Deep Tech Map in Asia. 2024

Comparison of VC / PE tech funding in Asia vs USA and Europe, total and by deep tech sectors (AI, compute, robotics, climate, space)

Highlights:

🇨🇳 China leads deep tech in Asia, dominating robotics (93% of APAC funding) and space tech (82%), while also pushing AI infrastructure and autonomous vehicles. In 2024, it outpaced the US in space tech funding ($2.7B vs. $2.2B).

🇸🇬 Singapore is Asia’s largest AI hub (outside China), attracting global startups (like MiniMax) and corporations (like GDS) thanks to its pro-business policies and great investment climate.

🇯🇵 Japan remains strong in robotics and some other deep tech areas but slow growth and corporate-dominated market make scaling startups tough, despite AI talent inflow.

🇦🇺 Australia is a rising space tech and climate leader, benefiting a lot from its rich natural resources, solid scientific base and strong US ties.

🇮🇳 India and 🇰🇷 South Korea are emerging. India is growing in climate tech and robotics, while South Korea’s semiconductor strength fuels AI and compute tech.

With the ongoing US-China rivalry and the shifting global supply chains, it's clear that Asia is emerging as a major hub for tech innovation. But understanding the true scale can be tricky without digging into the exact numbers.

In 2024, the US was still the heavyweight champion in venture funding, pulling in over 50% of global VC and tech PE investments. The US was the only major market that showed growth in 2024 (36% YoY), while others took a hit—Europe dropped 6%, and China and India both slid by 12%. The reasons? A business-friendly environment, a massive unified market and liquid capital markets.

Asia is no small player either, hitting $118B in VC and tech PE funding in 2024—75% bigger than Europe’s but still only about half the size of the US. China remains the region’s biggest driver, accounting for 66% of Asia’s tech funding, though its share slipped slightly from 69% in 2023.

What about deep tech?

The definition of deep tech various significantly across different sources, so we’ll not attempt to come up with a figure that would exactly define the total amount of all deep tech investments. Instead, we will focus on specific industries that we assume to be “deep tech”.

Let’s start with the area is now probably “the least deep tech” — Artificial Intelligence. Yes, it may be considered deep tech five years ago, but now almost every company is an AI company.

Nevertheless, AI is important in our context, because it dictates the trend for many other “truly deep tech” segments.

In 2024, it seemed that every deal was an AI deal. In the US, 37% of all investments were somehow “AI-related”, compared to 25% in 2023. However, in other markets it wasn’t really the case. In Europe and APAC it was only ~15%, 17% in China, 18% in Singapore and only 3% in India. US is clearly dictating the talk of the town!

🇨🇳 China is clearly the largest source of AI funding in Asia with 76% of all Asian AI investments in 2024 coming from there. This included:

Zhipu AI — the Chinese AI champion Zhipu AI that raised $1.3B in three rounds (Series C, Series D and a strategic round) in one year,

Moonshot AI with its Kimi AI assistant that raised $1.2B in Series A and B, also in one year,

IM Motors (智己汽车), the JV between SAIC Motors, Alibaba and Zhangjiang Hi-Tech manufacturing AI-powered EVs that raised a massive $1.1B Series B round.

🇸🇬 🇯🇵 🇰🇷 Singapore, Japan and South Korea also saw some prominent AI rounds:

MiniMax — Singaporean developer of AI video generation app Hailuo that raised $600M Series B from Alibaba and Hongshan (ex-Sequoia China),

Sakana AI — Japanese LLM champion that in one year raised $244M in seed and Series A funding from Lux, Khosla and NEA,

DeepX — Korean AI chip and SDK developer which closed a $163M Series C round from local PE and VC funds.

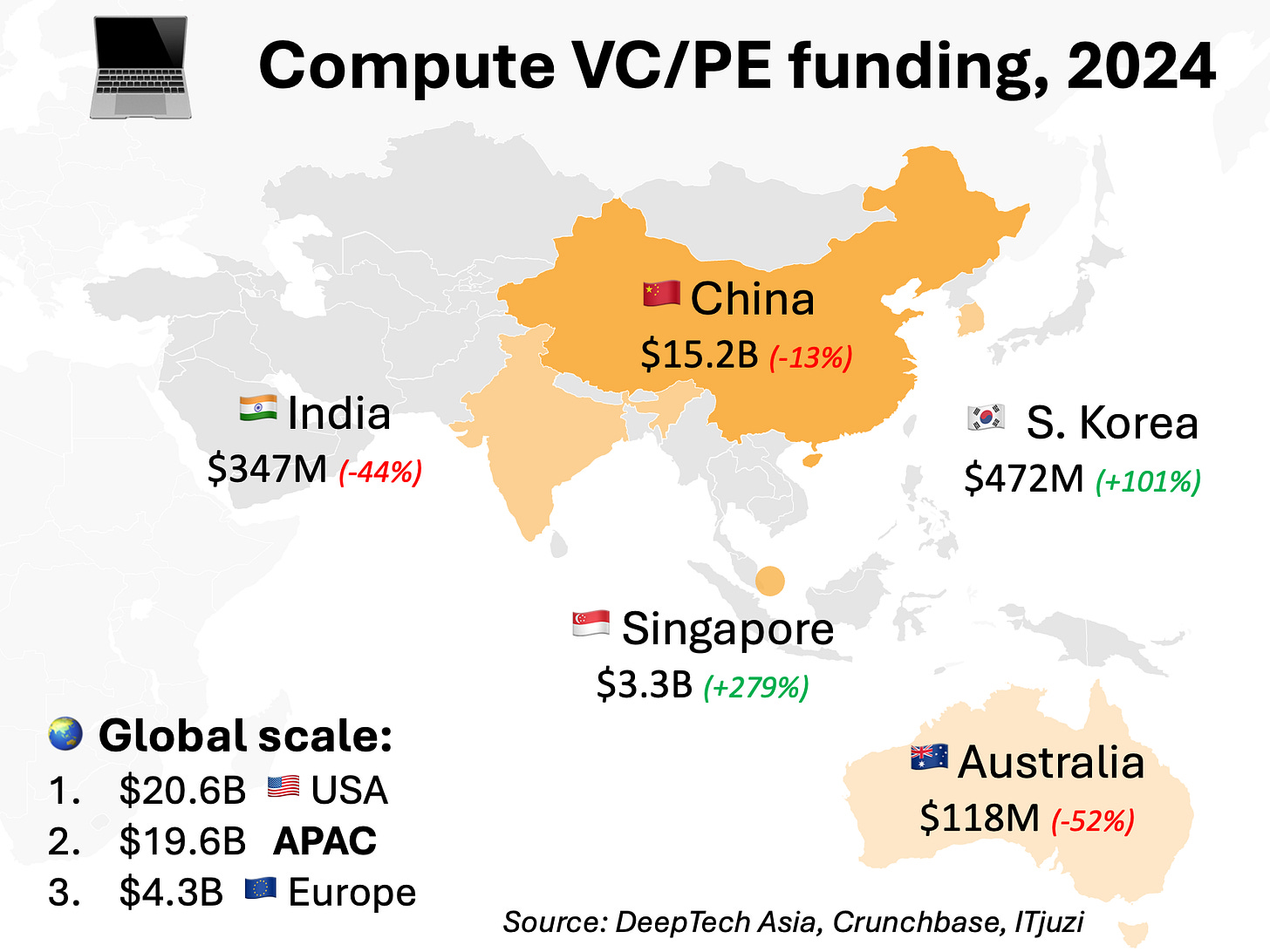

AI is fueling an explosion in demand for new computing technologies, cranking up the tech rivalry between the US and China. The US is way ahead, pouring nearly $21B into semiconductors and next-gen compute tech (quantum, photonics), keeping its edge in the race for AI dominance.

🇨🇳 China is up against tough sanctions and restrictions, cutting off access to top-tier tech from TSMC, ASML, and other global leaders. In response, it's going all-in on building its own semiconductor industry. In 2024, China pumped over $15B into new compute startups—a whopping 78% of all Asian investments in this space. But here’s the catch: most of these deals are tech PE rounds, not traditional VC rounds. For example:

BEHC (北电集成) — Chinese producer of digital-analog chips, MCUs and display driver chips ($2.8B round),

ChangXin Memory (长鑫存储) — Chinese dynamic random memory (DRAM) producer ($1.5B round),

Hefei Wanxin (合肥皖芯) — Chinese producer of 56-nm and 28-nm display chips ($1.3B round).

🇸🇬 Notably, Singapore is actively positioning itself as a regional data center hub, attracting a lot of large global players:

Chinese GDS data center operator that established its international headquarters in Singapore and raised $1.6B from Coatue and Hillhouse in 2024

ST Telemedia Global Data Center, a consortium of Singtel and KKR, raised $1.75B.

🇰🇷 Also, South Korea is becoming strong in the AI accelerator area with the news rounds of DeepX ($163M) and Rebellions ($140M).

AI breakthroughs—especially in large language models (LLMs)—are kicking off a robotics boom worldwide. Humanoid robots and self-driving cars, once straight out of Westworld and sci-fi movies, are inching closer to reality. The US is leading the charge, with monster funding rounds like Waymo’s $5.6B Series C for autonomous vehicles and Figure’s $675M Series B to build humanoid robots. The future we used to dream about? It’s finally coming to life.

🇨🇳 In Asia, China is an absolute dominant force in robotics, accounting for whooping 93% of all Asian investments. The biggest investments include:

YinWang Intelligence (引望智能) — a startup under Huawei developing software systems for autonomous vehicles that raised $3.2B round from Changan’s Avatr and another Chinese automaker SOKON,

The AV subsidiary of the ride-hailing company DiDi raised a $271M Series C,

Windrose (苇渡科技) — developer of autonomous EV trucks raised $200M in its Series B+ and pre-IPO round from HSBC and GSR Ventures.

🇯🇵 Japan has also been historically strong in robotics. In 2024, its industrial automation startup Preferred Networks raised a $121M round from SBI. But generally the investments in Japanese robotics companies are declining.

🇰🇷 Another emerging leader is South Korea which has a few promising startups such as LIDAR developer Bitsensing (raised $25M Series B), medical robotics startup AIRS Medical (raised $20M Series C) and self-driving software developer RideFlux (raised $19M Series B).

In 2024, the gap in climate funding between the US and Europe widened big time—from $2B in 2023 to $10B. The surge was driven by massive PE deals in US renewables, like Avangrid Renewables ($2.5B) and Pine Gate Renewables ($938M), along with huge VC rounds for nuclear fusion startup Pacific Fusion ($900M Series A) and carbon capture company Twelve ($600M). But things could shift in 2025, especially with Trump’s second term potentially shaking up US climate policy.

In Asia, climate funding took a noticeable dip compared to 2023, with significant decreases in China (-23%), India (-21%), and Australia (-68%).

🇨🇳 Despite this downturn, China still accounts for a whopping 74% of all climate investments in the region. The biggest investments are pouring into corporate and venture rounds for up-and-coming EV makers like Avatr ($1.6B Series C) and BAIC Blue Park ($1.1B). Renewable energy players are also attracting massive funding, with China Huaneng securing $2.7B, CNNP Rich Energy raising $1.1B, and China Hydrogen Technology pulling in $910M. These numbers highlight the growing momentum in green tech and clean energy.

🇮🇳 India is the second largest energy market in Asia with $3.3B funding in 2024, however, most of it are PE rounds of renewable companies, such as SAEL ($1B), the JV of Total Energies and Adani Green Energy ($440M+) and Fourth Partner Energy ($275M). On the venture side, here are some of the biggest rounds in India:

Battery Smart — EV battery swapping platform that raised a $110M Series B,

Ather Energy — provider of electric scooters and fast EV charging ($82M),

Lohum — developer of lithium-ion batteries and recycling tech ($77M).

🇨🇳 🇺🇸 The space race is heating up, and the US and China are throwing more money than ever into private space companies. In 2023, US space tech startups pulled in $3.1B in venture funding—nearly 3x more than China. But 2024 flipped the script —for the first time, China’s private space sector outpaced the US, raising $2.7B vs. $2.2B. Many of these Chinese startups keep a low profile, but we’ve got the scoop on some of the biggest funding rounds below:

Yuanxin Satellite (垣信卫星) — Chinese competitor of Starlink operating satellite constellation on a low Earth orbit and providing communication, navigation and remote sensing services for the commercial sector raised a $938M Series A',

Space Pioneer — manufacturer of reusable rockets raised a $210M Series C+,

FOSST — operator of a communication satellite constellation raised $140M.

Despite the fact that China accounts for 82% of all space tech investments in APAC, there were other sizeable space investments in other parts of the region, first of all, Australia, UAE and Japan:

🇦🇪 Orbitworks — Abu Dhabi-based integrator of remote sensing satellites, a JV between US-based Loft Orbital and UAE-based Marlan Space, raised $100M,

🇦🇺 Fleet Space Technologies — Australian space-enabled mineral exploration startup raised a $100M Series D,

🇯🇵 Japanese Synspective providing high-resolution satellite data and remote monitoring services for government agencies raised a $44M Series C.

China is still the largest Asian ecosystem

Drawing a clear line between “deep tech” and “non-deep tech” is tricky, however, it’s safe to say that China is by far the largest player in the deep tech ecosystem in Asia. Although China is losing its share in the overall VC/PE market (from 69% in 2023 to 66% in 2024), it still dominates every deep tech vertical, especially robotics (93% of all APAC investments) and space tech (82%).

🇨🇳 China still lags behind the US in funding across many sectors, especially AI ($81B vs. $13B). But that doesn’t mean Chinese AI models can’t keep up. The recent hype around DeepSeek, a Chinese open-source LLM developer, proves they’re very much in the game. If you want a deep dive, ChinaTalk’s latest article is worth a read. That said, the funding gap does point to a key difference— LLMs in China aren’t fueling the ecosystem of AI applications as effectively as they are in the US.

That said, the Chinese government is all in on AI—pushing for breakthroughs in AGI, AI hardware, autonomous vehicles, and robotics. In these areas, China’s VC/PE funding is only 30-40% behind the US, a much smaller gap compared to the 6x difference in overall AI funding.

One area where China actually pulled ahead in 2024 was Space tech. Chinese startups raked in $2.7B vs. $2.2B in the US, signaling that China is doubling down on private space ventures to go toe-to-toe with the US in the new space race.

The second largest ones

While China is an obvious technological leader in Asia, it’s hard to pick the second strongest player.

🇸🇬 Singapore is riding the AI wave thanks to its business-friendly policies and strong investment climate. More and more regional startups are setting up shop there, and Chinese companies are increasingly using Singapore as a launchpad for global expansion. With a highly skilled workforce and a solid semiconductor industry, Singapore has cemented itself as Asia’s biggest AI and advanced computing hub outside of Mainland China in 2024.

🇯🇵 Japan was Asia’s tech powerhouse back in the 1980s, and while it’s no longer on top, its strong robotics industry has kept it in second place after China. Japan is also working hard to attract top AI talent, leading to startups like Sakana AI setting up shop in Tokyo. But despite these efforts, Japan still struggles with sluggish economic growth, and its VC scene is dominated by big corporations, making it tough for smaller startups to break through.

🇦🇺 Australia is shaping up to be a major tech hub in APAC. In 2024, it ranked as Asia’s second-largest space tech VC market, thanks to its strong scientific base and close ties with the US. On top of that, its rich natural resources make it a huge player in energy and climate investments.

🇮🇳 India has huge potential thanks to its massive population and market size, but when it comes to deep tech, it’s still playing catch-up with other developed Asian economies. That said, there are a few bright spots—India has solid momentum in energy and climate tech, and its robotics and drone industry is starting to take off, though it’s still in the early stages.

🇰🇷 South Korea deserves a shoutout for its massive semiconductor industry, home to giants like Samsung and SK Hynix. This strong foundation has made it Asia’s second-biggest market for new compute technologies, helping the country build serious momentum in AI applications and robotics.

If you have any proposals, ideas, or feedback, we’d love to hear from you! Feel free to reach out at denis@deeptech.asia or on LinkedIn. Let’s connect and explore how to improve together.