China: Private Space Ecosystem of the Rising Superpower

Curious about China’s space race? Discover how it overtook the US in VC/PE funding, insights on 130 space startups, and why giants like Sequoia and ADIA are betting big—despite barriers to entry.

This article was originally published on substack Space Ambition and reviewed by Blaine Curcio, the founder of Orbital Gateway Consulting and substack China Space Monitor.

In the last decade, China has become the second dominant player in space, rivaling the US with its ambitious plans in exploring the Moon and beyond, as well as building the next generation space-enabled economy. China holds a solid second place in terms of orbital launches, it has its own space stations and manned spacecrafts, and is rigorously working on bringing the first taikonauts to the Moon by 2030.

The space industry in China – as any other major superpower – has historically been shaped through its massive government programs led by state-owned enterprises like CASC, CASIC and China Satcom, as well as government agencies like CNSA and SASTIND.

Although China does not officially disclose its space budget, research firms like Euroconsult estimate that Chinese government space spending reached approximately 20 billion dollars in 2024, making it the second-largest in the world after the United States (around 80 billion dollars). It is also nearly three times larger than the 7.7 billion euro budget of the European Space Agency (ESA).

China’s space budget has grown significantly—from 12 billion dollars in 2022—and is expected to continue rising, particularly with the expansion of its lunar program, which some forecasts suggest may require over 100 billion dollars in total funding.

In 2014, China opened its aerospace industry to private investments, which has eventually created a vibrant ecosystem of Chinese private space tech startups.

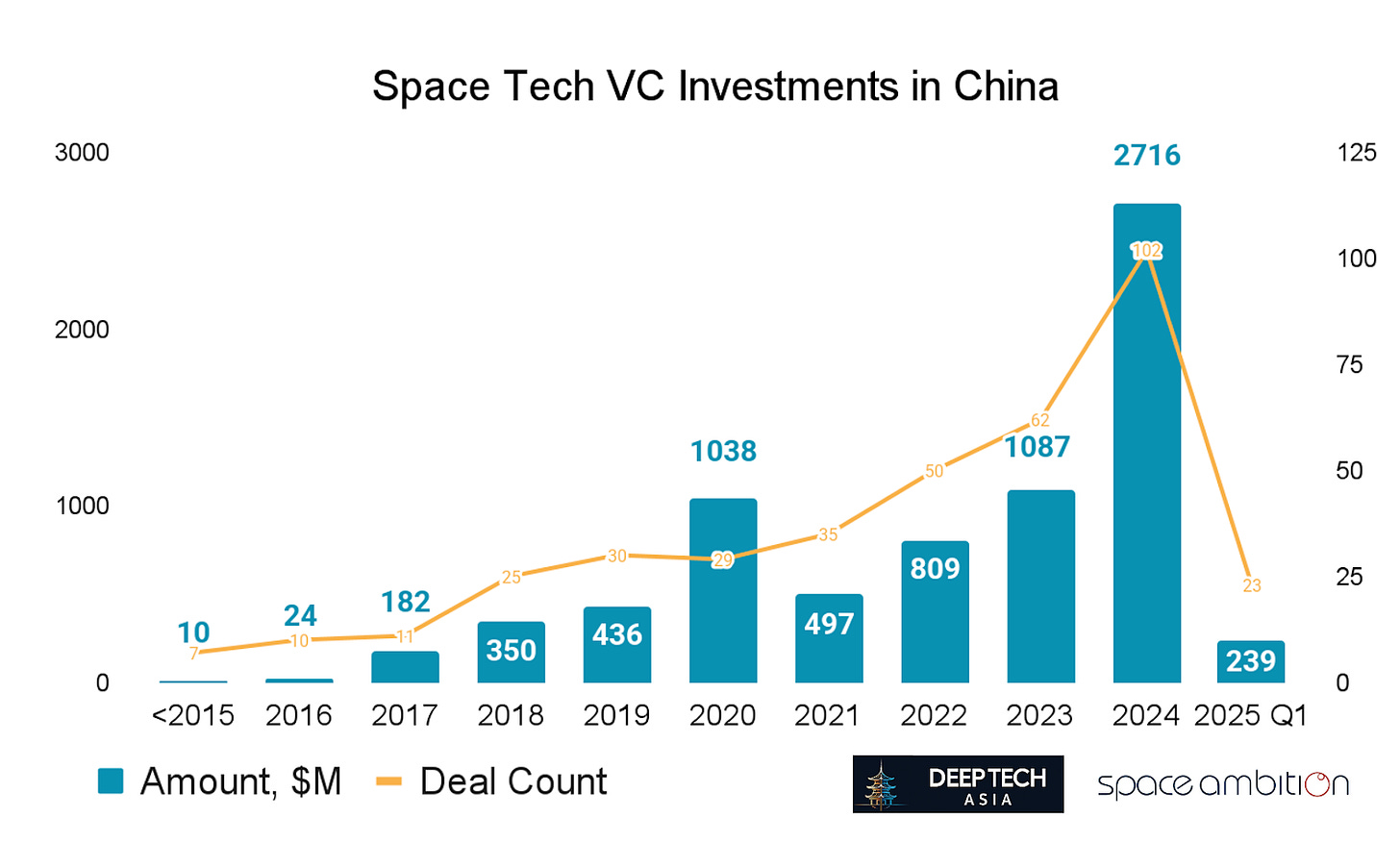

Fast forward to 2024, China for the first time surpassed the US in terms of VC/PE funding for space tech startups ($2.7B vs $2.6B). However, the Chinese private space industry still remains a bit of a mystery for almost everyone outside of China.

In this article we’ll try to shed some light on it and explore if there are any ways for global investors to leverage this booming sector in China.

State-Driven Venture Capitalism in Space

For this research, we analyzed 130 space tech startups from the Chinese VC database ITjuzi, including 85 VC/PE backed startups.

Private space sector in China has evolved through two major waves of development:

Pre-COVID wave (2015-2020): early success stories like pioneering rocket companies i-Space, Landspace and ExSpace, as well as satellite producer ChangGuang, driven by regional funds with an active participation of private VC firms such as Matrix China, Sequoia China, and Shunwei Capital.

Post-COVID wave (2021 - present): supercharged by investments from numerous regional funds and state-owned banks that backed such new leaders as satcom unicorn SpaceSail and rocket makers: SpacePioneer and Galactic Energy.

2021 marked a fundamental shift in the Chinese VC industry from consumer-oriented startups towards the next generation of deep tech projects, including space tech. This trend has been massively driven by the Chinese government and has ultimately reshaped the whole VC landscape in China. During the second wave, the share of direct government funding into space tech startups increased from 20-30% to 60-70%.

The significant involvement of the Chinese government has contributed to the perception that the country’s space industry operates as a closed ecosystem—largely inaccessible to foreign investors and suppliers.

But is that perception entirely accurate?

The Great Space Wall of China

To answer this question, we need to understand the structure of the Chinese private space industry in more granular terms.

We can divide all Chinese space tech startups into three major categories:

Manufacturing & Launches. Most manufacturers of rockets and satellites in China – same as SpaceX in the US – design, assemble and launch their vehicles in-house. These companies are served by a whole ecosystem of vendors that supply electronics, propulsion systems and other auxiliary components, while most key components like engines are still manufactured by CASC.

Operations & Services. These companies provide control and tracking systems for satellites, as well as communication infrastructure between space and ground systems.

Applications. This segment includes the operators of navigation, remote sensing and communication satellite constellations, as well as emerging deep tech startups, e.g. providers of nano satellites, edge compute infrastructure in space and others.

There are no explicit restrictions for Chinese private companies to invest in any of these segments, however, for some military-related projects they need to obtain certain approvals.

Currently, around 40% of total funding for Chinese space startups originated directly from government funds, while according to some expert estimations another 40% may be contributed indirectly via LP relationships with private VC/PE funds. The rest is coming from private investors (insurance companies, family offices and other LPs).

The largest space tech segments in China are rocket and satellite manufacturing, as well as satellite communication services. All these segments have a relatively large share of government funding (40-50%). The Operations & Services segment is also dominated by state-owned funds (50-70%), which may be explained by potentially low margins of these businesses and hence less interest from commercial investors. Emerging technologies also have high government ownership due to their connection to state-owned labs.

Meanwhile, segments such as remote sensing, navigation-related services, and the manufacturing of satellite and rocket components are increasingly led by private investors.

Success Stories of Chinese Space Startups

In the last five years, there were four notable space tech exits in China:

Piesat – satellite data provider for 3D visualization. Went public in 2019 on Shanghai Stock Exchange at a $1B market cap. Exit for QF Capital.

Geovis – providing the 3D mapping and data platform of the Earth for defense, mining, climate and other applications. The product includes an open API platform, data sets and 3D modeling tools for developers. The company went public in 2020 on Shanghai Stock Exchange at a $2.8B market cap. Exit for Sugon.

Everlight Space – satellite energy systems provider. Secondary transaction in 2024: exit for Oddor Capital.

Teemsun – high-precision navigation satellite manufacturer. Went public in 2024 on Shenzhen Stock Exchange at a $280M market cap. Exit for Lenovo Star.

There should also be significant markups for early-stage private investors that backed the following companies:

Landspace – manufacturer of liquid oxygen and methane fuelled rockets:

2016: FounDream invested at a seed stage

2020: Raised a $240M Series C from Matrix, Hongshan and Lightspeed

2024: Raised another $126M from a state-owned fund

i-Space – manufacturer of cost-effective commercial rockets:

2017: Shunwei, Fosun and CITIC invested at a ~$4M seed round

2018: Matrix led a ~$60M Series A

2024: $100M Series C by state owned funds

MinoSpace – turnkey manufacturer of communication satellites:

2017: FounDream, Essential Capital and CAS Star wrote a $1.5M seed check

2021: Lightspeed led ~$40M Series B

2024: Oriza Holdings led a $140M Series C

The Universe of Chinese Space Investors

The model of specialist VC funds is not common in China. That is why, in contrast to the US or other countries, China doesn’t have space-focused funds, like Seraphim, Space Capital or Beyond Earth Ventures. Instead, it has multi-specialist deep tech funds (both private and state-backed), as well as generalist funds that developed their space practice in-house.

There are really strong state-backed deep tech funds in China that actively invest in space, e.g. CAS Star under the Chinese Academy of Science, Shenzhen Capital Group or Addor Capital under Jiangsu High-Tech Investment Group.

Among TOP tier funds, Matrix China is by far the most advanced in terms of space tech investments, while Hongshan is much more generalist. At the same time, there are several Tier-2 deep tech funds with strong space tech expertise, e.g. Essential Capital or Hongfu Investments.

Another peculiarity of venture investments in China, is that the borderline between VC and PE mandates is extremely vague. Both private and public PE funds (Jiangsu Jinyu, Founder H Fund etc) and even asset managers (CICC, BSCOMC, etc) may invest in Series A or even seed startups.

Can Foreigners Invest in Chinese Space?

Instances of foreign investment in Chinese space startups are rare. One notable case is the investment by Abu Dhabi's state fund, ADIA, in the Chinese rocket manufacturer Ming Kong (明空航天) in December 2023. However, this investment is widely viewed as a strategic political move rather than a purely financial decision.

Additionally, while top-tier global funds like Sequoia, Matrix, and Lightspeed have active Chinese teams investing in the space tech sector, these teams operate independently and are fully localized, separate from their parent funds.

Why don’t foreign funds invest in Chinese space startups if the sector is booming?

China's regulatory framework imposes significant restrictions on foreign investments in certain segments of the aerospace sector, particularly those related to national security:

Negative List. The 2024 version of the Negative List for Foreign Investment Market Access prohibits foreigners from investing in aerial imaging, remote sensing and navigation mapping projects.

Dual Use. Some satellites and rockets may classify as weapons, which makes direct investment automatically impossible for foreign entities. Also, the Negative List broadly specifies that all foreign investment transactions related to national security must undergo approvals with Chinese regulatory agencies.

US Restrictions. Apart from Chinese restrictions, US export controls also prevent American and other global investors from backing China’s strategic areas which can be used for military applications, including aerospace.

Would Indirect Investments Help Bypass These Restrictions?

If the area where the startup operates is listed in the Negative List, any investments through SPVs (special purpose vehicles) would also be restricted. For dual-use companies an indirect foreign ownership below 20% is possible, but subject to approval.

Although investing as a Limited Partner (LP) into one of the Chinese funds may help solve this problem, putting money in an offshore GP structure (outside of China) may cause additional concerns with regulators. Moreover, there is a special license called QFLP that generally allows foreign investors to back Mainland Chinese funds. However, QFLP still needs to satisfy the requirements of the Negative List.

At the same time, a few years ago all manufacturing-related activities were excluded from the Negative List and added to the list of areas encouraged for foreign investments, including the design and manufacturing of rockets, civil satellites and their components.

Ultimately, almost any foreigners investing in a Chinese space startup need to obtain approvals from Chinese regulators and make sure their investment targets are not recognised as military companies.

Due to strict oversight, geopolitical tensions, and regulatory uncertainty, many overseas investors have understandably stayed away from China’s space tech sector. At the same time, Chinese startups themselves show little interest in foreign capital, because it’s often not worth the trouble, given all the restrictions and strong demand from domestic investors.

That said, this trend may change in the future as more startups begin to prioritize global expansion. As the ecosystem matures and becomes more dynamic and open—especially in areas like manufacturing—it may become more accessible. This may prompt global investors to start to learn about the Chinese ecosystem and find ways to navigate the challenges in order to gain exposure to China’s growing aerospace industry.

If you have any proposals, ideas, or feedback, we’d love to hear from you! Feel free to reach out at denis@deeptech.asia or on LinkedIn. Let’s connect and explore how to improve together.