Feb 2025 Digest. Should Investors Diversify into Asia?

US stock is falling, while China and India are catching up in AI, quantum and robotics, but Asian funding is plummeting and situation with exits is challenging

Dear Readers,

With the current turmoil on the US stock market due to escalating tariff wars and rising recession fears, some investors are looking to actively diversifying their portfolios — shifting focus toward European and Asian assets.

However, Asia’s VC market struggled to gain momentum in February, showing even weaker performance than Europe and the US. Overall, tech PE/VC investments in APAC dropped by 15%, with China down 17% and India experiencing a 23% decline.

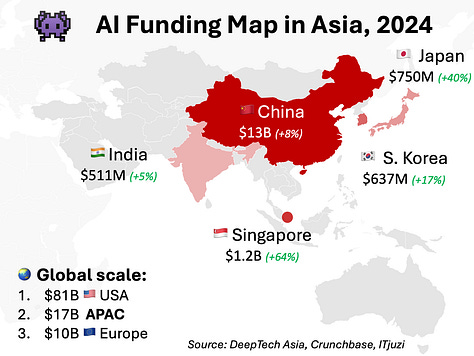

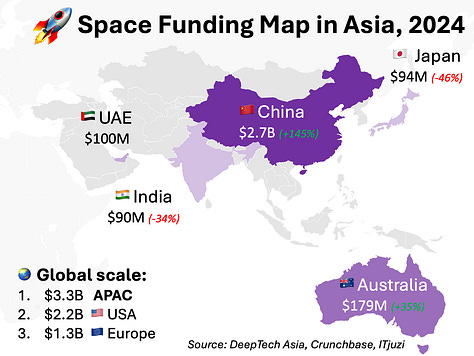

Despite the broader slowdown, AI and space tech stood out as growth sectors across the region. AI startups in India (Krutrim), Australia (Harrison.ai), and China (LillibAI) raised large funding rounds. Meanwhile, space tech saw major deals in Japan (Ark Edge Space) and China (RSpace), alongside new seed-stage startups emerging in India.

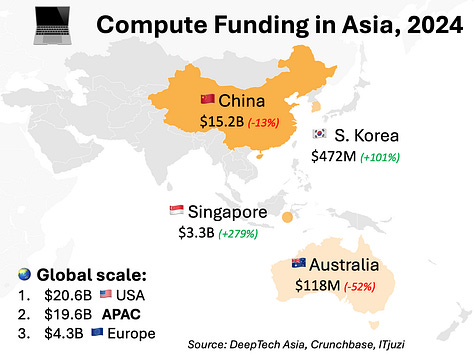

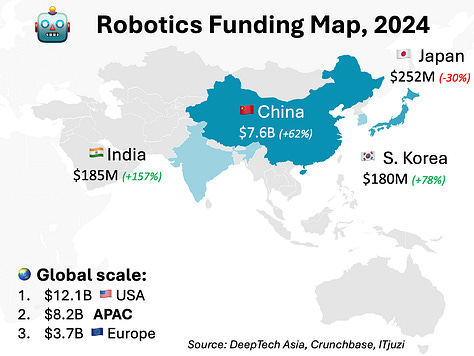

Compute and robotics continued to look promising, but China completely dominated—capturing ~99% of all APAC investments in February. Alongside traditional semiconductor PE rounds, next-gen quantum computing took off, with startups like CAS ColdAtom (neutral atom quantum computing) and Chinaprosp Quantum (diamond-based quantum sensors) securing major funding.

Another big trend: humanoid robots. Alibaba, Baidu, IDG, and CICC are backing the next wave of robotics leaders, betting on startups like Neolix and Galaxea to shape the future of automation.

Despite all this innovation, exits remain the biggest bottleneck for Asian VCs, especially in China. In February, China had just one small deep tech IPO and zero M&A deals. Among APAC markets, India is currently the most liquid, with four deep tech exits, but still trails far behind the US (31 exits) and Europe (15 exits).

In my next piece, I’ll take a closer look at the exit challenge, exploring what’s holding back liquidity in Asian deep tech and where the ecosystem goes from here. Stay tuned!

📃 Must Reads

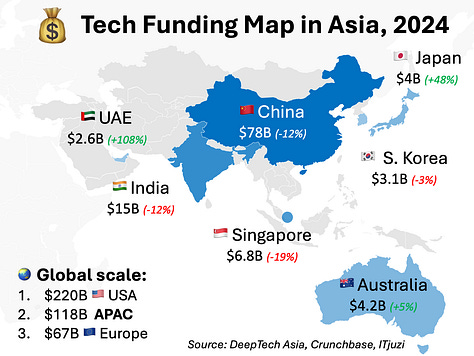

💰 🌏 Deep Tech Funding Map in Asia (by DeepTech Asia)

If you're looking for a high-level overview of deep tech developments across Asia, our latest Deep Tech Funding Map is the perfect starting point!

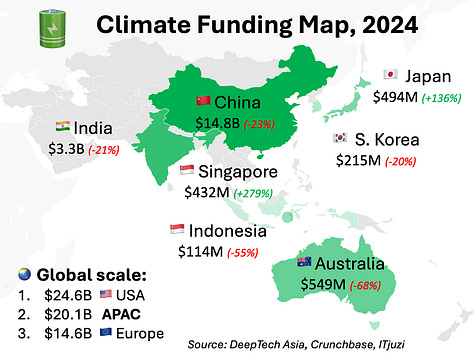

We’ve analyzed total PE/VC funding across APAC, breaking it down by major deep tech segments—including AI, compute, robotics, climate, and space. China is certainly the biggest ecosystem in all these segments. However, while China remains challenging for some investors due to geopolitical reasons, identifying the second and the third largest players in each category becomes crucial, but also less obvious.

See the full version here.

🇨🇳 👾 Manus: China’s Latest AI Sensation (by ChinaTalk)

Absolutely recommend the excellent piece by ChinaTalk’s Lily Ottinger and Jordan Schneider about another Chinese AI phenomenon — general AI agent Manus. It is capable of autonomously performing complex tasks such as rebooking flights and managing data. Since 2023, Monica, the company behind Manus, has evolved from an AI-powered browser plugin into a comprehensive AI agent, securing investments from prominent funds like Tencent and Sequoia Capital China. Monica rejected a $30 million acquisition offer from ByteDance in early 2024, opting instead to raise additional funding, elevating its valuation to nearly $100 million.

More details here.

🤑 Deals (Feb 2025)

🇨🇳 ⚠️ China’s Investment Slowdown Continues. In February, China experienced a weak VC/PE funding environment, with total investments reaching $3.8B — lagging behind both Europe ($4.7B) and the US ($11.7B). Across the broader APAC region, tech companies raised $6.2B, marking a 15% decline compared to January.

🏯 📉 Investment Dip Across Asia. Beyond China, all major APAC markets saw a decline in funding compared to January. Tech investments in India fell by 23%, while Singapore experienced a sharp 78% drop. The most significant pullback was in climate tech and compute sectors, reflecting shifting investor priorities and a more cautious funding environment.

India is catching up with China in the AI race, Indian billionaire is putting more money into India’s Open AI contender, Australian AI healthcare startup raises a massive Series C round

🌏 Global scale of VC funding (Feb 2025):

🇺🇸 USA — $3.4B, with $305M from Together AI and $300M from Harvey

APAC — $1.3B, inc. 🇨🇳 China ($816M), 🇮🇳 India ($304M) and 🇦🇺 Australia ($131M)

🇪🇺 Europe — $737M, with $100M from DreamSecurity and $75M from Luminance

Highlights:

🇮🇳 $230M round from Bhavish Aggarwal: Krutrim, leading AI-focused cloud provider in India, developing their own open source AI models. The startup is founded by Aggarwal himself and is positioned as the first AI unicorn in India. The round was financed through Aggarwal’s family office

🇦🇺 $112M Series C from Aware Super and Horizons Ventures: Harrison.ai, a clinician-led healthcare AI company using deep learning for IVF patients.

🇨🇳 $42M Series A+ from Shunwei Capital: LiblibAI, an AI-powered productivity tool and content creation and sharing platform for the content creative industry.

🇮🇳 $16M Series A from Vertex SEA & India: Spyne, a startup helping businesses and marketplaces create and upgrade high-quality product images and videos at scale.

🇨🇳 $14M Series B+ from Baidu: Infimind (极睿科技), an AI content generation engine for e-commerce with massive fashion data and computer vision algorithms

US-based AI developer cloud provider raises a large round, late stage compute rounds in Europe, quantum startup boom in China

🌏 Global scale of VC funding (Feb 2025):

🇺🇸 USA — $973M, with $480M from Lambda Labs

APAC — $445M, inc. 🇨🇳 China ($444M)

🇪🇺 Europe — $431M, with $170M from Quantum Machines, $165M from Eclairion

Highlights:

🇨🇳 Strategic round from Wuhan Quantum fund: CAS ColdAtom (中科酷原), a quantum spin-off from China Academy of Science developing cold atoms-based 100-qubit quantum computers and quantum precision measurement and control tools.

🇨🇳 Strategic round from HKIC: StarFive (赛昉科技), developing CPU IP, NoC IP, SoC, and development boards based on RISC V instruction sets.

🇨🇳 Series A: Chinaprosp Quantum (国盛量子), a developer of diamond-based quantum sensors for domestic and global industrial use cases.

🇨🇳 Series A+ from Beijing Industrial Fund: QBoson (玻色量子), a startup developing 550-qubit optical quantum computing equipment.

🇰🇷 $1M round from CRIT Ventures: FuriosaAI, a startup designing and developing data center accelerators for the most advanced AI models and applications.

US mega rounds, Baidu and Alibaba making early-stage bets on future humanoid robot leaders in China, Lightspeed investing in a Chinese AI agent startup

🌏 Global scale of VC funding (Feb 2025):

🇺🇸 USA — $1.1B, with $600M from Saronic and $350M from Apptronik

APAC — $377M, inc. 🇨🇳 China ($375M)

🇪🇺 Europe — $61M, with $44M from Nomagic

Highlights:

🇨🇳 $140M Series C+ from CICC Capital: Neolix (新石器无人车), a startup focusing on R&D and manufacturing of unmanned cargo vehicles with the L4 autonomy level.

🇨🇳 $42M Series A from IDG, Ant, Baidu and Hillhouse: Galaxea (星海图), a company building humanoid robots and advanced robotic arms.

🇨🇳 $42M Series A+ from Alibaba: CoreNetic (源络科技), a robot developer, focusing on the R&D and application of robot embodied intelligence technology.

🇨🇳 $42M Series pre-A from Legend Capital, Lightspeed: X Square Robot (自变量机器人), a startup developing general AI agents based on LLMs for robotic applications.

🇮🇳 $2M Seed round: Anscer Robotics, a startup building autonomous cleaning robots for nuclear waste.

Climate investments in Asia keep declining while Europe is leading the charge in this space, Chinese nuclear fusion project secures massive funding from CNNC

🌏 Global scale of VC funding (Feb 2025):

🇺🇸 USA — $878M, with $270M from TransGrid Energy

🇪🇺 Europe — $873M, with $615M from Enilive

APAC — $470M, inc. 🇨🇳 China ($418M), 🇮🇳 India ($17M), 🇯🇵 Japan ($15M)

Highlights:

🇨🇳 $245M round from CNNC and Zheneng Electric: Fusion Energy (中国聚变能源), a controlled nuclear fusion technology company under CNNC dedicated to pooling resources to accelerate nuclear fusion R&D in China.

🇨🇳 $3M Series A from CAS Star: Yili Technology (宜锂科技), a developer of solid state battery cathode material for power batteries, consumer, and drone batteries.

🇯🇵 $12M Series B from Keio Innovation Initiative: Aeterlink, a manufacturing company that develops wireless power transfer technology for wireless devices.

🇮🇳 $5M Series A from Unicorn India Ventures: Probus Smart Things, a company providing an IoT solution for electricity distribution utilities.

🇸🇬 $2M Seed: HYDGEN, a clean tech startup empowering empowers industries to produce their own green hydrogen on-site.

Japanese microsatellite manufacturer secured Series B, more seed startups from India, Chinese space manufacturing startup raising a massive Series A

🌏 Global scale of VC funding (Feb 2025):

🇺🇸 USA — $195M, with $100M from K2 Space

APAC — $130M, inc. 🇨🇳 China ($76M), 🇯🇵 Japan ($52M), 🇮🇳 India ($3M)

🇪🇺 Europe — $40M, with $21M from EnduroSat

Highlights:

🇯🇵 $52M Series B from Incubate Fund: Ark Edge Space, a manufacturing firm that offers microsatellite design, development, production, and operational services.

🇨🇳 $42M Series A+: RSpace (九天行歌), producer of room temperature and low temperature propellant tanks for liquid fuel rockets.

🇨🇳 $14M Series A+: Hongqing Technology (鸿擎科技), a satellite networking solution provider for low-orbit broadband Internet communication.

🇮🇳 $1M Seed round: Sisir Radar, a space and defense technology startup specializing in advanced Synthetic Aperture Radar (SAR) systems.

🇮🇳 $1M Seed round: Astrogate Labs, a spacetech startup specializing in high-speed laser communication systems for small satellites.

Exits remain the major challenge for the Asian VC ecosystem, India is leading the way, but still far behind Europe and the US

🌏 Global scale of VC-backed exits (Feb 2024):

🇺🇸 USA — 100 exits (31 deep tech exits)

🇪🇺 Europe — 58 exits (15 deep tech exits)

APAC — 47 exits (20 deep tech: 🇨🇳 China - 14, 🇮🇳 India - 4, 🇦🇺 New Zealand - 1, 🇦🇪 UAE - 1).

Highlights:

🇮🇳 $2.2B M&A: Ayana Renewable Power, an energy generation company that focuses on the development of the renewable energy sector, was acquired by Oil and Natural Gas Corporation. Exit for EverSource, NIIF and British International Investment.

🇨🇳 IPO at a $179M market cap: Changyou Technology (常友科技) , a wind power composite materials startup. Exit for EcoFund and China VC.

🇮🇳 M&A: Clari5, an AI-powered financial crime detection and risk management platform was acquired by Perfios, an Indian B2B SaaS Fintech company. Price is not disclosed.

🇦🇪 M&A: Tazzweed, a digital procurement and outsourcing platform for sales teams was acquired by Neu Ocean Technologies, a UK-based startup. Price is not disclosed.

🇮🇳 M&A: Grinntech, a designer of lithium battery packs was acquired by Yuma Energy, a battery-as-a-service JV of a Canadian auto component maker Magna International and Indian mobility startup Yulu. Exit for angel investors.

🇦🇺 M&A: Robotics Plus, a New Zealand-based robotic apple packer was acquired by the Japanese corporation Yamaha Motor.

If you have any proposals, ideas, or feedback, we’d love to hear from you! Feel free to reach out at denis@deeptech.asia or on LinkedIn. Let’s connect and explore how to improve together.