Jan 2025 Digest. Beyond DeepSeek...

Rise of the machines in China, Japan and India catching up in space, Asian exits still lagging behind and survey results on DeepSeek

Dear Readers,

If you were to name one word that came to your mind in January in relation to Asia, what would it be? — “DeepSeek”. It’s been a while since Asia, and specifically China, have been given that much attention globally, which is a good thing for both the West and the East.

For the West it is a “wake-up call” (quoting Trump) and the incentive to increase its efficiency and competitiveness, while for the East it’s an aspiring example that Asian cutting-edge startups can compete with their American and European opponents not only on price, but on quality and performance as well.

Below I share some other examples of promising deep tech startups coming out of Asia, apart from DeepSeek. In January, China led the charge in robotics with several big rounds of medical robotics companies led by global investors like EQT, Vertex, Medtronic and Saudi Aramco’s Prosperity7. Chinese startups in this area attracted $446M of VC money, compared to $216M in Europe and $169M in the US.

In space tech, Japan and India are looking stronger and stronger with new investments in satellite and space travel startups. Meanwhile, Singapore is further strengthening its status as a data center hub in Asia with the new mega round of Digital Edge collocation operator.

Having said this, exits still remain one of the biggest challenges for Asia, with only 41 VC-backed exits in January in the whole APAC region (including China), lagging behind Europe (53 exits) and by far the US (129 exits).

📃 Must Reads

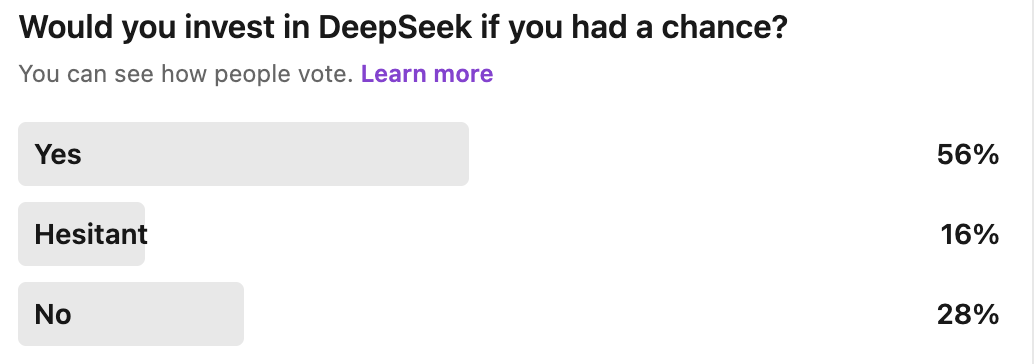

🐳 💰 Would you invest in DeepSeek if you had a chance? (by DeepTech Asia)

On the hype around DeepSeek, we’ve tried to differentiate and present a thought experiment on whether DeepSeek could be a good investment opportunity in case it goes out raising money. Still a very hypothetical scenario. The company is funded by its parent fund and the founder is not focused on commercialisation in the near term.

But I was really surprised to hear that Dylan Patel from SemiAnalysis also mentioned in his interview to Lex Friedman that DeepSeek is burning cash and may need funding soon. Also there is a rumour that DeepSeek actually tested the fundraising market in China in May last year, but eventually decided to keep bootstrapping.

Anyway, here you can find my “mini investment memo” on DeepSeek. I hope you’ll enjoy it! And below are the results of the survey:

🇨🇳 👾 Chinese AI companies that could match DeepSeek’s impact (by the Guardian)

A brief snapshot of other leading LLM companies from China that are competing with DeepSeek on their domestic market and could be joining the global race soon. The Guardian listed a few models developed by large corporates like Alibaba, Bytedance, Tencent, as well as, leading startups like Zhipu AI and Moonshot AI.

More details here.

🤑 Deals (Jan 2025)

🐍🏮 Lunar New Year in Asia. DeepSeek made quite a stir during the Lunar New Year when many investors and entrepreneurs in Asia enjoy holidays and time with their families. That is why the January period was pretty quite in Asia in terms of VC investments. For example, China only saw $4.6B investments which was lower than in Europe ($5.7B) and by far than the US ($18.7B). In total, tech companies from APAC attracted $7.3B in VC/PE funding in January.

🇮🇳 India was the second largest VC location in Asia. In January Indian startups attracted $1.3B. Singaporean startups also were quite active, securing $745M of VC/PE funding, while the biggest part was contributed by the PE round of a data center company — Digital Edge DC.

US is spearheading the AI funding, China doubles down on AI applications and Hedosophia backing an Aussie AI media startup

🌏 Global scale of VC funding (Jan 2025):

🇺🇸 USA — $3.6B, with $1B from Anthropic

APAC — $1.2B, inc. 🇨🇳 China ($1B), 🇮🇳 India ($48M) and 🇯🇵 Japan ($34M)

🇪🇺 Europe — $700M, with $180M from Synthesia

Highlights:

🇨🇳 $91M Series E: Insilico (英矽智能), utilising generative AI for drug discovery in the areas, such as cancer, fibrosis, immunity, central nervous system and aging-related diseases.

🇨🇳 $70M Series D from Legend Capital: Deepwise (深睿医疗), AI-powered solution for radiologists focused on diagnosis accuracy multiple applications, such as mammography, orthopaedics, neurosurgery and others.

🇨🇳 $42M Series Pre-A: AI² Robotics (智平方), developing LLMs for robotics applications with a focus on warehouses and households.

🇦🇺 $25M Series B from Hedosophia: Qsic, an AI driven experience platform focusing on in-store audio for retail media.

🇮🇳 $25M Series C: SuperOps.ai, an AI-powered professional services automation (PSA) and remote management monitoring (RMM) for MSPs.

US keeps plowing cash into more data centers, Vertex investing in a Chinese auto chip manufacturer and a new Japanese quantum startup secured seed funding.

🌏 Global scale of VC funding (Jan 2025):

🇺🇸 USA — $5.1B, inc. the $5B PE round of Aligned

APAC — $1.9B, inc. 🇨🇳 China ($1.3B), 🇸🇬 Singapore ($640M), 🇦🇺 Australia ($37M)

🇪🇺 Europe — $224M

Highlights:

🇸🇬 $640M PE round: Digital Edge DC, a Stonepeak-backed developer of carrier-neutral data centers and related digital infrastructure assets.

🇨🇳 $40M+ Series A from Lightspeed China: Infrawaves (基流科技) , providing hardware and software solutions for GPU cluster interconnection, including high-speed switches and management and communication frameworks.

🇨🇳 $42M Series A from Vertex: MetaSilicon (元视芯), designing integrated circuits for automotive applications.

🇦🇺 $20M Series A extension: Quantum Brilliance, a developer of quantum computers that operate at room temperature using synthetic diamonds.

🇯🇵 $4M Seed from Global Brain: OptQC, developing optical quantum computers based on the Furusawa-Endo Laboratory research.

China leading the charge in robotics globally, rise of medical robotics startups and more global investors betting on Chinese robotic companies.

🌏 Global scale of VC funding (Jan 2025):

APAC — $453M, inc. 🇨🇳 China ($446M)

🇪🇺 Europe — $216M, with $124M from Neura Robotics

🇺🇸 USA — $169M

Highlights:

🇨🇳 $70M Series C+ from EQT, Qiming, Alpha JWC: Cornerstone Robotics (康诺思腾), developer of soft tissue and other major specialized surgical robots.

🇨🇳 $42M Series E+ from Prosperity7: Fourier (傅利叶), developing humanoid robots and robotics solutions for rehabilitation applications.

🇨🇳 $14M Series B from Vertex: AI Force Tech (中科原动力), provider of robotic, automation and big data solutions for agriculture.

🇨🇳 $7M Series C from Medtronic: Rossum Robot (罗森博特), focusing on medical robotics, such as real-time intraoperative 3D navigation, assisted fracture reduction operation, automatic surgical planning.

🇯🇵 $3M Seed from JAFCO: ARCS, developing assisted reproductive medical devices using robotics and artificial intelligence technology.

Slowdown in climate investments in Asia, Temasek backing a mega Series A of a Chinese battery material startup and Walden betting on autonomous industrial EVs in India

🌏 Global scale of VC funding (Jan 2025):

🇺🇸 USA — $1.8B, with $1B from Origis Energy

🇪🇺 Europe — $1.1B, with $400M+ from Green Flexibility

APAC — $605M, inc. 🇨🇳 China ($486M), 🇮🇳 India ($62M), 🇰🇷 South Korea ($21M)

Highlights:

🇨🇳 $140M Series A+ from Temasek and TPC Group: Nanopore (纳力新材料), developing new composite current collector materials for lithium batteries.

🇨🇳 $42M Series B from Hongshan (ex-Sequoia China): PuXiJing (朴烯晶), developing high-end polymer materials for lithium battery separators.

🇮🇳 $20M Series B from Walden Catalyst: Ati Motors, an all-electric autonomous industrial vehicle maker.

🇰🇷 $16M Convertible Note from STIC Investment: H2, an advanced energy storage company specialized in vanadium redox flow battery.

🇳🇿 $11M Series A from Blackbird Ventures: Kwetta, an EV charging startup enabling deep integration with power grids.

US is supercharging Space Tech, Toyota’s VC fund doubling down on Interstellar Technologies and more seed deals from India

🌏 Global scale of VC funding (Jan 2025):

🇺🇸 USA — $520M, with $260M from Stoke Space and $170M from Loft Orbital

APAC — $129M, inc. 🇨🇳 China ($60M), 🇯🇵 Japan ($44M), 🇮🇳 India ($23M)

🇪🇺 Europe — $75M, with $41M from Xcalibur

Highlights:

🇯🇵 $44M Series F from Toyota’s Woven: Interstellar Technologies, developing cost-effective and convenient space transportation services.

🇨🇳 $42M Series A+ from Kunlun Capital: Hongqing Technology (鸿擎科技), a satellite networking solution provider, focusing on low-orbit broadband Internet communication satellite applications.

🇨🇳 $14M Series A from Shenzhen Capital: Azimuth Technology (方位角), providing high-precision spatiotemporal and indoor / outdoor integrated positioning and navigation services.

🇮🇳 $1.7M Pre-Seed: Catalyx, a space travel startup.

🇮🇳 $1.5M Pre-Seed: OrbitAID Aerospace is developing satellite life extension solutions enabling longer mission duration, reduced space debris generation.

Asian exits lagging behind, British fund Eight Roads on track to exit from its Chinese medical AI investment and Aussie energy tech startup getting acquired

🌏 Global scale of VC-backed exits (Jan 2024):

🇺🇸 USA — 129 exits (42 deep tech exits)

🇪🇺 Europe — 53 exits (14 deep tech exits)

APAC — 41 exits (13 deep tech: 🇨🇳 China - 11, 🇦🇺 Australia - 1, 🇸🇬 Singapore - 1).

Highlights:

🇨🇳 IPO at a $457M market cap: BrainAu (脑动极光), AI startup developing medical-grade digital therapy products for cognitive disorders. Exit for Eight Roads and Northern Light Capital.

🇨🇳 IPO at a $429M market cap: Hyper Strong (海博思创), a provider of large-scale energy storage and EV battery systems. Exit for IDG Capital and Qiming Ventures.

🇦🇺 M&A: Everty, providing vehicle charging station management services for residential, business, and public locations; acquired by Australian renewable energy producer AGL Energy. Exit for Artesian VC, EnergyLab and Sydney Angels.

🇨🇳 $304M acquisition: EverProTech (长芯盛), developing and producing photonic chips, optoelectronic modules, high-speed active optical cable (AOC) interconnects; acquired by a Chinese fiber optics manufacturer Broadex Technologies.

🇨🇳 IPO at a $194M market cap: Saimo Technology (赛目科技), a digital twin startup focusing on simulation tests for intelligent connected vehicles. Exit for Huawei Hubble and CITIC Securities.

If you have any proposals, ideas, or feedback, we’d love to hear from you! Feel free to reach out at denis@deeptech.asia or on LinkedIn. Let’s connect and explore how to improve together.