Demystifying VC Exits in Asia. Data vs Perception

Exits Map in Asia vs Global, liquidity ratio analysis, TOP 15 deep tech exits, deep-dive on China, myth busting and predictions

Big thanks to David Li, Rita Liao, and Fedor Susov for the insights and input that helped shape this piece!

Highlights:

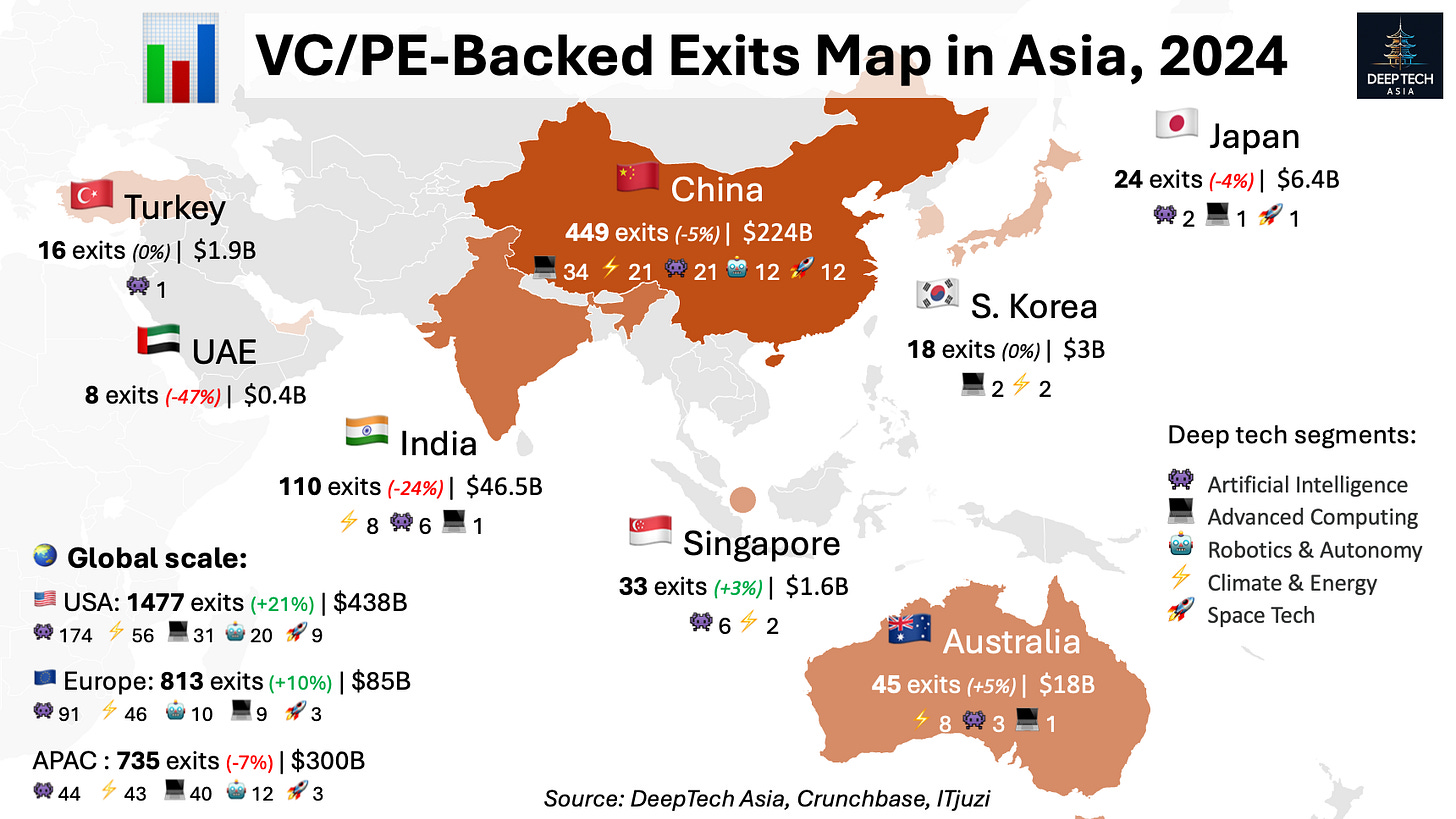

Exit value comparison. In 2024, Asian startups delivered $300B in exits, with China contributing $207B. The US led with $438B, while Europe trailed at $81B.

Exit count comparison. The US topped exit count with 1,477 deals. Europe surpassed APAC (813 vs. 735), while China had just 449.

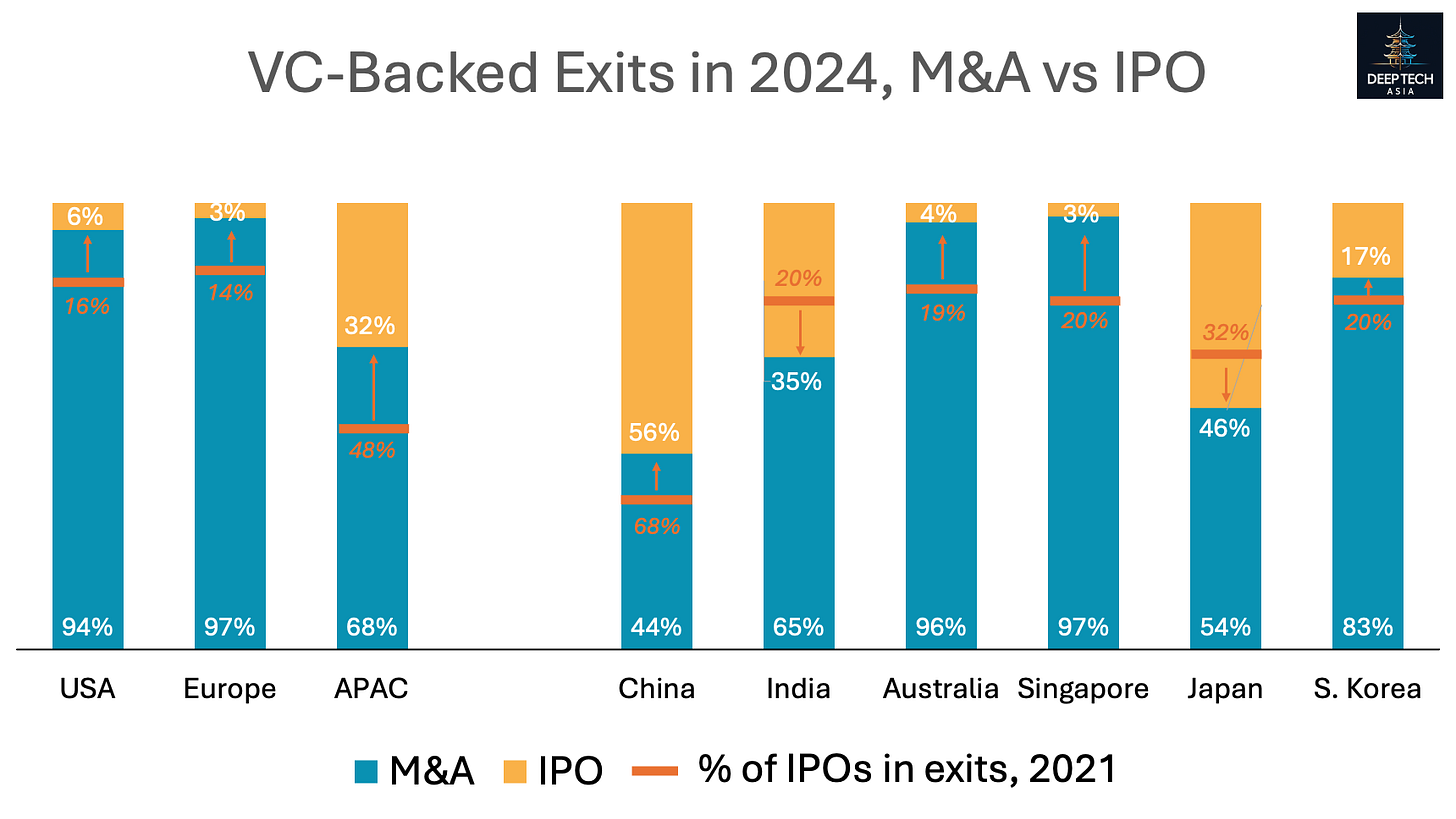

IPO vs M&A. China and India are more IPO-driven, and since IPOs are 5–6x larger than M&As, Asian exits yield higher returns per deal.

Average ROI: China 2.7x, India 3.1x — ahead of the US (2.0x) and Europe (1.2x). But exit rates are higher in the West: 14% (US), 13% (Europe), vs. 8% (China) and 6% (India).

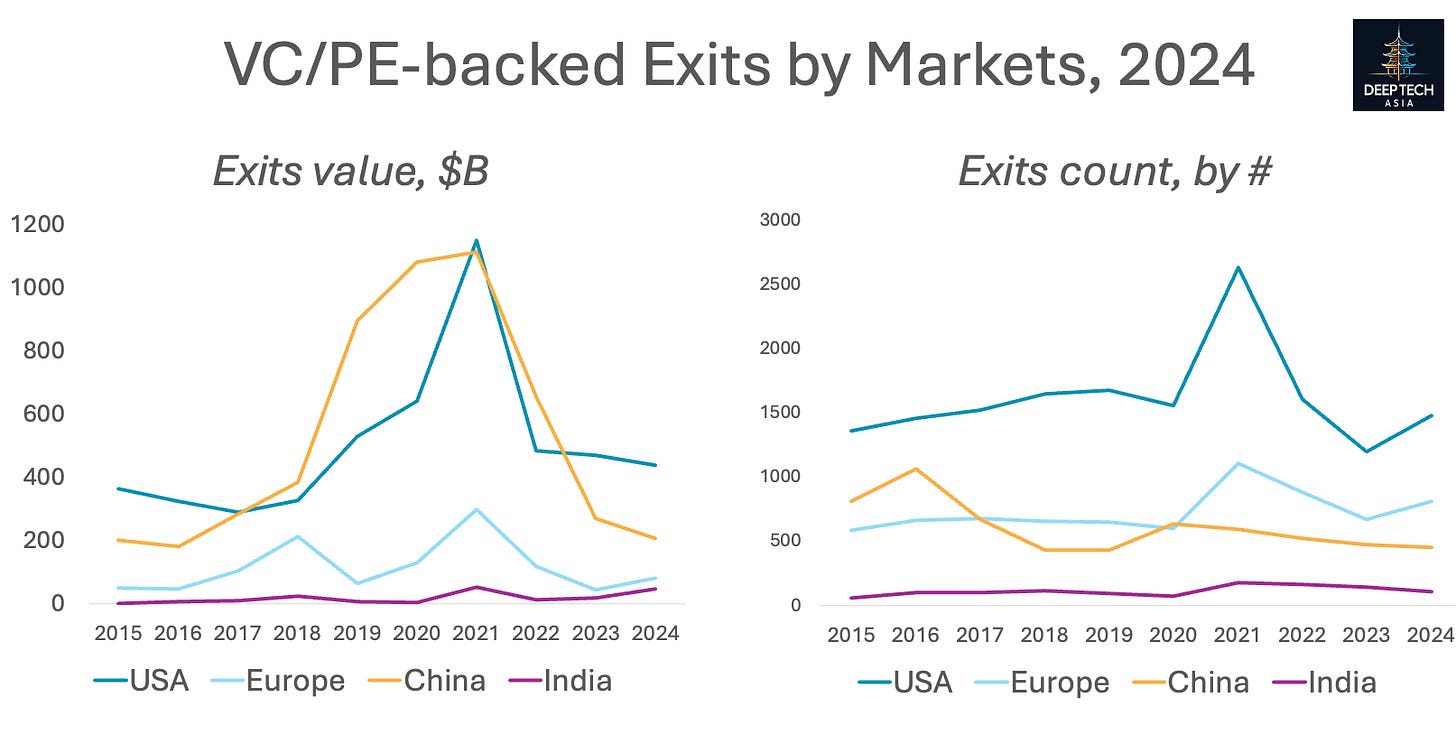

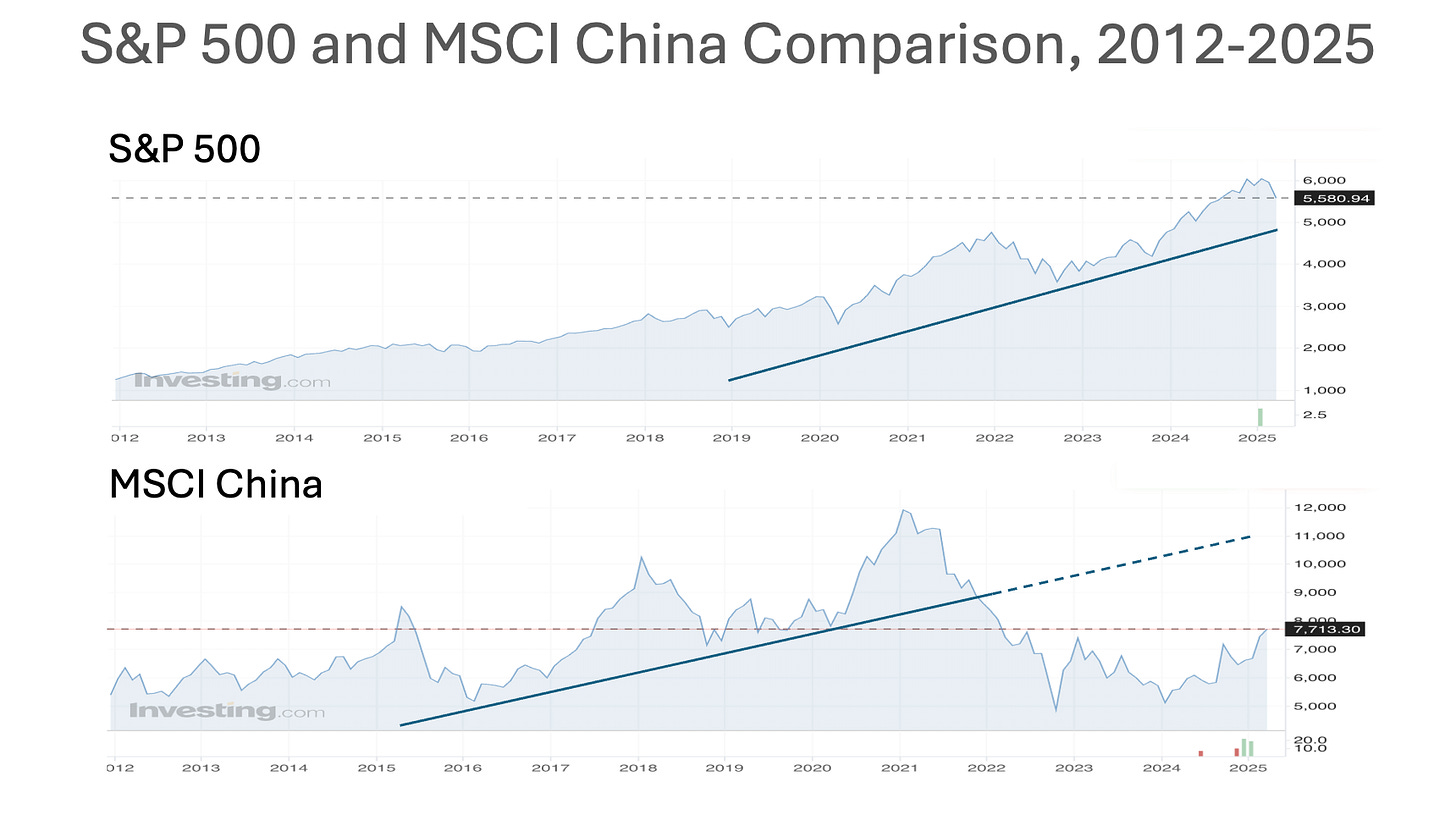

China’s Rise and Fall. From 2017 to 2021, Chinese startups outpaced the US in exit liquidity. But since then, China’s exit value has fallen over 80%, mainly due to an IPO slowdown — a trend that continued in 2024 even as other markets rebounded.

China’s Back on Nasdaq. The drop in Chinese exits no longer seems tied to regulation or geopolitics. In 2024, 24% of Chinese IPOs listed on Nasdaq, up from 5% in 2023 — making up 26% of all Nasdaq listings.

Mood is Bearish. Instead, the slowdown reflects macroeconomic headwinds, weak investor sentiment driven by poor stock market performance and general China’s policy shift from supporting IPOs in non-strategic sectors.

Deep Tech to the Rescue. Chinese deep tech exits will increase and follow two tracks: domestic IPOs from profitable “small giants” in strategic sectors, and overseas listings by globally-focused tech leaders like Pony.ai and WeRide.

Exits are one of the key parameters that define the VC ecosystem. They are perhaps more important than the size of VC funding itself, because without a mature exit market, even vibrant VC ecosystems will sooner or later stagnate.

That’s what happened in markets like Europe or Southeast Asia, where VC funding was peaking in 2020 and 2021, but then without clear path to liquidity a lot of VC managers struggled to demonstrate high DPI (distributions-to-paid-in capital) numbers to their LPs.

Low DPI — Few LPs re-investing into new funds — Fewer / smaller funds — Less capital for the startup ecosystem — Repeat…

This is why a lot of global fund managers are re-focusing on the US, as this is the only large VC/PE market with a smooth access to liquidity through M&A and IPO.

Or at least this is the common perception.

Perception vs Data

Perception or not — you never know until you look at the data.

The map below compares countries by the number and value of VC/PE exits in 2024. Following the Pitchbook methodology, in VC/PE exits we include IPOs and M&A deals involving companies that raised at least one VC or PE round prior to exit.

The map also highlights exits in deep tech sectors such as AI, advanced computing, robotics, climate, and space.

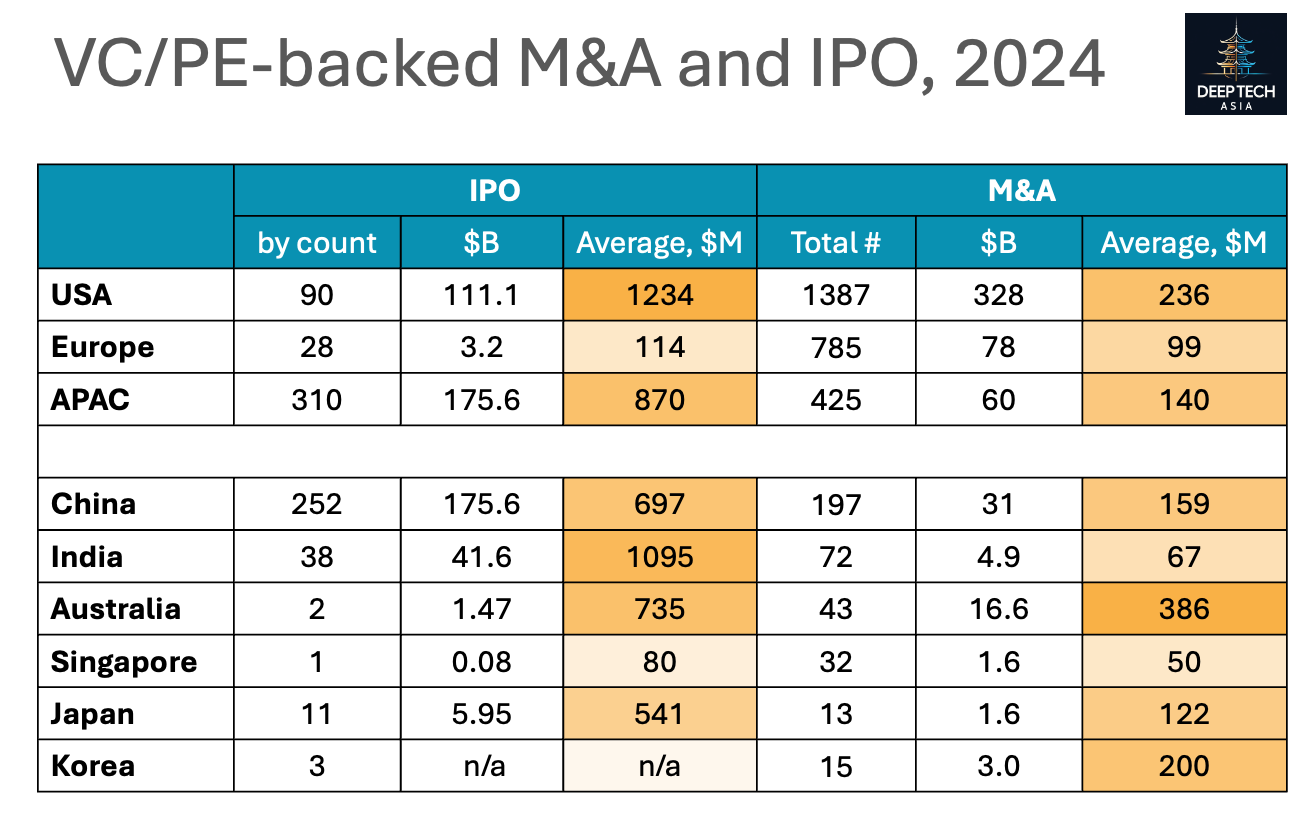

The data proves — the US is definitely the biggest source of VC/PE exits, which rightfully makes it now the best place in the world to do venture investments. In 2024, the American PE/VC-backed companies had $438B of total exits across 1,477 deals, which is 21% more than the year before.

What about other markets?

It depends on the methodology. In quantitative terms, Europe holds a solid second place with 813 exits, which is 11% more than in the the whole APAC, including China. Over 60% of Asian VC/PE backed exits occured in China (449 exits) — nearly 2x fewer than Europe and 3.3x fewer than the US. The rest were spread across India (110), Australia (45), Singapore (33), Japan (24), South Korea (18) and others.

However, when it comes to exit value, in 2024 China was 2.5x larger than Europe, with $207B generated in exits, though still less than half the size of the US. India’s $47B in exits was just 72% below Europe’s total, despite having 7.4x fewer exits.

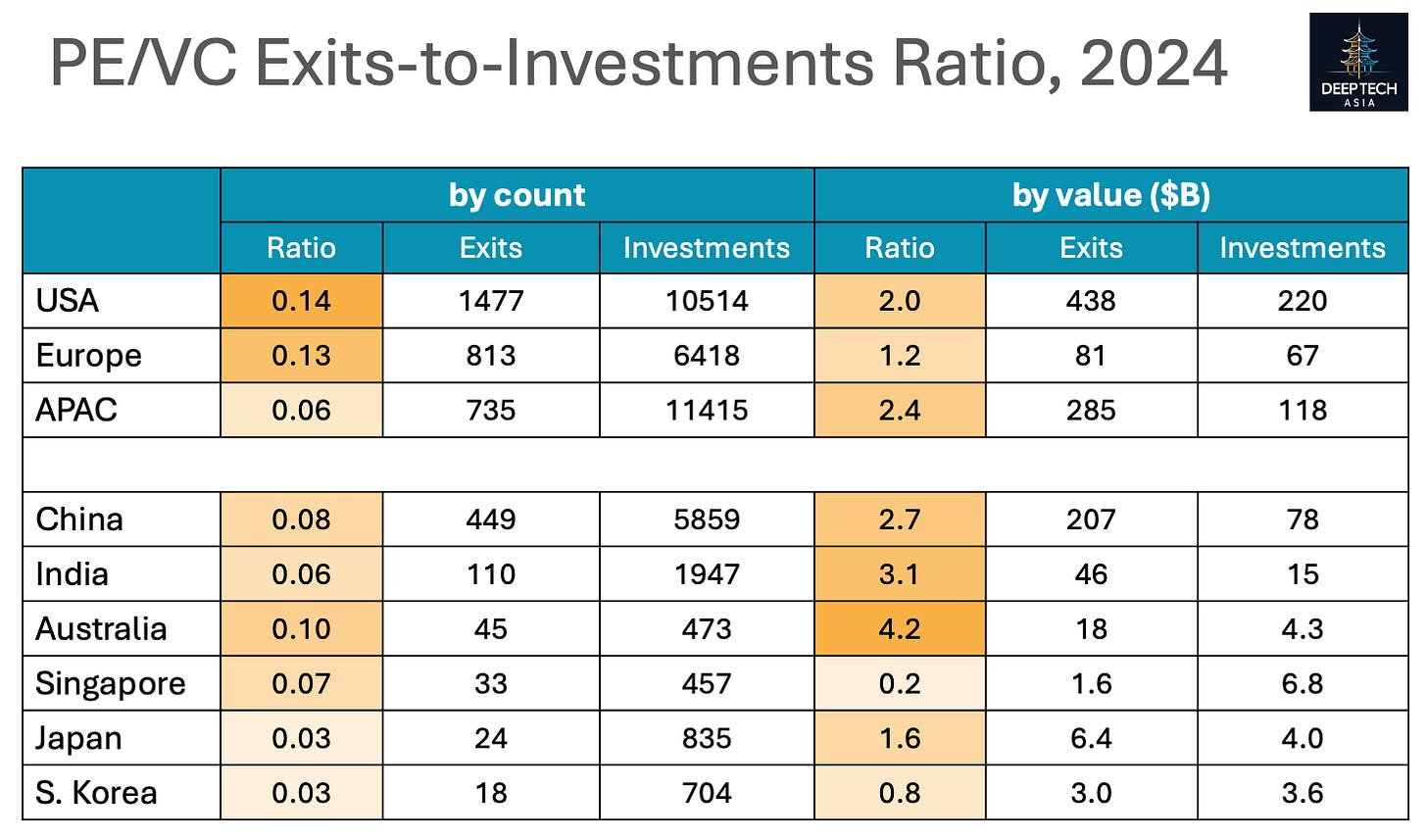

Exits-to-investments ratio is another useful metric for estimating the liquidity of a VC ecosystem, both by deal count and total value.

The US and Europe have higher exit-to-investment ratios by deal count, meaning startups there are more likely to reach an exit. In contrast, China and India outperform on value-based ratios, suggesting that while exits are less frequent, they tend to generate significantly higher liquidity per deal.

The US and Europe have higher exit-to-investment ratios by deal count than Asia markets, meaning that every investment in American or European startups is more likely to lead to an exit. However, China and India boast higher ratios by value, which implies that Asian startups generate on average larger liquidity amounts.

Australia appears highly liquid across both metrics. However, its 2024 exit value data is not very representative — of the $18B in exits, $16B came from a single deal: Blackstone’s acquisition of AirTrunk.

2024 marked a year of recovery, with exit activity gaining momentum in Europe (79%), the US (21%) and India (150%). In contrast, China continued its decline, with exits falling further both in volume and value.

Notably, between 2017 and 2021 Chinese startups were generating more liquidity than their US counterparts. But since 2021, China’s exit value has dropped by over 80%.

Key Drivers

For simplicity’s sake, we divide all VC/PE-backed exits into two categories: 1) IPOs, including stock exchange and over-the-counter listings, 2) M&As, including strategic trade sales and buy-outs.

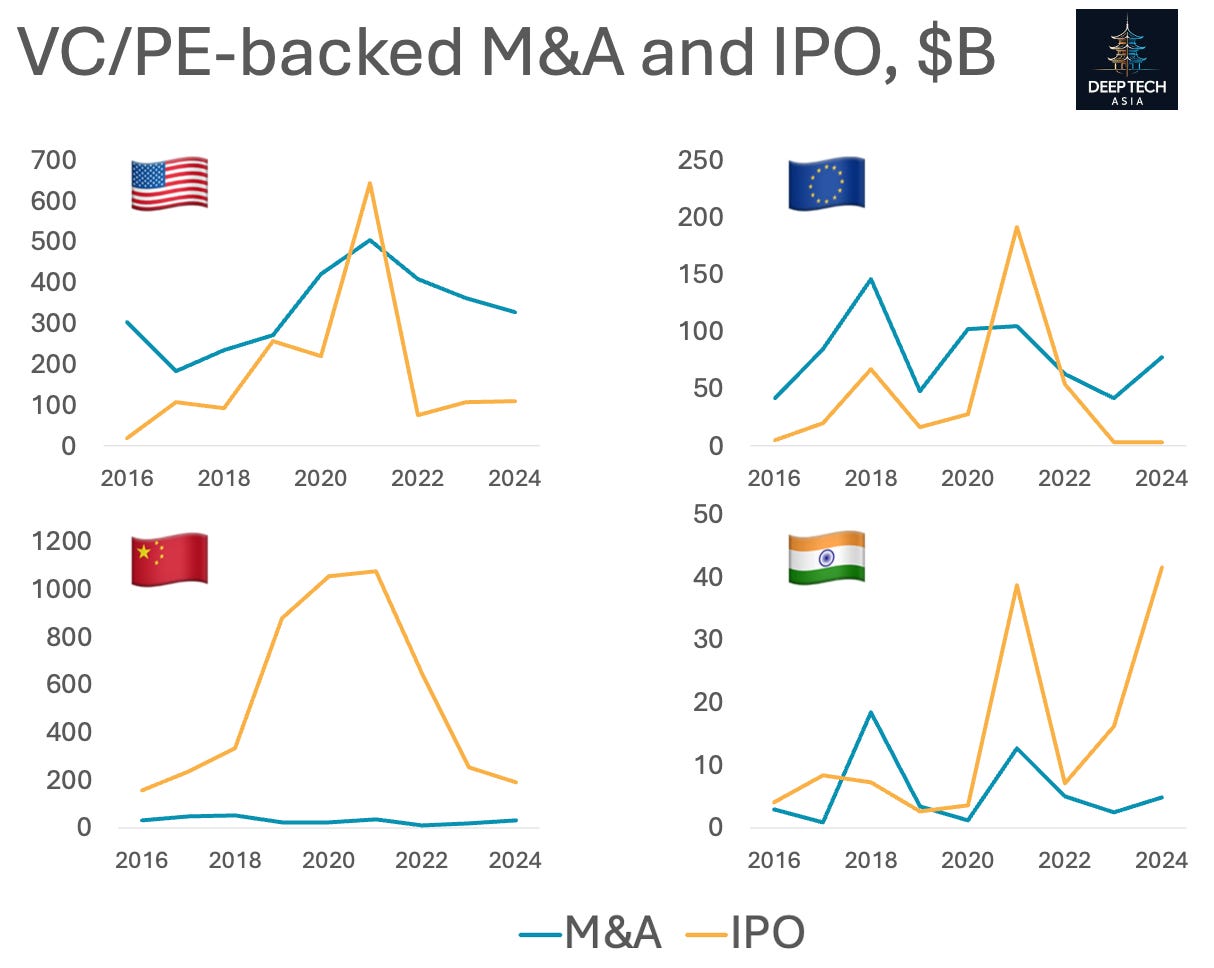

The key difference between Western and Asian VC ecosystems lies in the exit pathways: while the US and Europe are primarily M&A driven, Asia — especially China — is heavily reliant on IPOs.

In terms of number of exits, IPOs have consistently made up less than 20% of all exits in the US and Europe, whereas in Asia IPOs typically account for 30-50%. In China, that share is even higher, often reaching 50-70%.

IPO exits are typically 5–6x larger than M&A exits, as listing on a public exchange requires startups to reach a significant scale — unlike strategic acquisitions, where size is often less critical.

This helps explain why China is twice as large as Europe by exit value, yet has half as many exits. The same pattern holds for India, where a smaller number of outsized IPOs drive the bulk of liquidity.

Back in 2021, the global VC boom was largely fueled by mega IPOs—so much so that startups in the US and Europe generated more liquidity from IPOs than from M&A that year, a rare shift in the typical exit landscape.

Busting Some Myths About China

This is my favourite part!

Myth #1: Liquidity crunch in China — partially true

China’s exits-to-investments ratio (2.7x) is higher than in the US ratio (2.0x). It means that the Chinese VC/PE ecosystem is still more balanced in terms of liquidity than the US ecosystem.

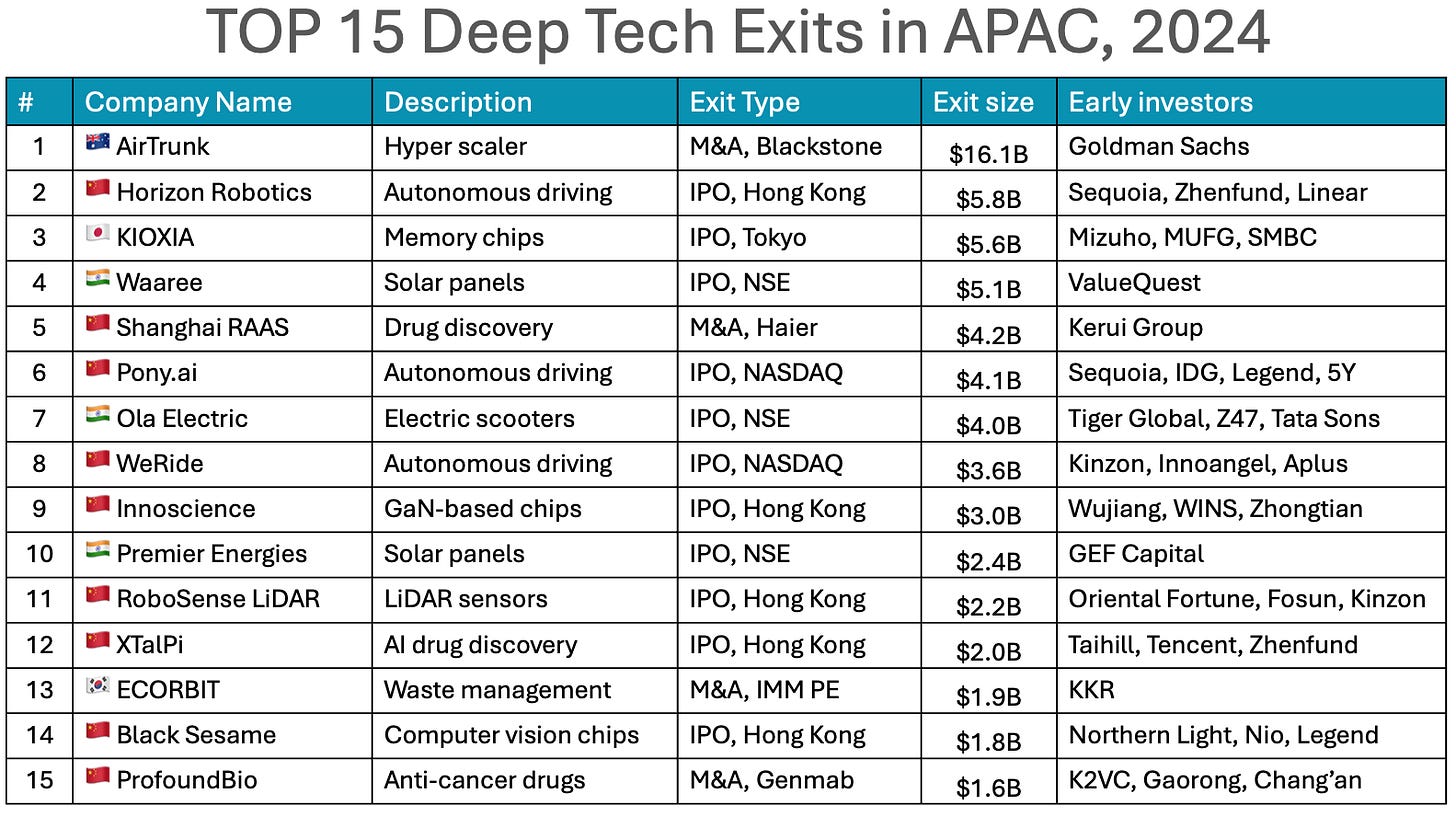

In 2024, China saw substantial amount of massive IPOs, including a lot of listings of deep tech startups, such as Horizon Robotics ($5.8B), Pony.ai ($4.1B), WeRide ($3.6B) and Innoscience ($3B). Some of them were even NASDAQ listings, despite the geopolitical tensions. Also there were some sizeable M&As, e.g. Shanghai RAAS was acquired by Haier and ProfoundBio was acquired by the Danish Genmab.

However, as mentioned above, China’s exit activity has been declining since 2022, both by number of exits and by exit value. It is mostly driven by the declining number of stock exchange listings: from 403 listings in 2021 to 141 listings in 2024.

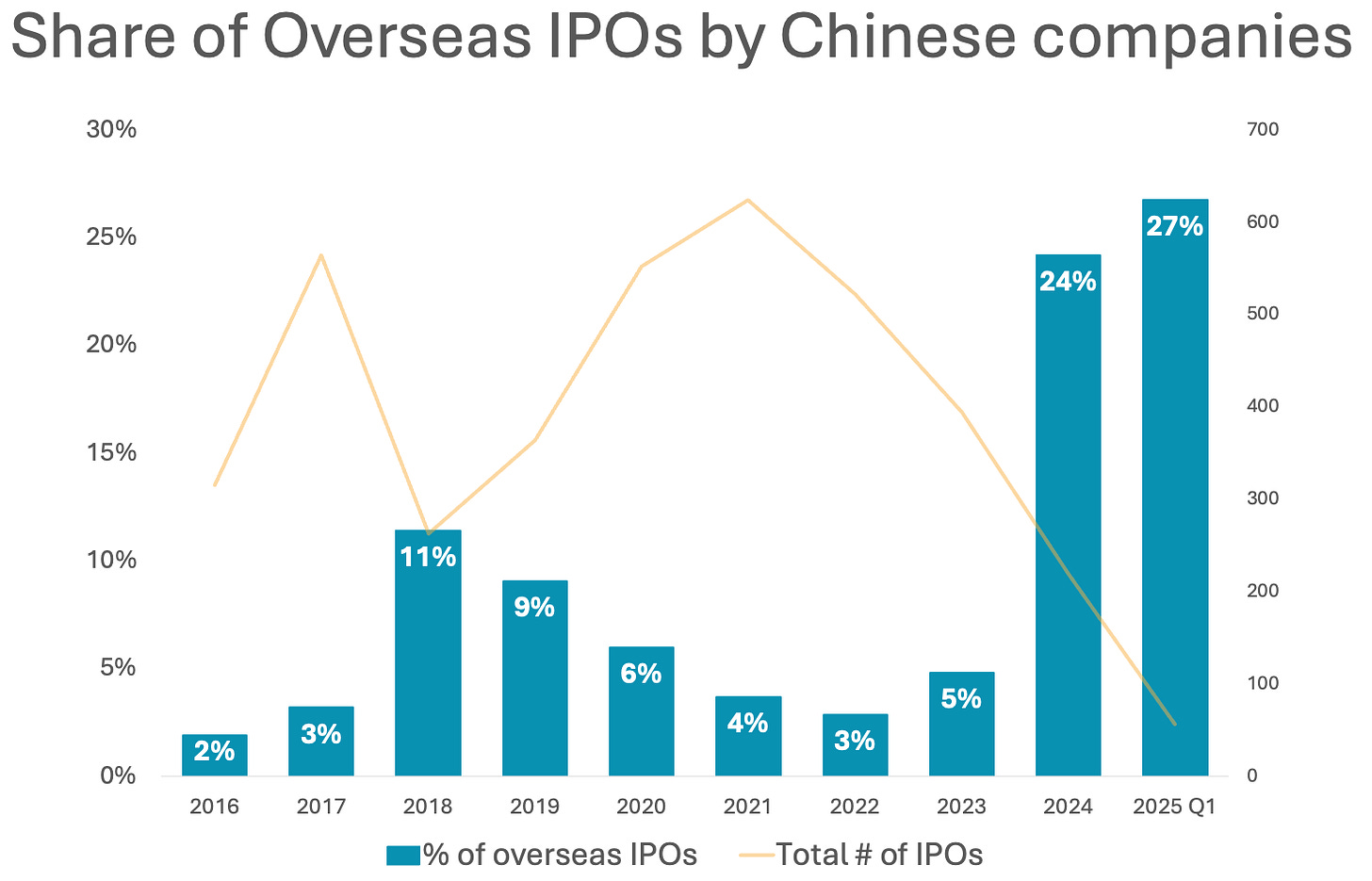

Myth #2: Chinese companies can’t access overseas IPOs — false

There were almost no overseas IPOs by Chinese companies between 2021 and 2023 because of geopolitical tensions and regulatory crackdown by the PRC government. It introduced strict rules obliging Chinese companies to obtain approvals for overseas IPOs. So, a huge backlog of pending applications has accumulated since 2022.

However, in mid 2023 the China Securities Regulatory Commission (CSRC) started signalling that it would continue to unblock overseas listing channels for Chinese companies. Before that China and the US also reached an agreement to share audits of US-listed Chinese businesses, which previously caused a lot of delistings.

In 2024, 52 Chinese companies went public on overseas stock exchanges — the vast majority of them on NASDAQ. The share of overseas listings among all Chinese IPOs jumped from just 3% in 2022 to 24% in 2024. Chinese companies also made up 26% of all NASDAQ listings that year.

But despite this rise in offshore IPO activity, the overall number of IPO exits from Chinese companies continues to decline. This likely reflects deeper structural issues in the Chinese economy — from deflationary pressures and slowing growth to rising unemployment. Add to that the consistently cautious investor sentiment around China over the past few years, and the IPO slowdown starts to make more sense.

Moreover, the Chinese government has increasingly focused its support on so-called “small giants” (小巨人) — companies operating in strategic industries such as advanced manufacturing, semiconductors, and industrial tech. In contrast, many consumer-facing companies have faced delays or rejections when seeking to go public.

As a result, the share of “small giant” IPOs on the Beijing Stock Exchange has surged from 38% in 2020 to 70% in 2024, even as the overall number of listings declined — highlighting the state’s clear preference for strategic sectors.

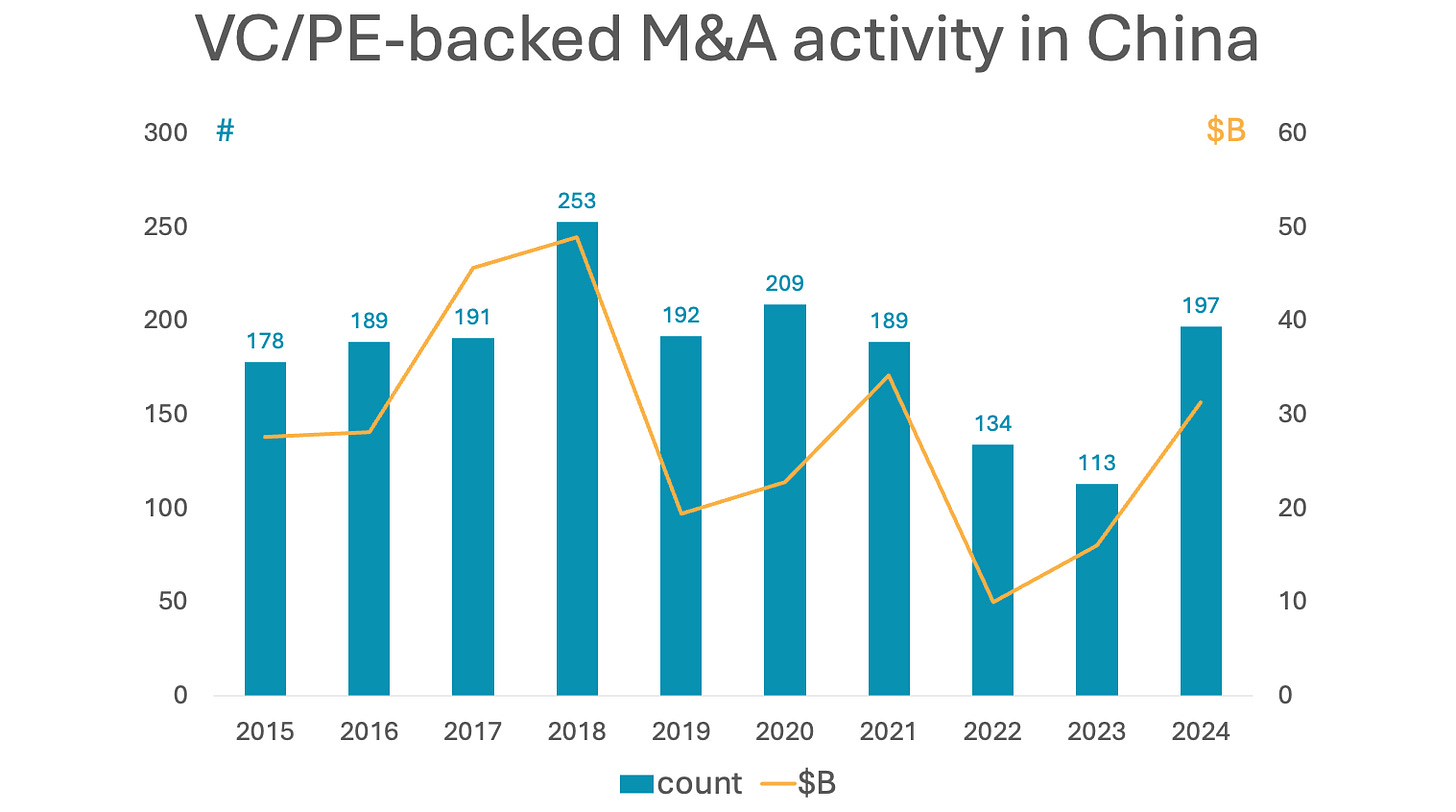

Myth #3: China’s M&A market is stagnating — true

Can Chinese M&A market save the day? — Probably, no.

Over the last ten years, it has been stagnating. Every year, there are some sizeable strategic acquisitions announced, such as Shanghai RAAS and ProfoundBio in 2024. But M&A has never been a driving force for exits in China.

There are a few reasons for this:

Regulatory Hurdles: China has long restricted certain M&A types — including cross-industry deals, takeovers of loss-making firms, and PE acquisitions of listed companies. New antitrust and national security rules have added complexity, often delaying or blocking deals — like the 2021 halt of Tencent-backed Huya and Douyu’s $5.3B merger.

Limited Pool of Strategic Buyers: State-owned enterprises typically focus on acquiring assets in strategic industries or distressed firms, not VC-funded tech startups. Moreover, foreign tech companies have been cautious with acquiring Chinese startups due to China’s foreign investment restrictions.

Cross-Border Scrutiny: Since 2021, foreign acquisitions in key sectors require national security clearance in China. At the same time, Western governments are tightening restrictions on Chinese tech through capital controls, making cross-border exits riskier.

Cultural Aspect: IPOs are seen as the ultimate success, while selling at anything less than a sky-high price – a startup can be viewed as a failure. Many Chinese founders are emotionally attached to their companies and resist M&A — viewing it as "giving up their child" rather than a strategic win. For example, when retail mogul Huang Guangyu once offered to buy rival Suning, Suning’s founder rebuffed him by saying he’d rather give the company away for free if he failed, than sell – selling is akin to admitting defeat.

What is Next for VC Exits in China?

I posed this question to several gurus in China’s VC space, including David Li from Open Innovation Lab. The consensus is clear: in the years ahead, deep tech–focused “small giants” will play an increasingly central role in China’s VC ecosystem.

Backed by strong government support, these companies will often become profitable early and choose to stay private, rather than pursue IPOs. Take Unitree Robotics, for example — founded in 2016, it has been consistently profitable since 2020. This shift could mean fewer IPOs, but not necessarily lower VC returns, as investors may receive dividends instead of exits. A VC model — with Chinese characteristics.

At the same time, we may see a separate track for globally-oriented Chinese deep tech startups, like Pony.ai or WeRide, which have raised capital from foreign investors and gained international traction. These companies are more likely to go public abroad — likely via the familiar VIE structure — and deliver returns through traditional IPO exits.

If you have any proposals, ideas, or feedback, we’d love to hear from you! Feel free to reach out at denis@deeptech.asia or on LinkedIn. Let’s connect and explore how to improve together.