Is VC Really Dead in China?

Spoiler alert: not really

Note: this article was included in the previous monthly update, but wasn’t officially published, so I’m publishing it once again for a broader audience.

Highlights:

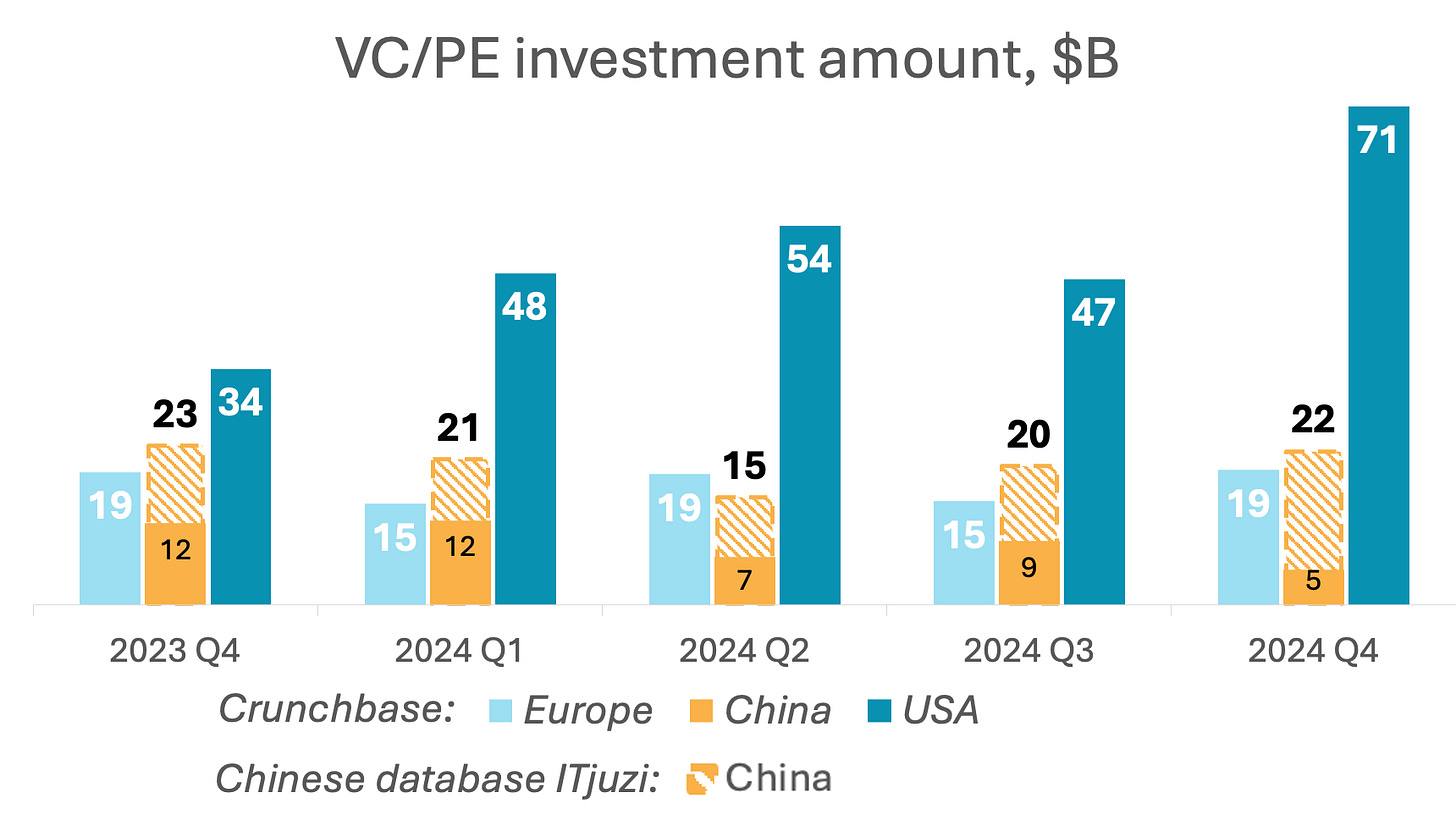

Global and Chinese sources provide different numbers on the size of the VC market in China. Based on our analysis of both local and global data, China invested $78B in VC and tech PE rounds in 2024, which makes it the world’s second largest PE/VC market, 16% bigger than the entire Europe (including the UK and Israel), but still 2.8 times smaller than the US.

That said, China’s tech PE/VC market shrank by 12% year-on-year in 2024, while Europe declined by 6%, and the US surged by 36%.

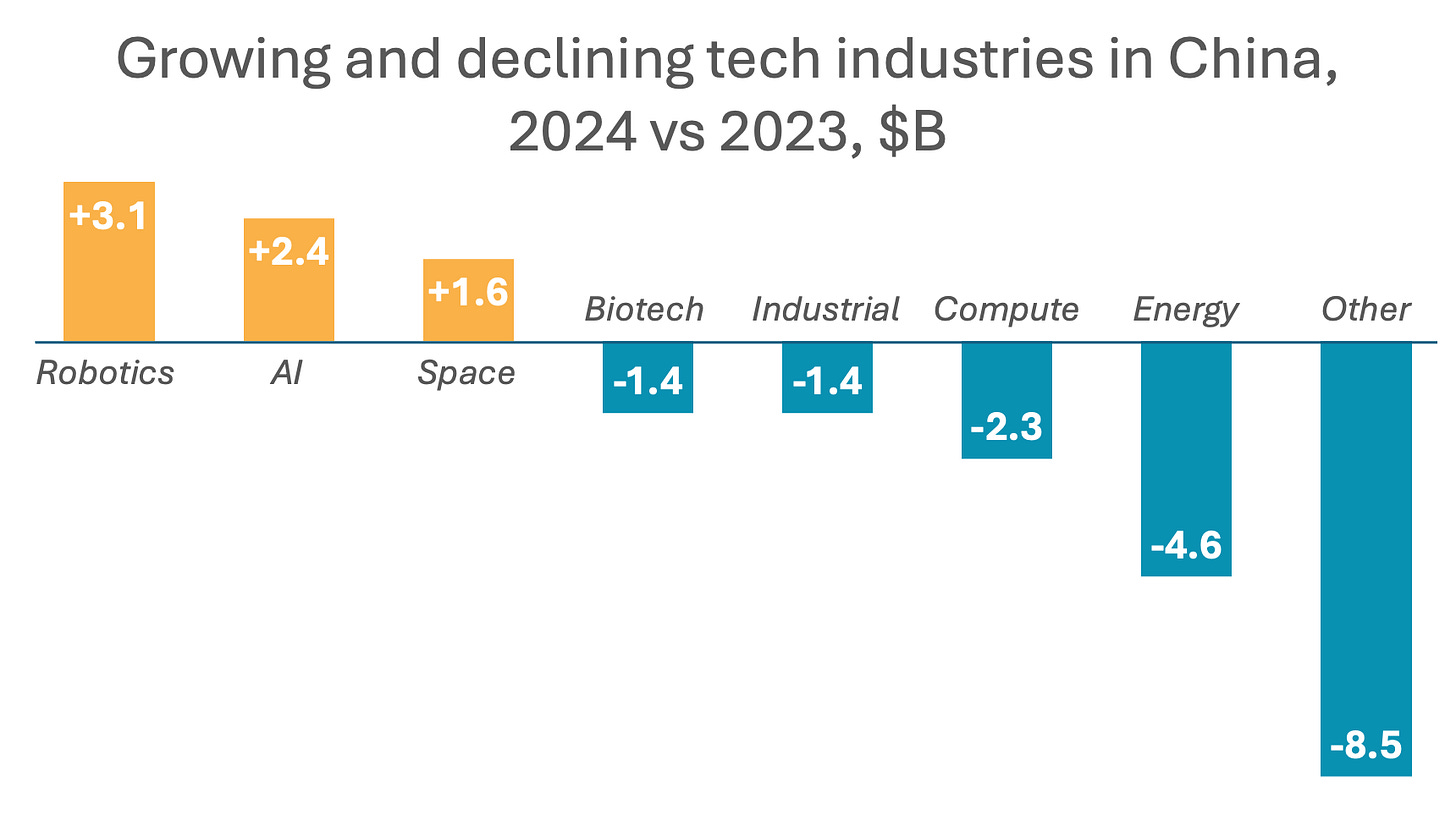

The decline in China is largely tied to a slowdown in non-deep tech industries, such as enterprise software and e-commerce, as well as, overheated areas like semiconductors and energy. In contrast, robotics, AI, and space technology are emerging as key growth drivers.

Comparing “apples with apples”

There are numerous articles in the Western media claiming that the VC market in China is struggling or even is “uninvestable”, e.g. by CBInsights (here) or Crunchbase News (here). At the same time, some Chinese VC reports (e.g. here, in Chinese) estimate that the VC market in China is almost as large as in the US.

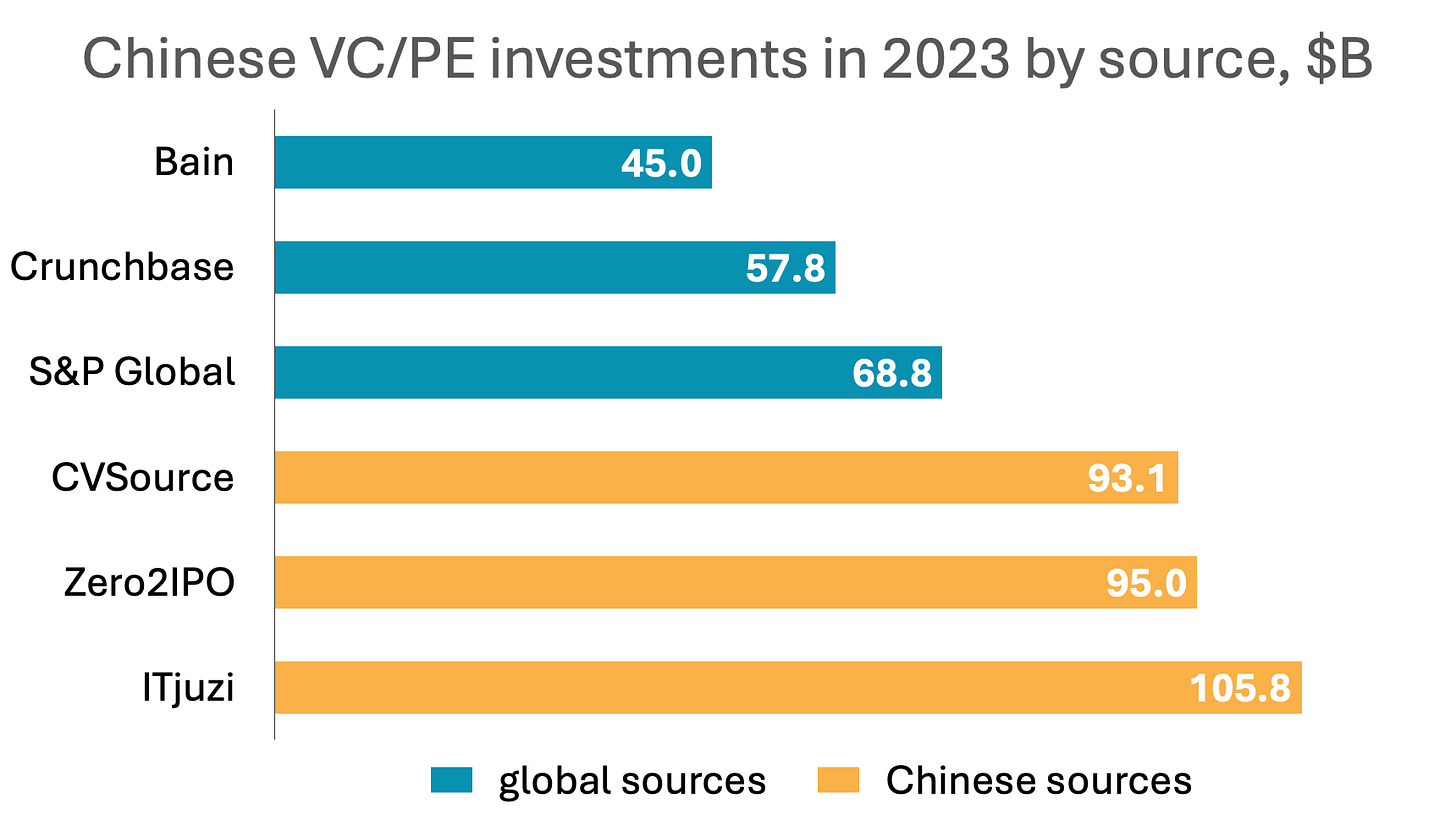

In my Techcrunch piece in 2021, I highlighted significant disparity (2-3x) between the estimations of the Chinese VC market size given by Chinese and global data sources.

In this article, we’ll try to give an unbiased view based on both Chinese and global VC databases. Every data source has different data structure and classification, so to compare “apples with apples” we used the following methodology:

included all classical venture rounds: angel, pre-seed, seed, series A,B,C,D,E and later-lettered rounds, pre-IPO rounds, other or unknown series venture rounds, and convertible notes.

included private equity rounds, secondary, corporate and strategic rounds for tech companies.

excluded all non-equity (grant, debt) or public equity (post-IPO) rounds.

included data on VC funding in Hong Kong and Macao, but excluded the numbers for Taiwan.

Global data vs Chinese data

As you can see from the graph above, the Chinese sources estimate the size of the VC/PE funding in China in 2023 as ~$100B, while according to the global sources (Crunchbase, CBInsights) it’s only ~$50-60B. Almost twice the difference!

What is the reason for such disparity?

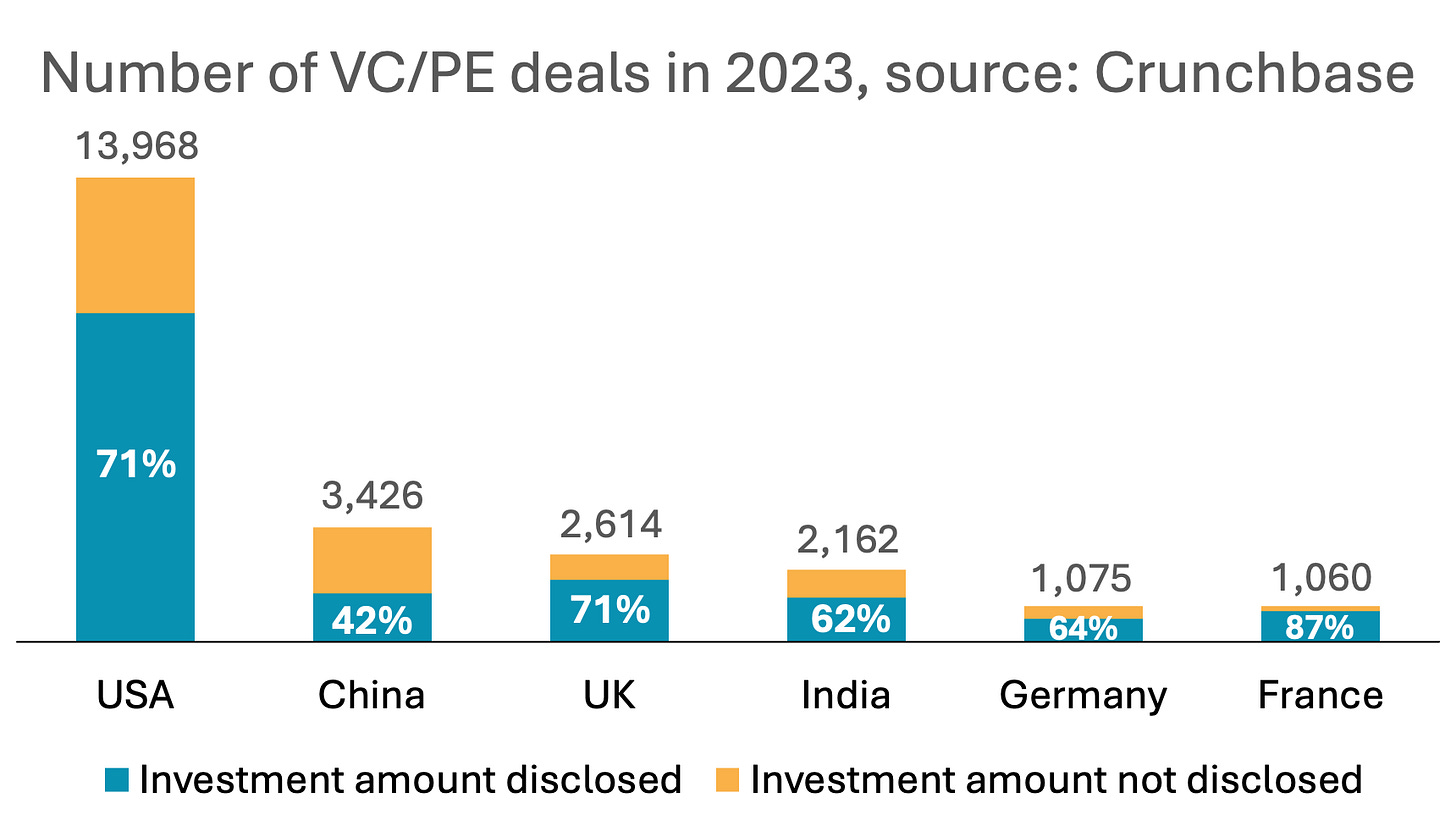

Firstly, Chinese databases just cover more deals. In 2023, ITjuzi registered 5,568 VC/PE deals in China, while Crunchbase reported only 3,426 deals.

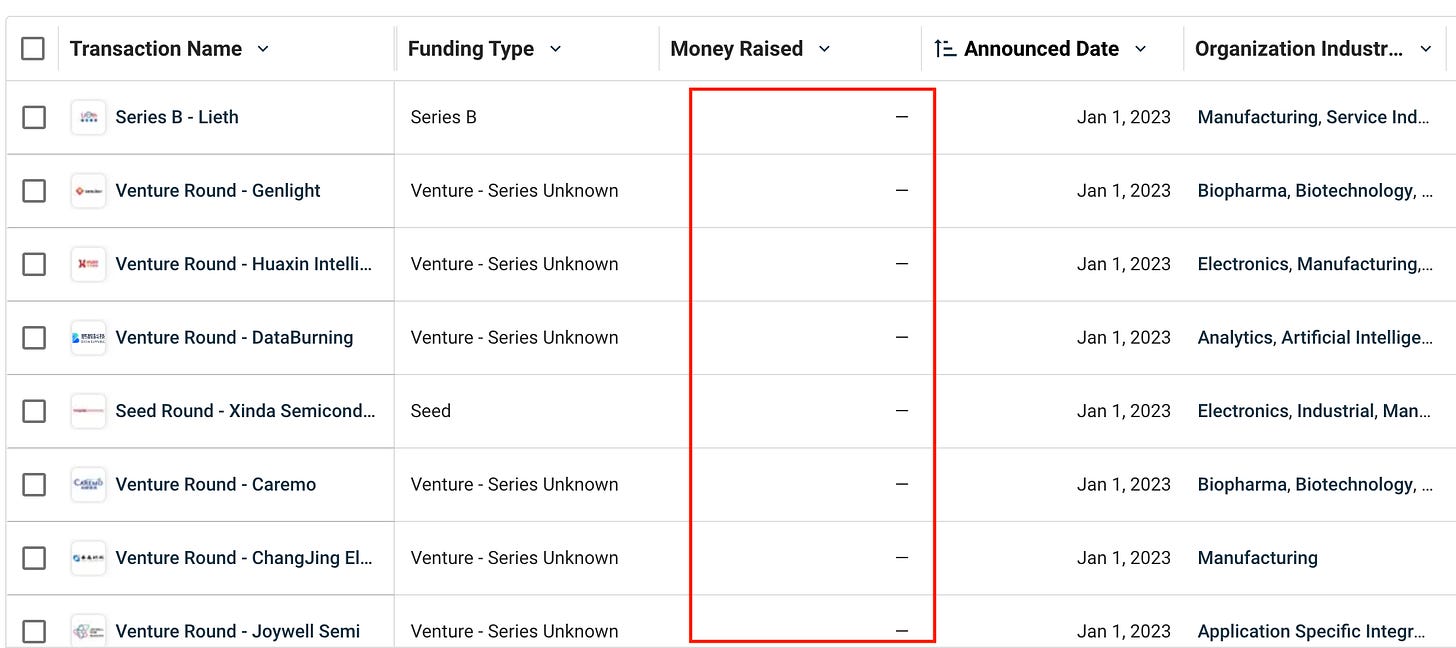

Moreover, for some transactions Crunchbase doesn’t specify investment amounts. These transactions are not included in the total VC/PE funding amount, although these are real rounds.

The Crunchbase breakdown by countries shows that, specifically for China, only 42% of deals have disclosed investment amounts, while for other large VC markets it’s usually 60-70% (see the graph below).

At the same time, the Chinese VC databases, instead of counting such rounds as “0”, attempt to estimate the missing numbers. For example, ITjuzi uses the following approach: any angel rounds without a disclosed investment amounts = 1M RMB ($150k), A rounds = 20M RMB ($3M), B rounds = 30M RMB ($4.5M), C rounds = 50M RMB ($6.5M) etc.

If we use the Crunchbase methodology for ITjuzi and count all undisclosed rounds as “0”, the share of Chinese VC/PE deals with disclosed investment amounts will be 66%, which is in line with average figures for other countries in Crunchbase.

Still the second largest market

In this case, according to ITjuzi, tech PE/VC investments in China totalled $89.1B in 2023 — less than the originally reported $105.8B, but significantly higher than Crunchbase’s estimate of $57.8B. The same pattern shows up in 2024, with ITjuzi estimating $78B in total investments, compared to Crunchbase's much lower $33B.

This approach proves that China is still the second largest VC market, 16% larger than the entire Europe (including the UK and Israel), but still 2.8x smaller than the US. The difference between China and the US was especially stark in Q4 2024, with the massive rounds of Databricks ($10B), OpenAI ($6.6B), xAI ($6B), Anthropic ($4B) leading the charge in the US.

Notably, 2024 was clearly a bad year for China. It declined stronger than Europe (12% vs 6% year-on-year), while the US saw a stellar growth of 36%.

The $11B drop in Chinese tech investments was largely driven by declines in the energy sector (-$4.6B), the compute industry (mostly semiconductors, -$2.3B), and non-deep tech areas like enterprise software (-$3.6B), e-commerce (-$2.4B), and automotive (-$2.1B).

E-commerce and software startups were growth engines for China in the past decade, but as these industries mature, the capital is shifting towards other emerging areas.

Despite the slowdown, semiconductors, energy, and automotive remain the top three investment areas, making up 40% of China's total tech funding. These sectors have been heavily backed by the Chinese government in recent years, but the current decline signals a pivot toward newer priorities like robotics, AI, and space tech.

Final remarks

There’s some debate about the actual size of China’s VC market and its current state. Chinese sources clearly have broader coverage of the local ecosystem, but in order to compare China with the rest of the world, we need to apply to those sources the methodology of the global data platforms like Crunchbase.

Using this approach, we found that despite macroeconomic and geopolitical challenges, China still remains the world’s second-largest VC market, with $78B invested in VC and tech PE rounds. This puts it slightly ahead of Europe’s entire tech ecosystem but still far behind the US market.

Recent years have been tough for China’s tech sector as it grapples with external shocks and shifts focus from traditional software and e-commerce to advanced deep-tech fields like robotics, AI, and space, aligning with China’s state priorities.

While many factors could still shape the future of China’s VC landscape, it’s clear that it’s far too soon to count China out.

Special thanks to Fedor Susov for contributing to the drafts of this article.

Please let me know your thoughts and don’t hesitate to contact me at denis@deeptech.asia or find me on LinkedIn if you have any suggestions or comments. Always glad to discuss and hear other people’s opinion!