How DeepSeek Made China Investible Again

Observations on how DeepSeek (and its founder) disrupted the AI landscape in China, inspired Chinese entrepreneurs to go global and "made China investible again"

The article is the second part of the deep-dive series “Was DeepSeek Such a Big Deal?” originally published in AI Supremacy newsletter in collaboration with Michael Spencer.

Check out the full version here.

In my previous article, I argued that DeepSeek’s sudden rise turned out to be less revolutionary on the global scale than the media suggested. Rather, it served as a catalyst for trends already in motion — declining LLM prices, the expansion of open source, and technical innovations such as Mixture-of-Experts (MoE) and Multi-Head Latency Attention that made its models highly efficient.

Yet, the disruption DeepSeek triggered within China’s AI ecosystem — and its pivotal role in shaping both domestic and global trajectories — proved far more significant.

Red Ocean of Chinese LLMs

China is home to over 200 companies developing their own LLMs, including major tech giants such as Alibaba, Tencent, Baidu, and Bytedance. Alongside them, a new wave of next-generation AI startups—often referred to as the “Six Tigers”—has emerged with a singular focus on advancing frontier LLMs. These include Zhipu AI, Moonshot AI, Baichuan, Stepfun, Minimax and 01.ai.

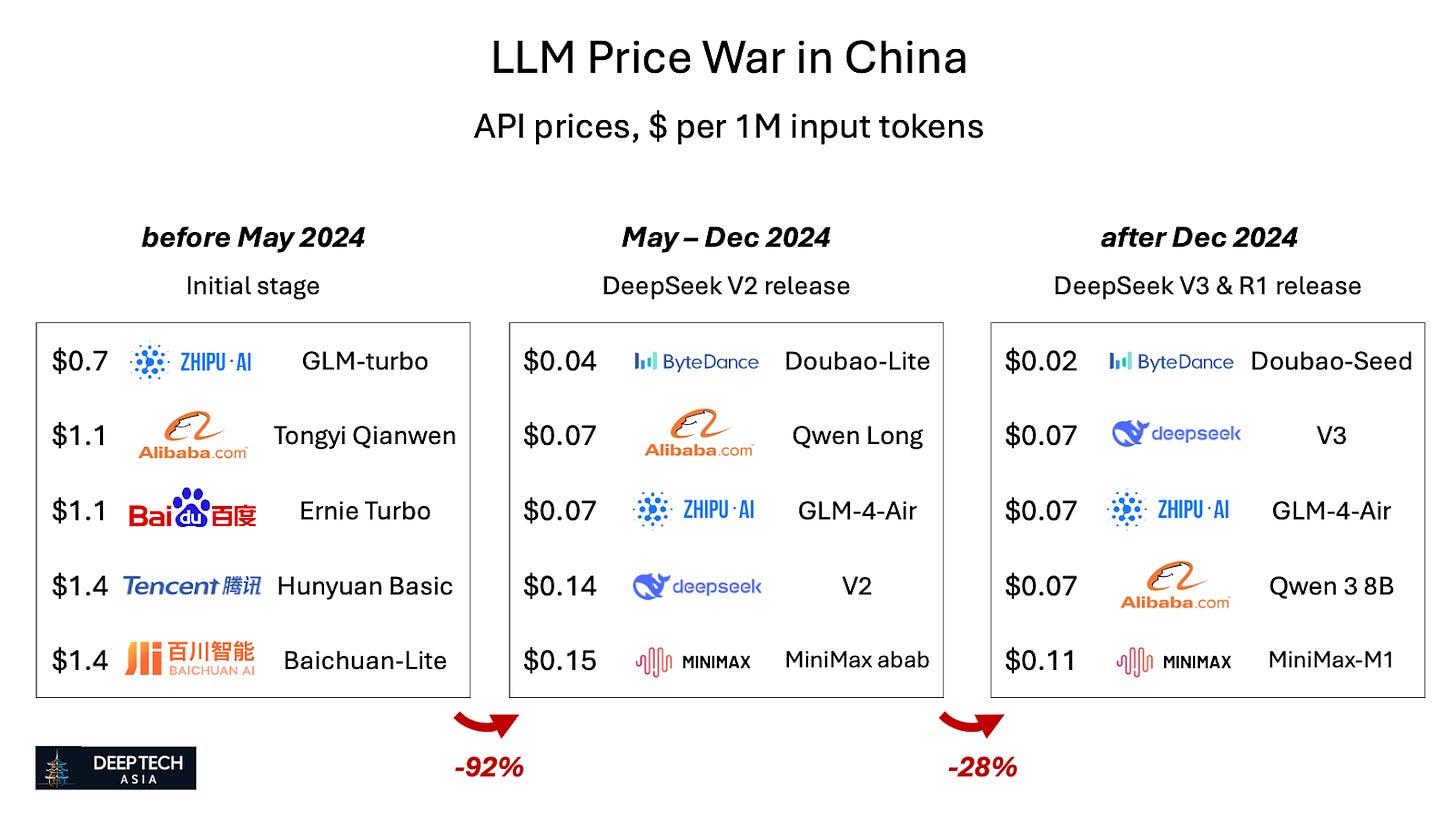

The first major shock came on May 6, 2024, with the release of DeepSeek-V2. Its API launched at just $0.14 per 1 million input tokens—a dramatic 5–10x lower than the prevailing market rates at the time.

This immediately triggered a price war. Alibaba quickly slashed the price of its Qwen model from $1.10 to $0.07 per million tokens, and just a week later, Bytedance entered the fray, launching its new model, Doubao, with an aggressively low entry price of $0.04 for the lite version.

By the time DeepSeek’s R1 and V3 models gained global attention in December 2024 and January 2025, the average price of LLMs in China had already fallen by 92% compared to May 2024. Following the R1 release, Chinese providers were forced to cut prices further—though the drop in early 2025 was less dramatic, averaging around 30%.

The response to DeepSeek’s aggressive pricing was far more intense in China than in the rest of the world — largely because, unlike OpenAI, xAI, or Anthropic, domestic AI companies viewed DeepSeek as a direct competitor. As I explored in my recent piece on China’s strategy for nurturing global champions, price wars are a familiar pattern across most Chinese industries — from solar panels and EVs to consumer electronics.

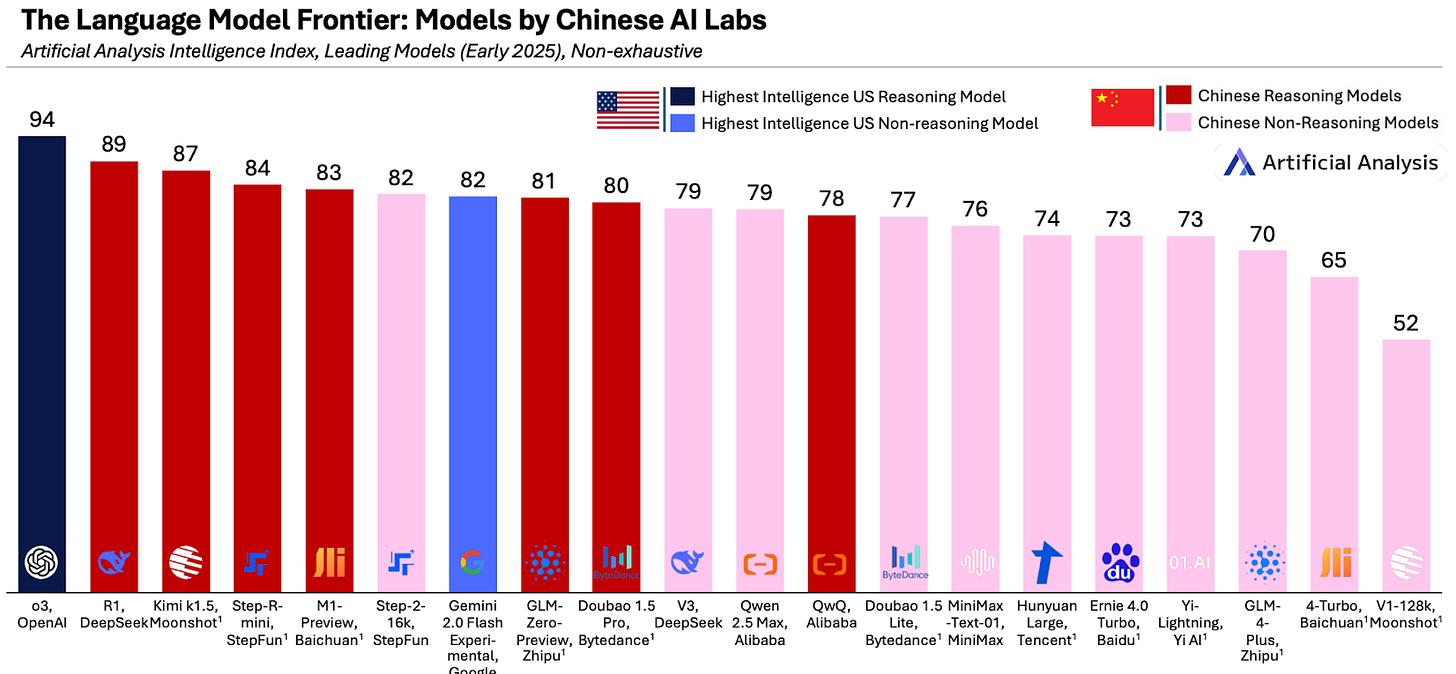

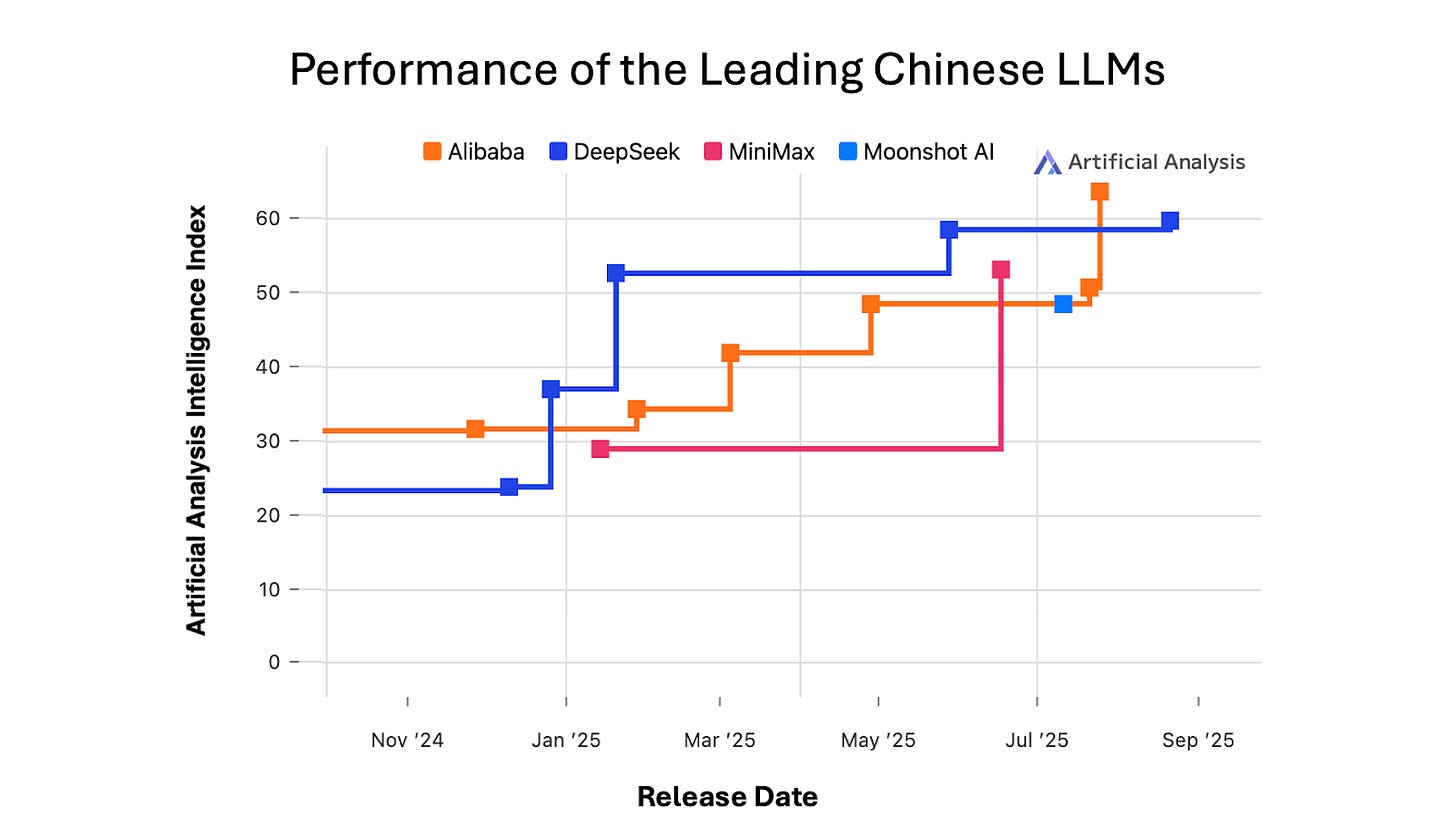

By January 2025, DeepSeek R1 had become the top-performing LLM in China, but rivals like Moonshot AI, Stepfun, and Baichuan were not far behind, creating a fiercely competitive domestic landscape.

Since January 2025, only Alibaba and Minimax have released new models that rival DeepSeek R1 in performance.

Survival of the Fittest

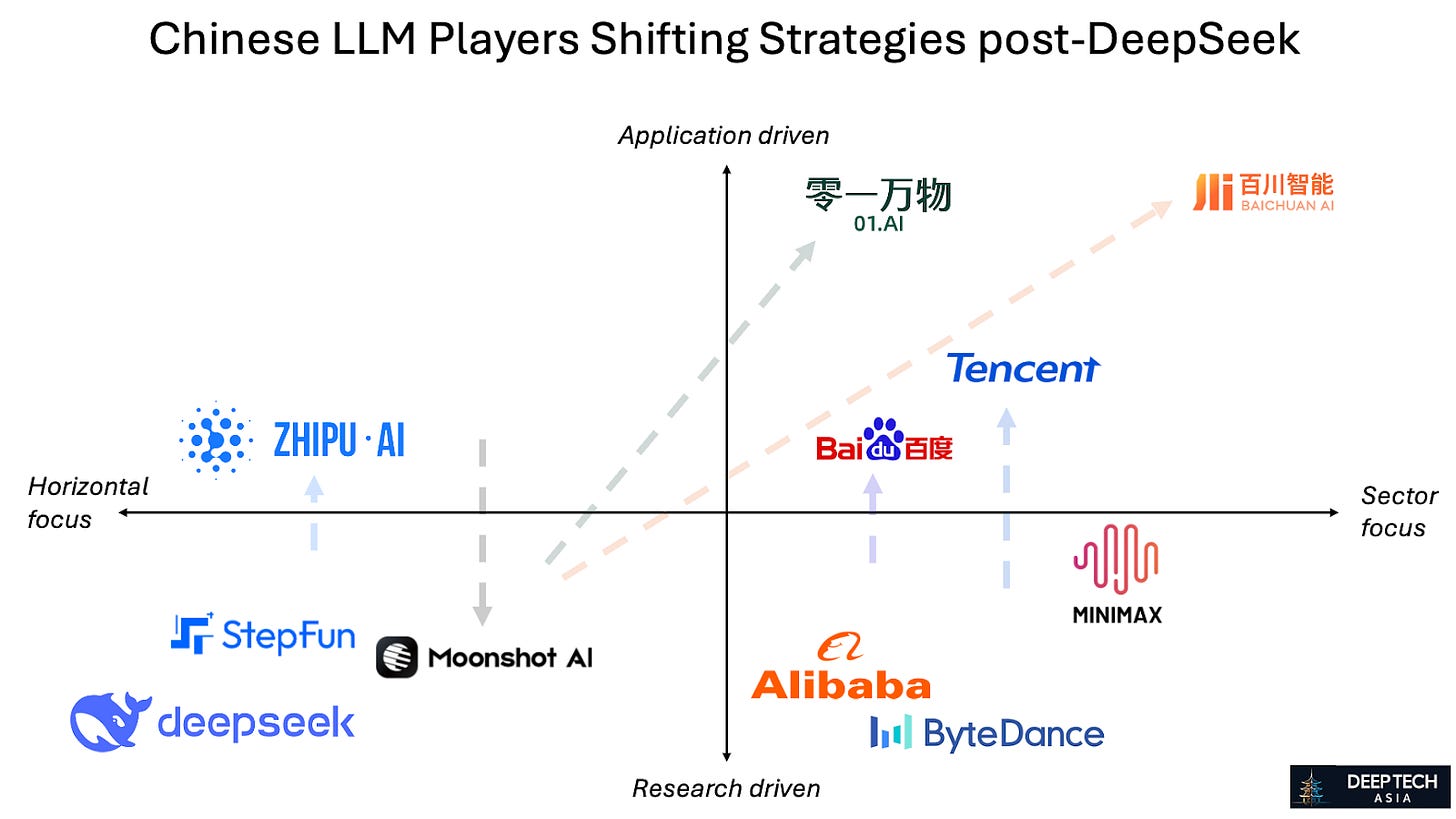

If 2024 was the year of AI price wars in China, then 2025 became the year of strategic pivots. Beyond DeepSeek, Alibaba, and Minimax, only a handful of players — such as Bytedance, StepFun, and Moonshot AI — chose to stay in the game of developing large, high-performance models, while many others began to scale back or refocus their efforts.

Zhipu AI is focusing on commercial traction through developing enterprise and consumer grade applications ahead of its upcoming IPO. Baidu and Tencent doubled down on integrations with DeepSeek and leveraging its extensive ecosystem. 01.ai started focusing on enterprise-grade solutions powered by DeepSeek, while Baichuan prioritized healthcare applications. Minimax, despite still heavily investing in its foundational model, leverages its video and image generating consumer applications.

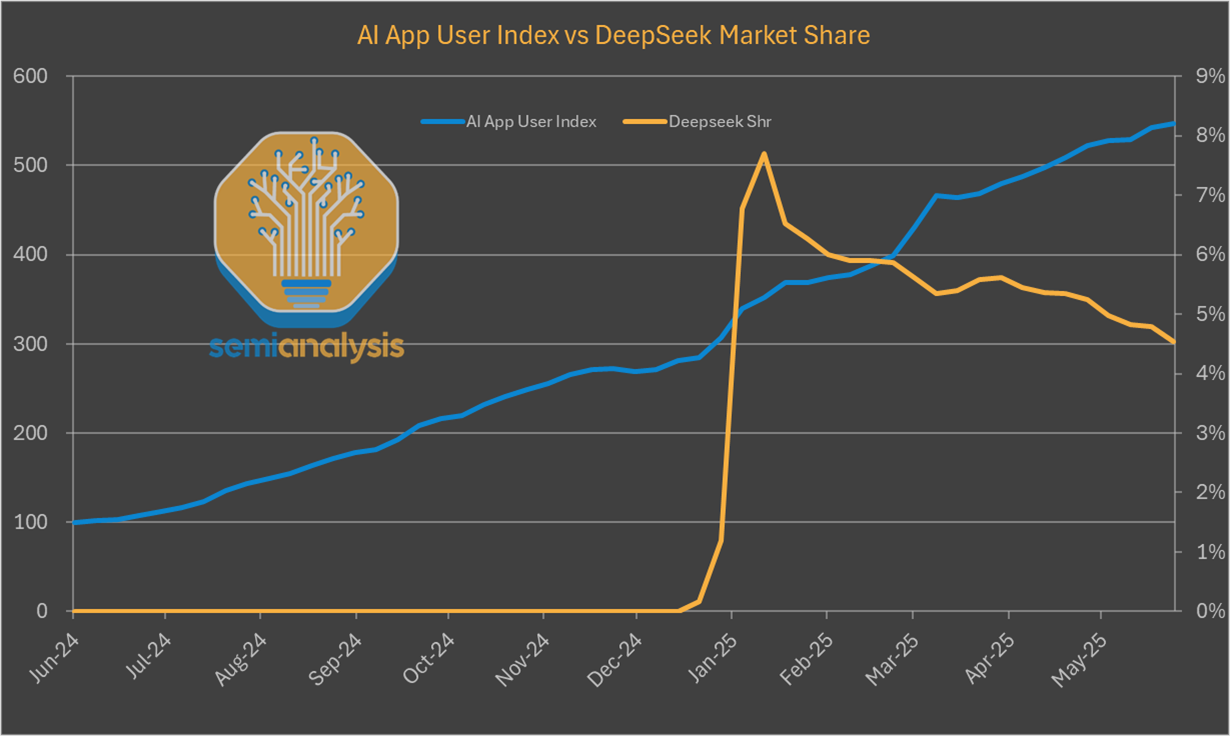

I think all these pivots make a lot of sense. DeepSeek positions itself as a research-heavy infrastructure company, rather than a B2C customer facing app. And it clearly can’t do both, considering that the resources of its parent company are not as vast as OpenAI or Bytedance. That is why despite DeepSeek’s growing B2B adoption, its consumer web traffic is decreasing after riding the hype wave.

This level of specialization among Chinese LLM players stands in stark contrast to the global landscape, where leading providers like OpenAI, Anthropic, and xAI typically pursue end-to-end strategies—building both core infrastructure and industry-specific applications.

Open Source is the New Normal

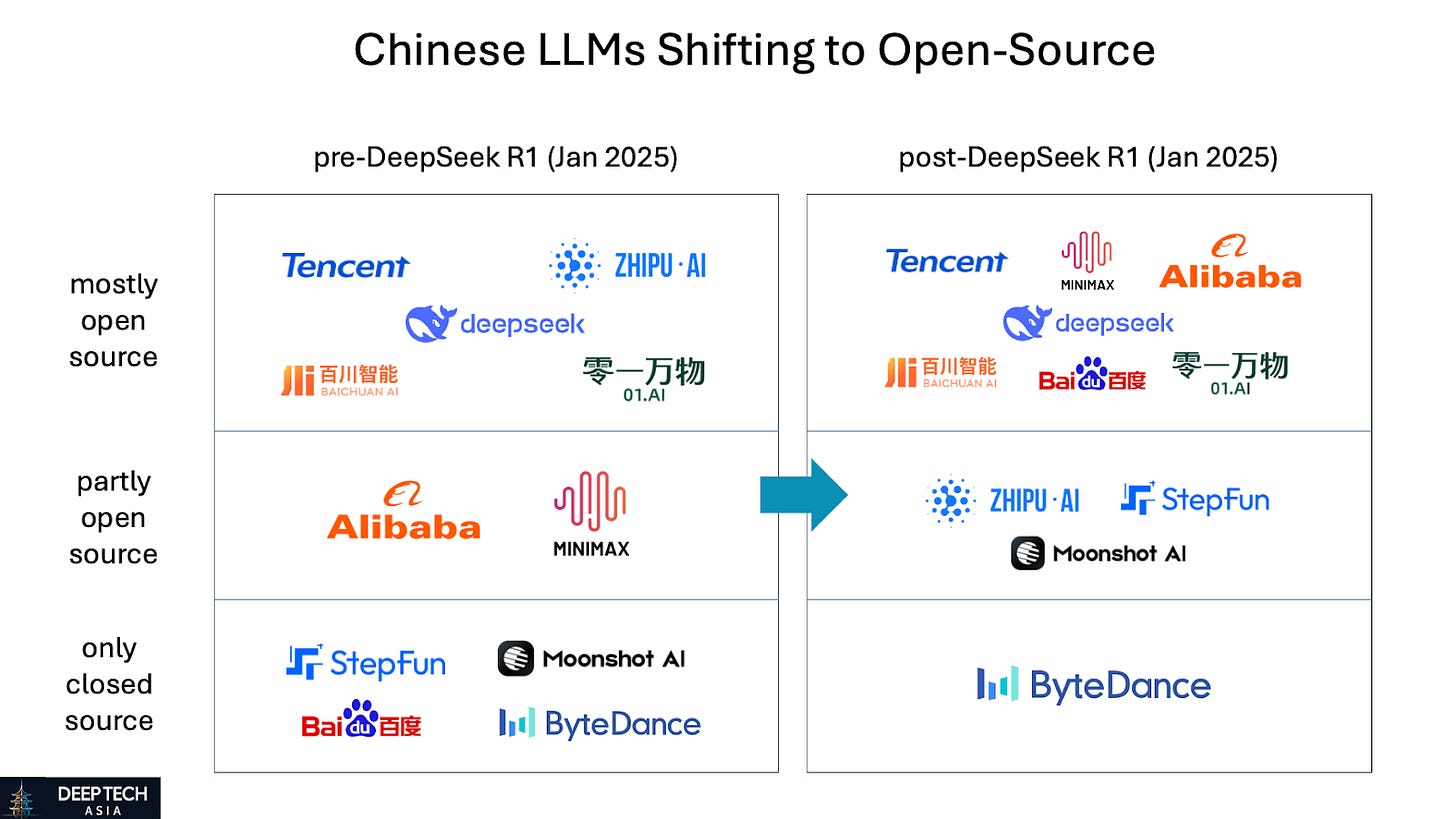

Another consequence of DeepSeek’s rise that I mentioned above is that it pushed many previously closed-source LLMs in China to adopt partially or fully open-source strategies.

On one hand, DeepSeek has set a new industry benchmark by offering basic LLM infrastructure for free. On the other, intensifying competition in China is likely to push domestic LLM providers to expand globally. To succeed internationally, many of them will need to embrace open-source strategies, as discussed earlier.

In parallel, DeepSeek appears to have improved the overall perception of Chinese AI models—even outside China. For instance, I've observed a growing number of European startups adopting Alibaba’s Qwen, signaling a shift in sentiment and trust.

What Comes After DeepSeek

DeepSeek’s impact on Chinese companies building AI applications has also been profound — both directly and indirectly.

Lower infrastructure costs

The most immediate effect has been the LLM price war triggered by DeepSeek’s ultra-low pricing. Unlike their global counterparts, Chinese developers are not limited to open-source versions; they can leverage cloud-based LLMs at a fraction of the cost—a major advantage, especially given the complexities of self-hosting under current U.S. export restrictions.

This creates a unique cost advantage for Chinese AI developers, allowing them to build and scale more efficiently. However, it may also discourage international expansion, since low-cost LLM access is largely restricted to domestic users—or more precisely, to customers comfortable with Chinese cloud infrastructure handling their data.

Better funding environment

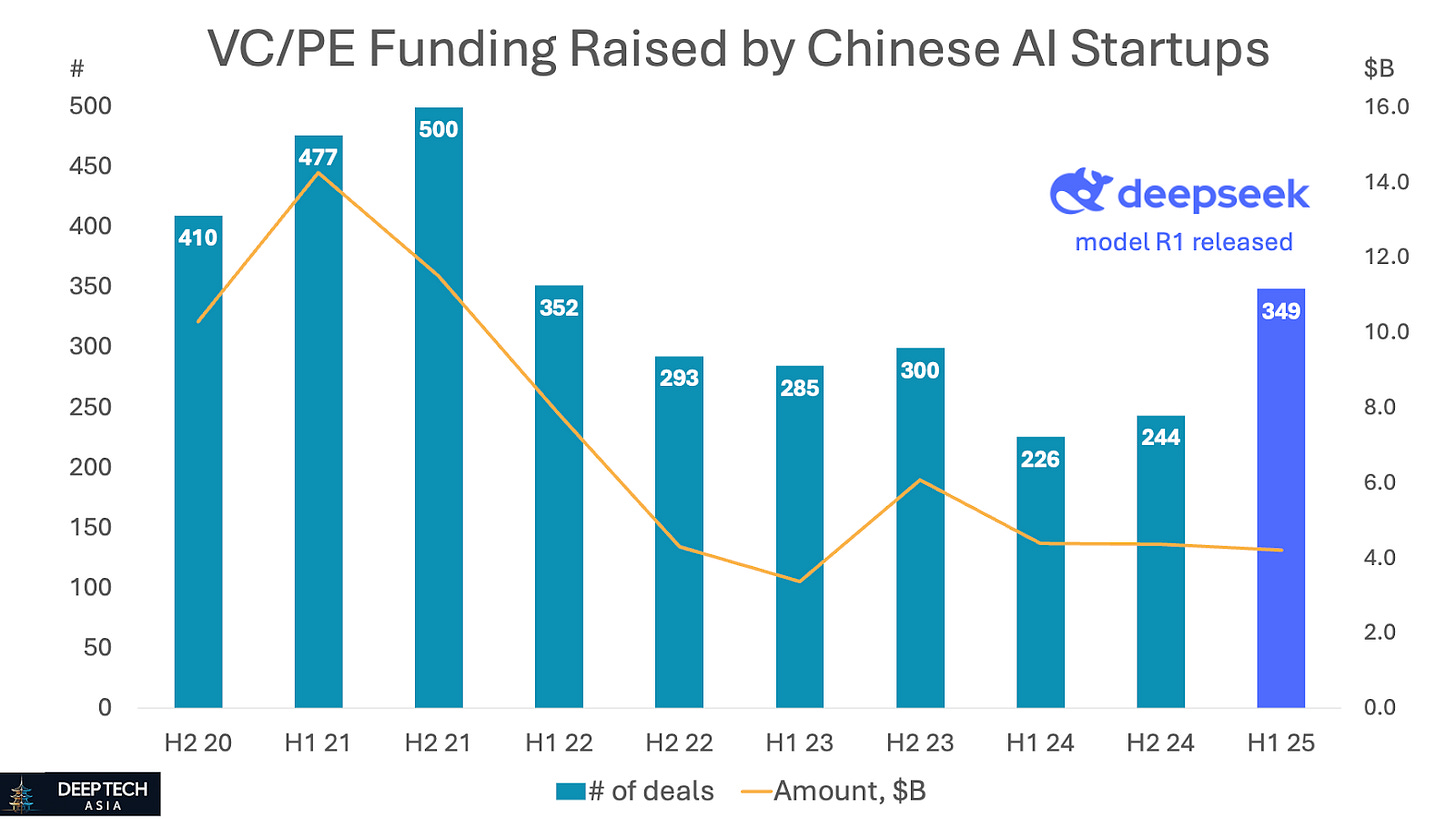

Over the past four years, Chinese AI startups have faced a tough funding environment, with venture and private equity investment in sharp decline.

AI funding in China began to show signs of recovery in 2024—likely aided by falling infrastructure costs. However, the real momentum shift came in the first half of 2025, when the number of funding rounds by Chinese AI startups rebounded to levels not seen since early 2022. While the total capital raised hasn't grown significantly, this trend suggests a reallocation toward early-stage startups rather than continued concentration in already well-funded players.

In my view, the "DeepSeek moment" in January 2025 was a key catalyst. Its international breakthrough not only shifted the global narrative on Chinese AI, but also revived investor confidence in the broader ecosystem. Given how closely investor sentiment tracks media perception, DeepSeek’s global spotlight likely encouraged both domestic and international funds—including Temasek, Prosperity7, EQT, and even Benchmark—to re-engage with Chinese AI startups.

Flexible startup culture

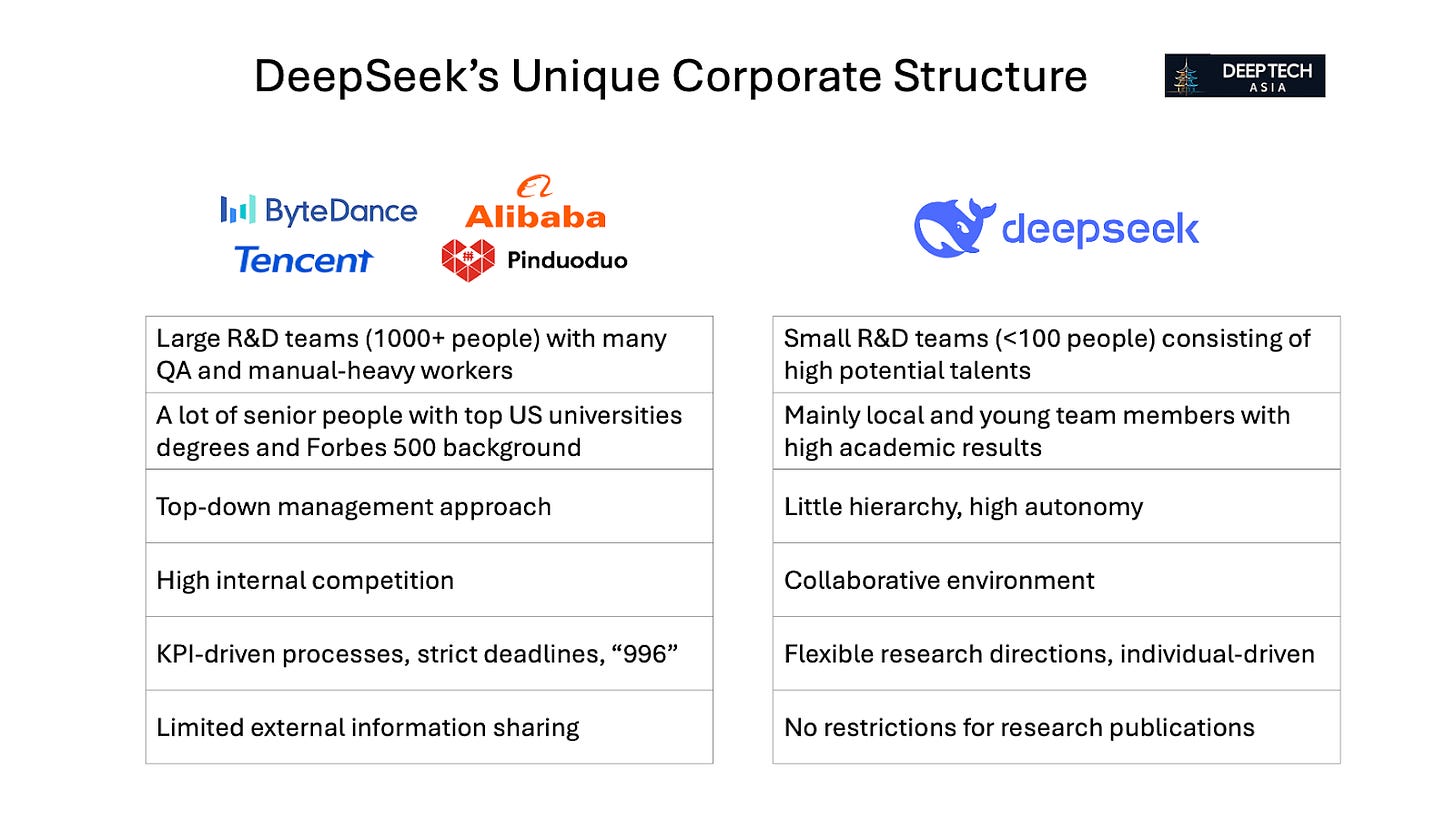

DeepSeek is truly unique in its culture that is drastically different from many other tech companies in China like Bytedance or Alibaba. This topic was covered in much detail by JS Tan (here and here) and Jon from Asianometry (here), so I’ve just summarized their points below.

The key takeaway is that DeepSeek’s founder, Liang Wenfeng, is challenging the conventional belief that Chinese companies need high-profile executives, massive teams, and grueling work culture to compete globally.

In many ways, DeepSeek operates more like a U.S. startup than a traditional Chinese one—emphasizing agility, creative problem-solving, and flexible execution over brute force and hierarchy.

Inspiration to go global

Bytedance was arguably the first “truly global” Chinese tech company, with TikTok reaching around 760 million monthly active users (MAU) in China and 1.8 billion MAU internationally. However, Bytedance was founded in 2012, and its global expansion only began in 2017 with the acquisition of Musical.ly. Its first product, the news app Toutiao, was entirely China-focused.

In contrast, DeepSeek has demonstrated that a Chinese company can be global from day one—not just in market reach, but also in technical competitiveness. It has contributed to a more positive global image of China’s tech ecosystem.

DeepSeek’s success with international users—amplified by strong global media coverage—encouraged other leading players like Manus and Minimax to target global markets early. While DeepSeek wasn’t directly responsible for their success, it undoubtedly helped legitimize their global ambitions and accelerated their credibility abroad.

In contrast to the US or Europe, most AI application startups in China that raised money in the first half of 2025 were hardware-related, developing either robots (Flexiv, Noematrix), drones (i-Kingtec, SkySys), autonomous vehicles (Zelos, Boonray, Yihang) or industrial solutions (Ensonic).

A wave of early-stage AI agent startups has emerged in China following DeepSeek’s breakthrough—many of them raising their first institutional rounds in 2025 and targeting global markets from day one. Companies like Shulex, WaveSpeed, and LynxAI are among this new cohort. I’m sure almost nobody outside of China has ever heard about them yet. Some of these companies might fail quickly, but the others may become the “next Manus”.

DeepSeek’s success has redefined the global ambition of Chinese startups, proving that it’s possible to compete internationally without raising billions or relying on government backing. In interviews, Liang Wenfeng has hinted that this very aspiration—to build a lean, globally relevant AI company from China—was one of his core motivations for starting DeepSeek.

Challenges remain

There are still some other aspects that have prevented Chinese software companies from winning the global markets in the past and that DeepSeek is not able to solve.

Geopolitics and negative perception. Unfortunately, it is what it is. I appreciated how Rita Liao, former TechCrunch reporter, expressed her frustration with Chinese startups hiding their identity—only to note later in her Substack that, post-DeepSeek, more founders are embracing the label of “Chinese challengers.” Still, the skepticism—and in some cases, outright hostility—from Western customers is unlikely to fade without a fundamental shift in geopolitical relations. Until then, even neutral or apolitical companies like DeepSeek will continue to face accusations of “ties to the Chinese military,” regardless of how transparent or open they try to be.

B2B Sales and go-to-market. One reason Chinese consumer tech has scaled globally is that most users never interact with the companies behind the products. Few Western consumers know that Red Note, Temu, or Shein are in fact Chinese brands. In contrast, B2B sales require trust-building, founder-led conversations, and hands-on customer support—especially in the early stages. This is where cultural and political barriers become real friction points.

Final Remarks – True Meaning of DeepSeek

In my view, DeepSeek’s greatest impact lies not in technological novelty, but in its symbolic value for China’s tech ecosystem. A small team based in Hangzhou—not Silicon Valley—composed of recent graduates from Chinese universities—not Stanford or MIT—and with no prior experience at Meta, Google, or Amazon, managed to build an LLM that rivals top-tier global models while using a fraction of the resources.

DeepSeek didn’t invent the Mixture of Experts (MoE) architecture—that dates back to the 1990s. Nor was it the first to apply MoE to AI; Google Brain, DeepMind, and later Mistral led that adoption in the early 2020s. But DeepSeek did what the best companies do: they took an existing idea and made it significantly more efficient and scalable.

In that sense, the "DeepSeek phenomenon" should come as no surprise to anyone familiar with China’s industrial playbook—as I’ve described here. It mirrors the trajectory of Jinko Solar in photovoltaics, CATL in batteries, BYD in EVs, and Bytedance in recommendation algorithms.

DeepSeek and its founder Liang Wenfeng hold symbolic importance for China. After four difficult years for China’s tech sector (2021–2024), they’ve served as a powerful reminder that China remains the world’s second-largest tech ecosystem—with untapped global potential.

While DeepSeek hasn’t disrupted the global AI landscape or directly accelerated the growth of other Chinese companies, its deeper contribution lies in something harder to measure—but far more meaningful: conviction.

Conviction among Chinese entrepreneurs to build globally competitive companies—without leaving China.

Conviction among domestic investors to back homegrown talent with global ambition.

Conviction among international investors to take a fresh look at China—not as a follower, but as a creator of breakthrough technologies.

And that, arguably, is exactly what Liang Wenfeng set out to achieve.

If you have any proposals, ideas, or feedback, we’d love to hear from you! Feel free to reach out at denis@deeptech.asia or on LinkedIn. Let’s connect and explore how to improve together.

Love the deep dive. Just wondering if bytedance still belongs to the closed-source camp, since the seed team seems to release several open source LLMs already.

DeepSeek-R2 needs to show it pushes the world forward. Qwen's pace of iteration is above Google's right now.

If Trump's immigration policies means more Chinese talent head back home, it could signal a startup boom in the late 2020 is there. Economic conditions are dire, so without foreign Capital mostly from Saudi it's a big issue.