Macro Monitor Q3 2025

Deep tech investment trends across the US, Europe, and Asia—covering VC/PE funding, exits, and cross-border deals. For the data nerds out there, this one’s for you!

Some trends that caught my eye in Q3:

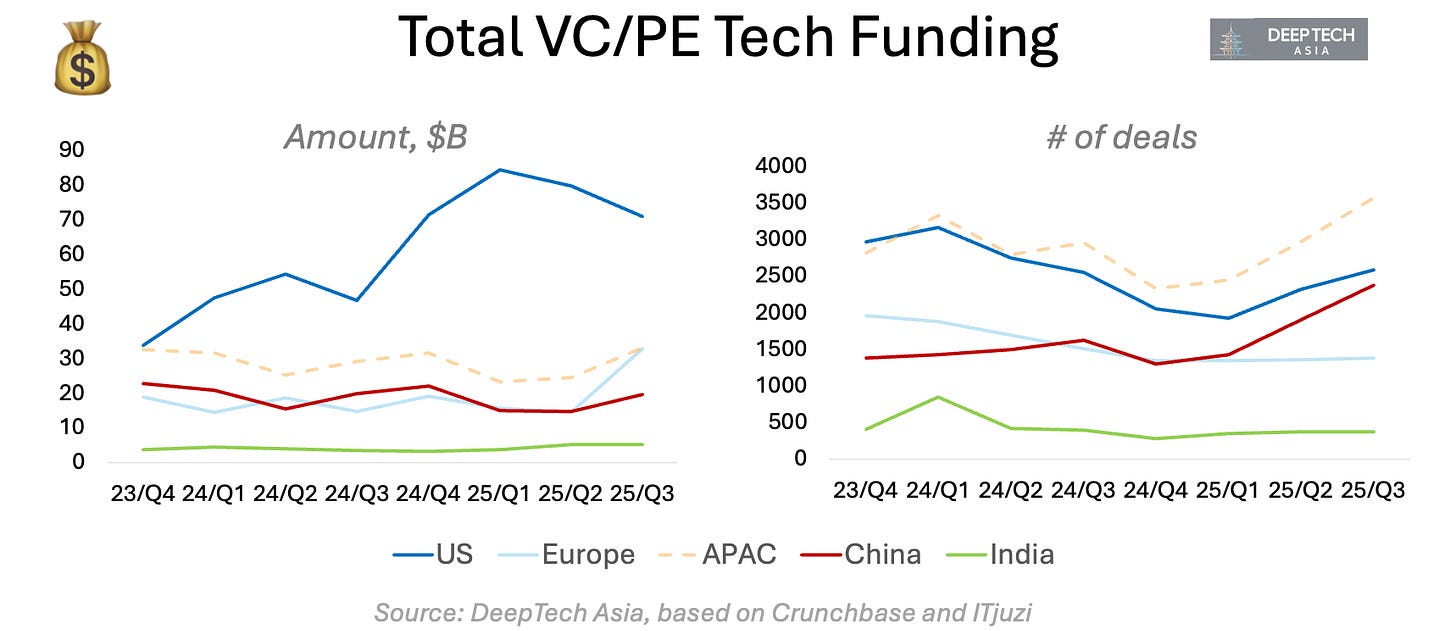

China’s PE/VC activity has growth the fourth quarter in a row, nearing the US deal count (2,376 vs 2,588), while the funding gap remains wide ($71B vs $20B).

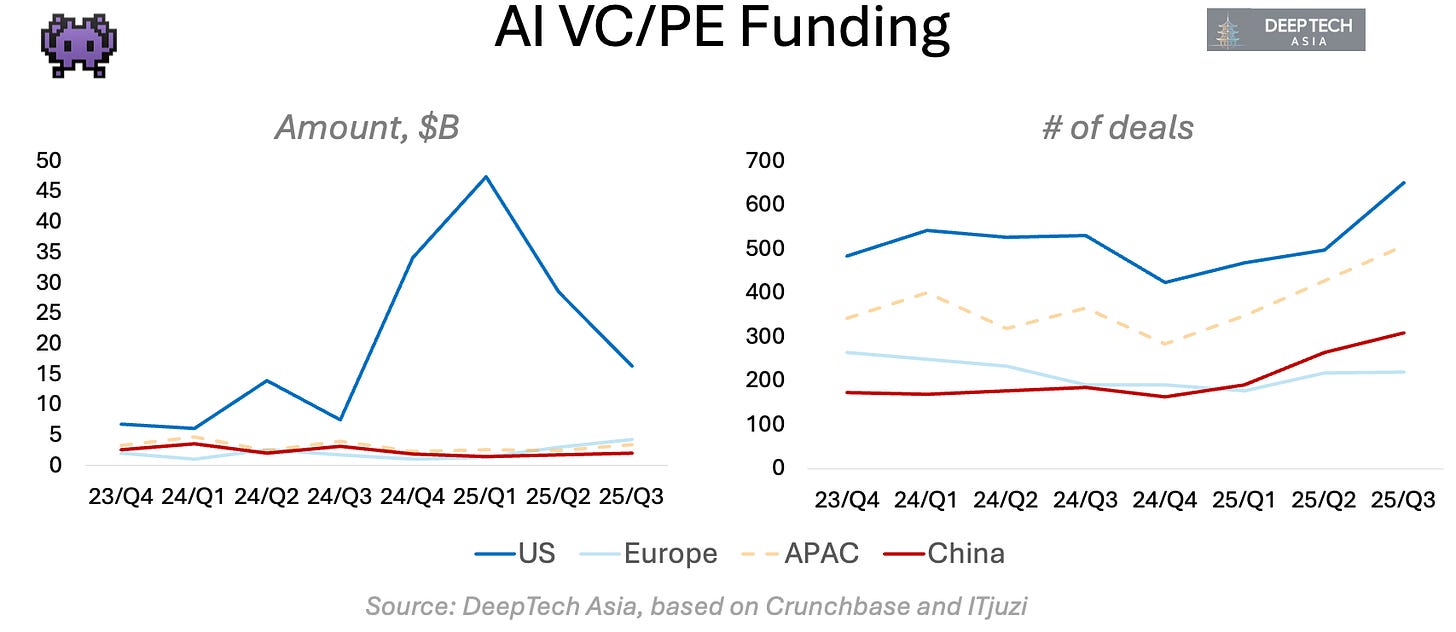

US AI funding keeps plummeting from $47B in Q1 to $16B in Q3; while the number of AI rounds is steadily growing both in the US and China.

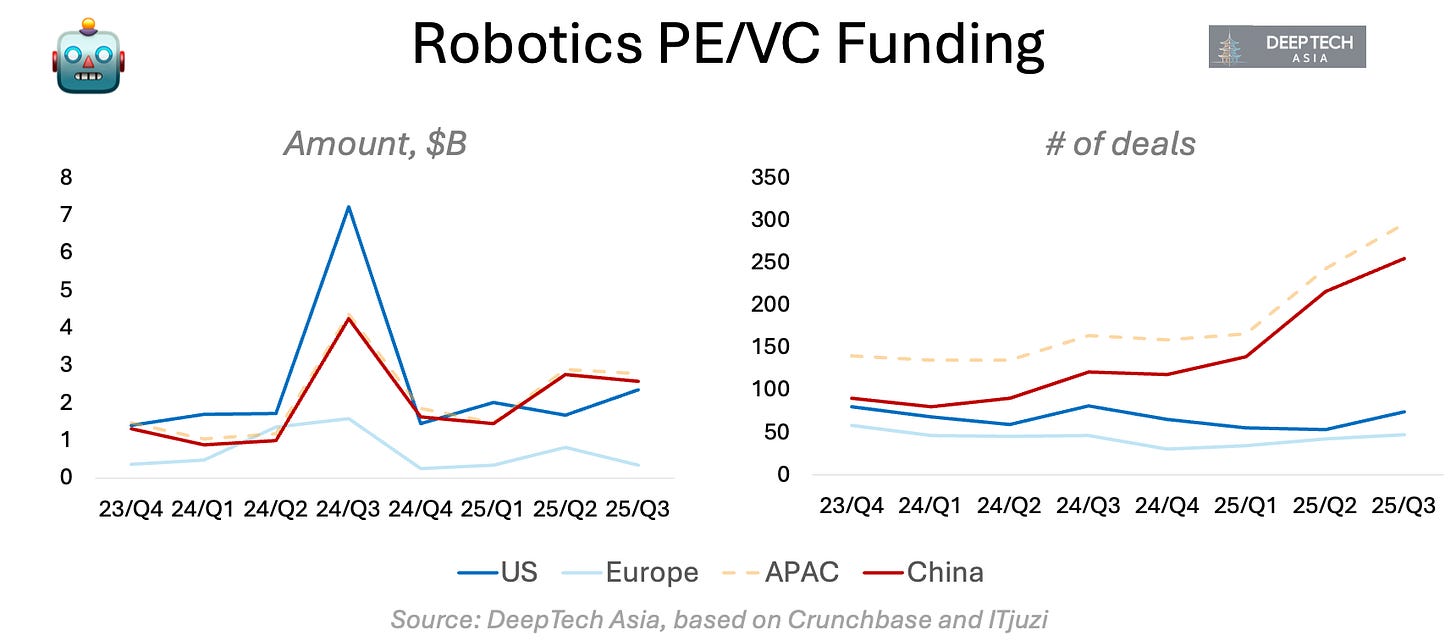

China is significantly outpacing Europe and the US by the number of investment rounds in robotics and compute technologies (3-5x).

China is also leading in space tech for the 4th quarter in a row (by deal count).

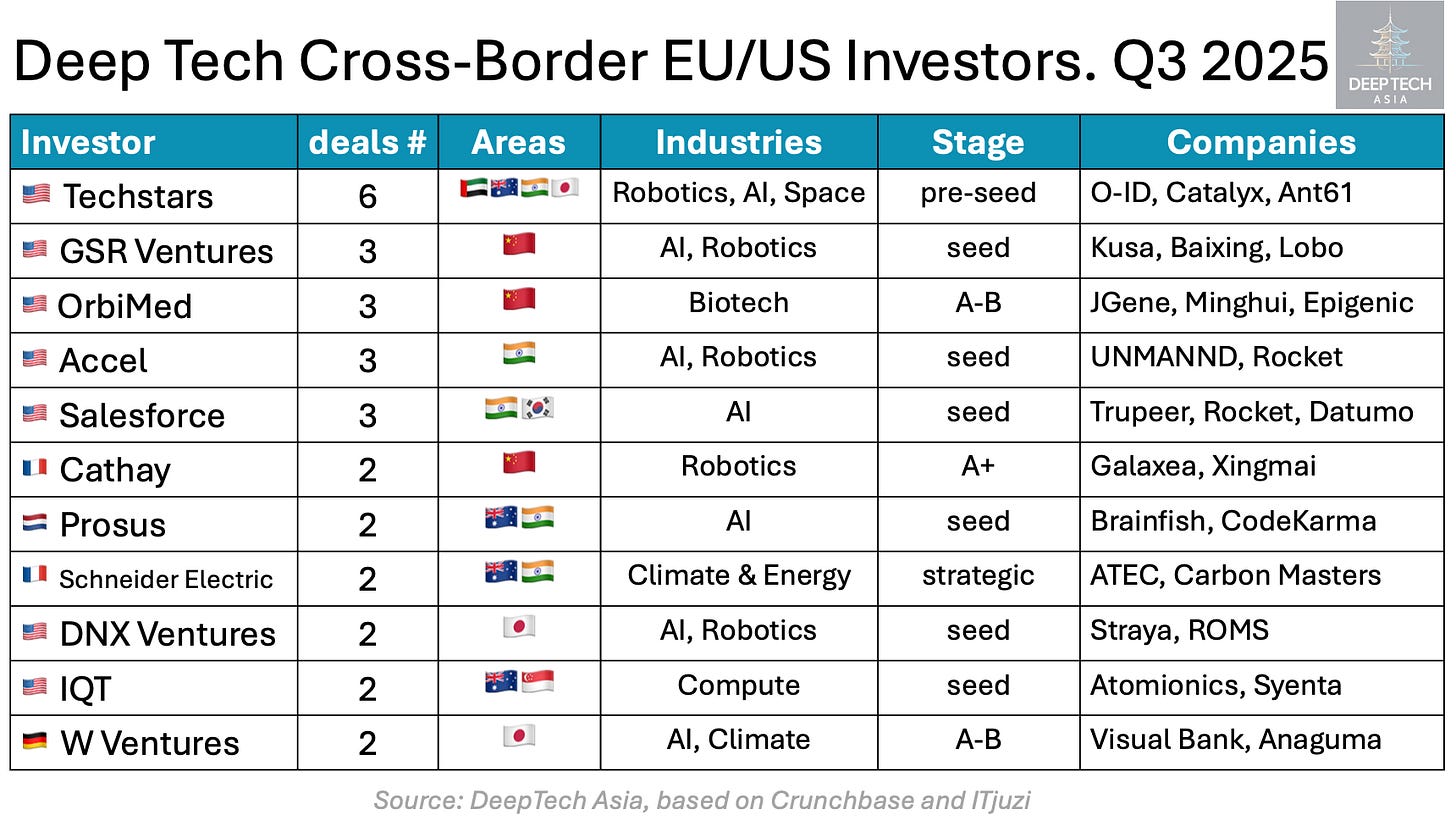

Western investors are still cautious about investing directly in Chinese startups, doubling down on markets in APAC like India, Japan and Australia.

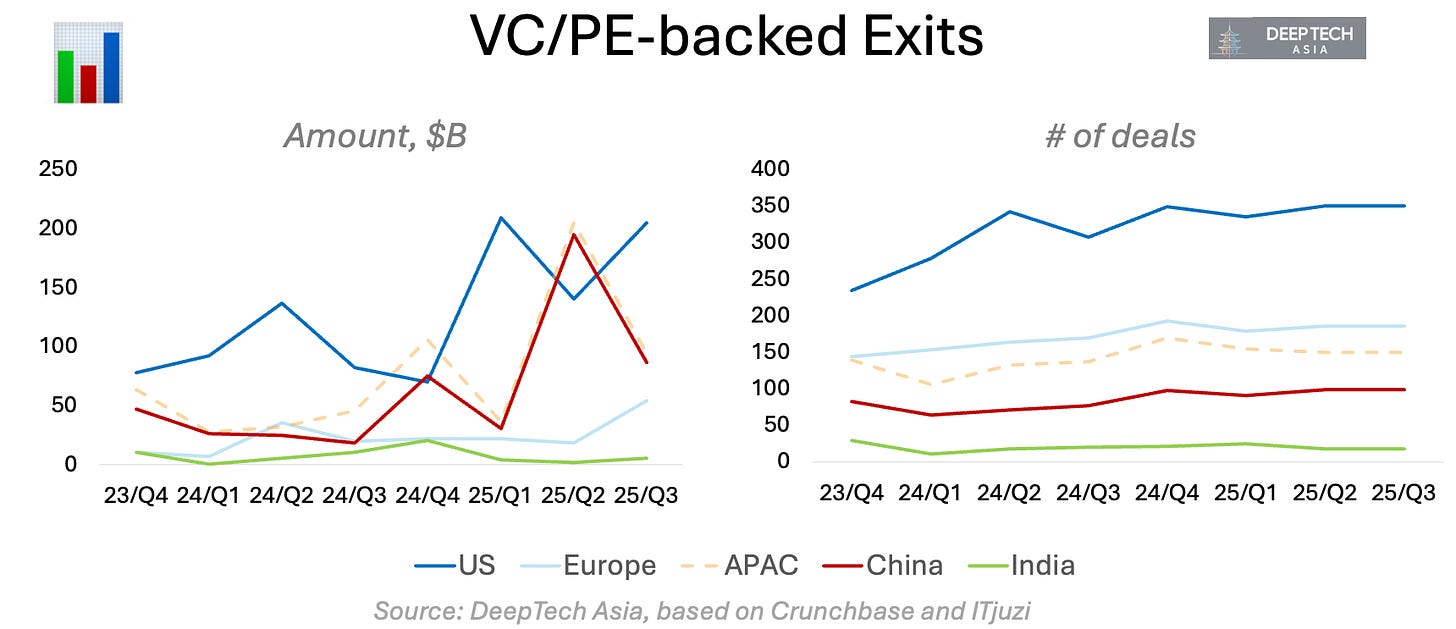

While Hong Kong IPOs went up and overall VC/PE exits in Asia are slowly recovering, they still trail the US and remain roughly on par with Europe.

US was by far the world’s largest tech ecosystem in terms of PE/VC funding amount in Q3 2025 with major investment rounds like the $5B+ raise of Elon Musk’s xAI. Tech PE/VC funding in Europe also performed strongly, significantly outpacing China the first time for the past three years. As for the deal count, China is rapidly catching up with the US and by far surpassing Europe.

US has been fuelling the global AI investments for the past two years, however, the AI funding in American startups is dropping the second quarter in a row.

Is the AI bubble finally going to burst soon?

We’ll wait and see. But the number of AI startups securing funding — both in the US and China — keeps growing, which gives hope that the real AI adoption is closer than we think.

Some of the interesting AI rounds from Asia below:

🇨🇳 $273 round from Chinese state funds: Minimax (稀宇科技), developer of general large models of different modalities, including a trillion-parameter MoE text large model, a speech large model, and an image large model.

🇨🇳 $140M round from Pudong, Zhangjiang Group: Zhipu (智谱), China’s leading developer of the full-stack open-source LLM.

🇨🇳 $111M seed round from SAIF, Linear, Meituan: TARS (它石智航), a company developing large language models for embodied AI, as well as the integration of software and hardware.

🇯🇵 $50M Series E from Goldman Sachs: LegalOn Technologies, an AI platform helping lawyers improve corporate legal operations efficiency with advanced legal AI tools.

🇰🇷 $45M Series B from KDB: Upstage, an AI-driven language models and document processing engines that streamline data extraction, analysis, and workflow management.

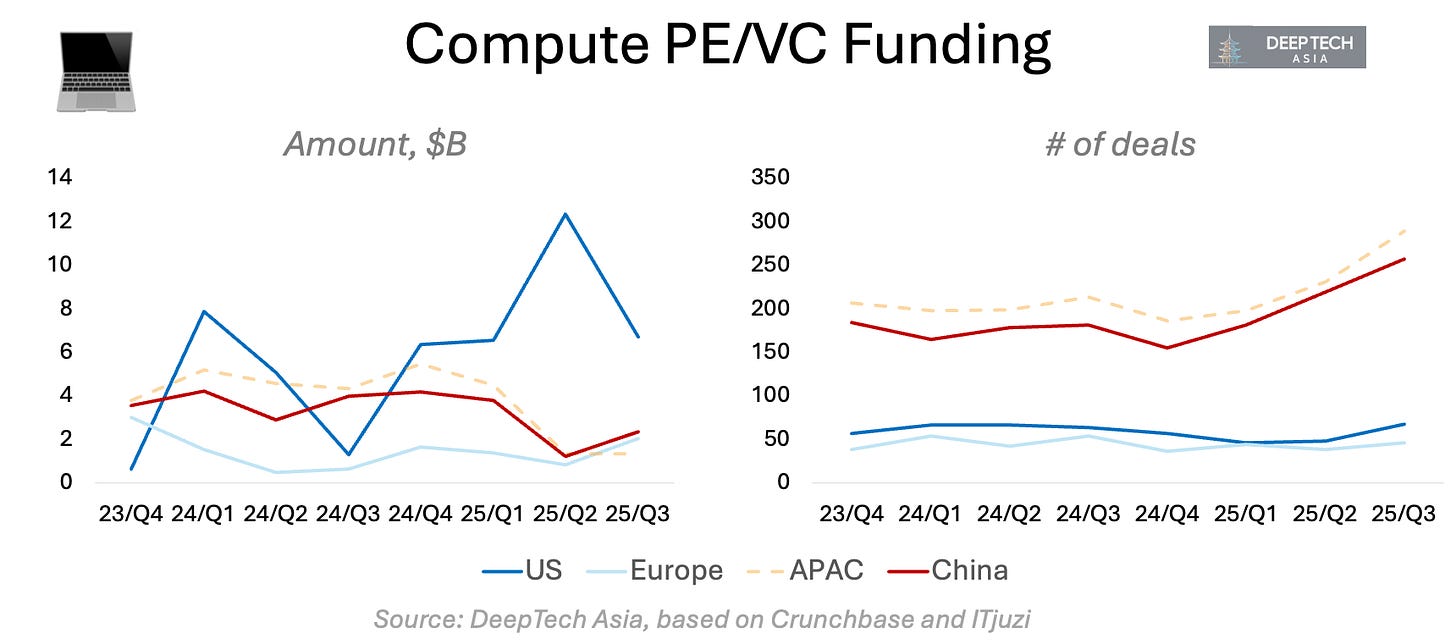

Compute funding in the US also started to drop, which I think is connected with the falling AI investments. However, it is still more than 3x larger than in Europe and China, with such major round as Vantage Data Centers ($1.6B), Cerebras ($1.1B) and PsiQuantum ($1B).

Meanwhile, China is far ahead in terms of the number of compute-related investment rounds — 4-5x larger than the US and Europe. It’s mostly driven by the local government push to build a fully self-sufficient supply chain for chipmaking.

A few standout compute investments in Asia include:

🇰🇷 $250M Series C from Arm Holdings, Samsung: Rebellions, a provider of AI accelerator chips and data center systems designed for efficient inference in large‑scale applications.

🇨🇳 $210M Series C from Tencent, Baidu: Xizhi Technology (曦智科技), a provider of hybrid optoelectronic computing power, offering a series of computing power transition solutions, starting from the three core technologies of photon matrix computing (oMAC), on-chip optical network (oNOC), and inter-chip optical network (oNET).

🇰🇷 $123M Series C: FuriosaAI, a developer of data center accelerators for the most advanced AI models and applications.

🇨🇳 $42M Series C from Legend Capital: SJI Semi (尚积半导体), developer of a new semiconductor front-end equipment.

🇨🇳 $42M Series A from Primavera Capital: PSR Semi (研微半导体), a startup specializing in high-end thin film deposition equipment, with product lines covering thermal ALD, PEALD, silicon epitaxial, silicon carbide epitaxial, and PECVD equipment, etc.

China continues to dominate global robotics funding, outpacing all regions despite the $1B Series C of US humanoid leader Figure AI. In Q3 2025, Chinese robotics startups closed 3x more deals than their US peers and 5x more than Europe.

Some of the recent robotics investments in China and the of Asia include:

🇨🇳 $140M Series A from JD, T-Capital, Stone Venture: Engine AI (众擎机器人), a general-purpose humanoid robot startup with the full-stack development of all the core components of the body to embodied intelligence and operation control algorithms.

🇨🇳 $140M Series A+ from Hongshan, Legend, Meituan, Alibaba: X Square (自变量机器人), a startup building general intelligent agents that can operate precisely based on large robot models.

🇨🇳 $91M Series A+ from IDG, Cathay, Meituan, MiHoYo: Galaxea AI (星海图), an AI startup developing embodied intelligence basic models and embodied intelligence robots.

🇨🇳 $70M Series C+: Deep Robotics (云深处科技), developing foot type robots, including quadruped bionic robots that can run fast and the series of robots for industrial applications such as power stations, factories, pipe gallery inspections, emergency rescue, and fire reconnaissance.

🇯🇵 $57M Series D from MUFG Bank: SkyDrive, an automotive start-up that develops flying cars and logistics drones.

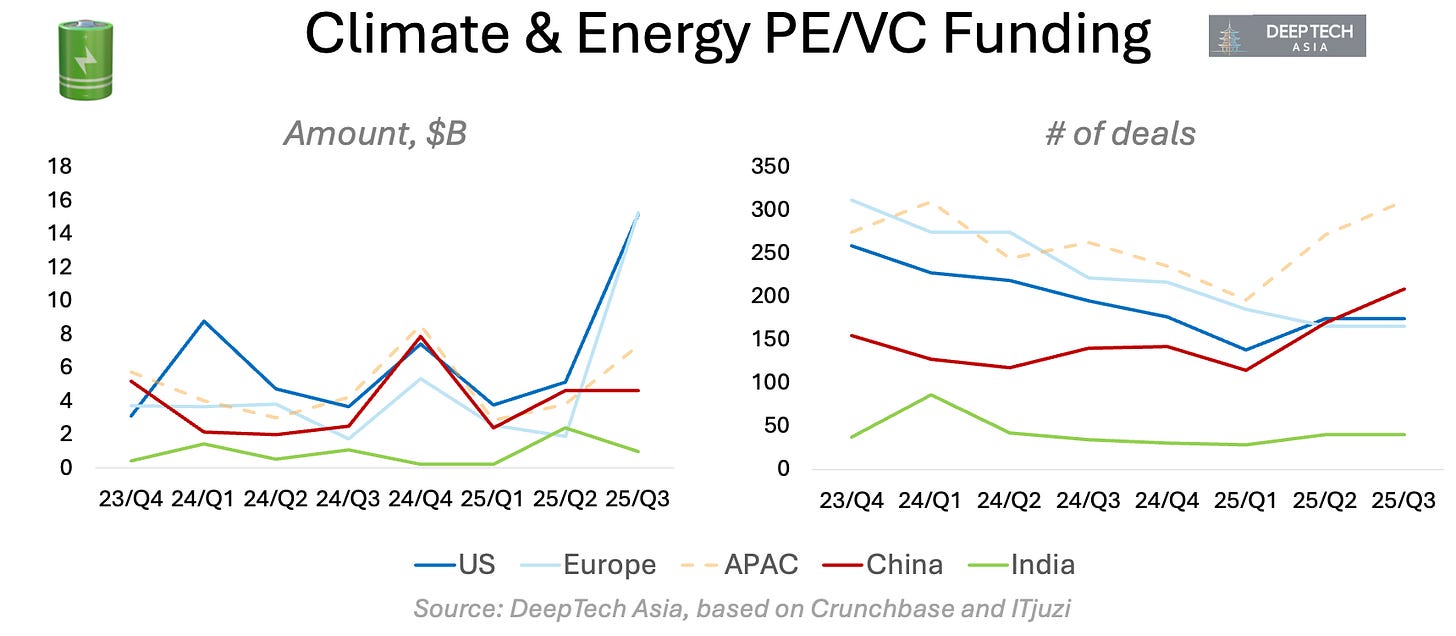

Q3 2025 saw a dramatic increase in climate funding in the US and Europe, mostly driven by two large infrastructure deals: TenneT in the Netherlands ($11B) and Sempra in the US ($10B).

Q3 was also the first quarter for a long time when China outpaced Europe and the US by the number of climate investment rounds.

A few notable climate deals in Asia include:

🇮🇳 $405M PE round from Green Climate Fund: Vertelo, offers complete fleet electrification services.

🇦🇺 $329M PE round from KKR: CleanPeak Energy, clean energy solutions for commercial and industrial sectors, focusing on sustainability.

🇸🇬 $72M round: I-Pulse, a high-pulsed-power technology company that develops innovative commercial applications for pulsed power technologies.

🇨🇳 $70M seed round from Legend Capital, Alibaba: Nova Fusion (诺瓦聚变) develops small, distributed, and modular nuclear fusion devices, adopting adopt the advanced field reaction (FRC) magnetic compression technology route to develop small modular reactors (SMR).

🇨🇳 $42M Series A from Qiming: Sany Hydrogen (三一氢能), developer of water electrolysis equipment for producing hydrogen, focusing on downstream customers such as large-scale wind-solar coupled hydrogen production, chemical engineering, metallurgy, transportation, and hydrogen blending in natural gas.

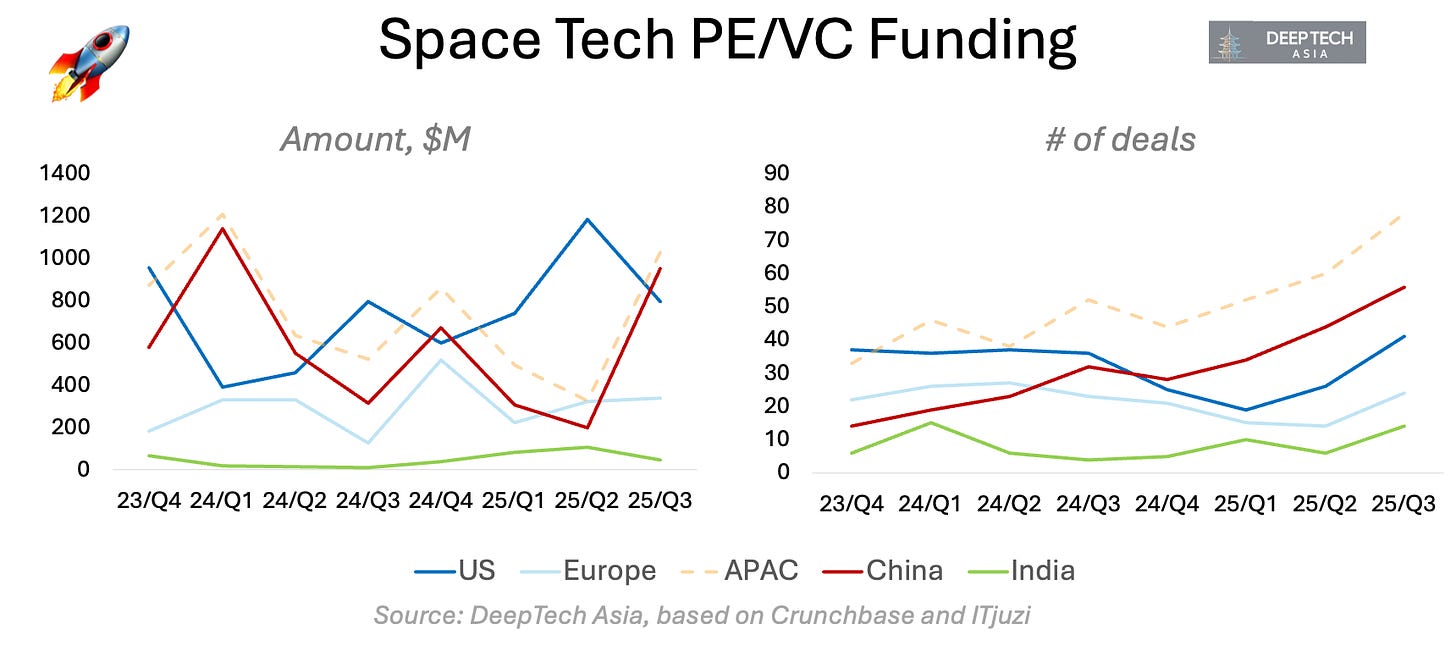

The US-China space race is intensifying. Both countries have comparable amount of PE/VC funding for space tech startups for the past two years. At the same time, China keeps leading in terms of the number of space tech rounds the fourth quarter in a row.

It’s worth noting that India’s number of space tech deals is growing steadily and now only ~40% smaller than in Europe.

Here are some standout space tech deals in APAC from Q3 2025:

🇨🇳 $336M Series D: Galactic Energy (星河动力), developing low-cost commercial rockets with a possible payload of 350 kg, focused on bringing microsatellites to the low-earth orbit.

🇨🇳 $280M round from a state EV-focused fund: Geespace (时空道宇), a global low-orbit communication constellation of 72 satellites serving real-time data communication for mass consumers and various industry applications.

🇯🇵 $10M Series C: Pale Blue, a developer of water propulsion systems and satellite mobility infrastructure for the aerospace industry.

🇮🇳 $10M Seed round: Astrobase, India’s first reusable, medium-lift orbital launch vehicle—purpose-built for on-demand launches, constellation deployments, sovereign missions, and global satellite infrastructure.

🇨🇳 $3M Pre-A round from Vertex: Dragonfly Wing (蜻蜓翼行), a tilting wing eVTOL, the first technical team in China to complete the development of 30kG-class tiltrotor flight control technology.

India is the most popular investment destination in Asia for Western deep tech investors, along with Japan and Australia.

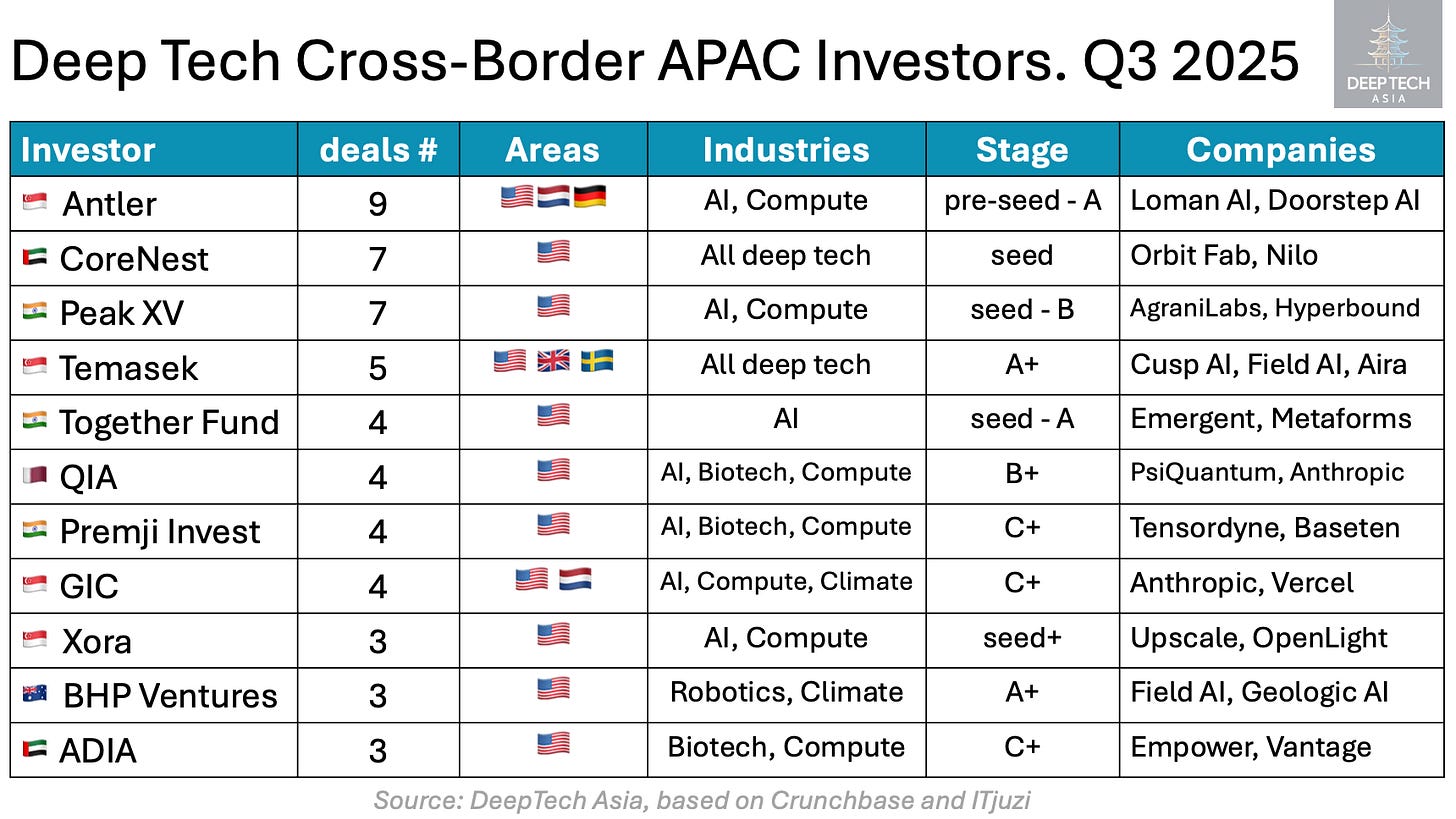

US is the most popular destination for Asian deep tech investors outside of their home region. Indian and Singaporean allocators were the most active in Q3 2025.

Worth noting that none of the Chinese funds got into the TOP 10 due to geopolitical constrains. It’s reasonable to assume that some transactions with Chinese investors are also not reported for the same reason.

The US remains the largest exit market for VC/PE investors, leading both in the number of exits and total exit value. In Europe, liquidity is gradually recovering after a prolonged slowdown.

China’s exit value saw a temporary correction in Q3 following CATL’s massive IPO in Q2, though the overall trend remains upward.

2025 has been a strong year for Hong Kong’s capital markets — IPO volumes surged by over 200% in Q3, according to KPMG. However, the number of VC/PE-backed Chinese IPOs declined from 44 in Q2 to 29 in Q3.

At the same time, PE/VC-backed M&A activity in China reached a multi-year high, with 92 transactions in Q3 compared to the usual 40–60 range in prior quarters — a clear sign of growing market consolidation.

Below are some of the Q3 exit highlights from APAC:

🇨🇳 IPO at a $2.4B market cap: Geek+ (极智嘉), leading developer of robotics solutions for warehouse logistics. Exit for Intel, B Capital, Vertex, Volcanics, Gaorong, Vertex and others.

🇨🇳 IPO at a $3.5B market cap: BEST (屹唐股份), manufacturer of wafer processing equipment used for dry de-gumming, dry etching, rapid heat treatment, millisecond-level annealing and other solutions. Exit for Hongshan (ex-Sequoia China), IDG, Shenzhen Capital.

🇨🇳 IPO at a $1.5B market cap: Fortier Tech (峰岹科技), a startup specializing in developing chips for motor drivers used for industrial equipment, motion control, power tools, consumer electronics, intelligent robots, and other drive control fields. Exit for Xiaomi, Legend Capital, Shenzhen Capital.

🇨🇳 $645M acquisition: PhiGent Robotics (鉴智机器人), a provider of next-generation autonomous driving systems focused on visual 3D understanding, got acquired by a Chinese public mobility tech company NavInfo ($3B+ market cap).

🇯🇵 IPO at a $160M market cap: Axelspace Holdings, a pioneer in microsatellite technology. Exit for SBI, MUFJ, SMBC, Keio Innovation Initiative, ITOCHU.

🇰🇷 IPO at a $150M market cap: AUTOCRYPT, a developer of end-to-end mobility security solutions for autonomous vehicles. Exit for KB Investment, Ulmus, Shinhan, Pathfinder H, BSK.

If you have any proposals, ideas, or feedback, we’d love to hear from you! Feel free to reach out at denis@deeptech.asia or on LinkedIn.

Let’s connect and explore how we can improve together.