Is Robotics VC-Scalable?

Deep-dive on TOP 10 Robotics Segments (China, US, Europe) with $1T+ VC opportunities in the next 25 years: AVs, humanoids, drones, service robots, AI models, and more

Special thanks to David Li, Rachel Cheung, Kyle Chan, JS Tan, Fedor Susov, Francesco Ricciuti, Poe Zhao, Grace Shao, Aaron Wolff, Ivan Kuzmenkov, Diana Pavlova for contributing to this article.

Summary:

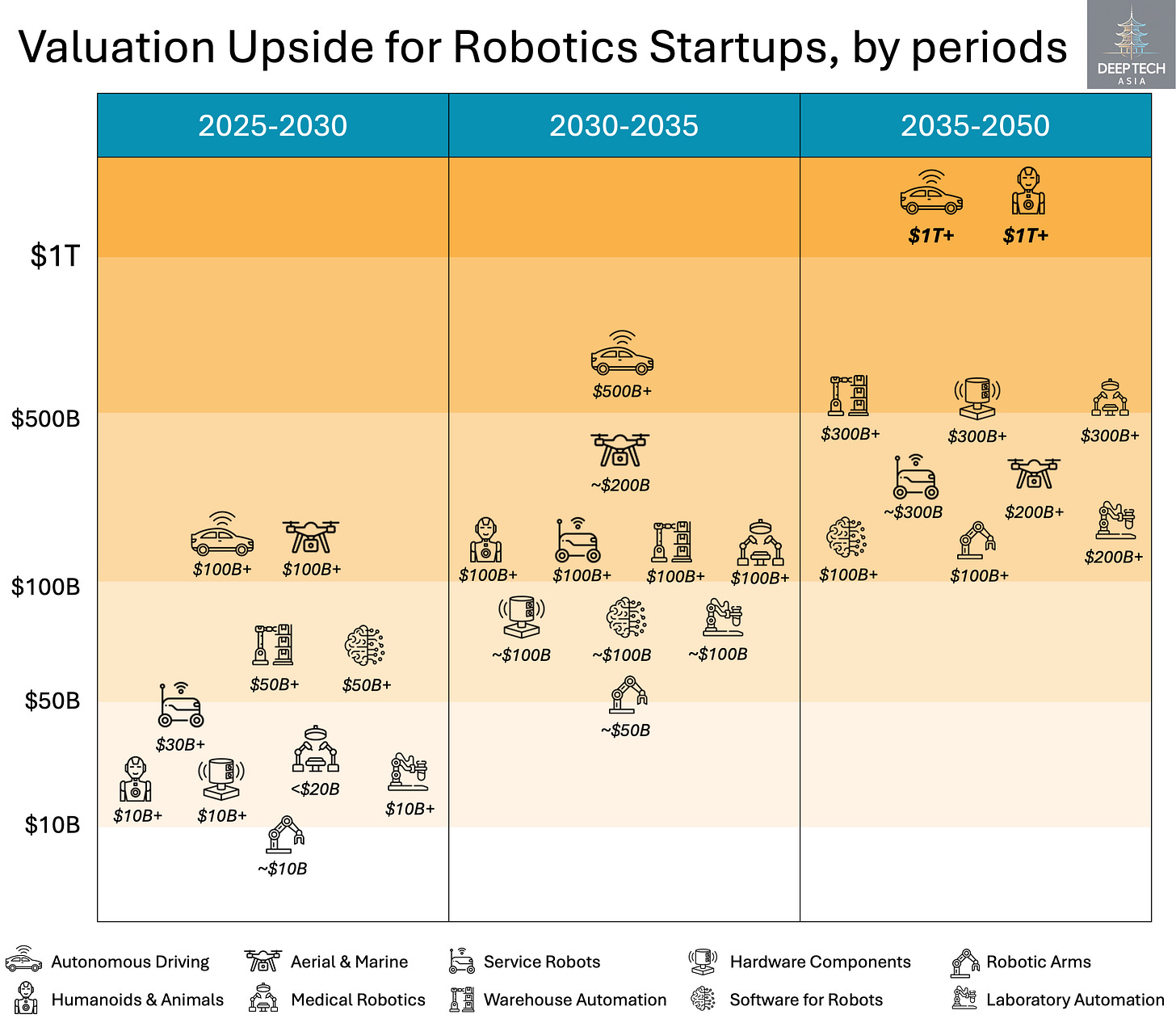

Ten robotics segments are already VC-scalable: autonomous driving, humanoids & animal robots, drones & marine robots, medical robots, service robots, warehouse robots, hardware components, software for robots, robotic arms, laboratory robots.

VC-scalability varies across countries, e.g. hardware and service robots are easier to scale in China, while pure software plays are more sustainable in US/EU.

China is leading by the number of unicorns and VC/PE exits in robotics, while US has the largest VC-backed robotic companies (Intuitive, Waymo, Figure, Anduril).

The following five areas have the largest VC-upside in the next 5-10 years: autonomous driving, drones & marine robots, warehouse robots, medical robots and service robots.

Autonomous driving will probably be the first segment to produce a $1T robotic company in the next 10 years, while it will take longer for humanoids and medical robots.

AI & Software is a critical part for the robotics progress, but the business model of pure software players is hardly sustainable in robotics in the long run.

China will keep dominating the robotic supply chain, both hardware and software, although software will most likely be open source and hard to monetise.

Western players will be much stronger in applications and vertical solutions due to their proximity to large and mature markets.

For the past decades, the world has been shaped by digital innovation: first the internet, then mobile and cloud, and most recently — AI.

These technologies gave birth to the world’s first $1T+ companies (Facebook, Amazon etc) and emerging $100B+ unicorns (OpenAI, Databricks, Anthropic, Bytedance), nurtured by the top tier VC firms like Sequoia, Kleiner Perkins, a16z and others.

However, the contribution of software to the world’s GDP is still low, e.g. only 4% in the US. The majority of global value creation still remains in physical industries, such as manufacturing, construction, logistics. All these sectors are built on physical interaction and have historically been insulated from pure software disruption.

Robotics was meant to transform these physical industries, but almost none of the robotics pioneers managed to reach even $100B in valuation:

Unimation, the world’s first robotics company — acquired by Westinghouse for $107M in 1983.

KUKA developed their first robot in 1973 — acquired by Chinese company Midea for €4.5B in 2016.

ABB Robotics, world’s largest industrial robotics manufacturer — acquired by Softbank Robotics for $5.4B in 2025.

EPSON, the world’s 2nd largest industrial robotics manufacturer — less than $4B market cap as of Nov 2025.

Boston Dynamics, the pioneer in humanoid and animal robotics — acquired by Google, then by Softbank, then by Hyundai. The last price was $1.1B in 2021.

Moreover, none of these companies were backed by VCs.

Why has robotics been always hard for VCs?

The short answer — scalability. Hardware businesses are less scalable than software because you need to procure components, produce and assemble them and then move physical products across sophisticated supply chains to the other part of the world.

Niche applications is another even bigger issue. In areas like automotive manufacturing, semiconductor fabrication and packaging, warehouse fulfilment automation already reaches 70-90%. However, deploying robotic solutions at every facility requires high customisation and support from system integrators, which significantly limits scalability.

All these issues make it hard for VCs to underwrite a potential 100x return from robotics investments.

Physical AI — A New Hope

This may be starting to change now.

Over the last few years, hardware innovation is getting back on the radars with NVIDIA’s Jensen Huang predicting that “the next wave of AI will be Physical AI”, referring to AI penetrating the physical dimension in a form of more advanced robots, autonomous driving, drones and other smart devices.

The timing seems to be right.

Demand side — aging population and labor shortages in developed countries:

By 2030, one in six people globally will be over 60.

By 2050 the population aged 80+ will nearly triple to around 425M.

0.5–1.5% annual workforce decline in Japan, South Korea, Italy, Germany, China.

US manufacturing industry is projected to have 2.1M unfilled jobs by 2030.

Logistics and warehousing report 40–60% vacancy rates during peak periods.

Construction in Europe and Japan has 20–30% of roles consistently unfilled.

Supply side — progress in AI and reducing hardware costs.

Large-scale multimodal models and RL-based control systems improve perception, dexterity, and generalisation.

Component prices (servo motors, sensors, batteries, compute) have dropped 30–70% over the past decade due to Asian supply chains and Chinese scale manufacturing.

All this is resulting in bullish forecasts by the leading consulting firms predicting the physical AI and robotics market to reach $300B by 2030 and $1T by 2040-2050.

VC-Scalable Segments in Robotics

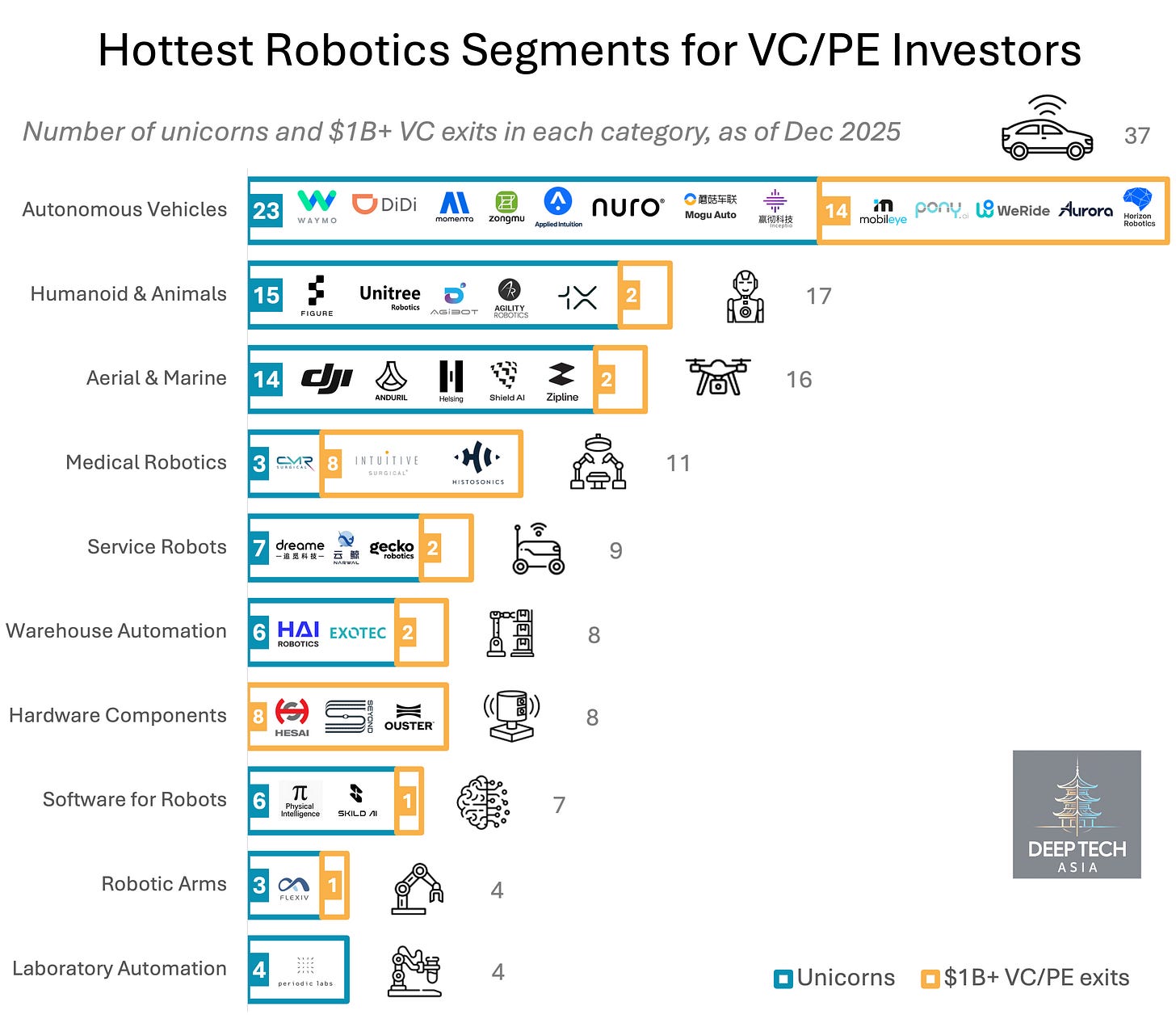

To identify which robotics areas have the highest potential to reach a VC scale, I’ve collected data on 123 publicly known VC-backed robotics companies with $1B+ valuation, including unicorns, public companies and acquired companies. The exact methodology is described at the end of the article.

This analysis does not only pinpoints the most hyped areas, but also highlights the following key considerations about these sectors:

Market size. Investors understand that the potential market is big enough to reach at least a $1B+ outcome (VC-scale).

Scalability. Investors expect that companies in this segment can grow exponentially every year without high customisation for each deployment site.

Moat. Investors believe that due to the economies of scale and the ecosystem flywheel these companies will be defensible and the barriers will grow, preventing new competitors from entering the space and compressing margins.

Access to capital. As a consequence of the previous three points, investors are ready to deploy more capital into these companies, which will help them scale faster and become more defensible in the future.

The abundance of $1B+ VC-backed companies in certain segments also proves that early backers of those startups can return at least 10-20x from their investments.

Based on this analysis, I’ve identified the ten robotics segments that already indicate VC-scalable growth.

VC-hyped segments:

autonomous driving (including robotaxis, autonomous trucks),

general-purpose bio-inspired robots (humanoids, robot dogs etc),

unmanned aerial & marine systems (drones, vessels, eVTOLs).

These segments have the biggest number of unicorns, while not as many exits yet. Valuations are high, but the actual market adoption is nascent, as positive ROI from implementing those technologies is still unreachable. Nevertheless, VC investors are actively pursuing those opportunities, as they promise the next generation of general-purpose hardware platforms, akin to cars in the early 20th century.

Mature VC-scalable segments:

medical robots (first of all surgical robots),

non-humanoid service robots (cleaning robots, vacuum cleaners, operators with hybrid robotic platforms),

warehouse automation (AGVs/AMRs and other robotics solutions),

hardware components (mostly LIDARs and edge compute chips).

Most of these segments already have significant amount of $1B+ acquisitions or IPOs, current market sizes are measured in dozens of billions of dollars with real adoption and proven positive ROI.

New VC segments

pure software for robotics (robotic brains and traditional SLAM),

general-purpose robotic arms (adaptive or collaborative arms),

laboratory automation (robotic solutions for autonomous labs).

These segments don’t have many sizeable exits yet, but there are some unicorns, which proves that VC-scale is possible.

Missing segments

Automated production lines — there are incumbent players like ABB, FANUC, Siemens etc, but no sizeable VC-backed unicorns, because these solutions require a lot of customisation and integration support, which hinders scalability.

Basic robotic arms — market is commoditised with hundreds of producers and no clear product differentiation.

Basic hardware components (actuators, electric motors, gearboxes, drives) — same as for generic robotic arms: commoditisation and no defensibility.

Pure integrators — consulting companies that deploy robots on the customer premises; although being a crucial link in the chain, these players are rarely VC-backable due to their service-oriented revenue and low scalability.

Which Countries Are Leading?

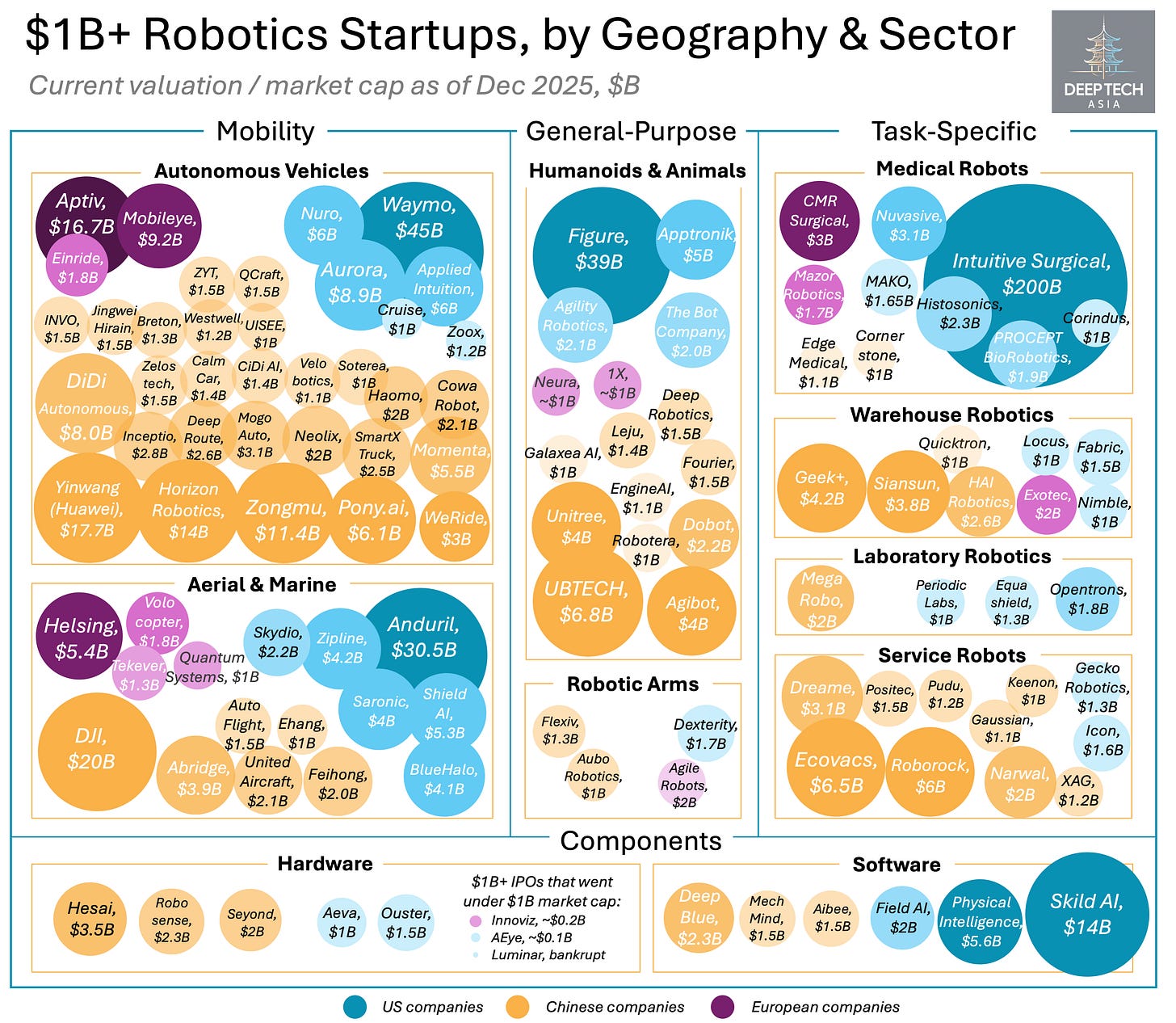

Out of 123 unicorns and $1B+ exited companies:

China — 68 companies (55% out of total),

USA — 39 companies (32% out of total),

Europe — 16 companies (13% out of total), with Israel and Germany as leaders.

Nevertheless, out of the TOP 5 companies by valuation / market cap, four companies are American and only one is Chinese — DJI.

TOP 10 VC/PE-backed robotics companies:

🇺🇸 Intuitive Surgical — $200B+ (public)

🇺🇸 Waymo — $45B

🇺🇸 Figure — $39B

🇺🇸 Anduril — $30.5B

🇨🇳 DJI — $20B

🇨🇳 Yinwang / Huawei — $18B

🇨🇭 Aptiv — $17B

🇨🇳 Horizon Robotics — $14B (public)

🇨🇳 Zongmu — $11.4B

🇮🇱 Mobileye — $9.2B (public)

$1B+ robotics exits:

China — 17, mostly IPOs

USA — 16, both M&As and IPOs

Europe — 7, mostly IPOs

Historically, the USA have been the largest exit market for robotics companies, but last year China caught up with four new robotics IPOs in 2025 (Geek+, Seyond, CiDi, Breton) and five IPOs in 2024 (Horizon Robotics, Robosense, Weride, Pony.ai, Dobot).

Competitive dynamics varies across each segment.

Americans are leading in:

Medical robotics — with an ultra success story of Intuitive Surgical.

Robotics software — Skild AI, Physical Intelligence, Field AI that are VC-backed + other leading labs like Google DeepMind (RT-2, RT-X), OpenAI (Aiko), NVIDIA (GR00T)

Laboratory automation — with Opentrons, Equashield, and Periodic Labs.

Chinese are leading in:

Service robotics — among $1B+ VC-backed cleaning-related players, all companies are Chinese, especially after the US consumer robotics pioneer iRobot went bankrupt in Dec 2025.

Autonomous vehicles — despite the growing adoption of Waymo’s robotaxis, there are dozens of Chinese unicorns targeting passenger, commercial and industrial segments.

Hardware components — although NVIDIA Jetson chips are a household name in global robotics, it only contributes to ~1% of NVIDIA’s revenue; meanwhile, China is the absolutely leader in LIDARs (Hesai, Seyond etc) and is catching up with its edge compute chips.

Warehouse automation — although the legacy players like Vanderlande and Dematic are American and European, many major next generation VC/PE-backed companies are Chinese, e.g. Geek+, Siasun, HAI Robotics. American company Symbotic is another significant player ($36B market cap), but it’s not VC-backed.

Equal competition:

Unmanned aerial & marine systems — although DJI is the market leader in standardised commercial drones, there are several specialised American and European startups, especially in defence that might not have the same revenue scale as DJI, but are valued at much higher multiples, as they provide integrated solutions for the end customers.

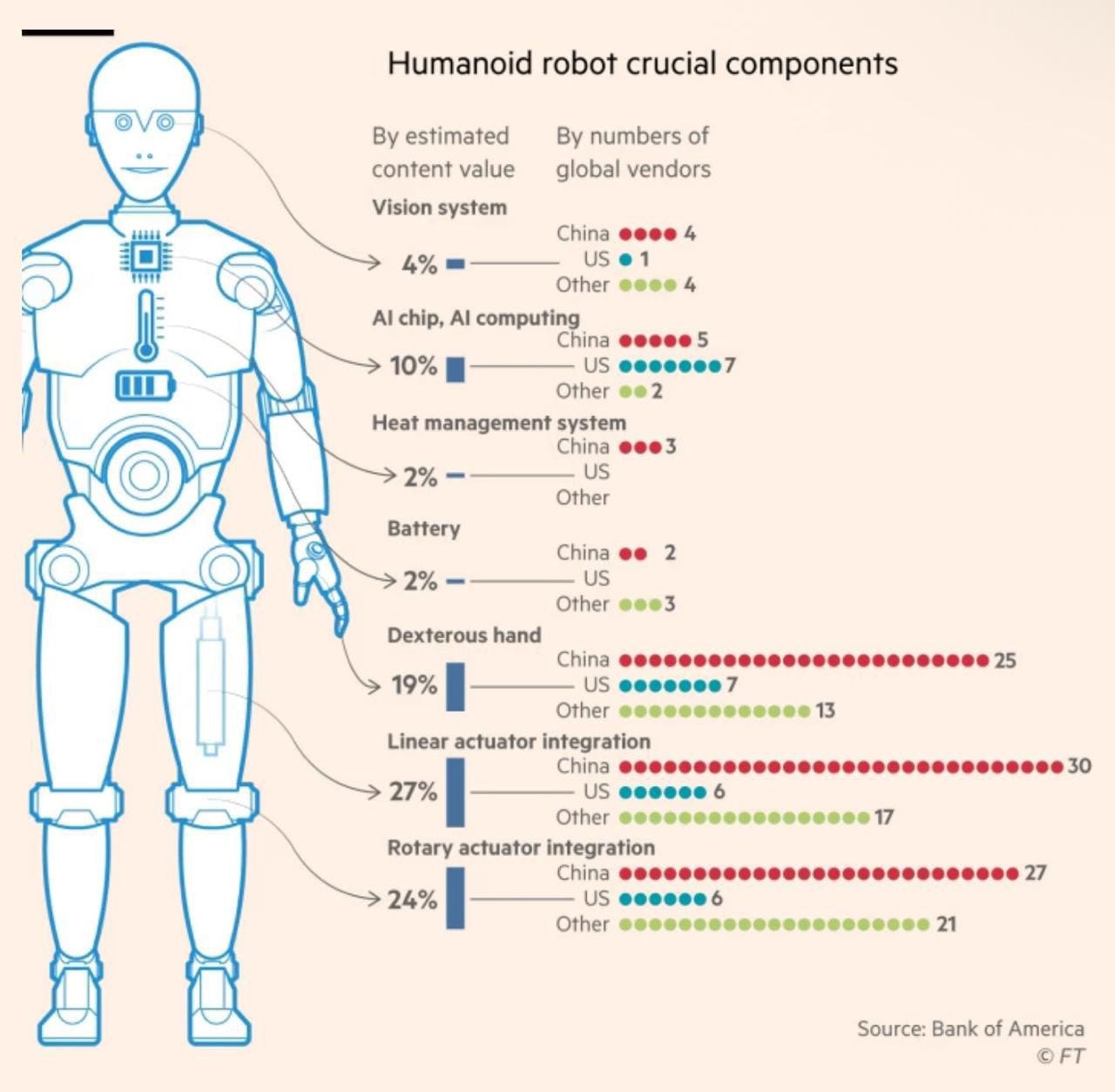

Humanoids & animal robots — although China is dominating hardware supply chains for humanoids and robotic dogs (Unitree, UBTECH etc), the US and European players — like Figure, Optimus, 1X — are still much stronger in AI capabilities, although China is catching up.

One of the conclusions is that VC scalability varies not only across different segments, but also across different ecosystems. Manufacturers of hardware components and service robots — especially cleaning robots — are much harder to scale in the West, than in China. Likewise, pure robotic software developers are more sustainable in the US than in China where software is harder to monetise.

When Will We See a $1T+ Robotic Company?

Robotics automation has existed for decades, but the mature segments haven’t yet shown the scalability needed to produce a $1T company — unlike AI. As of now, the largest robotics company is the medical robotics pioneer Intuitive Surgical with a ~$200B market cap.

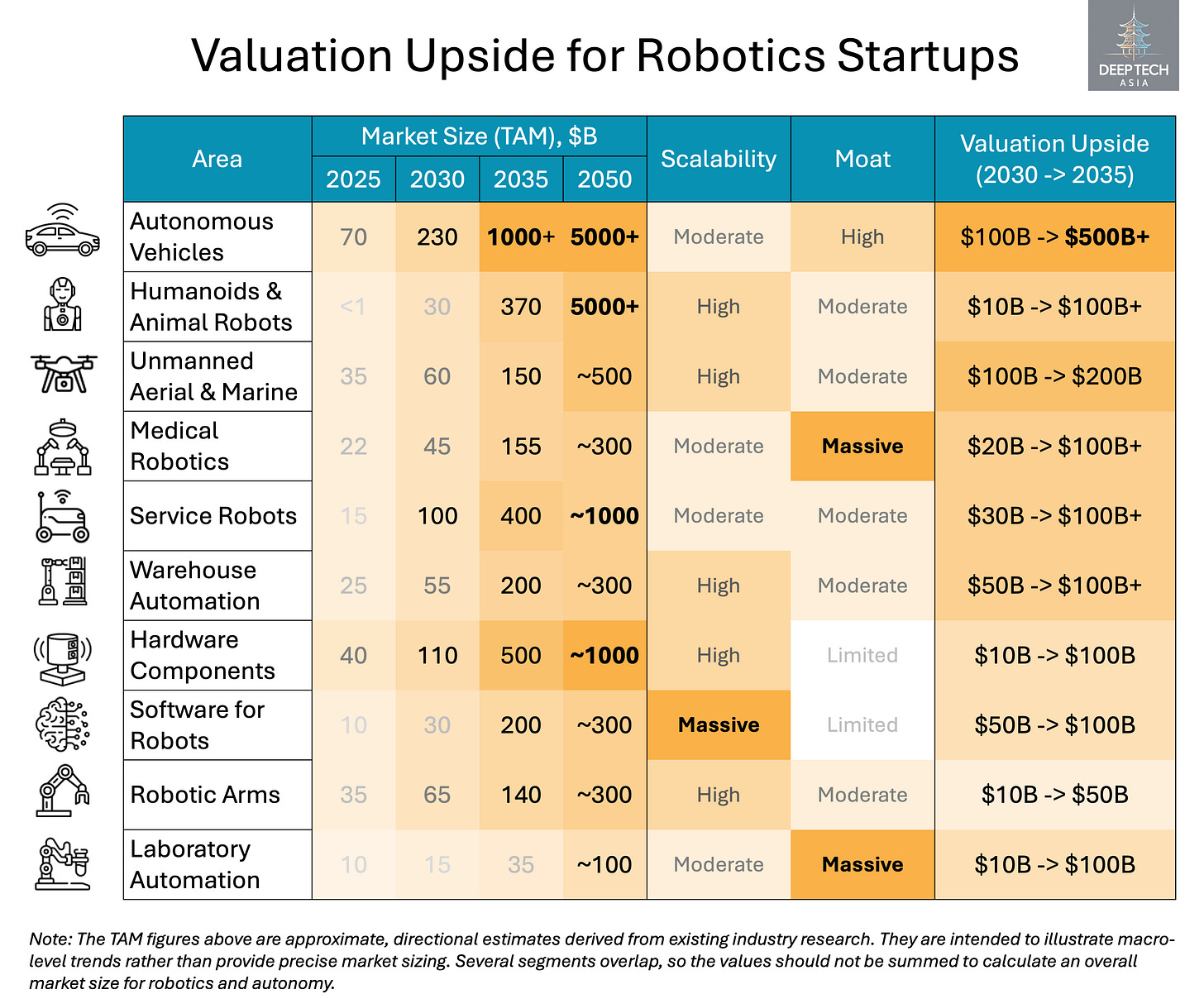

Below I’ll try to summarise my estimations on the upside potential for VC-backed companies in each robotics segment across different time horizons:

5 years (by 2030) — for VC/PE growth funds,

10 years (by 2035) — for early-stage VC funds,

25 years (2050 and beyond) — for strategic investors.

These estimations are based on assumptions across the following factors:

Three VC-scalable factors: total addressable market (TAM), scalability and moat;

Size of the existing incumbents that the new companies are disrupting;

Size of major companies in other industries with similar business models;

Speed of disruption and stickiness of the existing incumbents.

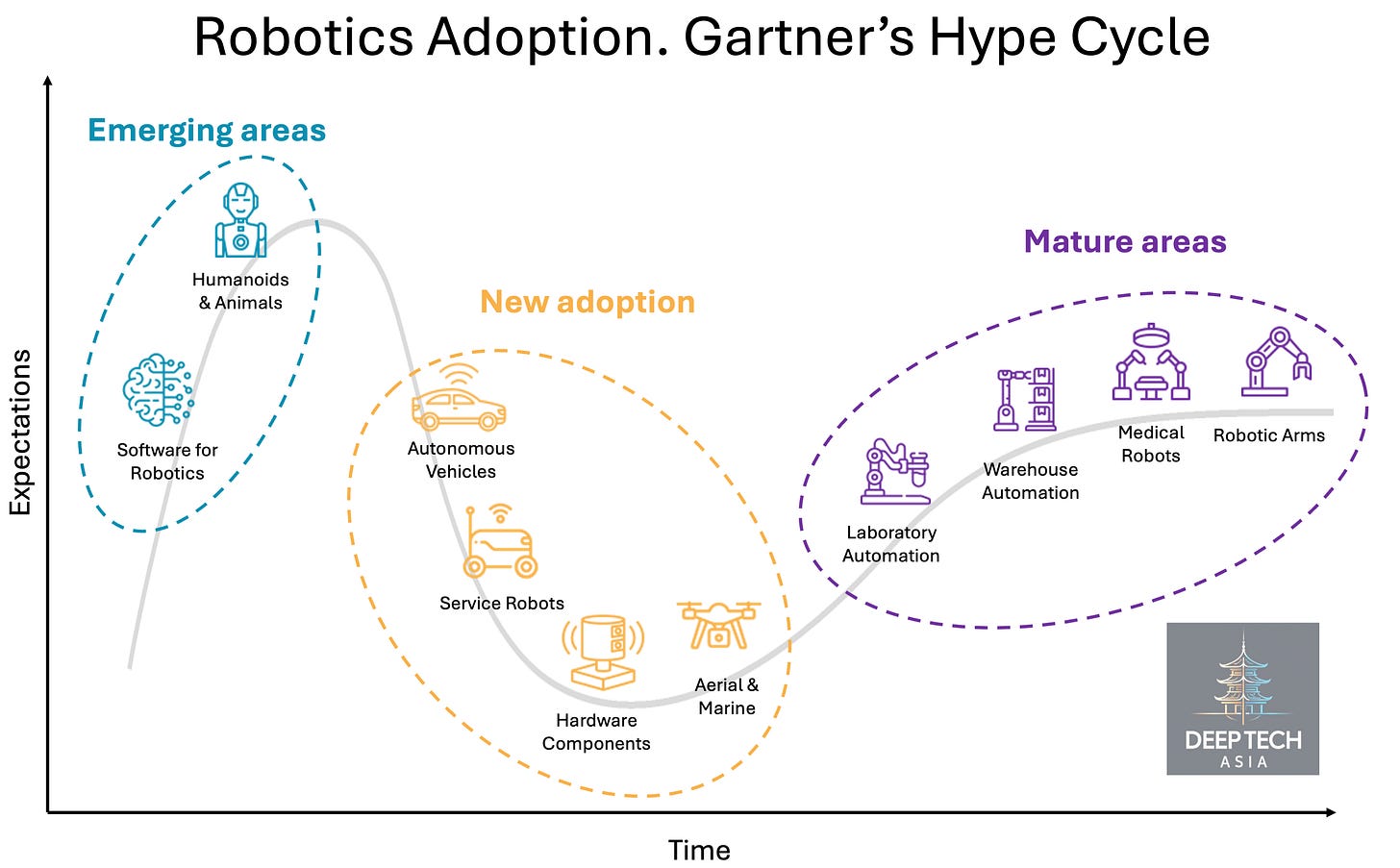

The upside potential doesn’t always progress linearly over time; it depends on where the technology sits on the Gartner Hype Cycle. For example, the rise of physical AI may drive near-term valuation uplift for humanoids, but since large-scale adoption is still at least a decade away, their mid-term upside doesn’t increase meaningfully.

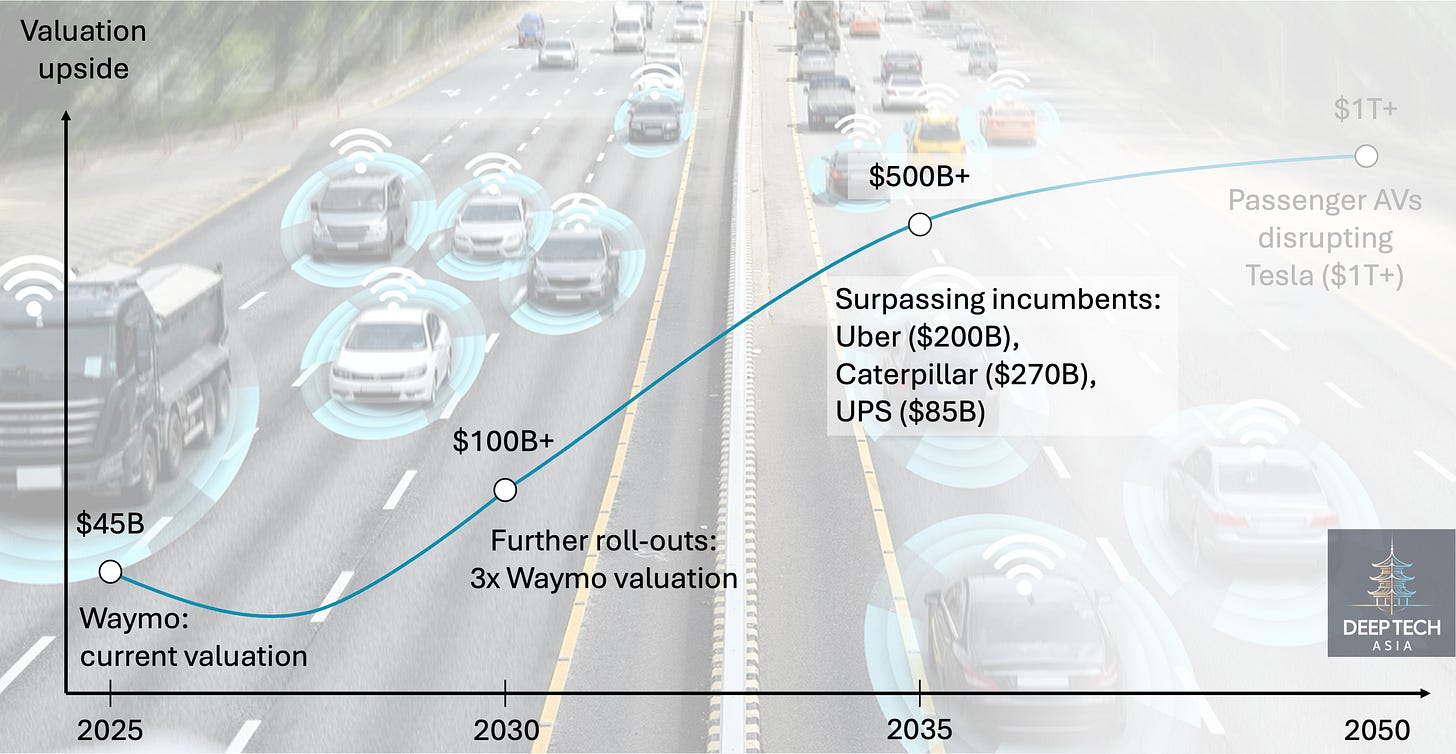

Autonomous Vehicles (AVs)

The sector is shifting from localised pilot programs to a global infrastructure utility with a Mobility-as-a-Service (MaaS) model where autonomy is embedded into public infrastructure, logistics and industrial fleets.

By 2030: Further Robotaxi Roll-outs ($100B+ potential)

TAM is still relatively small, but expanding fast as robotaxis scale in dense cities and autonomous trucking is adopted in fixed corridors and private industrial domains. Waymo is already valued at ~$45B in its 2024 round and is reportedly discussing a new raise at $100B+, while Chinese leaders (e.g., Pony.ai, WeRide) are also ramping fleet scale globally. Scalability remains moderate because fragmented regulations, safety cases, edge conditions, and “city-by-city” localisation keep rollouts constrained.

2030–2035: Robotaxis & Commercial Fleet Adoption ($500B+ potential)

Robotaxi operators should capture the bulk of value as they replace traditional ride-hailing services like Uber, and could surpass incumbents to reach $500B+ market caps as removing human drivers increases take-rate and improves unit economics. Autonomous long-haul trucking, industrial vehicles, and public transport should also see meaningful adoption by 2035, but those markets are either too niche or too fragmented — with weaker moats — to produce single players at $100B+ scale. Logistics companies (e.g., UPS $85B, FedEx $70B, DHL $60B) may capture major value by deploying autonomous rides to cut costs and increase capacity, yet their market caps will likely still be in the ~$300B range. In industrial trucks (e.g., mining/construction), most value is captured by incumbent OEMs like Caterpillar ($270B+ market cap), so the largest upside requires directly disrupting those players.

After 2035: Mass Consumer Adoption ($1T+ potential)

Over time, new entrants may still capture significant share in autonomous commercial vehicles, but the largest upside should come from automating consumer passenger mobility. This likely happens either through new and legacy automotive OEMs adopting ADAS at scale, or through robotaxis becoming a cheap substitute for individual car ownership. In an ADAS-led path, competition will eventually compress margins and cap valuations near today’s automotive OEM levels (~$500B) or around $1T similar to Tesla. If robotaxis become a true alternative to owning a car, operators can capture far larger value ($1T+) by controlling the full passenger-mobility loop, with strong moats from decades of safety data and tightly integrated hardware/software supply chains. Other non-obvious winners could be consolidating providers of data infrastructure — safety assurance/validation, simulation + synthetic data pipelines, mapping/localisation, fleet orchestration.

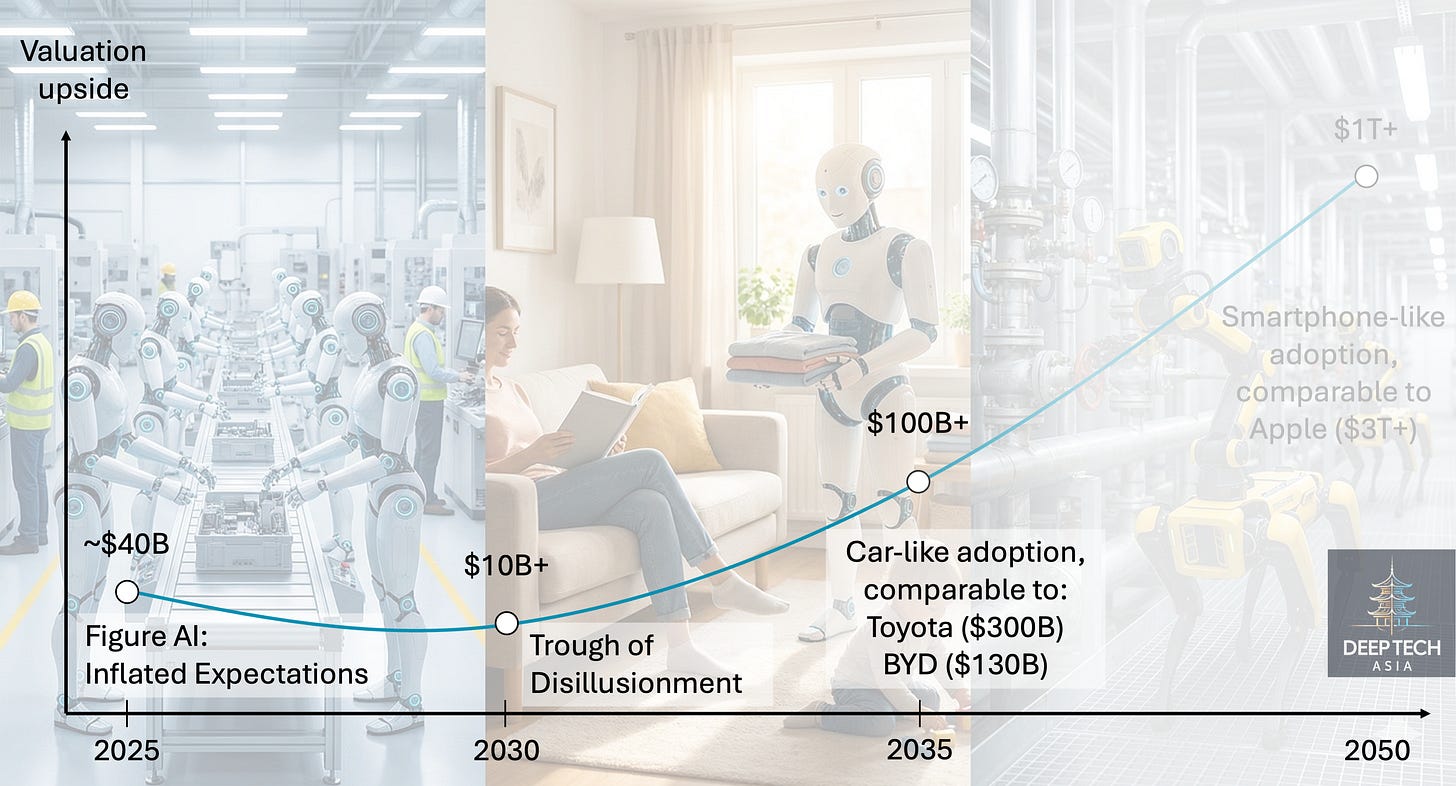

Humanoids & Animal Robots

This segment is transforming the whole robotics industry from specialised robots into general-purpose hardware platforms replacing / augmenting manual labor in all areas.

By 2030: R&D and Niche Deployment ($10B+ potential)

The market is still small as the industry remains in a heavy R&D and product development stage, with adoption limited to pilot programs in automotive plants and logistics centers. Although Figure has reached $39B valuation in its Series C and it may well reach a $100B+ valuation, it’s hardly sustainable. Scalability is constrained by high BOM + reliability + service costs, while robodogs scale earlier in inspection/defense but remain niche with capped TAM. Moats are either in large-scale / low cost hardware capabilities (e.g., Unitree with $4B valuation) or in proprietary datasets and AI models and quick real-world deployment feedback loops.

2030–2035: Car-Like Adoption ($100B+ upside)

After 2030, we may see the first real humanoid deployments that directly replace or augment manual labor in industrial and commercial facilities (manufacturing, warehouses, retail, etc.) that are not yet fully automated. This adoption wave may mirror the rise of cars in the 20th century: a split between robotic OEMs (general-purpose hardware platforms with basic intelligence) and robotic integrators that build their own AI models and sit closer to distribution, but remain tied to specific use cases. Hardware OEMs will be more scalable yet eventually commoditised, so their upside may resemble today’s automotive manufacturers (~$200B). Robotic integrators may also top out around $100–200B because, despite a large market opportunity, the model remains service-heavy and harder to scale; animal robots follow a similar pattern at smaller scale in niches like inspection. In this period, none of these systems are truly general-purpose — each still needs adaptation to specific tasks.

After 2035: Smartphone-Like Adoption ($1T+ upside)

As with AVs, the largest upside for humanoids is consumer adoption. To be useful in unpredictable household environments, robots will need highly sophisticated AI plus adaptivity and continuous learning—initially enabled by teleoperation and ultimately reaching full autonomy. Once that threshold is crossed, adoption could become genuinely general-purpose, akin to smartphones, with humanoids serving as universal physical companions for a household or even each individual. That implies a massive $5T+ TAM and creates room for Apple-like winners that integrate hardware + software supply chains, distribution, and ecosystem lock-in. Such platforms could plausibly reach $1T+ market caps.

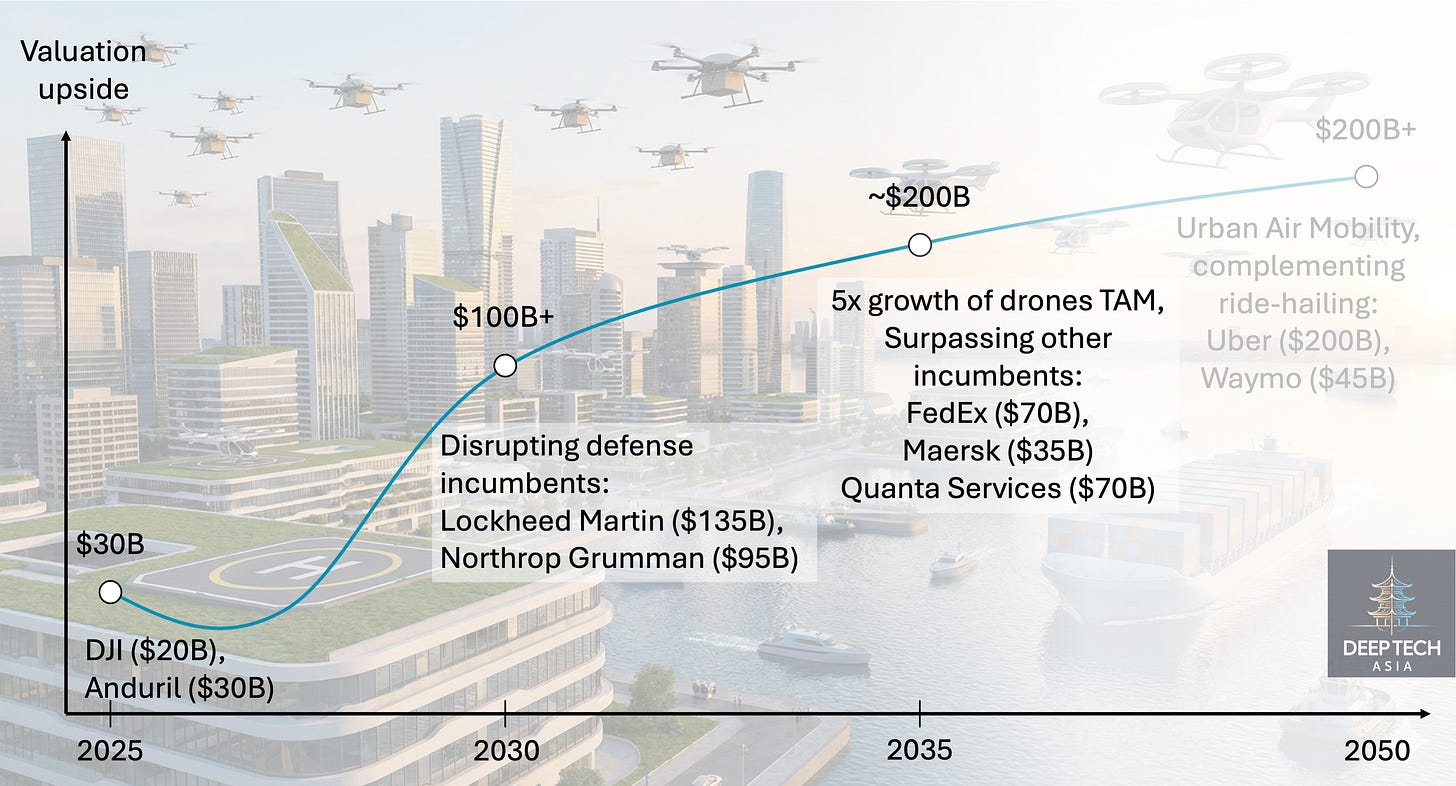

Unmanned Aerial & Marine Platforms

The unmanned aerial & marine autonomy stack is evolving from “tools” into software-defined infrastructure for defence, logistics, offshore energy, and (eventually) passenger mobility.

By 2030: Defence Driver ($100B+ potential)

Commercial adoption is proven, but it’s driven mainly by defence, inspection and mapping. Scalability is high for standardised hardware producers, such as DJI ($20B valuation) that produce drones at mass-scale (70% of the global market) — their moat is in the economies of scale. Vertical software-led players have even stronger moats, because they own industry-specific software and autonomy stack, along with the customer relationships. But because of the tight airspace regulation and early stage of the technology, in the near term only the defence-focused players like Anduril ($30.5B valuation) are likely to gain significant scale — similar to incumbents like Lockheed Martin ($135B), Northrop Grumman ($95B).

2030–2035: Vertical Use Cases (~$200B potential)

Use cases shift from defence to civil industries, led by drone logistics (campuses, industrial sites, offshore assets, and corridor-based routes), energy and utilities inspection at scale (grids, wind/solar, pipelines, offshore), and autonomous maritime operations (ports, coastal shipping, offshore support, subsea inspection). However, their scale will be capped by $100B, similar to existing incumbents like FedEx ($70B), Maersk ($35B), Quanta Services ($70B). Horizontal drone OEMs will continue to scale, but limited product defensibility is likely to compress margins as vertical players increasingly internalise hardware. Urban aerial mobility will see the first meaningful pilots (eVTOLs, drone delivery), though deployment is limited by airspace regulation and local noise & safety permitting.

After 2035: Mass Vertical Adoption + Early Urban Mobility ($200B+ potential)

The markets for drones and unmanned maritime vessels in logistics, inspection, and offshore operations are likely to mature and consolidate with market caps hardly exceeding $200B. EVTOL deployment will be accelerating, providing faster alternatives to car ride-hailing or even short-term airline flights. This adoption will most likely be concentrated in public and shared transport systems, rather than mass-consumer ownership, which will cap the scale of the eVTOL operators roughly at the size of the existing ride-hailing companies like UBER ($200B) or Waymo ($45B).

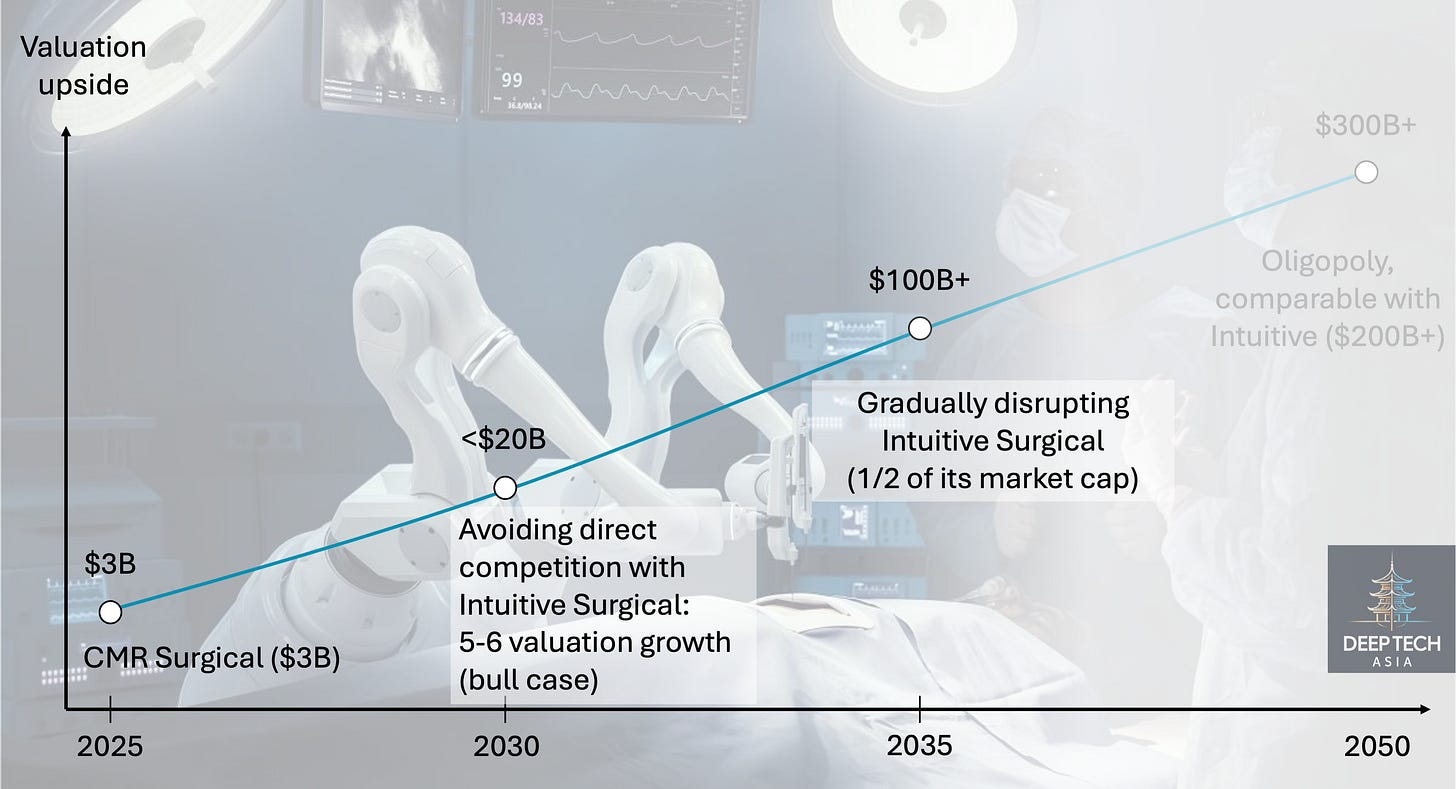

Medical Robotics

Surgical robots are by far the largest segment of the medical robotics market which is evolving from complex robotic tools towards modular, affordable and AI-powered platforms enabling co-piloted and tele-operated procedures. All other segments (rehabilitation robots, exoskeletons etc) will stay niche, while non-surgical robotics assistants are included in the humanoid and service robot sections.

By 2030: David vs Goliath (<$20B potential)

Surgical robotics is dominated by a single player — Intuitive Surgical ($200B+ market cap) that is growing ~20% YoY with ~30% net margins. While the core surgical robots market appears niche, it is sizeable ($30–50B TAM) and still early, with only ~10–15% penetration. Importantly, robots account for just ~25% of Intuitive’s revenue, with the majority coming from high-margin, recurring instruments and service — materially expanding the effective TAM. Scalability is currently gated by long hospital CAPEX cycles and intense regulatory requirements, while the moat is in high switching costs and specialised surgeon training. New modular entrants like CMR Surgical are expanding the market by targeting “new-to-robotics” sites with lower pricing, but their near-term valuations are likely to remain in the $20B range.

2030–2035: Gradually Disrupting Intuitive ($100B+ potential)

We may expect a further disruption of Intuitive, with the emerging players winning over an increasingly larger market share due to their modular and more affordable system designs, as well as AI co-pilots and remote collaboration features. Although Intuitive also heavily invests in these technologies, the gap between legacy and new players will narrow. Intuitive itself might reach a $1T market cap by now, while its growth will mostly likely be stagnating.

After 2035: Oligopoly ($300B+ potential)

Next-gen surgical robotics platforms will keep pressuring Intuitive’s dominance and could plausibly scale to $300B+ market caps — unless Intuitive or other incumbents acquire them first. Even in that scenario, Intuitive is likely to remain a top-tier winner given its installed base, consumables flywheel, and regulatory “safety trust” moat. Exoskeletons and most non-surgical medical robots should grow, but will likely stay niche relative to the surgical platform opportunity.

Non-Humanoid Service Robots

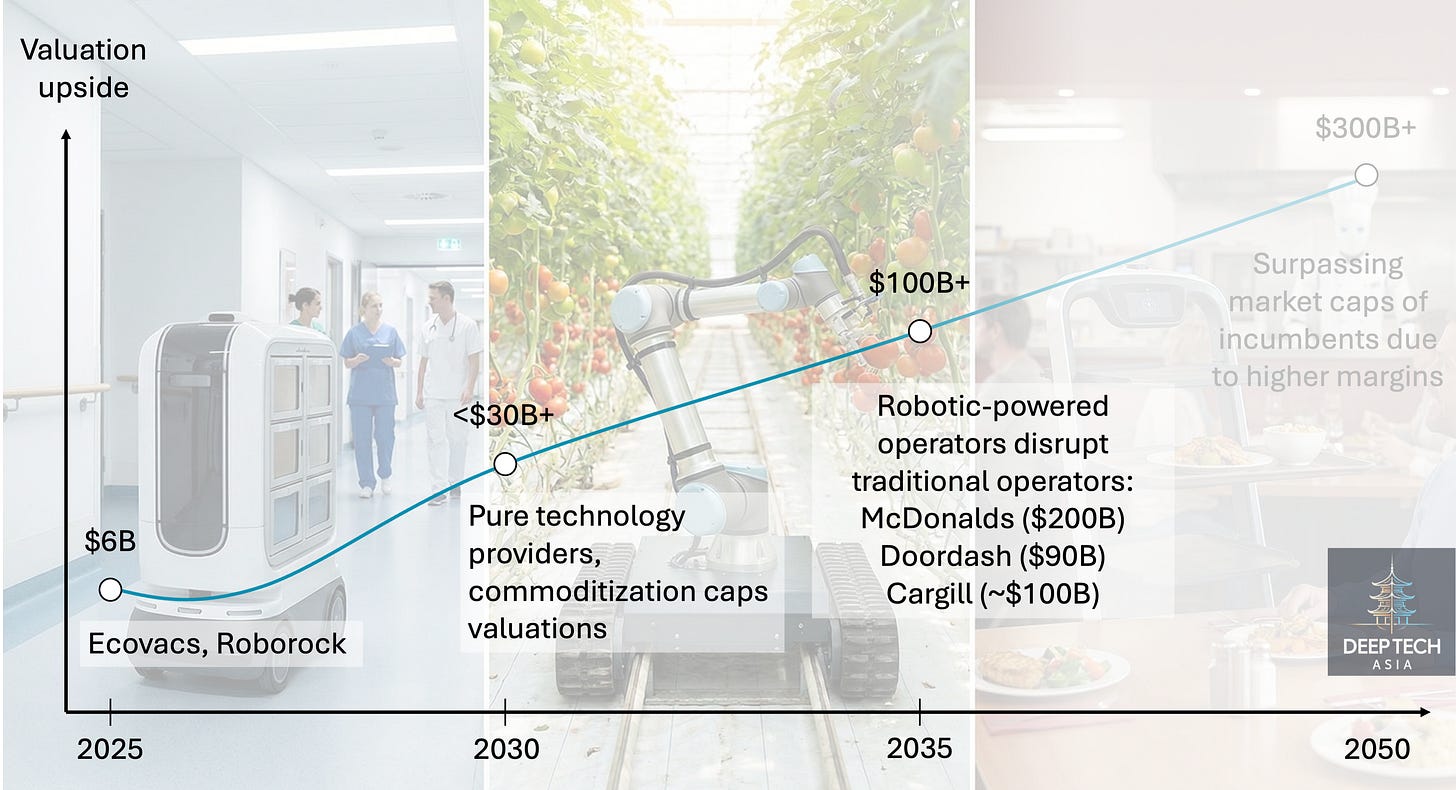

These types of task-specific robots will eventually disrupt multiple traditional industries and give birth to a next generation of operating companies, although at some point it may face some competition with general-purpose humanoid robots.

By 2030: First Mature Niches ($30B+ potential)

The sanitation and cleaning industry is the early adopter: cleaning robots and autonomous lawnmowers are already becoming a mature niche with established players (Ecovacs, Dreame, Keenon, etc.). Standardized customer requirements across industries, a sizeable market, and low regulatory hurdles enabled smooth scaling — although commoditisation will cap upside (typically ~$20–30B market caps), making funding and brand awareness key success factors. Meanwhile, robotics is emerging as a core differentiator in other niches — agriculture (XAG), predictive maintenance (Gecko Robotics), construction (Icon) — but these remain early because the tech is still nascent and market education is required.

2030–2035: Rise of Robotics-Powered Operators ($100B+ potential)

As robots get more capable and affordable, traditional industries increasingly deploy robotic assistants to complement human labor — e.g., autonomous carts for last-mile and indoor delivery in hospitals and hotels, harvesting robots in agriculture, and kitchen/waitress robots in F&B. This will create two types of companies: service-robot suppliers and robotics-powered operators. Suppliers may scale fast, but commoditisation and intense competition likely keep their valuation upside in the ~$50B range, similar to the current electronics manufacturers; operators, while less scalable, can capture more value by disrupting incumbents (McDonalds, Doordash, Cargill, etc.) and may eventually reach $100B+ market caps. via structurally better unit economics, although it may require decades.

After 2035: Task-Specific vs General-Purpose (~$300B potential)

By 2035, non-humanoid service robots will likely be embedded across many industries, supported by a next generation of operating companies that have matured into large-scale businesses. After 2035, humanoid robots may finally reach the technological threshold to meaningfully replace or augment human labor across a wide range of use cases. Even then, general-purpose humanoids will likely co-exist with task-specific non-humanoid robots: humanoids handle flexible, unpredictable tasks typically done by humans, while specialized robots remain the most efficient for repeatable workflows. Human labor shifts toward managing and maintaining robots, plus higher-level tasks and decision-making. VC-scalable robotic operators will be gradually replacing traditional operators in each niches and better unit economics will provide potentially higher upsides (~$300B).

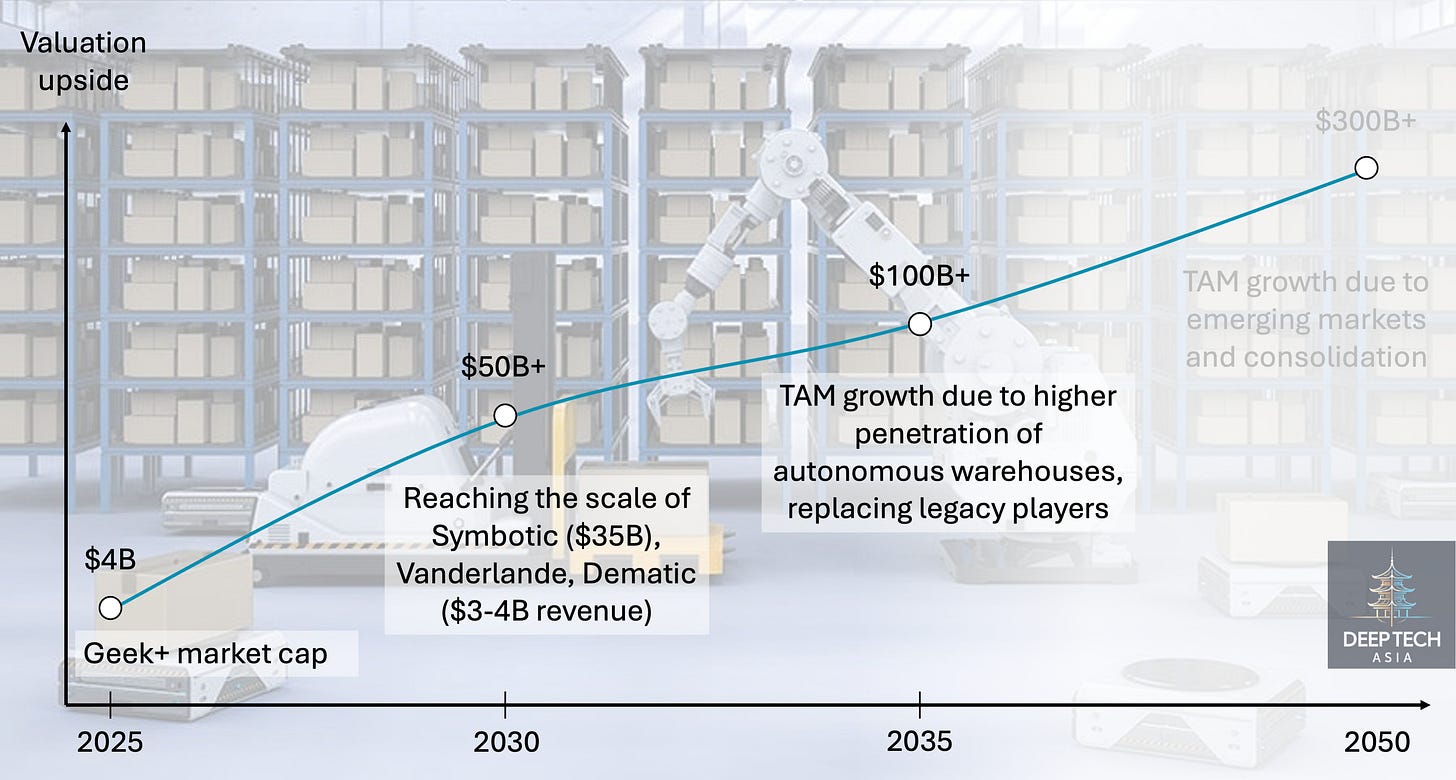

Warehouse Automation

The sector is evolving from rigid, hardware-heavy conveyor systems and “islands of automation” into fully autonomous “dark warehouses” with an AI-orchestrated ecosystem of mobile robots and intelligent manipulators.

By 2030: Disrupting Legacy Players ($50B+ potential)

The market is already sizeable as legacy integrators like Vanderlande, Dematic, and Daifuku maintain $3-4B revenues, while the public non-VC-backed player Symbotic shows the market’s massive upside with a $36B market cap and 20–30% growth. Scalability is driven by the global rollout of proven AS/RS and AMR stacks, though challenges remain in integrating these with legacy warehouse management systems (WMS). Moats are shifting from pure mechanical engineering to software-driven orchestration and workflow lock-in, with VC-backed challengers like Geek+, Exotec, and Fabric poised to capture significant market share and reach $30-50B valuations.

2030–2035: Rise of “Autonomous Warehouses” ($100B+ potential)

The market growth is driven by the adoption of “autonomous warehouse” ecosystems with true piece-picking at scale via tactile-aware manipulation and robotics foundation models for open-ended “physical work.” The standard adoption of autonomous truck loading/unloading modules and warehouse “autopilot” layers that reduce the need for manual intervention. Scalability improves through modular automation that speeds up multi-site replication across different building types. Moat concentrates in whoever owns end-to-end orchestration + performance data, enabling a shift from equipment projects to Labor-as-a-Service economics and creating room for new “warehouse OS” entrants alongside incumbents.

After 2035: Mass Adoption ($300B+ potential)

The “lights-out” warehouse becomes the global standard, with growth driven by penetration into smaller facilities and emerging markets that were previously uneconomic to automate. Scalability reaches its peak through standardised hardware platforms and autonomous exception handling, allowing for 24/7 operation with minimal human oversight. The long-term moat hardens into an oligopoly built on ecosystem lock-in. By 2050, the leading automation platforms will function as the mandatory “operating systems” for the global supply chain.

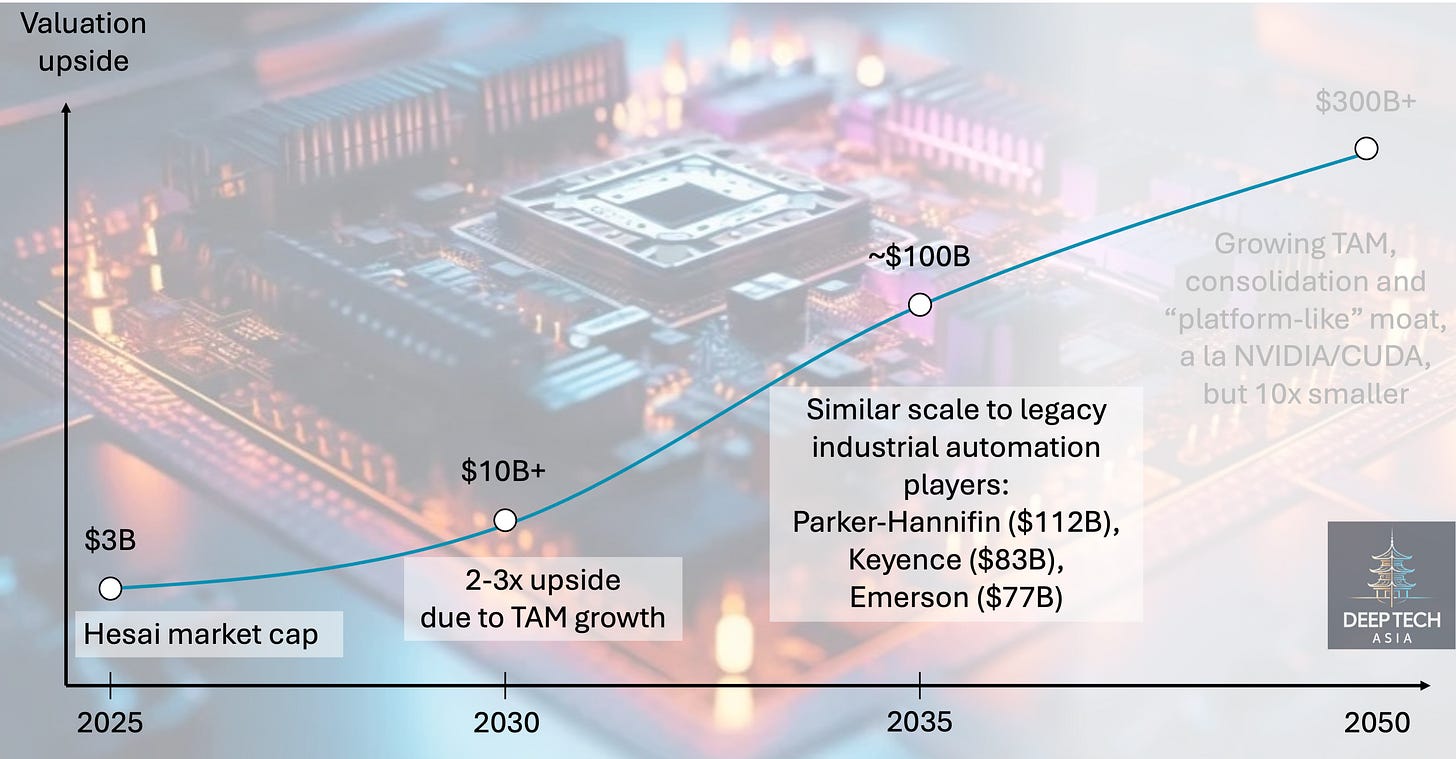

Hardware Components

This segment is foundational to robotics, but early commoditisation and weak defensibility will cap upside — unless a few players create durable moats via platform lock-in, standards, or ecosystem software.

By 2030: Premature Commoditisation ($10B+ potential)

By 2025, much of the robotics BoM (actuators, motors, drives, batteries, sensors) already has dozens of largely interchangeable Asian suppliers, so value capture is thin and few VC-scale winners emerge. LiDAR was the exception because it was technically hard, but it is rapidly commoditising as Chinese leaders (e.g., Hesai, RoboSense) out-scale Western peers, due to lower costs and massive economies of scale. These companies have already reached multi-billion dollar valuations and can still compound 2–3x, but persistent pressure from new competitors and price curves keep the moat fragile.

2030–2035: Scale-Up Phase (~$100B potential)

As robot volumes grow, component suppliers scale revenues, and the market consolidates around the best-funded players with manufacturing scale, quality/reliability data, and distribution. However, differentiation remains limited for most SKUs, so winners look more like best-in-class industrial component companies than software monopolies. The top few platforms could reach ~$100B market caps — comparable to the current manufacturers of hardware components for industrial automation, such as Parker-Hannifin ($112B), Keyence ($83B), Emerson ($77B).

After 2035: Search for a Moat ($300B+ potential)

Commoditisation remains the default; the only path to outsized $1T+ outcomes is owning a true bottleneck and wrapping it in a sticky software layer (toolchains, safety certification, reference designs, developer ecosystem) — a “NVIDIA’s CUDA-like” lock-in for robotics. The challenge is that robotics supply chains are fragmented, with no single chokepoint like datacenter GPUs, so ecosystem plays are hard and even more capital-intensive. Edge compute platforms or developer boards are the most plausible wedge and some companies are already pushing this narrative (like D-Robotics, less than $1B valuation yet), but it requires massive funding, standards adoption, and a defensible developer flywheel rather than just better hardware.

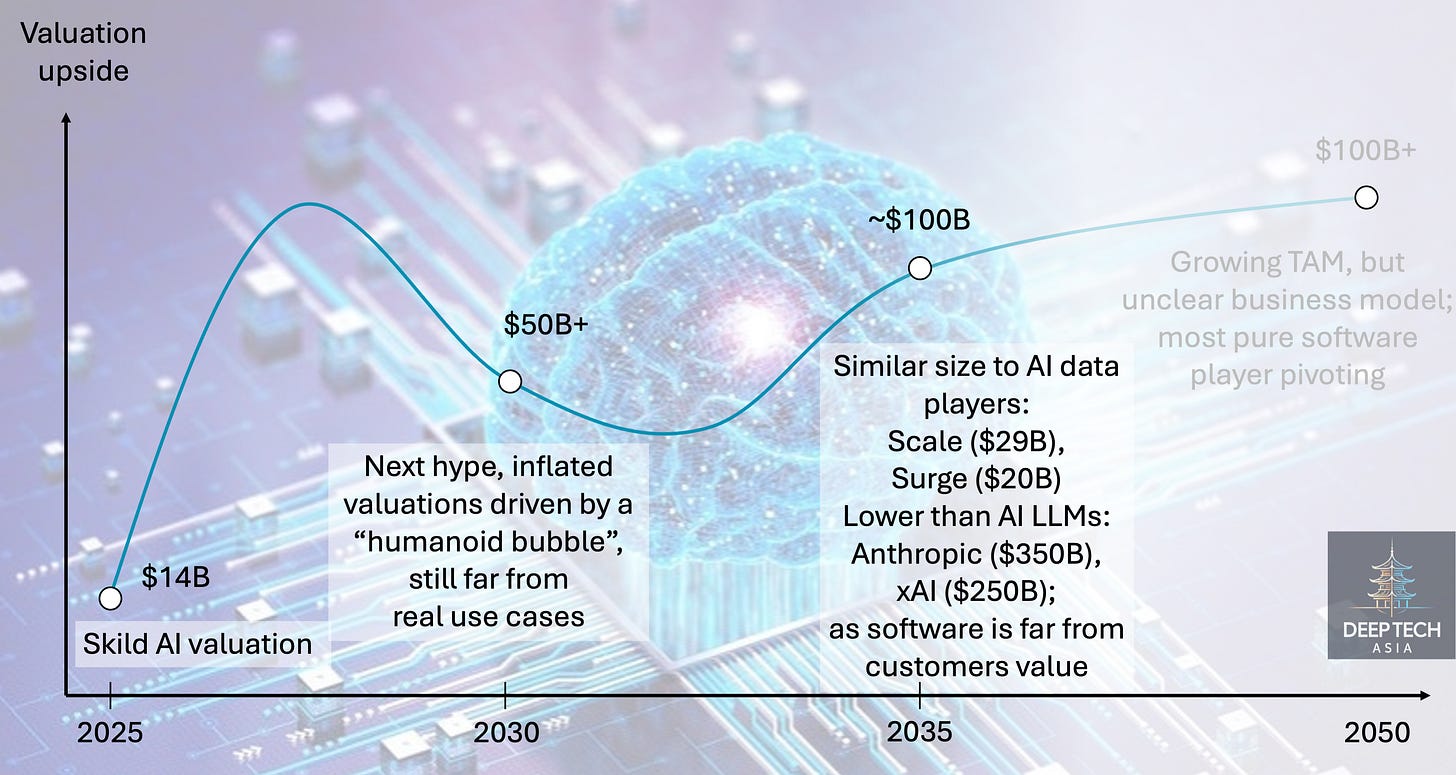

Software for Robots

The first wave of robotics software startups in the 2010s focused on SLAM and navigation, but they were mostly project-based, tightly coupled to specific robot platforms, and hard to scale across environments. As a result, most pioneers (e.g., Covariant, 6D.ai, Metaio) were acquired before reaching meaningful scale.

By 2030: The Next Hype ($50B+ potential)

In the 2020s, foundation models spawned a new cohort — Skild AI, Physical Intelligence, and Field AI — already at $1B+ valuations. Because the “robotic brain” is the key bottleneck for useful general-purpose robots, investors frame these as the next OpenAI/Anthropic for robotics. But they were founded only ~2 years ago and the trend is very recent, so near-term valuations will be driven more by demos than business metrics; upside could reach ~$50-100B, but may be unsustainable long-term.

2030–2035: Unclear Business Model (<$100B potential)

Even if someone builds the best robotic brain, monetisation is hard because it sits far from the end-user value capture — much like PC and smartphone OS platforms that were built in-house (Windows, iOS), absorbed into ecosystems (Android & Google), or open-sourced (Linux). Robotics is even tougher: many OEMs are trying to build internal AI models, and unlike LLMs trained on internet data, robotic AI needs contact-rich physical-world feedback that’s easier to collect with owned hardware. Monetisation paths could be similar to AV players — hardware + software (Mobileye, Horizon Robotics), going downstream into applications (e.g. Palladyne AI going into defense, or Waymo and Momenta going into ride-hailing), or tooling/integrations (fleet management; Red Hat & Linux analog) — but most of these break the “software-only” categorisation. A cleaner software-only wedge is dev tools for robotics, especially data management, similar to Scale.ai or Surge.ai but tailored to robotics.

After 2035: Focus on Dev Tools ($100B+ potential)

As robots mature, robotic AI models likely commoditise (similar to LLMs today), pushing pure “robotic brain” developers toward applications or full-stack solutions. At the same time, a much larger robotics industry will create durable demand for software infrastructure — data management, security, compliance, and adjacent tooling — where $100B+ valuation outcomes become plausible.

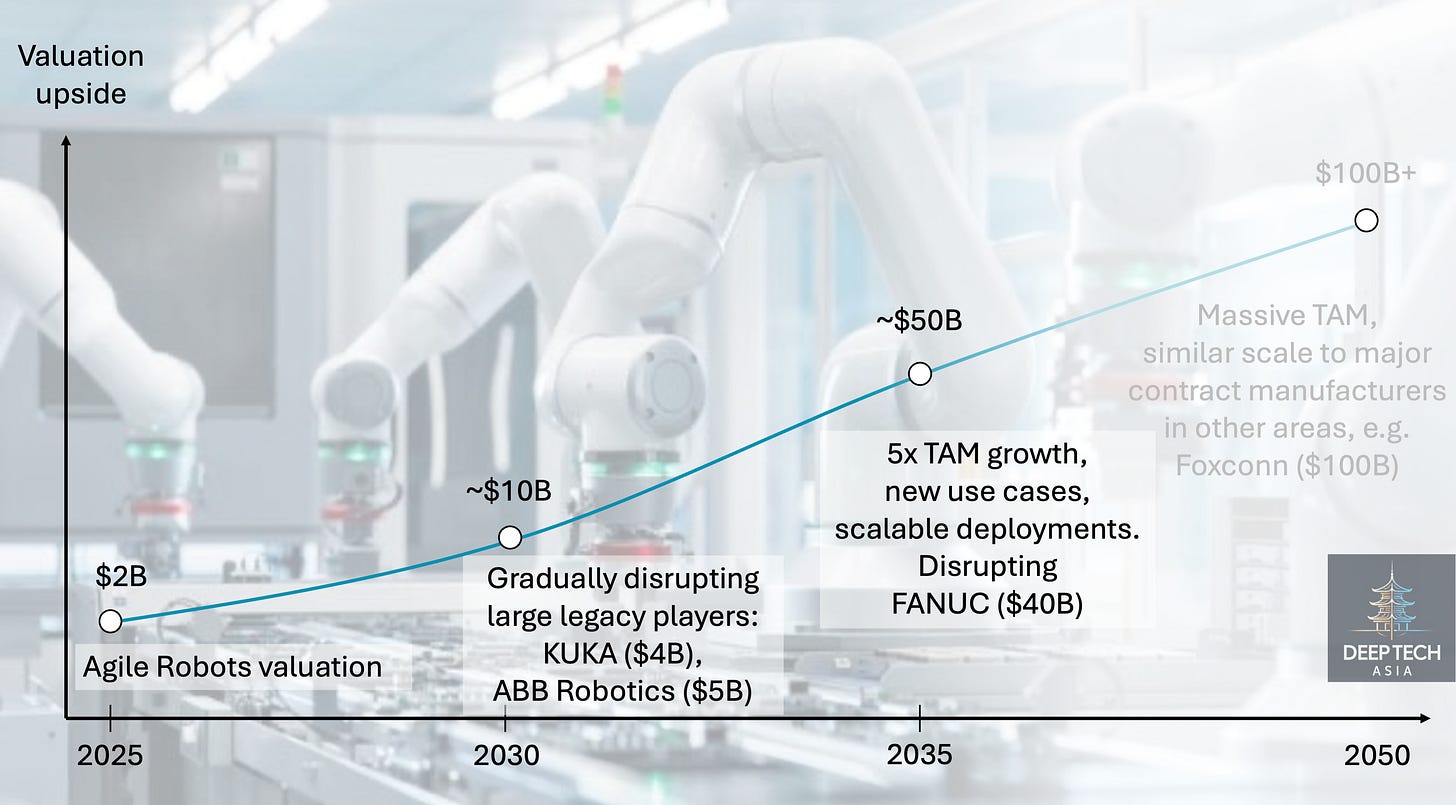

General-Purpose Robotic Arms

Robotic arms are the most basic, proven embodiment of practical robots, and they’ve been a backbone of industrial automation since the dawn of the industry, dominated by established players like FANUC, KUKA, ABB, and Yaskawa. But traditional arms are also increasingly commoditised: they require customised pre-programming and integration work, which constrains scalability across sites and use cases.

By 2030: Generalist Approach (~$10B potential)

A new wave of VC-backed unicorns like Flexiv, Agile Robots and Aubo Robotics is targeting the scalability bottleneck by pairing arms with more advanced foundation/VLA models that can follow instructions and generalise across objects, scenes, and modest task variation. Combined with tactile sensing and force control, dexterous hands, and collaborative operation, these players aim to expand the feasible task set and take share from legacy manufacturers. In parallel, software layers and no-code platforms reduce integration and programming friction, making deployments faster and more repeatable.

2030–2035: Stationary Assistants (~$50B potential)

As robot adoption accelerates, the TAM for arms expands, splitting between cheap traditional arms and more flexible “general-purpose” arms. Advanced service-robot and humanoid developers will likely keep using traditional arms (or build their own), while general-purpose arms are adopted broadly by industrial incumbents and less-automated businesses that want robotics without full mobile platforms — restaurants, warehouses, pharmacies, etc. These systems effectively become stationary assistants: cheaper than mobile service robots/humanoids, scalable across many small workflows, and defensible through a developer-friendly platform plus accumulated datasets for continuous model improvement. The margin risk is that many deployments will be owned by task-specific robot operators with their own capabilities, where the arm becomes “middleware,” compressing hardware and platform margins.

After 2035: Infrastructure Play ($100B+ potential)

General-purpose arms likely become an industry standard with a few dominant vendors — similar to ABB/KUKA/FANUC today, but with stronger software-enabled moats and better scalability. Even so, because these platforms sit relatively far from end-customer value capture — and their lock-in is unlikely to match NVIDIA/CUDA-level control — they may struggle to scale far beyond ~$100B, closer to the ceiling implied by today’s large manufacturing platforms (similar to Foxconn).

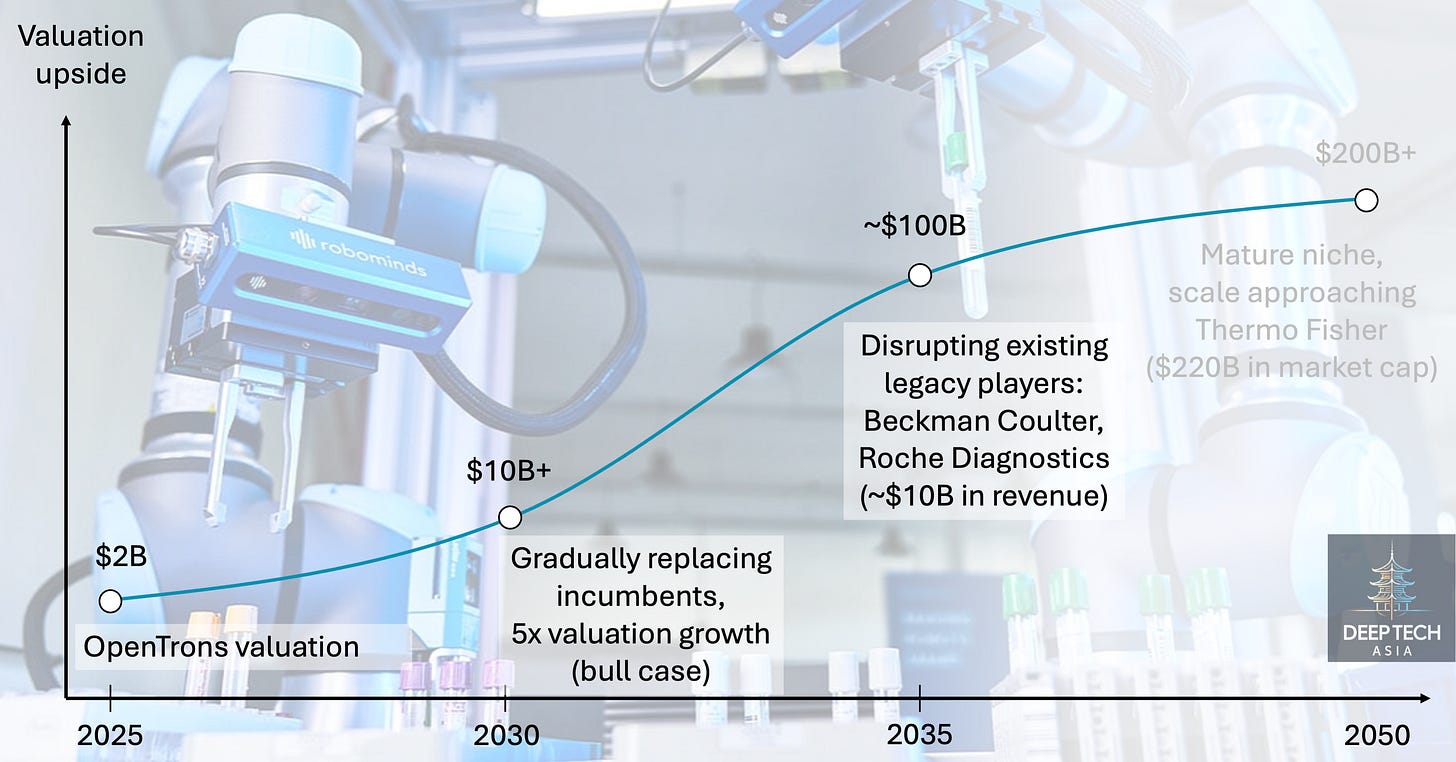

Laboratory Automation

The market seems niche, but it’s large enough with some incumbents reaching significant scale, e.g. Thermo Fisher Scientific ($220B+ market cap), Beckman Coulter (reached $5.8B in sales at some point), Roche Diagnostics ($14B+ revenue). This segment includes discovery/R&D labs (tech R&D, research institutes, big pharma) and testing / quality control labs across factories.

By 2030: New Disruptors (+$10B potential)

Demand is driven by large share of manual processes (up to 90% for some cases) and high cost of lab personnel. Scalability is decent for horizontal “AI-powered lab” stacks (e.g. Periodic Labs, OpenTrons, MegaRobo) but slowed by heterogeneous lab layouts, labware variation, and integration into existing instruments / management systems (LIMS), while task-specific systems like Equashield can scale faster within a narrow workflow.

2030–2035: Fully Autonomous Labs (~$100B potential)

The mass adoption of “fully autonomous labs” with a closed-loop from experiment design to execution, measurement and learning, challengers will be gradually replacing incumbents by accelerating entire R&D and quality control cycles, along with providing modular robotic blocks with higher scalability. However, this process will take more than a decade, because the existing systems are sticky because of the existing experimental datasets and regulated workflows.

After 2035: Mature Niche ($200B+ potential)

As autonomous lab operations become the industry standard, new disruptors could reach — and potentially surpass — incumbent scale ($200–300B market caps). Even if the overall TAM isn’t massive, the combination of high switching costs and the strategic value of owning the full R&D and quality control loop should let the leading platforms capture an outsized share of industry profit pools.

This table summarises the estimates above. I believe every segment listed here is “VC-scalable”, but the valuation upside varies meaningfully by segment and time horizon.

For early-stage investments in startups priced below $50M, even after ~90% dilution until a liquidity event, a ~20x return over the next 5–7 years and up to ~200x over 10–12 years is still a reasonable base-case scenario.

For growth-stage funds targeting a “safe” 10x in 4–5 years and assuming ~50% dilution (i.e., 2–3 new rounds before liquidity), underwriting becomes much more sensitive to entry price:

$500M entry: almost any segment can still deliver 10x.

$1B entry: 10x remains plausible for autonomous driving, aerial & marine systems, medical robots, warehouse automation, and robotics software.

$5B entry: 10x is realistically only possible in autonomous driving or aerial & marine systems.

These are best-case outcomes for the category leaders and don’t account for downside risks (execution, regulation, geopolitics). They also exclude more bullish, hype-driven scenarios with inflated valuations — which matter in practice, but are hard to predict.

Final Thoughts on China

Some time ago, I published an article on how China nurtures its global champions in areas like solar panels, wind energy and electric vehicles. In that piece, I’ve highlighted robotics as the sector which has the highest potential to give birth to the “next BYD, Bytedance and renewables giants”.

China currently concentrates the largest share of the global robotics hardware supply chain within its borders — often even within single industrial clusters like Shenzhen and the Yangtze River Delta.

As robotics and autonomy become the next major technology wave reshaping every industry, China’s role in that global transition becomes even more central — bringing both outsized opportunities and structural challenges.

Here’s how I see China’s role in global robotics playing out over the coming decades:

Chinese hardware OEMs will remain the backbone of the global supply chain — from basic components to robotic arms and increasingly sophisticated service robots and humanoids. Western suppliers will still matter in sensitive/strategic domains, but China will dominate mass-market use cases.

Industry-specific deployments will be led by local companies — integrators and robotics-powered operators, largely sourcing hardware from Chinese (and other) OEMs while building workflow, distribution, and service layers locally.

China will be strong in consumer-facing applications (robotaxis, home humanoids) with major players successfully expanding abroad. In the near-to-mid term, Europe is likely the primary overseas market as the largest mature region while the US becomes more sensitive to Chinese suppliers; longer term, gravity may shift toward emerging markets (APAC, LATAM) as they mature and as Europe becomes more self-reliant and more skeptical toward China.

West will lead in premium, regulated niches (medical robotics, laboratory automation), with Chinese players becoming more competitive but primarily focused on domestic demand plus selective emerging markets.

China will catch up in robotics AI with its open-source approach. Robotics AI models are the main bottleneck and are currently dominated by US companies, but China has an advantage in physical-world datasets that matter for training embodied systems. As with LLMs, China may produce strong competing robotics models, yet many will likely be open-sourced with limited direct monetisation and ultimately absorbed into larger platforms.

If you have any proposals, ideas, or feedback, we’d love to hear from you! Feel free to reach out at denis@deeptech.asia or on LinkedIn. Let’s connect and explore how to improve together.

Methodology:

Companies from the following segments are included in the research:

autonomous vehicles, drones and other unmanned mobility platforms;

general-purpose robots (robotic arms, robodogs, humanoids, rovers etc) and special-purpose robots (medical robots, warehouse robots etc);

developers of software or hardware used specifically for robots;

only companies with robotics as their core products are included;

if a company is engaged in several segments, it is assigned to a category of its core product;

non-VC-backed companies (like KUKA, FANUC etc) are excluded;

VC-backed divisions or spin-outs of large corporations are included (e.g. Waymo / Google, Mobileye / Intel, Yinwang / Huawei), but non-VC-backed divisions are excluded (Optimus / Tesla).

Information on the valuations of private unicorns is retrieved from press releases or VC databases, such as CBInsights, Crunchbase and ITjuzi.

Sources for TAM estimations:

Humanoids & Animal Robots. ABI Research — Humanoid Robot Market Size, 2024 to 2030

Humanoids & Animal Robots. Morgan Stanley — Humanoid Robot Market Expected to Reach $5 Trillion by 2050

Humanoids & Animal Robots. MarketsandMarkets — Humanoid Robot Market Size, Share, Industry Report Trends, 2025 To 2030

Unmanned Aerial & Marine. Spherical Insights — Top 50 Commercial Drone Market Size, Statistics Report Till 2035

Warehouse Automation. Data Bridge Market Research — Warehouse Robotics Market Size, Share, and Trends Analysis 2032

Warehouse Automation. IDTechEx — Mobile Robotics in Logistics, Warehousing and Delivery 2024–2044

Warehouse Automation. IDTechEx — Mobile Robots, Autonomous Vehicles, and Drones in Logistics, Warehousing, and Delivery 2020–2040

Warehouse Automation. LogisticsIQ — Warehouse Automation Market

Medical Robotics. Data Bridge Market Research — Medical Robots Market Size, Trends, Growth Report 2032

Medical Robotics. Fortune Business Insights — Medical Robots Market Size, Share & Forecast Report, 2034

Hardware Components. WiseGuyReports — Robot Parts Market

Service Robots. Fortune Business Insights — Service Robotics Market

Service Robots. Mordor Intelligence — Service Robotics Market

Robotic Arms. Data Bridge Market Research — Robotic Arm Market

Software for Robots. Market Research Future — Robot Software Market

Software for Robots. Mordor Intelligence — Robot Software Market

Laboratory Automation. Vision Research Reports — Laboratory Robotics Market

Laboratory Automation. Grand View Research — Lab Automation Market

It sounds like we're going to be throwing a lot of capital at trying to create AI a body. But is this something people really want or need is one of those questions.

The question is always where the value will consolidate. Nice article…would love a deep dive in software in robotics, VLAs and different approaches towards this (e.g. emergences)