for the Hunger Games.”

Stage 5. Natural selection. Such a harsh market environment forces Chinese companies to innovate faster and increase operational efficiency. Eventually, those with the best unit economics and largest cash war chest survive and start expanding into the global markets where margins are higher. The domestic market starts consolidating.

Stage 6. Global dominance. The survivors emerge as national champions, expand into global markets, and outcompete international rivals through aggressive pricing, competitive product quality, and deep cash reserves. Ironically, the casualties of China’s expansion are often the very companies that once transferred the original technology—like Vestas, Gamesa, and Volkswagen.

Stage 7. Price wars continue. Even after acquiring a major market share, the Chinese players continue fiercely competing with each other, which eventually leads to overproduction, both in China and globally. Margins keep falling, national champions become loss-making and force their local government sponsors come for rescue (too big too fail), as it happened with NIO being saved by the Anhui government in 2024.

Stage 8. Equilibrium. At some point, price wars end through setting price floors, either by the government intervention (solar panels) or agreements between the largest players (wind turbine). For EVs, such a solution is still to come.

State-Driven Model — Key Success Factors

Why did these three industries in China manage to become so competitive both on the local and global markets in such a relatively short period of time, while other countries fail to catch up?

Below are the key factors sorted by their contribution to success:

Government support

The central government, along with provincial and municipal authorities, implement targeted measures to support solar panel, wind turbine, and EV manufacturers. This support mainly focuses on 1) enhancing the cashflow reserves (direct subsidies, grant, low-interest loans), 2) optimising cost (R&D subsidies, land grants), and 3) boosting revenue growth (feed-in tariffs, consumption subsidies, local component procurement requirements etc).

In the solar sector, the "Golden Sun" program (2009–2013) provided billions of RMB in subsidies for PV deployment. Similarly, wind power benefited from the Renewable Energy Law of 2005 and subsequent feed-in tariffs that guaranteed fixed returns.

For electric vehicles, the government rolled out direct consumer subsidies of up to $10,000 per vehicle in the early 2010s, along with extensive public investment in charging infrastructure. Between 2009 and 2022, total government subsidies for EVs exceeded $30B. BYD alone received almost $2B subsidies from various local governments between 2020 and 2022.

Talent

China's extensive higher education infrastructure and focus on STEM education have yielded a vast pool of engineering and technical talent. As of 2023, China graduates more than 1.4 million engineers annually, the highest in the world. Universities such as Tsinghua, Zhejiang, and Shanghai Jiao Tong play major roles in clean energy R&D, often in collaboration with industry partners.

For example, Huawei’s ICT Academy program has partnered with over 3,000 universities globally, training more than 1.3 million students in fields like AI, cloud, and 5G. Other programs are pushed by the government, such as the joint-talent training initiative of the Ministry of Education which has linked more than 2,400 employers with more than 2,000 universities, benefiting more than 6.2 million students in strategic tech areas (AI, semiconductors, robotics etc).

In terms of patents, China leads global filings in solar PV, wind turbine design, and EV battery technologies. According to WIPO, after 2020 over 30% of global patents in solar and other energy-related technology are filed by Chinese entities. Leading firms like CATL (for EV batteries) and LONGi (for high-efficiency solar wafers) invest over 5–7% of annual revenue into R&D.

Innovation

China’s green tech rise has been accelerated by both internal innovation and the strategic transfer and adaptation of foreign technologies—often facilitated by state policy. In solar, the early 2000s saw Chinese firms import manufacturing equipment from Germany and the US, while hiring experienced engineers from Taiwan and Japan. The 2008 financial crisis triggered a wave of bankruptcies among Western PV firms, enabling Chinese companies to acquire equipment, patents, and technical talent at a discount—rapidly localising and scaling solar manufacturing.

Wind turbine development followed a similarly state-guided trajectory. During the 2000s, China imposed mandatory technology transfer requirements on foreign wind firms in exchange for market access. Firms such as Goldwind and Mingyang licensed turbine designs from Vensys (Germany) and Aerodyn (Denmark), then gradually developed proprietary solutions. China’s National Development and Reform Commission (NDRC) reinforced this by tying project approvals and feed-in tariff eligibility to local content thresholds — a policy that significantly accelerated domestic technology absorption.

The electric vehicle (EV) sector saw a more refined and targeted approach to tech transfer, driven by lessons from the traditional automotive industry. In the 1990s and 2000s, foreign automakers like Volkswagen, GM, and Toyota operated via joint ventures with SOEs such as SAIC and FAW, but retained control over core technologies like internal combustion engines and transmissions—components that were not subject to local production mandates. Consequently, China failed to domesticate critical elements of traditional automotive manufacturing.

In contrast, China’s EV industry was shaped by stricter localization mandates, including requirements that vehicles use domestically produced batteries and motors to qualify for government subsidies under the New Energy Vehicle (NEV) policy regime. This policy gave domestic players like BYD and CATL a significant head start, enabling them to gain a competitive edge through vertical integration of battery production and powertrain systems. Foreign automakers were effectively constrained unless they partnered with Chinese firms or established local R&D and manufacturing operations. While these requirements were lifted in 2018, allowing Tesla to enter the market in 2019 with its wholly foreign-owned Gigafactory in Shanghai, the domestic EV ecosystem had already matured. By then, Chinese brands had secured dominant positions across the EV value chain—from cells and packs to drive units and final assembly—making them formidable global competitors.

Supply chain integration

A unique feature of China is that it has built the world’s most complete and cost-effective supply chains for solar, wind, and EV manufacturing. In solar, China controls over 80% of the global supply of polysilicon and wafers with major hubs in Jiangsu and Sichuan provinces that produce nearly every component in-house, reducing reliance on imports and lowering costs through scale.

For wind, China produces most of the nacelles, gearboxes, blades, and inverters domestically. Integration between state-owned utilities, component suppliers, and OEMs like Goldwind and Envision streamlines production and deployment. In EVs, China leads the world in lithium-ion battery production, accounting for over 75% of global cell manufacturing capacity in 2024. CATL and BYD anchor domestic EV supply chains that include battery metals refining, anode/cathode materials, and electric drivetrain components.

Domestic market

A massive home market has provided the runway for scaling production and achieving learning curve efficiencies. In solar, domestic deployment exceeded 887 GW by the end of 2024, making China the largest PV market globally. In wind, China installed over 80 GW of new capacity in 2024 alone—more than the rest of the world combined. EV sales in China reached 11 million units in 2024, representing over 60% of global EV sales.

Usually having a large domestic market discourages players to come out and fight with the global competition in a more difficult environment. However, with China it’s different, because surviving on the local market is already hard enough and global expansion is seen as one of the ways to scale and even survive.

Low prices

The key selling point of most Chinese brands is that they are priced lower than their American and European rivals, while maintaining competitive performance and functionality. For example, BYD and XPeng are usually 30-50% cheaper than comparable models of VW and Tesla, Chinese onshore wind turbines 20-30% cheaper than Siemens or Vestas.

Having said that, low prices do not always mean lower cost. Chinese wind turbine producers Goldwind and Envision have 4-6% gross margins, while for Vestas and Nordex 12-20%. In solar, China’s Jinko Solar gross margin in 2024 was 10.9%, while for the largest US solar company First Solar it was over 40%. BYD and Tesla gross margins for comparable car models (Tesla Model 3 and BYD Han EV) were similar, around 22-25%.

Among all these factors, government support is pretty crucial. It’s not only about subsidies and tax breaks — other countries also introduced supporting measures for green energy and other domestic sectors (e.g. Europe). The uniqueness of China is that its government support enabled other factors like talent nurturing, tech transfer and supply chain integration.

It’s probably one of the reasons why India couldn’t achieve the same result in creating competitive high-tech industries, while having a comparably large domestic market and strong talent pool.

The same state-driven model applies to many other emerging industries in China that are considered to be “strategically important”, such as AI, robotics, space, semiconductors, quantum computing.

Exception — Consumer Internet. Bottom-Up Approach

One of the brightest exceptions are companies like Alibaba, Tencent, Bytedance, Pinduoduo and other consumer internet giants. These companies didn’t take any significant subsidies from China’s government for their core businesses (not talking about their cloud divisions), but were rather funded by VC money.

There are two reasons for this:

Not in the Five-Year plan. Although stimulating consumption is also a priority for the Chinese state, its efforts mostly focused on the domestic market. Creating global gaming or e-commerce giant doesn’t provide the same strategic edge in the geopolitical race against the USA, as AI or space technology. At least, it was the case before TikTok became so huge in the US.

Easy to raise VC money. Consumer internet in 2000-2010s was a very hot topic among private investors both globally and in China, so it was relatively easy to raise mega VC rounds from Softbank, DST, Tiger others. Meanwhile, strategic areas are more long-term and did not necessarily fit into VC’s mandate back then.

Technological innovation wasn’t the decisive factor behind the global success of companies like Alibaba, Shein, or Pinduoduo. They managed to successfully compete with Amazon or other global e-commerce giants not through cutting-edge tech, but rather through scrappy execution, deep integration with Chinese supply chains, massive domestic scale, and ultra-competitive pricing.

Tencent’s dominance in global gaming similarly wasn’t built on original IP, but on the back of China’s vast user base, abundant capital, and a brilliant M&A strategy —acquiring or investing in leading studios like Riot, Supercell, and Epic Games.

The clearest exception is ByteDance, which did distinguish itself through its unique recommendation algorithms powering TikTok’s feed. But even in ByteDance’s case, execution speed, product iteration, and aggressive marketing were just as critical to its global breakout.

Generally, the evolution of the consumer internet companies is also pretty much the same as for the state-driven industries described above — harsh domestic competition (e.g. apart from Alibaba, China had over 100 other e-commerce platforms in mid 2000s), price wars, squeezed margins, global expansion, beating the competition there, reaching 20-50% global market share.

However, many other success stories were state-led.

Failure cases — Cloud, SaaS, Semiconductors

Of course, Five-Year plans don’t always work as planned.

Areas like semiconductors, cloud infrastructure and B2B SaaS applications have been supported by both local governments and VC/PE funds, but still fail to reach significant success outside of China.

There are multiple articles by JS Tan, Lillian Li and other brilliant authors explaining why Chinese cloud giants lag behind Amazon and Google (e.g. here), why China doesn’t have its comparable versions of Salesforce or ServiceNow (e.g. here, here and here) or why China’s SMIC still struggles with its 7 nm nodes despite raising over $5B in equity and subsidies.

We can summarise these answers based on the framework of factors introduced above:

Semiconductors. Although the talent is there and the domestic market is huge, Chinese foundries still focus on producing low-end chip, because they still depend on ASML’s EUV lithography and have limited access to EDA tools from Synopsys or Cadence and other advanced equipment from LAM Research and Advanced Materials due to the US export controls. It significantly slowed down the development of high-end supply chain in China.

B2B SaaS. The biggest challenge is that the actual B2B SaaS market in China is pretty small. It’s only the 7th largest market in the world ($9B), similar size as Australia and smaller than France, Canada and Germany. SME customers usually don’t have a lot of spare cash to invest because of generally low margins and automation is still not the most pressing issue due to low labour costs. Enterprise customers follow the “build-over-buy” principle, considering that they have access to relatively cheap and good quality developers and require high customisation for every implementation.

Cloud Infrastructure. This market is also not very big in China (AWS generates more revenue than all the Chinese cloud companies combined), which is the function of the small SaaS market. As JS Tan explained in his article, in contrast to the US, Chinese cloud providers generate their revenue mainly from low margin IaaS (Infrastructure-as-a-Service), because in China customers treat the cloud more as a commodity rather than a platform to transform business operations and enhance productivity.

It’s important to note that these “failure cases” can still be turned around with the new cycles of technology.

The same happened with automotive industry — when I wrote my master thesis in 2018 about tech transfer examples in China, automotive was still considered as a failure case. However, with the successful adoption of EV batteries, Chinese automakers managed to ride the wave of EVs and increase its share on the global automotive market from 10% in 2014 to 23% in 2024.

The same may potentially happen in semiconductors if China develops its own advanced lithography or successfully masters the next generation compute architecture, e.g. optical computing or quantum computing. Similarly, AI adoption may disrupt the existing limitations of the cloud and B2B software markets in China.

Can Emerging Industries Replicate the Success?

Obviously, this section is a bit of a look into the crystal ball, but still based on the framework above, I’ll sort the industries by their success probability and try to make a few educated guesses:

Robotics. China is already a leader in industrial robotics and it has all the factors to win over the race in autonomous vehicles, humanoid robots and other emerging robotics areas. It has an almost complete supply chain (sensors, actuators, mechanical structures, power electronics, software) and huge domestic market as the world’s largest production base. Chinese robotics companies will most likely replicate the global success of EVs, although there will be limitations for entering sensitive areas in developed countries (defence, finance, healthcare).

Logical & memory chips. Huawei and some emerging players (Enflame, MetaX etc) are making considerable progress in developing the next generation GPUs and CPUs that can already compete with NVIDIA on the Chinese market. The US export controls and still underdeveloped semiconductor production ecosystem in China are the main hurdles for further R&D advancements. If these challenges are solved either through more successful tech transfer or through adopting the next generation platform (photonics, quantum), leveraging the existing expertise of selling hardware globally won’t be too hard.

LLMs and AI dev tools. China has definitely made a stir with DeepSeek and other breakthrough AI models which by some parameters are even more superior than OpenAI or Anthropic. A lot of success is in open source. However, so far we’ve seen success only in the consumer segment (Minimax, Question.ai etc), while scaling in the B2B segment still remains a challenge. To win a significant share on the global markets, the Chinese developers of AI infrastructure tools need to master the B2B SaaS sales process, which is the biggest bottleneck.

Satellites and Rockets. Chinese state-owned satellite manufacturers and space tech startups already make the first success in expanding into developing countries (Southeast Asia, Africa). However, as Blaine Curcio mentioned in his article, the satellite market is nowadays much smaller than the EV market and it’s much more influenced by geopolitics, which makes scalability a bit challenging.

Final Remarks — Role of Venture Capital

As the table below illustrates, all of the Chinese industries mentioned in this article had VC/PE-backed leaders (at least one). Despite massive subsidies, industry champions are still eager to take VC money. It is especially noticeable for the new industries, like AI, robotics, space. But even at the early days of solar panels in China, the first investment rounds of Jinko Solar were led by US funds (Flagship Pioneering, CIVC Partners).

The three groups of companies outlined above operate under distinct motivations and face different challenges:

VC/PE-backed firms are driven primarily by financial returns and investor exits. They scale aggressively and often lead in innovation, but rely heavily on external funding to support high burn rates, making capital access a constant pressure point.

Subsidy-backed private companies focus on building cash-generating, scalable businesses, while aligning closely with government KPIs. Their success depends not just on market performance, but also on maintaining policy alignment and securing ongoing support from state programs.

State-owned enterprises (SOEs) are less focused on short-term profitability and more on strategic ecosystem building—supporting domestic supply chains, standard-setting, and industrial resilience. Their key challenge is not financial sustainability, but rather overcoming bureaucratic inertia and inefficiencies that can hinder speed and adaptability.

Despite these structural differences, category leadership can emerge from any model. For example, Jinko Solar, the world’s largest solar panel manufacturer, is VC/PE-backed; Goldwind, the global leader in wind turbines, is state-owned; and BYD, a dominant EV player, is a private firm whose growth was supercharged by government subsidies.

For the perspective of a VC investor, betting on a potential leader in an emerging strategic sector in China may be a viable strategy. But in this case, the key challenge is to pick the VC-backed startup that can survive in the uphill battle with the much better funded state-owned or private behemoths.

In other words, how to differentiate between XPeng (or Li Auto, NIO) and 400+ other EV brands that died in the last seven years?

And of course, how to mitigate all the legal risks related to such investment?

But this is perhaps a topic for another article…

If you have any proposals, ideas, or feedback, we’d love to hear from you! Feel free to reach out at denis@deeptech.asia or on LinkedIn. Let’s connect and explore how to improve together.