2025: Renaissance of China's Deep Tech VC

China surpasses US in deep tech exits, tech deal activity is booming: robotics, AI, semiconductors; global investors still cautious. India emerging in energy & space

2025 was a pivotal year for Asia’s VC ecosystem in Asia, particularly in China.

Across both developed markets such as Europe and emerging regions like Southeast Asia, the traditional VC model is under growing strain. Constrained exit markets and limited liquidity have made LPs increasingly reluctant to commit capital to another ten-year cycle with local early-stage VC funds. As a result, both LPs and GPs are reallocating toward more established asset classes, including mid-market buyouts, traditional private equity, and private credit.

At scale, only two ecosystems still offer the full venture playbook: the United States and China. While global investors remain deeply familiar with the US market, interest in China’s VC ecosystem has only begun to meaningfully recover over the past year.

2025 was phenomenal for China.

The year began with Chinese startup DeepSeek releasing its R1 model, which surprised the global tech community with its exceptional efficiency and performance — on par with leading US AI labs. As I noted in a previous article, while DeepSeek itself was not a VC-backed story, it created a powerful global reference point — the so-called “DeepSeek moment” — that materially strengthened confidence in China’s deep-tech capabilities among customers, investors, and the media.

That shift in perception helped propel a broader wave of Chinese AI companies, including MiniMax, Moonshot, and Manus AI, enabling them to gain international traction, raise larger funding rounds, pursue public listings, and, in some cases, attract acquisition interest from major US technology firms.

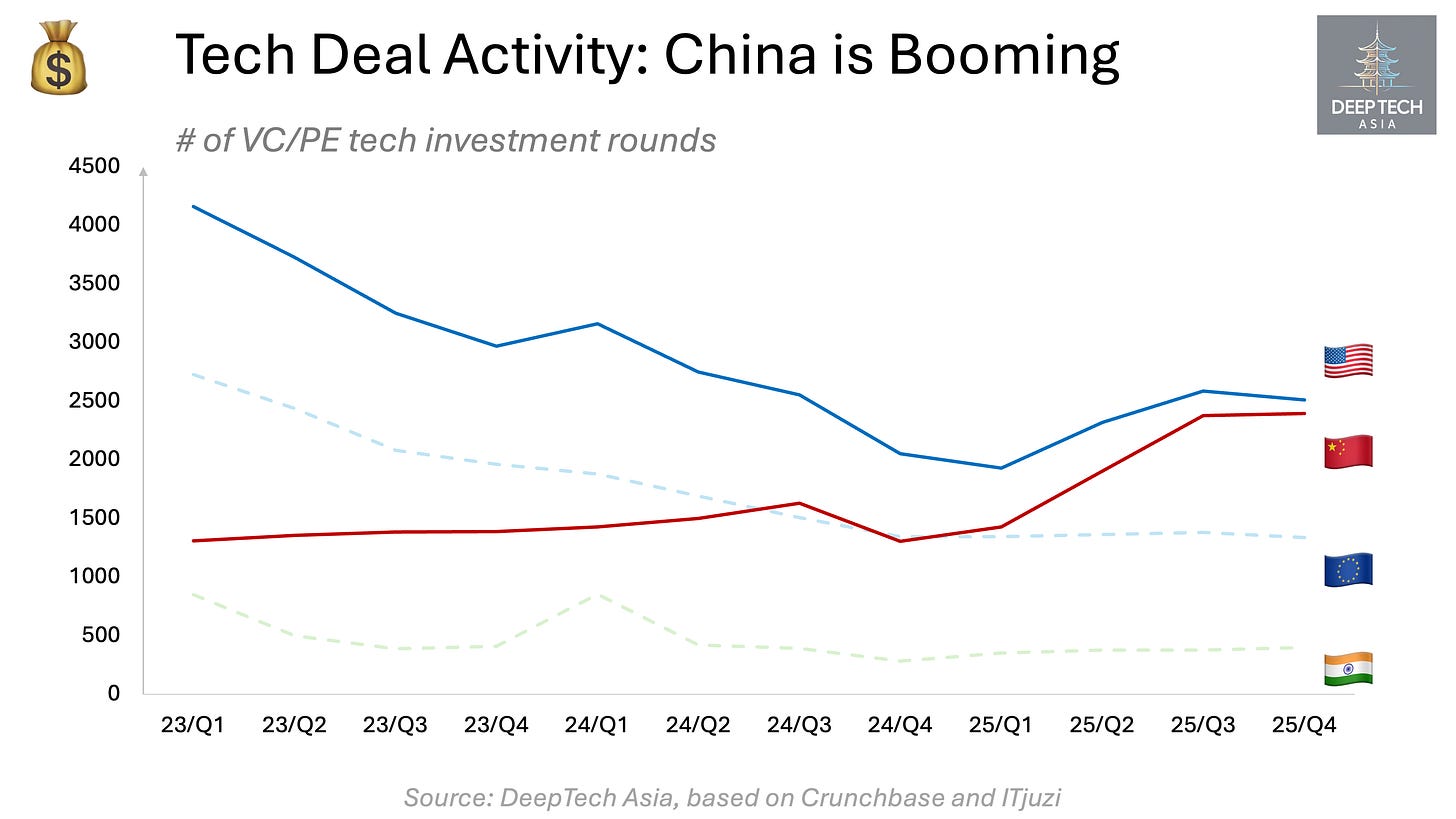

After 2022, despite COVID lockdowns and a prolonged regulatory reset in the tech sector, China’s venture activity continued to expand. By 2024, the number of investment rounds in China had reached parity with the entire European region, including the UK and Israel.

By Q4 2025, China’s tech deal volume exceeded Europe’s by roughly 80% and had nearly caught up with the US.

China also remains by far the largest VC/PE ecosystem in APAC, surpassing India — the region’s second-largest market — by approximately six times in deal count.

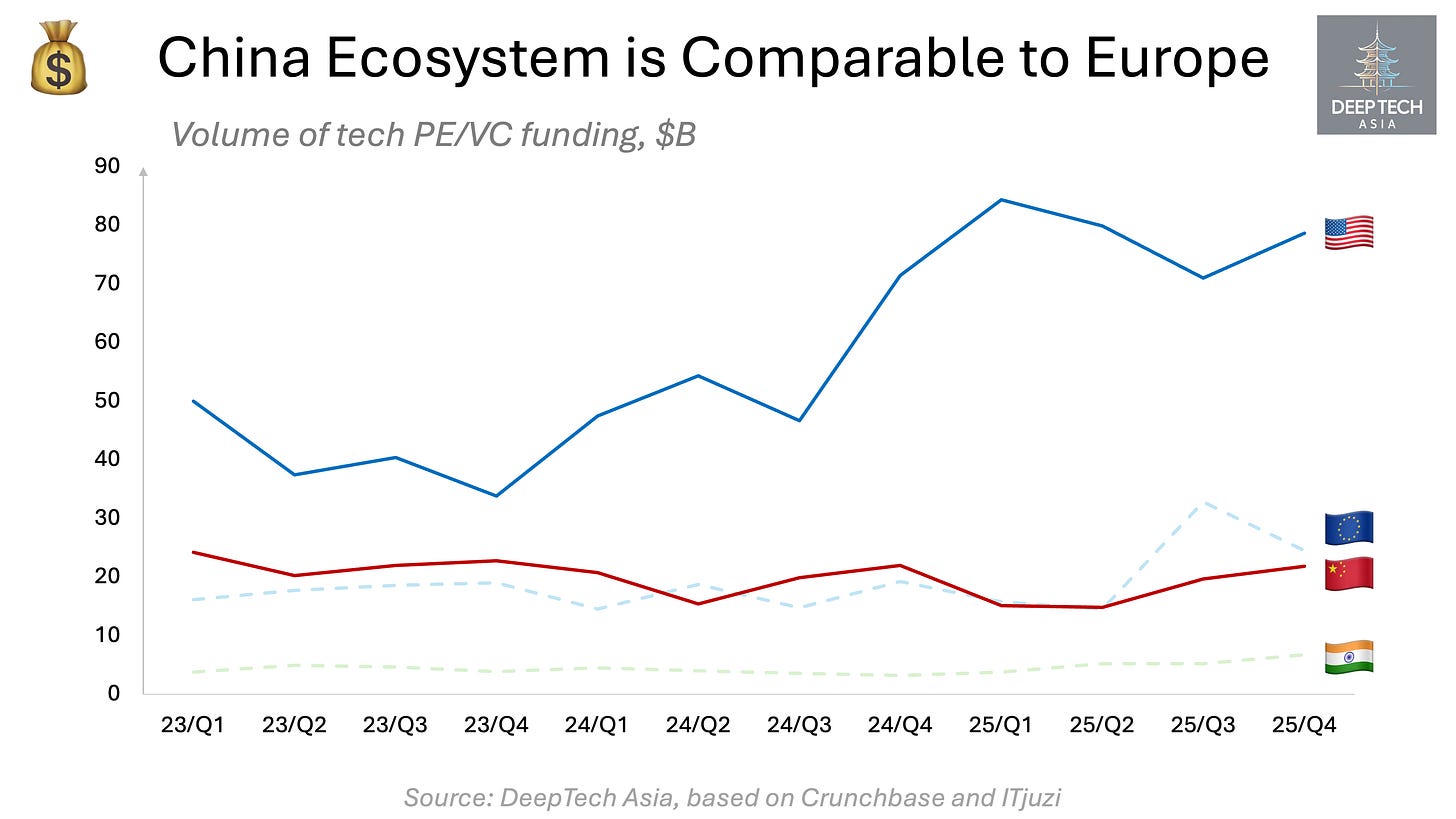

In terms of total capital raised by tech startups, China is broadly comparable to Europe but remains significantly smaller than the US, which attracts more than 3.5× the funding.

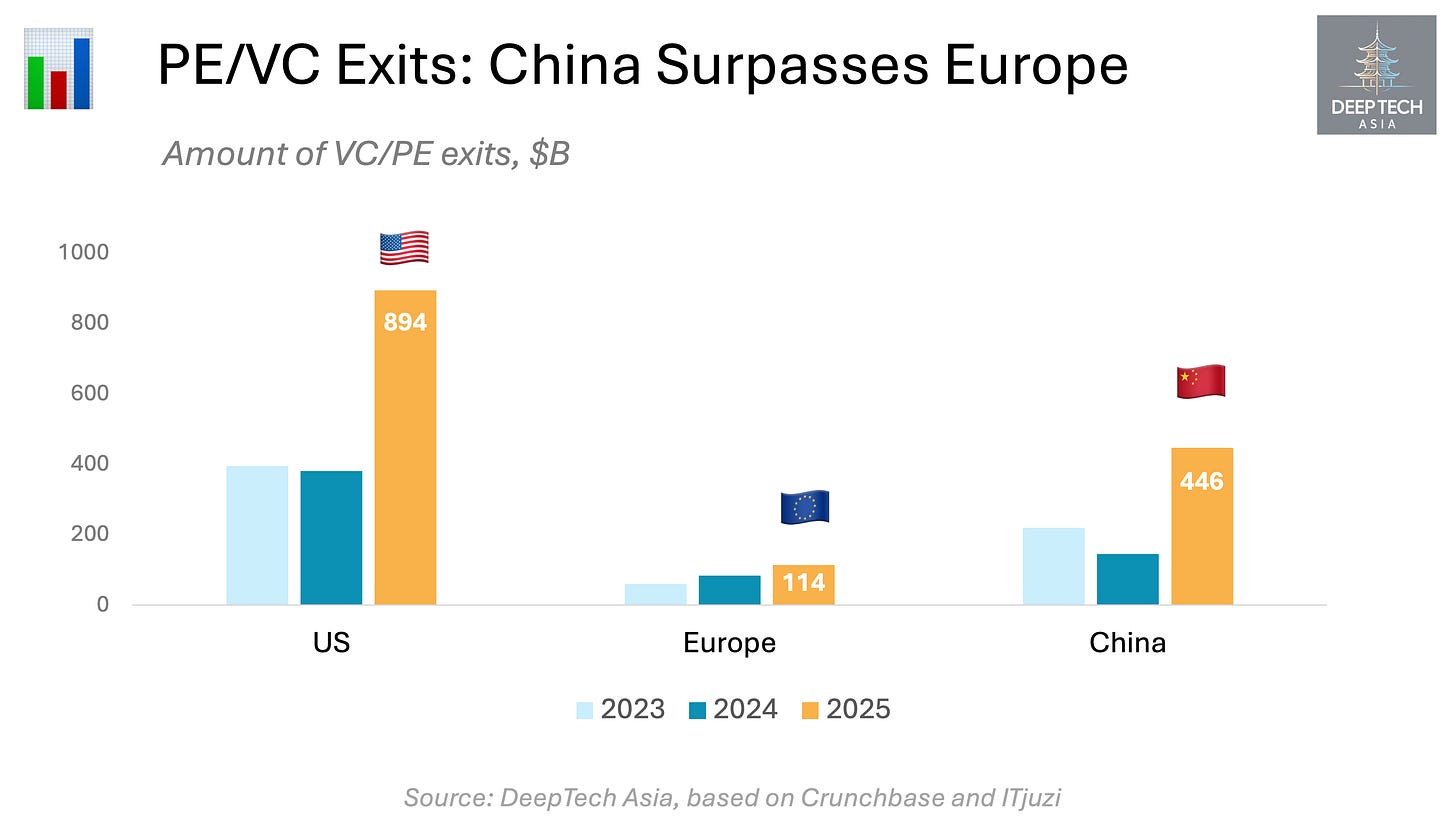

Despite raising a similar amount of capital, Chinese startups generated roughly 4x more PE/VC exits than their European counterparts. This was driven primarily by a wave of large public listings, led by the CATL IPO in May 2025 ($134B), alongside other sizeable offerings such as Seres ($26B) and SF Express ($19B).

In total, China accounted for 86% of all tech PE/VC exit value in APAC in 2025.

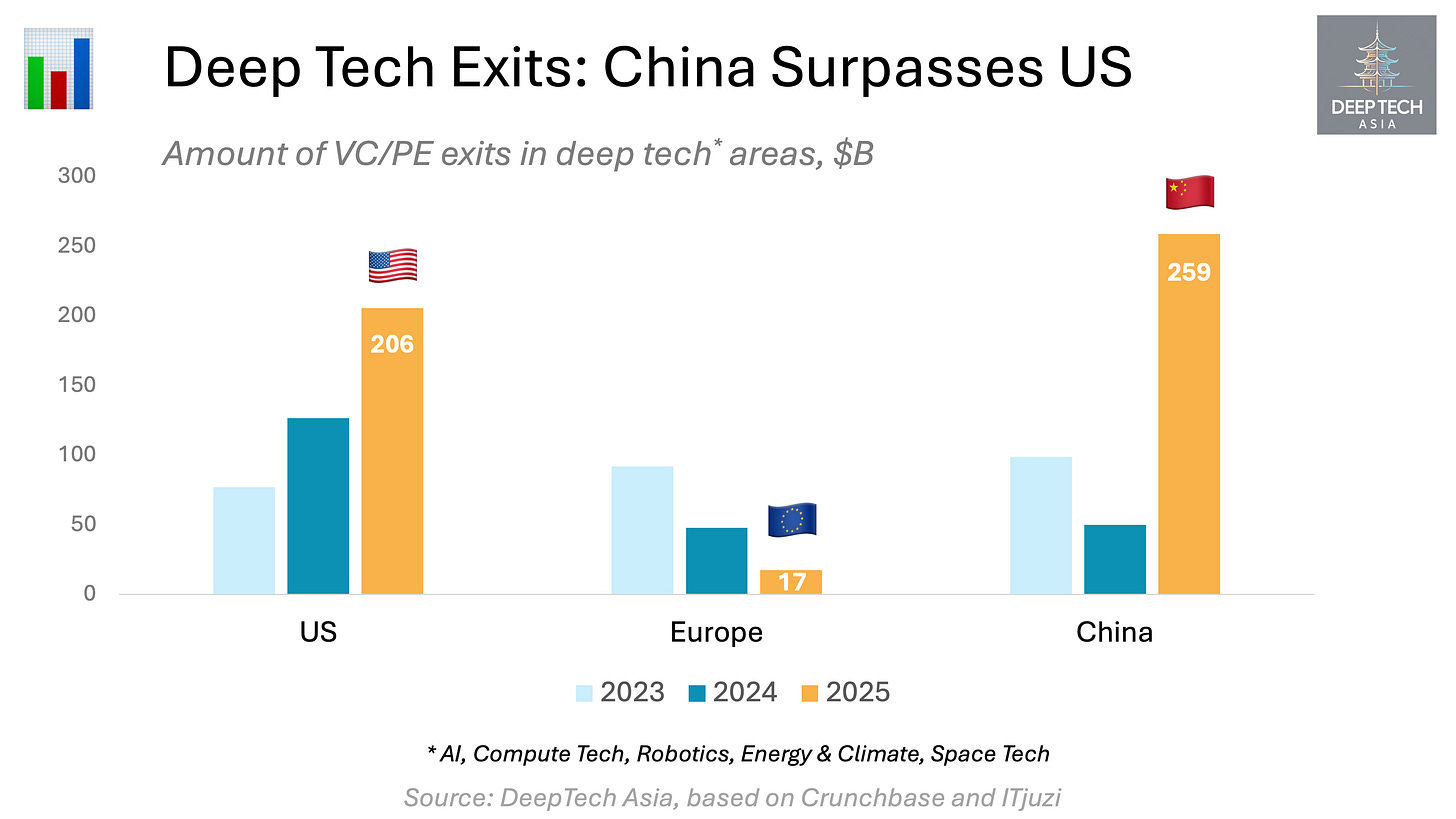

Focusing only on the top five deep tech verticals — AI, compute, robotics, energy, and space — Chinese startups even surpassed their US counterparts in 2025 in terms of PE/VC exit value. Beyond the landmark CATL IPO, the growth was driven by a combination of large primary listings, including Moore Threads ($7.5B) and MetaX ($5.9B), as well as secondary listings in Hong Kong such as WeRide ($6.8B) and Pony.ai ($6.0B).

China contributed to 94% of all deep tech PE/VC exit volumes in APAC in 2025.

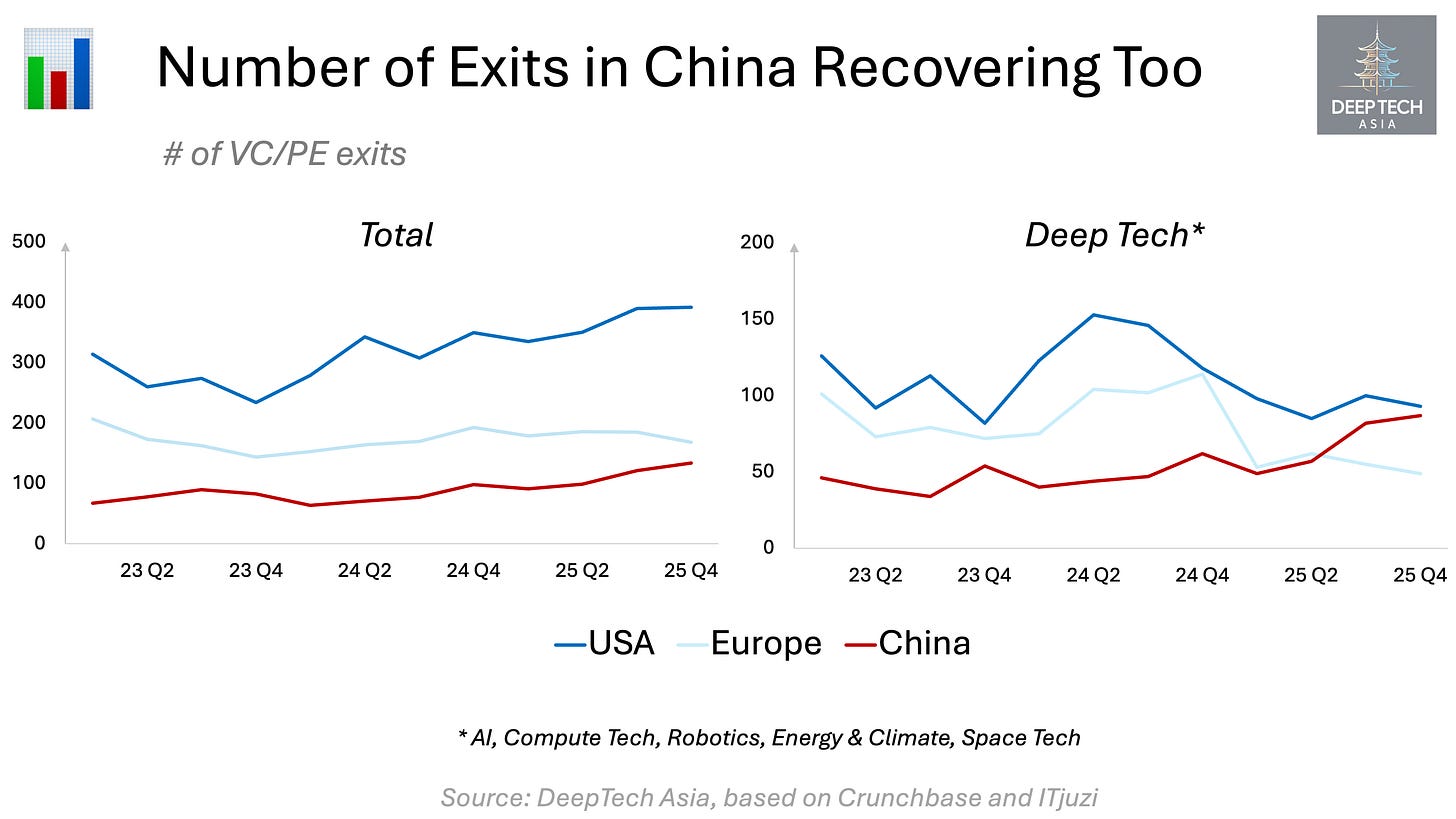

Historically, China has recorded fewer exits by deal count than Europe or the US, largely because IPOs — rather than M&A — have been the dominant liquidity path for Chinese startups. While IPOs are less frequent, they tend to be significantly larger in size than typical M&A transactions.

In 2025, this dynamic shifted meaningfully. China nearly reached parity with Europe in total PE/VC exit count and surpassed Europe — while almost matching the US — in the number of deep-tech exits. This acceleration was driven by a sharp increase in both IPO activity (up 70% year-on-year) and M&A transactions (up 36% year-on-year).

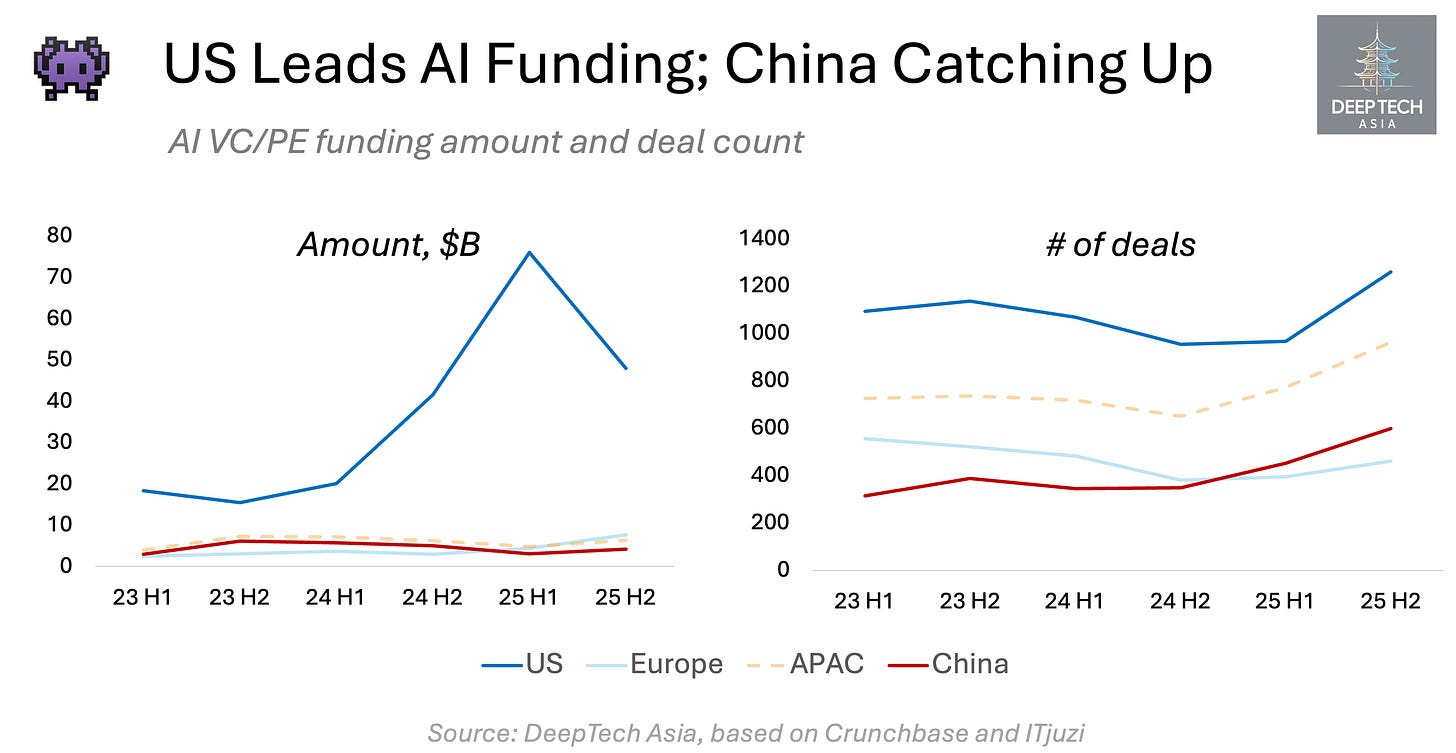

Despite the early momentum of Chinese AI startups, the US remains by far the largest VC market for AI — both in funding volume and deal count. This dominance is driven by a concentration of mega-rounds, including OpenAI ($40B and $7.6B), xAI ($5.3B), and Databricks ($5B), as well as a much broader base of VC-backed AI application startups than in China.

AI adoption in China is also robust, but it’s not as broadly productised through VC-backed startups as in the US. Instead, it’s mostly concentrated within large corporations or even state-owned companies.

Even so, by 2025 Chinese AI startups surpassed their European peers in deal count. Within APAC, China accounted for approximately 62% of all AI investment rounds, compared with around 20% for India and 12% for Japan.

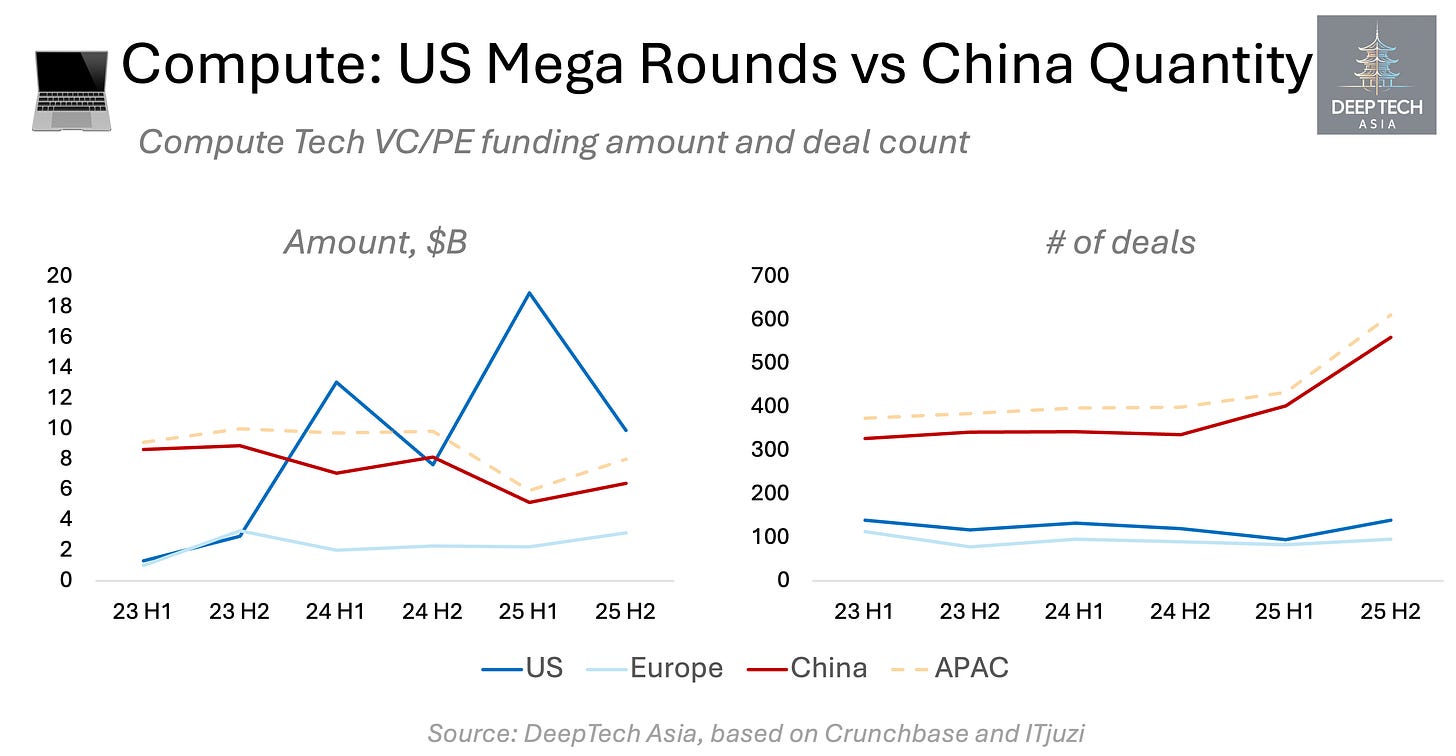

As with AI, the US remains the largest source of capital for next-generation compute technologies, driven primarily by a handful of mega-rounds. These include large financings for emerging compute infrastructure and accelerator players such as Crusoe ($11.6B), Lambda ($2B), Cerebras ($1.1B), and PsiQuantum ($1.0B).

China, meanwhile, has led global compute investment by deal count over the past several years. However, the majority of Chinese startups operate across the traditional semiconductor value chain — covering wafer manufacturing, testing and packaging equipment, EDA tools, and other critical components of the domestic chipmaking ecosystem.

There are also more advanced players, e.g. the next generation of Chinese GPU providers like MetaX, Moore Threads, Biren, Cambricon, Enflame and others that are building Chinese alternatives to NVIDIA.

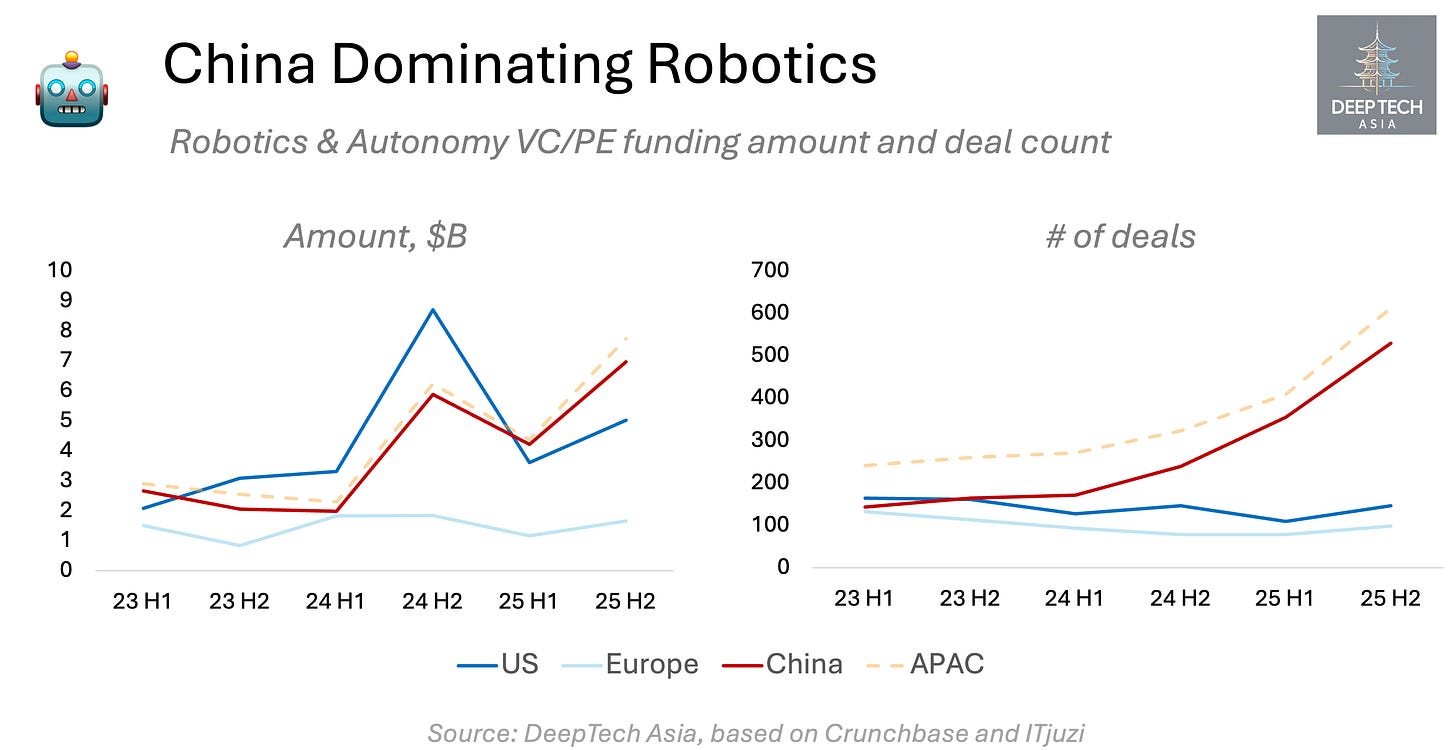

In robotics and autonomous driving, China has already emerged as a formidable force — both in the number of startups raising capital and in total funding volume. Although US has massive companies like Waymo (in talks to raise $15B at $100B+ valuation) and Figure (raised at $39B valuation), China had 50% more robotics investment rounds than the US in 2024 and 3.5x more rounds in 2025.

These investments span a wide range of segments, including autonomous vehicles, humanoid robots, drones, warehouse automation, robotic arms, and core hardware components across the robotics supply chain.

Within APAC, China accounted for approximately 87% of all robotics investment rounds, with the remaining activity fragmented across South Korea, Japan, and India, each contributing roughly 3–4%.

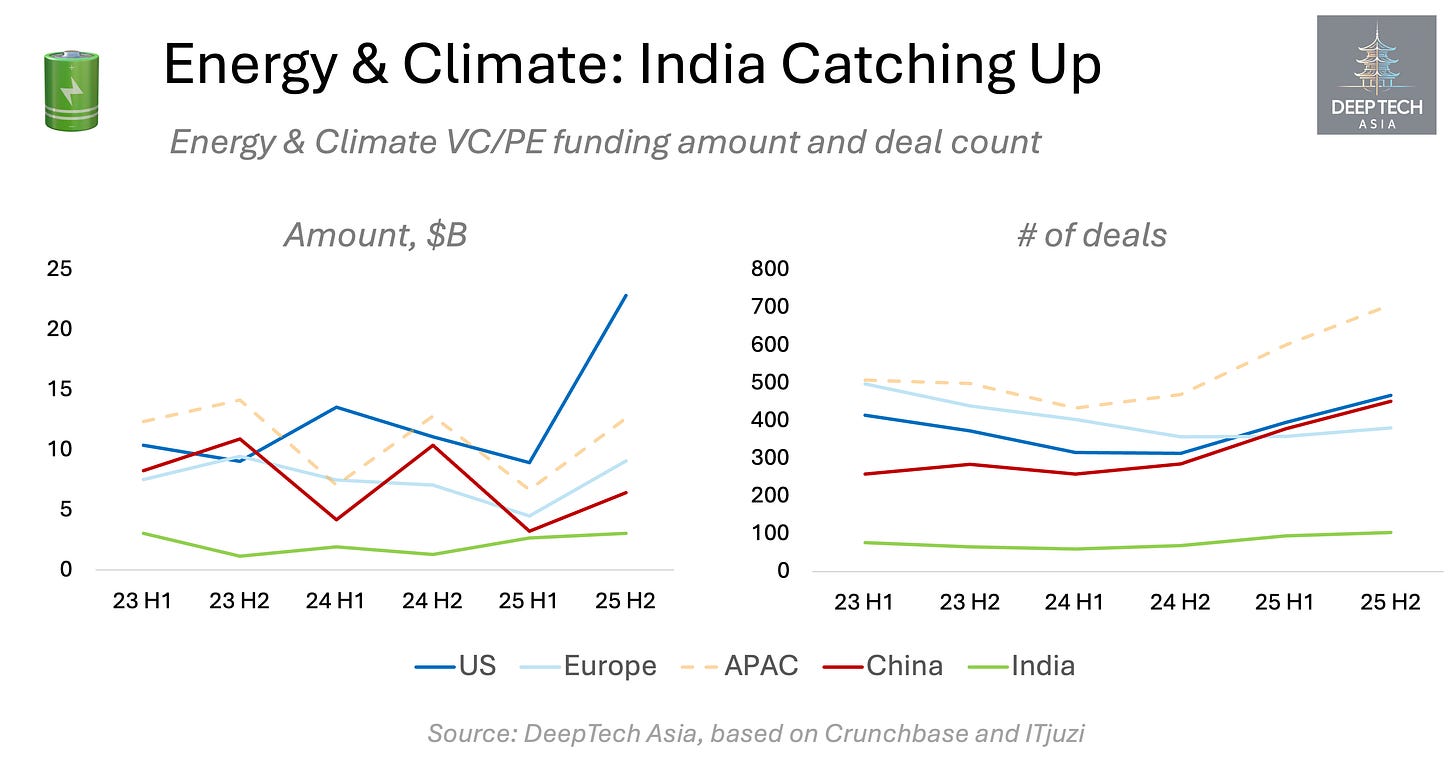

In 2025, India reached 60% of China’s VC/PE investment volumes in energy and climate startups, with projects like Greenko ($1.4B), Inox Clean Energy ($550M), Exide Energy ($420M).

Meanwhile, US is leading with mega projects like Sempra ($10B), Origis Energy ($1.3B), Commonwealth Fusion ($860M), X-Energy ($720M).

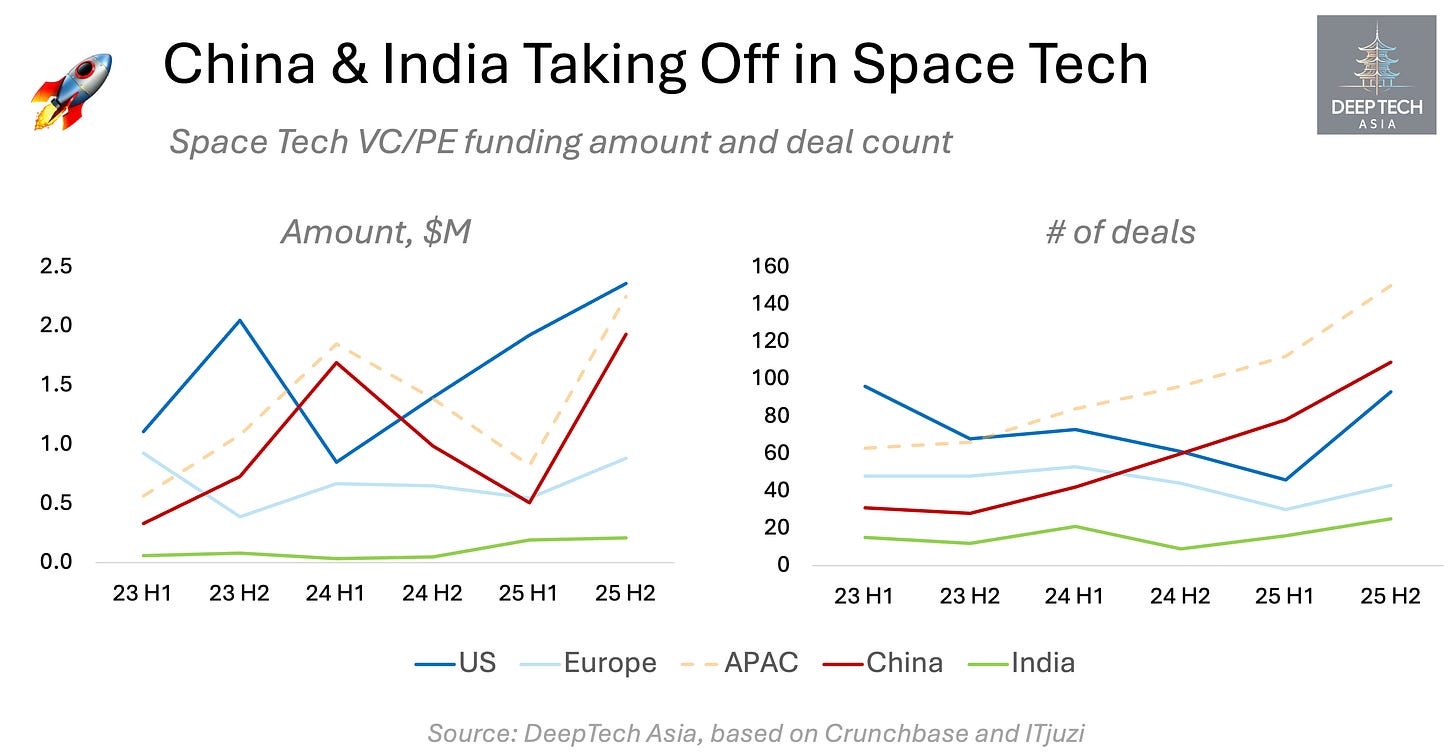

While US space- tech startups attracted more capital than their Chinese counterparts in 2025 ($4.3B vs. $2.4B), China overtook the US in deal activity (187 vs 139) with the rounds like Space Pioneer ($350M), Galactic Energy ($350M), GeeSpace ($280M), Minospace ($147M) and iSpace ($140M).

India is also becoming a stronger space tech ecosystem with 41 deals in 2024, compared to 73 deals in Europe. Largest deals included Raphe mPhibr ($100M), RMSI ($56M), Digantara ($50M) and Rangsons Aerospace ($34M).

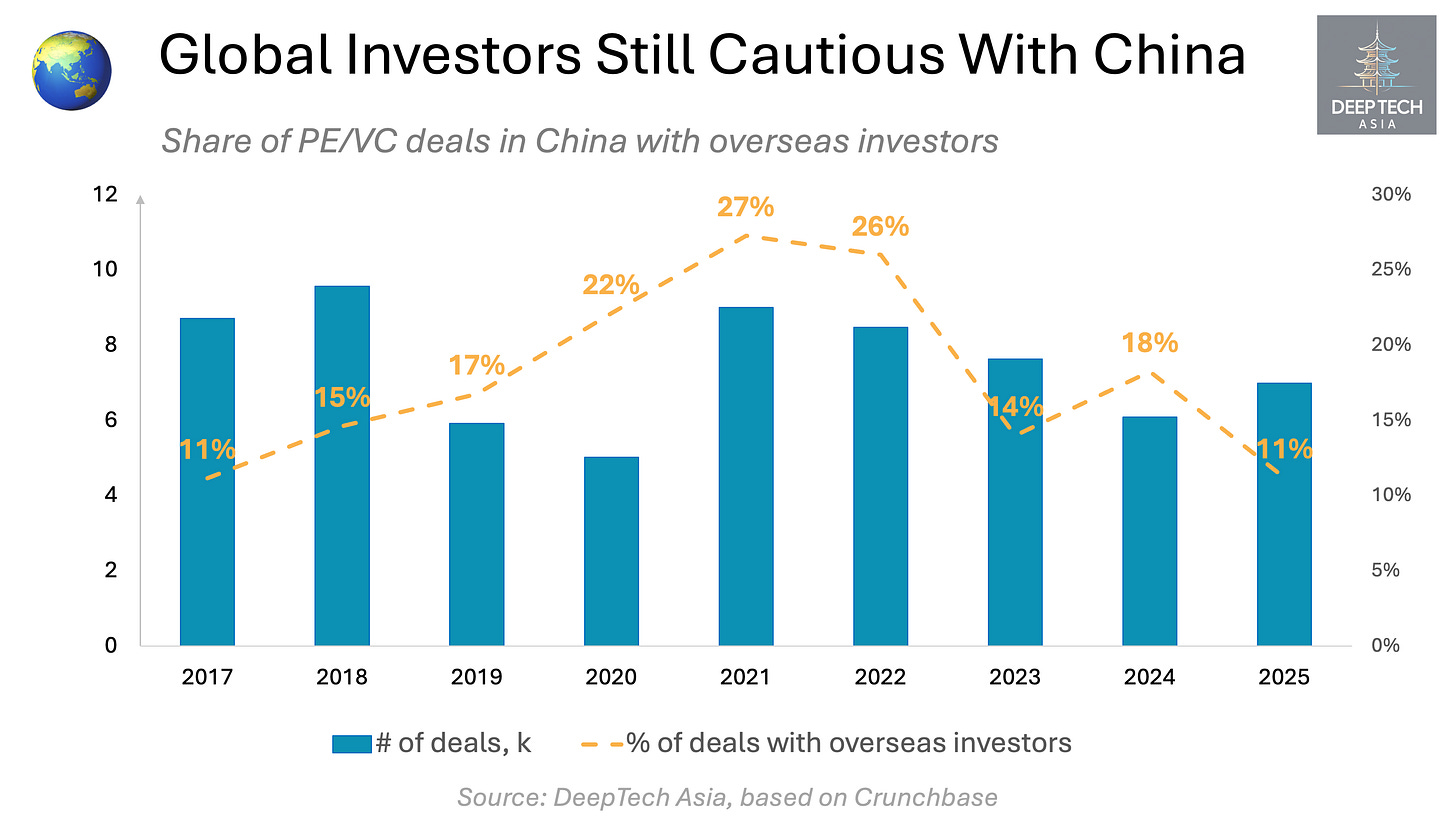

Despite the improving dynamics of China’s VC and deep tech ecosystem, the share of investment rounds involving overseas capital declined sharply — from 27% in 2021 to around 11% in 2025. This contraction has been driven primarily by geopolitical constraints and a persistent information gap around the Chinese startup landscape.

Importantly, the 11% figure for 2025 also includes overseas funds managed by Chinese GPs — such as GGV and GSR — which only partially qualify as cross-border investors.

The broader trend is a growing reluctance among foreign funds to invest directly into Chinese startups from their flagship global vehicles. This analysis does not capture overseas LP commitments to China-focused GPs, which face fewer formal restrictions but remain largely opaque due to limited public disclosure.

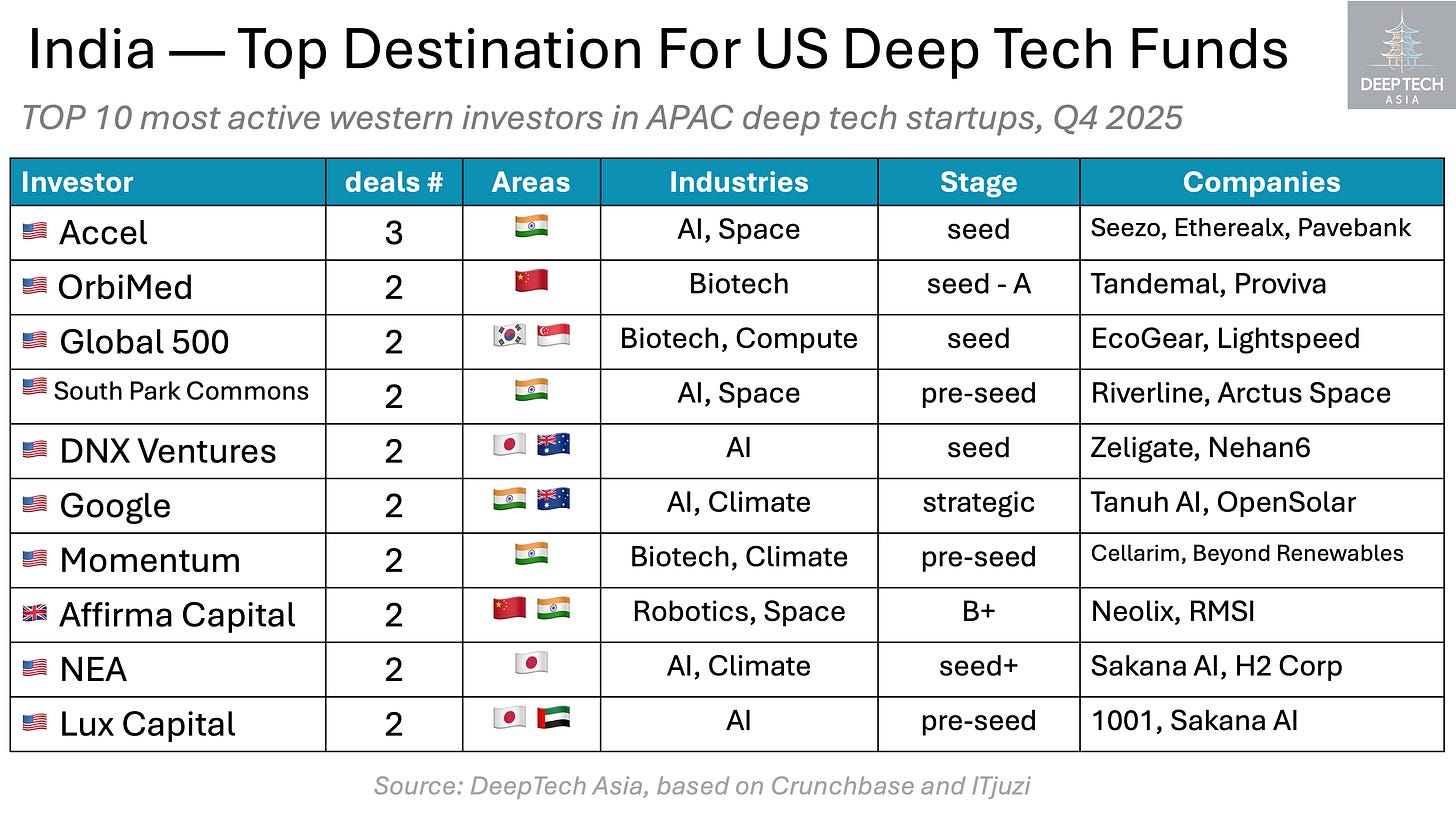

Most Western funds — primarily US-based — continue to concentrate their APAC deep tech exposure in India and Japan. These markets are perceived as carrying lower geopolitical risk, despite being less scalable than China.

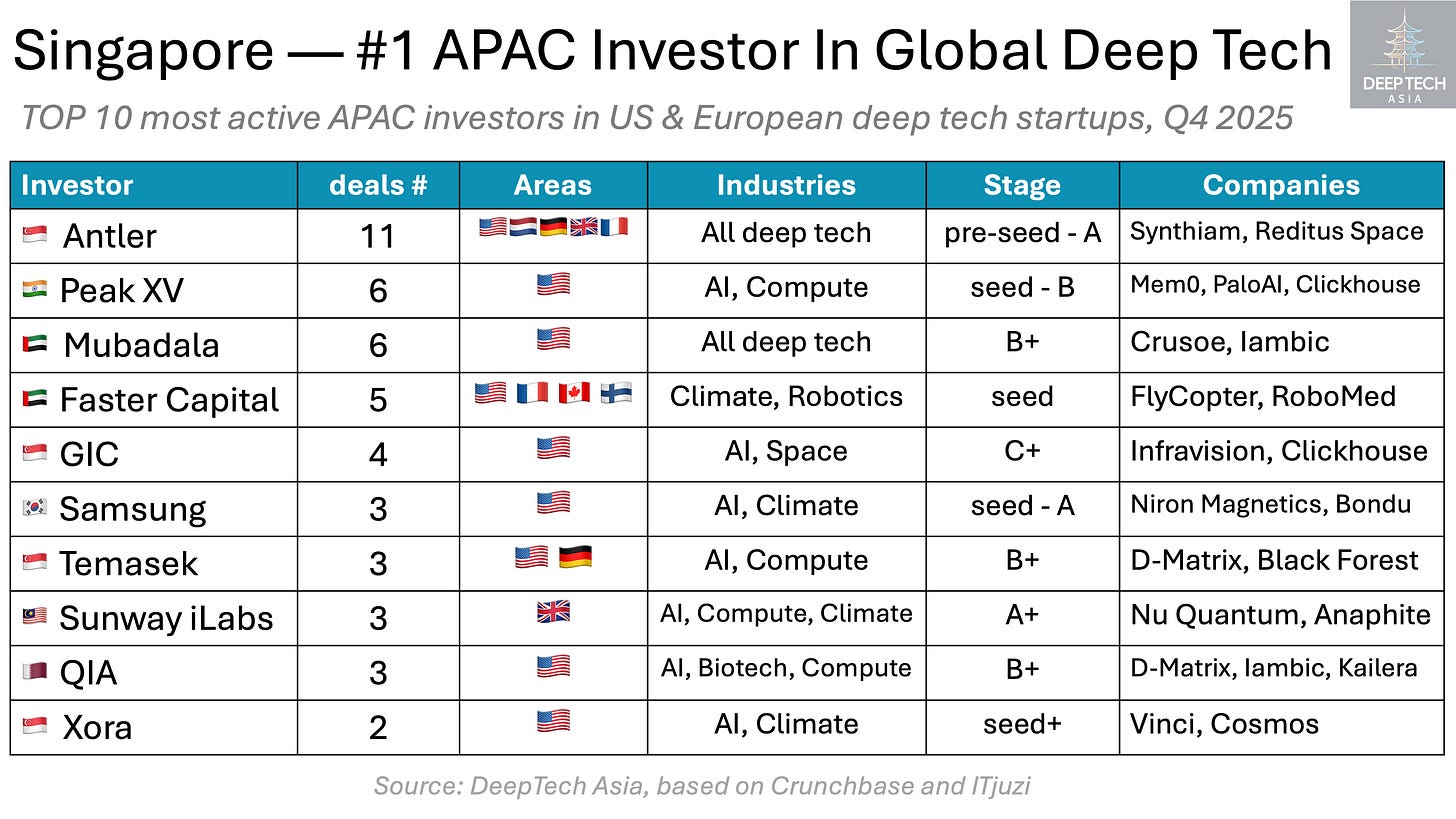

Overall, Western participation in Asian deep tech remains limited. In Q4 2025, the most active US-based investor in Asia, Accel, completed no more than three Asian deep-tech investments. By contrast, Singapore-based Antler—the most active Asian investor in the US and Europe — backed 11 Western startups over the same period, while Peak XV and Mubadala each made six investments.

The US remains the primary destination for Asian deep tech investors, led by Singapore-based funds such as Antler, Temasek, GIC, and Xora. This marks a sharp reversal from 2020–2021, when Chinese technology groups — including Tencent, Alibaba, and Baidu — were among the most active Asian backers of Western deep tech startups. This comparison does not capture Chinese GPs that have established onshore operations directly in the US.

If you have any proposals, ideas, or feedback, we’d love to hear from you! Feel free to reach out at denis@deeptech.asia or on LinkedIn.

Let’s connect and explore how we can improve together.