Edition #1. No Winter Break in the US-China Tech Race

DeepTech Asia intro, investigation into the death of China's VC ecosystem, Asian robotaxis, US and China's AI domination and Australian space breakthroughs

Dear Readers,

I'm thrilled to share the first edition of the DeepTech Asia newsletter! As the name suggests, this newsletter dives into the latest trends in AI, robotics, new energy, computing, space, and other groundbreaking technologies emerging across Asia.

Why Asia?

While Asia might not yet be the go-to destination for the world's top tech entrepreneurs and investors, it is home to 4.8 billion people—nearly 60% of the global population. The continent boasts a dynamic mix of technologically advanced nations like China, Japan, and South Korea, alongside rapidly growing economies like India, Vietnam, and Indonesia. We believe that in the coming decades, Asia has the potential to outpace Europe and the USA to become the global leader in deep tech innovation.

That said, Asia is far from a homogeneous region—it’s complex and fragmented. Some countries, despite their technological advancement, remain isolated from the global English-speaking community. This often fuels myths and misinformation, leading to misunderstandings and poorly informed decisions when engaging with Asian markets.

Our mission is to cut through the noise and provide an accurate and unbiased view of the region.

The first edition sheds light on China’s VC ecosystem, and gives insights on Asian tech investments in Dec 2024 and how they stack up against the global VC landscape.

📃 Must Reads

🇨🇳 😵 Is VC Really Dead in China? (by DeepTech Asia)

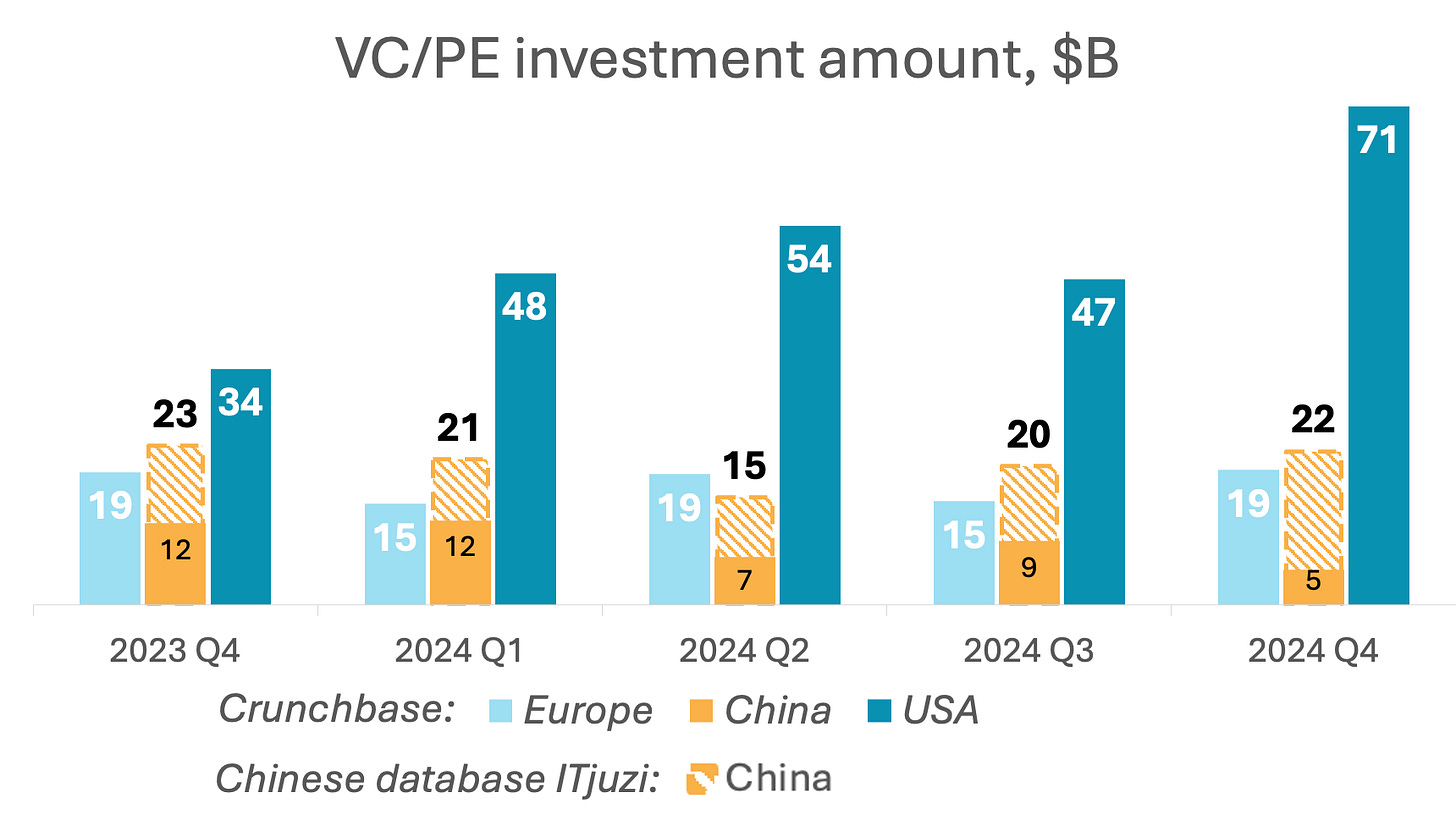

China is clearly a large tech ecosystem, but due to the lack of information available in English and the recent regulatory scrutiny, the real situation still remains a bit of a mystery. In our recent article, we shed the light on its real size and bust some myths spread by both Western and Chinese media. We estimated China’s tech VC/PE market at $78B in 2024, which is 16% larger than the entire Europe (including the UK and Israel), but still 2.8 times smaller than the US.

More insights here.

🐴 🚕 Pony.ai’s Robotaxis and the Long Road Ahead (by ChinaTalk)

Pony.ai, a Chinese version of Waymo, is making waves in the autonomous driving. Created by ex-Baidu engineers in 2016, it launched China’s first public robotaxi service in 2018 and went public on Nasdaq at a $5B+ valuation. The company plans to grow its robotaxi fleet from 250 to 1,000 by 2025, but it’s facing hurdles like tough regulations and the high costs of building and scaling self-driving tech.

More about Pony.ai’s journey here.

🤑 Deals (Dec 2024)

⛄️ Low season in Europe, not in the US. In December Europe only had $4.2B in VC funding. It wasn’t the case for the US though, raking in a massive $23B with a few mega-deals like Databricks’ $10B Series J and Veeam Software’s $2B secondary round.

📈 Asia also skipped the Xmas. Asian startups attracted $13.2B in funding, with China leading the pack with $10.4B, largely driven by climate deals like Huaneng New Energy ($2.1B) and Avatr ($1.6B). India came in second with $1B, but only about 10% of that could be defined as deep tech.

For comparison, in China 88% of deals were AI or deep tech, in the US — 87%.

US-China AI race goes on, Hongshan and Tencent backing their LLM champions and an Asian open-source edge AI player raises Series B.

🌏 Global scale of VC funding:

🇺🇸 USA — $12.5B, with $10B from Databricks

APAC — $2B, inc. 🇨🇳 China ($1.8B) and 🇯🇵 Japan ($140M)

🇪🇺 Europe — $685M

Highlights:

🇨🇳 $420M led by ex-Sequoia China: Zhipu AI (智谱AI), a leading developer of new generation of cognitive intelligence LLMs with Chinese-English bilingual 100B+ level pre-trained model GLM-130B, a chat bot ChatGLM and the open source model ChatGLM-6B. Legend and Hillhouse also led the round.

🇨🇳 $273M Series B from Tencent: Stepfun (阶跃星辰), a developer of general LLM with 100B+ parameters and high performance in knowledge understanding, mathematical ability, logical reasoning, code guidance and text creation. Qiming Ventures, 5Y Capital (ex-GGV) also led the round.

🇨🇳 $42M Series B: Model Best (面壁智能, aka Wallfacer Intelligent, the Three Body Problem fans would get the reference), an open source lightweight and high-performance LLMs for edge devices.

🇨🇳 $28M Series A+: AI Sphere (爱诗科技), a leading AI video generation model and application developer.

🇯🇵 $6.6M Series B: Lazuli, an AI-powered SaaS platform that enables companies to organize, generate, and transform product data into useful formats.

US pouring billions into cloud compute and data center tech and fresh funding for Aussie quantum and Chinese RISC-V and optical compute.

🌏 Global scale of VC funding:

🇺🇸 USA — $4.8B, inc. $2B from Veeam Software and $1.5B from Vantage DC

APAC — $649M, inc. 🇨🇳 China ($556M), 🇰🇷 Korea ($38M), 🇦🇺 Australia ($30M)

🇪🇺 Europe — $209M

Highlights:

🇨🇳 $42M Series A+: Spacemit (进迭时空), a SoC chip startup developing high performance RISC-V processor cores for edge compute and cloud applications.

🇰🇷 $37.8M Series A from KIP, Mirae and Vickers: HyperAccel, a company providing hardware solutions for AI data centers.

🇦🇺 $30M Series A: Quantum Brilliance, a developer of quantum computers that operate at room temperature using synthetic diamonds.

🇨🇳 $14M round: Lightstandard (光本位), a developer of photonic chips for high-performance and low cost communication and data center operations.

🇮🇳 $8M Series A: Mindgrove, a provider of innovative Systems on Chips (SoCs) and hardware.

Ex-Sequoia China betting on humanoid robots, Singapore’s Eureka closing Series A and China Mobile promoting urban drone delivery.

🌏 Global scale of VC funding:

APAC — $501M, inc. 🇨🇳 China ($373M) and 🇯🇵 Japan ($121M)

🇪🇺 Europe — $114M

🇺🇸 USA — $47M

Highlights:

🇯🇵 $121M round: Preferred Networks, a startup developing real-world applications of deep learning, robotics and other latest technologies.

🇨🇳 $40M+ pre-A: Noematrix.ai (穹彻智能), a developer of LLMs and related infrastructure for humanoid robots solving complex real world problems. Investors include Hongshan (ex-Sequoia China), Plug and Play and Prosperity7 Ventures.

🇨🇳 $42M round: Cloud Whale (云鲸智能) a company developing home service robots with 200 patents in the areas of SLAM, 3D perception, and AI object recognition.

🇨🇳 $40M+ Series C from China Mobile: Antwork (迅蚁), a startup building a drone-based urban air distribution network.

🇸🇬 $10.5M Series A from B Capital & Airbus: Eureka Robotics, provider of software and automation systems for precision manufacturing.

Asia doubling down on climate, Saudi Aramco’s first bet in China and new Softbank’s solar investment.

🌏 Global scale of VC funding:

APAC — $5.8B, inc. 🇨🇳 China ($5.6B), 🇯🇵 Japan ($84M), 🇮🇳 India ($48M)

🇺🇸 USA — $1.9B

🇪🇺 Europe — $411M

Highlights:

🇨🇳 $1.6B Series C from Huawei & Changan: Avatr (阿维塔科技), a manufacturer of high-end smart electric vehicles (SEV).

🇯🇵 $66.4M Series D: Terra Charge, an EV charging infrastructure startup.

🇮🇳 $40M Series B from Lightspeed: SolarSquare Energy, a residential solar company that designs and installs solar rooftop panels for homes and commercial establishments.

🇨🇳 $14M round from Saudi Aramco: HydoTech (海德氢能), a startup developing green hydrogen energy generation, storage and safety systems. It’s Saudi Aramco’s first direct investment in China.

🇯🇵 $10M Series A from Softbank: PXP, a startup developing next-generation photoelectric conversion elements for generating clean energy.

China dominating space, Australian satellite startups getting fresh funding and India’s Pixxel closing Series A.

🌏 Global scale of VC funding:

APAC — $574M, inc. 🇨🇳 China ($409M), 🇦🇺 Australia ($141M), 🇮🇳 India ($24M)

🇺🇸 USA — $124M

🇪🇺 Europe — $82M

Highlights:

🇨🇳 $140M Series A+: Genesat (格思航天), a startup developing and producing civilian-commercial satellites.

🇨🇳 $126M round: Landspace (蓝箭航天), a leading liquid rocket development and operation commercial company.

🇦🇺 $100M Series D: Fleet Space Technologies, a satellite constellation startup focusing on mineral exploration, space exploration and defense.

🇦🇺 $31.2M round: Myriota, a startup manufacturing satellite connectivity products to offer secure data transmission for IoT applications.

🇮🇳 $24M Series B: Pixxel, a space data company that develops a constellation of hyperspectral earth imaging satellites.

Asian exits lagging behind, Japan’s memory producer going public and NVIDIA acquiring a Vietnamese AI startup

🌏 Global scale of VC-backed exits (Dec 2024):

🇺🇸 USA — 96 exits (34 deep tech exits)

🇪🇺 Europe — 52 exits (10 deep tech exits)

APAC — 50 exits (20 deep tech, inc. 🇨🇳 China - 11, 🇯🇵 Japan - 2).

Highlights:

🇯🇵 IPO at $5.6B market cap: KIOXIA (aka Toshiba Memory), a manufacturer of non-volatile memory solutions, such as wireless secure digital cards and micro SD cards.

🇨🇳 IPO at $3B+ market cap: InnoScience (英诺赛科), covering the full R&D and production cycle of semiconductor silicon gallium nitride chips. Exit for Addor Capital and Everest Ventures.

🇨🇳 IPO at $1.4B market cap: Refire (重塑能源), a hydrogen startup developing and producing fuel cell systems, stacks, membrane electrodes, and bipolar plates. Exit for Hongshan (ex-Sequoia China), IDG Capital and Legend Capital.

🇯🇵 IPO at $375M market cap: Synspective, a space tech firm that provides data and remote monitoring services to government agencies. Exit for SBI Investment and Pavilion Capital.

🇻🇳 M&A by NVIDIA: VinBrain, a Vietnamese startup providing AI solutions for medical image diagnostic. Congrats, Steven Truong!

If you have any proposals, ideas, or feedback, we’d love to hear from you! Feel free to reach out at denis@deeptech.asia or on LinkedIn. Let’s connect and explore how to improve together.